1. What is the projected Compound Annual Growth Rate (CAGR) of the High Strength Automotive Steel?

The projected CAGR is approximately 7.59%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Strength Automotive Steel

High Strength Automotive SteelHigh Strength Automotive Steel by Application (Commercial Vehicle, Passenger Vehicle), by Type (Duplex Steel, Martensitic Steel, Boron Steel, TRIP Steel, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

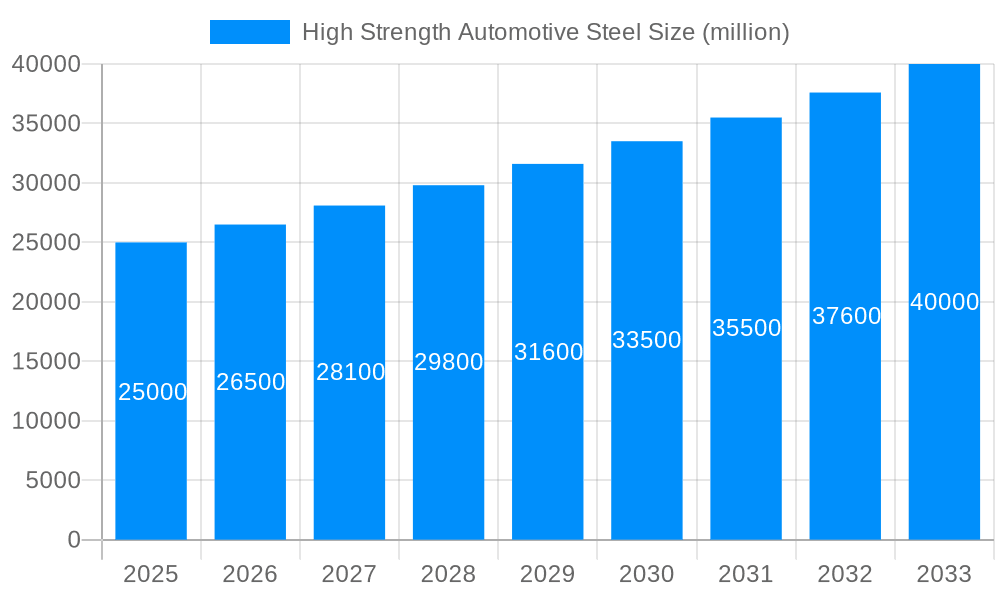

The global High-Strength Automotive Steel (HSAS) market is poised for significant expansion, driven by the automotive sector's escalating need for lightweight, fuel-efficient vehicles. The market is projected to grow from a base of $35.68 billion in 2025 to reach approximately $77.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.59%. This upward trajectory is underpinned by several critical factors. Increasingly stringent government mandates on fuel economy and emissions are compelling original equipment manufacturers (OEMs) to integrate lighter materials, thus escalating the demand for HSAS. Concurrently, technological advancements in HSAS production are yielding materials with superior mechanical properties and enhanced cost-effectiveness, further stimulating market growth. The widespread adoption of Advanced High-Strength Steels (AHSS), including duplex, martensitic, boron, and TRIP steels, across diverse automotive segments like passenger cars and commercial vehicles, is a key growth driver. The Asia-Pacific region, led by China and India, is anticipated to dominate the HSAS market, propelled by burgeoning automotive production volumes.

Despite the positive outlook, the HSAS market faces certain challenges. Volatility in raw material prices, notably iron ore and steel scrap, presents a notable restraint. Furthermore, the substantial initial capital investment required for HSAS manufacturing and the inherent complexity in processing these advanced materials can impede widespread market penetration. Nevertheless, the long-term prospects for the HSAS market remain highly favorable, bolstered by continuous innovation in materials science and an unwavering global focus on sustainable mobility solutions. Leading industry participants, including ArcelorMittal, Nippon Steel Corporation, and SSAB, are strategically enhancing their market positions through dedicated investments in research and development, capacity expansions, and key strategic alliances. The competitive environment is characterized by a blend of major multinational steel producers and agile regional players, fostering a dynamic market landscape that prioritizes innovation and cost optimization.

The global high-strength automotive steel market is experiencing robust growth, projected to reach several million units by 2033. Driven by the automotive industry's relentless pursuit of fuel efficiency, safety enhancements, and lightweight vehicle design, the demand for high-strength steel is surging. The historical period (2019-2024) witnessed a steady increase in adoption, particularly in passenger vehicles, with a notable shift towards advanced high-strength steels (AHSS) like TRIP and martensitic steels. The estimated year 2025 shows a significant market value, exceeding several million units, and the forecast period (2025-2033) anticipates continued expansion fueled by evolving vehicle regulations and consumer preferences. This growth is not uniform across all steel types; while traditional boron steel remains a significant segment, the faster growth is observed in more advanced AHSS grades due to their superior strength-to-weight ratio. The key players in the market are constantly innovating to improve the formability, weldability, and cost-effectiveness of these advanced steels to further enhance their market penetration. This report analyzes this dynamic market, providing in-depth insights into the drivers, challenges, and future trends shaping its trajectory, highlighting the leading players and key regional developments in the market. The base year for this analysis is 2025.

Several factors are propelling the growth of the high-strength automotive steel market. Stringent fuel efficiency standards implemented globally are forcing automakers to reduce vehicle weight, leading to a significant increase in the use of lightweight materials like high-strength steel. Simultaneously, rising concerns about vehicle safety are driving demand for stronger, more impact-resistant materials. High-strength steel effectively addresses both challenges, improving fuel economy and occupant protection. Furthermore, advancements in steel manufacturing technologies have led to the development of advanced high-strength steels (AHSS) with enhanced properties like improved formability and weldability, making them more attractive to auto manufacturers. The increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) also contribute to the growth. EVs, in particular, require high-strength materials to compensate for the added weight of batteries, increasing demand for this category of steel. Finally, the continuous innovation in steel grades and production processes, aiming for better cost-effectiveness and optimized performance, further bolsters the market's growth trajectory.

Despite the significant growth potential, the high-strength automotive steel market faces several challenges. The higher cost of AHSS compared to conventional steels remains a primary barrier to wider adoption, particularly in cost-sensitive segments. The complexity of processing AHSS due to their higher strength also necessitates specialized equipment and expertise, adding to manufacturing costs. Ensuring consistent quality and performance across various production batches presents another challenge for steel manufacturers. The development of advanced joining and forming technologies is crucial to fully exploit the potential of AHSS and overcome limitations regarding weldability and formability, but this requires additional investment. Furthermore, fluctuating raw material prices, particularly iron ore and coking coal, can significantly impact the profitability of steel producers, creating pricing volatility within the market. Finally, environmental concerns related to steel production, including carbon emissions, are increasingly pushing for sustainable production practices, imposing further challenges on the industry.

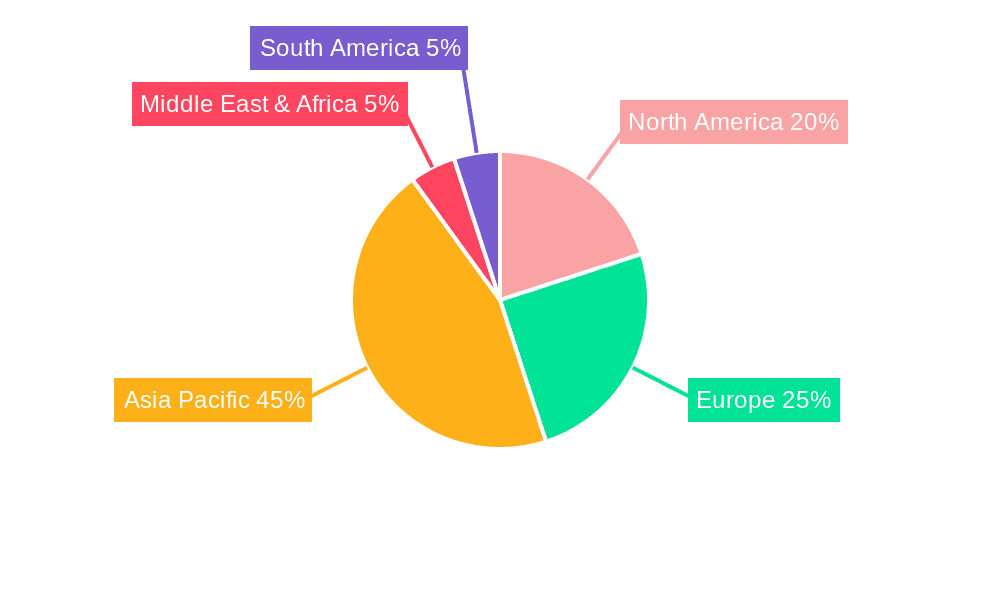

The global high-strength automotive steel market is geographically diverse, with significant growth anticipated across various regions. However, Asia-Pacific, particularly China, is poised to dominate the market due to its massive automotive production volume and rapidly expanding domestic auto industry. The region's strong manufacturing base and burgeoning middle class fuel demand for affordable yet safe vehicles, making it a key driver of high-strength steel consumption. North America also holds substantial market share driven by stringent fuel economy regulations and a significant presence of major automotive manufacturers. Europe, while witnessing slower growth compared to Asia, still remains a considerable market due to its mature automotive industry and advanced safety standards.

Dominant Segments:

Passenger Vehicles: This segment is expected to maintain its leading position due to the rising demand for safer and more fuel-efficient passenger cars, which directly contributes to a larger demand of High Strength Automotive Steel.

Advanced High-Strength Steels (AHSS): Within the steel types, AHSS, including TRIP and martensitic steels, will witness faster growth than traditional boron steel. This is because of their superior strength-to-weight ratio and better mechanical properties, even though initial cost is higher.

The growth in both these segments is interconnected. The increasing demand for light-weighting in passenger vehicles pushes the industry towards greater adoption of advanced high-strength steels, fueling the overall market expansion. This trend is predicted to accelerate throughout the forecast period.

Several factors will fuel the continued growth of the high-strength automotive steel industry. Ongoing advancements in steel technology, leading to even lighter, stronger, and more cost-effective materials, will drive adoption. Stricter government regulations on fuel economy and vehicle safety worldwide will force automakers to incorporate more high-strength steel into their designs. The expanding global automotive industry, with growth in both developed and developing markets, will directly impact the demand for high-strength steel. Finally, increasing collaboration between steel manufacturers and automotive companies to develop tailored steel solutions will also contribute to market expansion.

This report offers a comprehensive analysis of the high-strength automotive steel market, providing valuable insights for stakeholders across the value chain. From market sizing and forecasting to detailed segment analysis and competitor profiling, this report serves as a critical resource for informed decision-making. The detailed assessment of market dynamics, including growth drivers, challenges, and opportunities, provides a 360-degree view of the industry landscape. The in-depth analysis of leading players, including their market strategies and competitive dynamics, enables a thorough understanding of the market's competitive landscape. This report is an invaluable tool for companies seeking to navigate the complexities of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.59% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.59%.

Key companies in the market include ARCELORMITTAL, NIPPON STEEL CORPORATION, SSAB, Baoshan Iron & Steel, Maanshan Iron and Steel Company, Angang Steel Group, Hesteel Company, VALIN Steel, .

The market segments include Application, Type.

The market size is estimated to be USD 35.68 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "High Strength Automotive Steel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Strength Automotive Steel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.