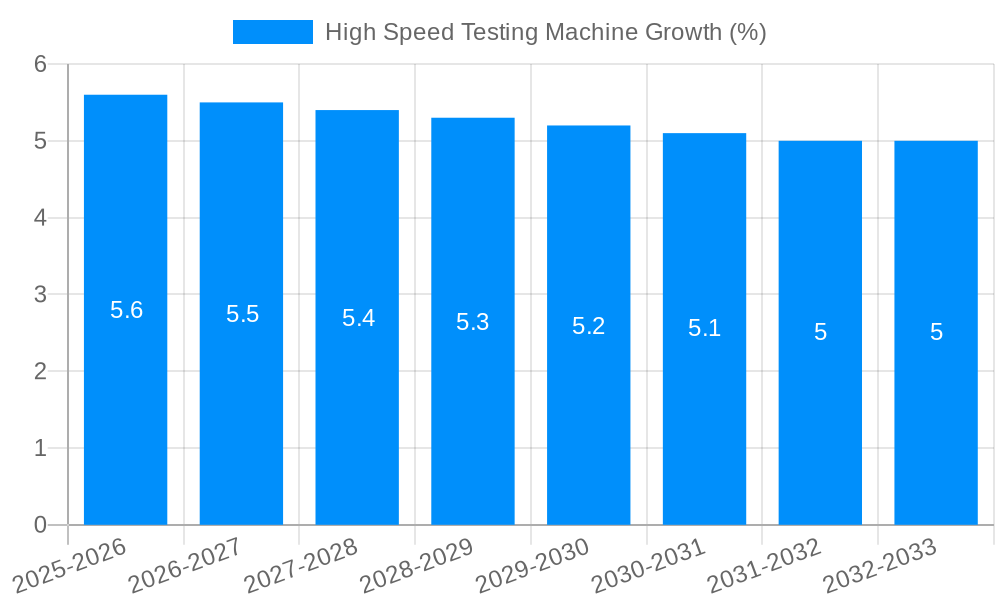

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Speed Testing Machine?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Speed Testing Machine

High Speed Testing MachineHigh Speed Testing Machine by Type (25 kN, 50 kN, 80 kN, 160 kN, Others), by Application (Manufacture, Automotive, Aerospace, Electronic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

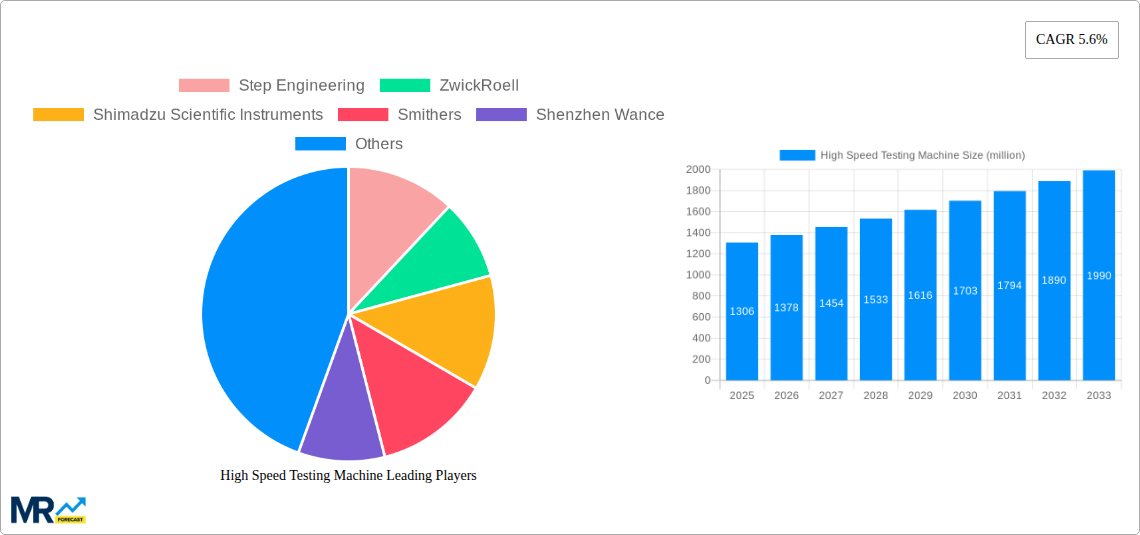

The global High Speed Testing Machine market is poised for significant expansion, with a projected market size of USD 1306 million in 2025, growing at a robust Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This growth is primarily fueled by the increasing demand for advanced material characterization and quality control across a multitude of industries. The manufacturing sector, in particular, is a major driver, seeking to enhance product durability, performance, and safety through rigorous testing. Furthermore, the automotive and aerospace industries are increasingly adopting high-speed testing solutions to meet stringent regulatory requirements and to develop lighter, stronger, and more resilient components for next-generation vehicles and aircraft. The electronics industry also contributes to this upward trajectory, as miniaturization and the development of novel electronic materials necessitate sophisticated testing capabilities to ensure reliability and prevent failures.

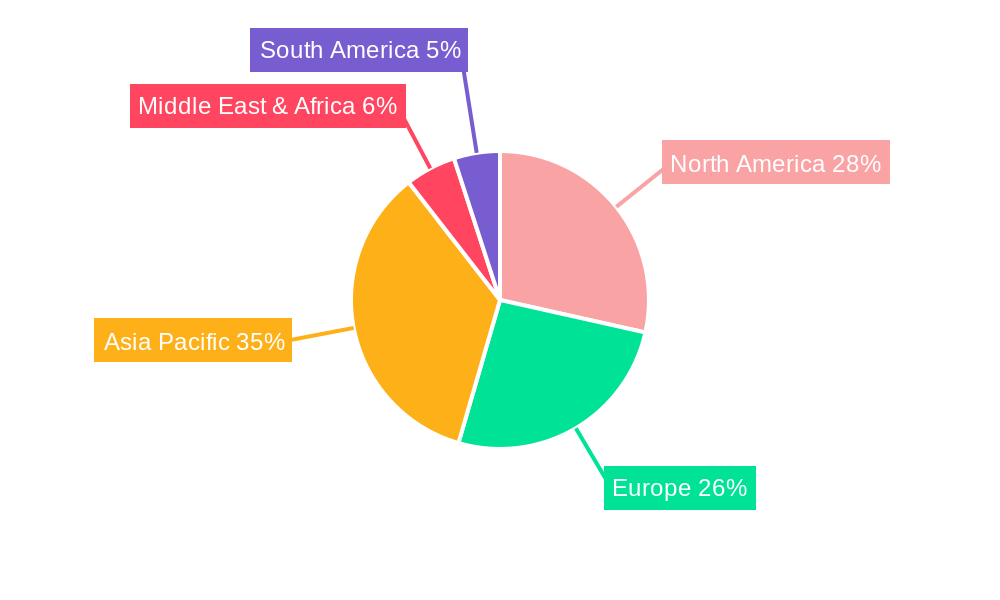

The market is characterized by several key trends that are shaping its evolution. A prominent trend is the increasing integration of advanced digital technologies, such as IoT and AI, into high-speed testing machines. This allows for real-time data acquisition, advanced analytics, predictive maintenance, and remote monitoring, significantly improving testing efficiency and insights. The demand for specialized machines catering to specific applications, such as those with higher kN capacities (e.g., 160 kN) for heavy-duty industrial applications, is also on the rise. Geographically, the Asia Pacific region, led by China and India, is emerging as a powerhouse for growth due to its burgeoning manufacturing base and increasing investments in research and development. Conversely, established markets in North America and Europe continue to represent substantial demand, driven by technological advancements and the presence of major players. Despite the positive outlook, potential restraints include the high initial investment costs associated with these sophisticated machines and the need for skilled personnel to operate and maintain them effectively.

The global High Speed Testing Machine market is projected to experience robust expansion, with an estimated market size poised to reach over 1.2 million units by the Estimated Year 2025. This growth trajectory is underpinned by an escalating demand for advanced material characterization across a multitude of critical industries. The Study Period (2019-2033), encompassing the Historical Period (2019-2024) and the Forecast Period (2025-2033), reveals a consistent upward trend, driven by technological advancements and the increasing need for rigorous safety and performance validation. Within this period, the Base Year (2025) serves as a crucial benchmark for understanding the market's current standing and projecting future dynamics.

The 25 kN and 50 kN segments are expected to dominate the market in terms of unit volume, driven by their versatility and widespread adoption in research and development, quality control, and manufacturing processes for various materials, including polymers, composites, and metals. These capacities are particularly favored for testing smaller components and performing intricate analyses where high strain rates are paramount. However, the 160 kN segment is anticipated to witness significant growth, fueled by its application in testing larger structural components, particularly within the automotive and aerospace sectors, where impact resistance and high-velocity deformation studies are critical. The "Others" category, encompassing higher kN capacities, is also expected to see a steady increase, catering to specialized applications in defense and advanced research initiatives.

The Application landscape is equally dynamic. The Automotive sector is a primary driver, with manufacturers increasingly investing in high-speed testing to evaluate the performance of lightweight materials, safety components like airbags and seatbelts, and crashworthiness simulations. The Aerospace industry follows suit, demanding advanced material testing for aircraft components subjected to extreme conditions and high-velocity impacts. The Electronic segment is also showing considerable promise, as the miniaturization of components and the need for reliable performance under dynamic stress necessitate sophisticated testing solutions. The Manufacture segment, as a broad umbrella, encompasses a wide range of applications where high-speed testing is crucial for optimizing production processes and ensuring product integrity. Emerging applications within the "Others" category are also contributing to market diversification. The report anticipates that by 2025, the market will have solidified its reliance on these high-speed testing capabilities, with an ongoing push towards greater automation and data analytics integrated into these machines.

The expansion of the High Speed Testing Machine market is intrinsically linked to the relentless pursuit of enhanced material performance and safety across various industrial verticals. A primary catalyst is the growing emphasis on crashworthiness and impact resistance, particularly within the Automotive and Aerospace sectors. As manufacturers strive to develop lighter yet stronger vehicles and aircraft, the ability to simulate real-world impact scenarios at high strain rates becomes indispensable. This allows for the validation of new materials and designs, ensuring they can withstand extreme forces without catastrophic failure. Furthermore, advancements in material science, including the development of novel composites, advanced polymers, and high-strength alloys, are creating a demand for testing equipment capable of characterizing these materials under dynamic conditions. The intrinsic properties of these advanced materials often manifest differently at high speeds, necessitating specialized testing to fully understand their behavior and optimize their application. The increasing regulatory scrutiny concerning product safety, particularly in critical applications, also plays a significant role. Stringent safety standards mandate thorough testing, pushing industries to invest in high-speed testing machines that can provide accurate and reliable data for compliance.

The globalization of manufacturing and the resultant rise in competition compel companies to optimize their production processes and ensure the highest quality standards. High-speed testing machines play a crucial role in this endeavor by enabling rapid and precise quality control checks, identifying potential defects early in the manufacturing cycle, and ultimately reducing product recalls and associated costs. The digital transformation wave, often referred to as Industry 4.0, is also a significant propellant. The integration of sensors, data analytics, and automation into high-speed testing machines is enhancing their efficiency, accuracy, and user-friendliness. This allows for more sophisticated data acquisition, real-time analysis, and predictive maintenance, further driving adoption. The ongoing research and development in sectors like defense, where materials need to withstand high-velocity projectiles and extreme conditions, also contribute to the market's growth, albeit in more specialized niches.

Despite the promising growth trajectory, the High Speed Testing Machine market faces several significant challenges and restraints that could potentially temper its expansion. A prominent hurdle is the high initial cost of these sophisticated machines. High-speed testing equipment, by its very nature, incorporates advanced technology, precise instrumentation, and robust construction, leading to substantial capital investment. This can be a significant deterrent for small and medium-sized enterprises (SMEs) or research institutions with limited budgets, especially in regions with less developed economies. The complexity of operating and maintaining these machines also presents a challenge. High-speed testing requires specialized expertise and trained personnel to ensure accurate setup, operation, and data interpretation. The learning curve for new operators can be steep, and the availability of skilled technicians might be limited in certain geographical areas, leading to increased operational costs and potential downtime.

The rapid pace of technological evolution in materials science and testing methodologies can also act as a restraint. While it drives innovation, it also means that existing equipment can become obsolete relatively quickly, necessitating frequent upgrades or replacements. This can lead to ongoing capital expenditure for businesses, further straining budgets. Furthermore, the lack of standardization in certain high-speed testing protocols can create inconsistencies in data and comparability across different laboratories and manufacturers. While efforts are being made to establish universal standards, the diverse nature of applications and materials can make this a complex undertaking. The economic uncertainties and global recessionary pressures can also impact capital spending on advanced equipment. During periods of economic downturn, industries may prioritize essential operational expenses over investments in new testing machinery, thereby slowing down market growth. Lastly, supply chain disruptions, which have become more prevalent in recent years, can affect the availability of critical components and raw materials required for the manufacturing of these machines, leading to production delays and increased costs.

The global High Speed Testing Machine market is anticipated to witness a dynamic interplay of regional strengths and segment dominance, with particular emphasis expected on the Automotive application and the North America and Europe regions.

Dominant Segments:

Dominant Regions:

While other regions like Asia-Pacific are exhibiting rapid growth, particularly driven by manufacturing hubs and burgeoning automotive production, North America and Europe are expected to maintain their leading positions through 2025 and beyond due to their established industrial base, advanced technological infrastructure, and stringent regulatory environments, making them the epicenters for high-speed testing adoption within the automotive sector and for mid-range kN capacities.

The High Speed Testing Machine industry is experiencing significant growth catalysts, primarily driven by the escalating demand for enhanced material performance and safety across critical sectors. The continuous innovation in lightweight materials and composites, particularly for the automotive and aerospace industries, necessitates sophisticated testing to understand their behavior under extreme dynamic conditions. Furthermore, the increasing stringency of global safety regulations mandates rigorous testing protocols for components subjected to high-velocity impacts, pushing manufacturers to invest in advanced machinery. The integration of Industry 4.0 principles, including automation, data analytics, and IoT connectivity, is revolutionizing the capabilities of these machines, making them more efficient, accurate, and user-friendly, thereby accelerating their adoption.

The High Speed Testing Machine market is characterized by the presence of several key global players, each contributing to the innovation and supply of these critical testing solutions. The leading companies in this sector include:

The High Speed Testing Machine sector has witnessed a series of significant developments that have shaped its evolution and market landscape. These advancements, spanning from technological integrations to strategic collaborations, highlight the industry's commitment to innovation and customer-centric solutions.

A comprehensive High Speed Testing Machine report provides an in-depth analysis of the global market, meticulously dissecting its various facets from 2019 to 2033, with a focus on the Base Year (2025) and the Forecast Period (2025-2033). Such a report typically delves into market segmentation by machine capacity (e.g., 25 kN, 50 kN, 80 kN, 160 kN, Others) and application sectors (Manufacture, Automotive, Aerospace, Electronic, Others). It meticulously examines market drivers, restraints, opportunities, and challenges, offering insights into the factors propelling growth, such as the demand for enhanced safety and performance validation, and the hurdles, like high initial investment and technical expertise requirements. Regional analysis, highlighting dominant markets like North America and Europe, and emerging ones, is a key component. The report also details significant industry developments, technological trends, and a thorough competitive landscape featuring leading players like ZwickRoell, Shimadzu Scientific Instruments, and Step Engineering. The overarching aim is to equip stakeholders with strategic intelligence for informed decision-making and market navigation.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Step Engineering, ZwickRoell, Shimadzu Scientific Instruments, Smithers, Shenzhen Wance, ELSTAR, Waygate Technologies, CME Technology, Jinan Hensgrand, Labtone, MRC, Qingdao Gaoce, TIANJIN JIURONG, Shenzhen Mason Electronics, MCS.

The market segments include Type, Application.

The market size is estimated to be USD 1306 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Speed Testing Machine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Speed Testing Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.