1. What is the projected Compound Annual Growth Rate (CAGR) of the High Purity Tube and Fitting?

The projected CAGR is approximately 5.37%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Purity Tube and Fitting

High Purity Tube and FittingHigh Purity Tube and Fitting by Application (Semiconductor, Pharmaceutical, Chemical, Others), by Type (Stainless Steel, Fluoropolymer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

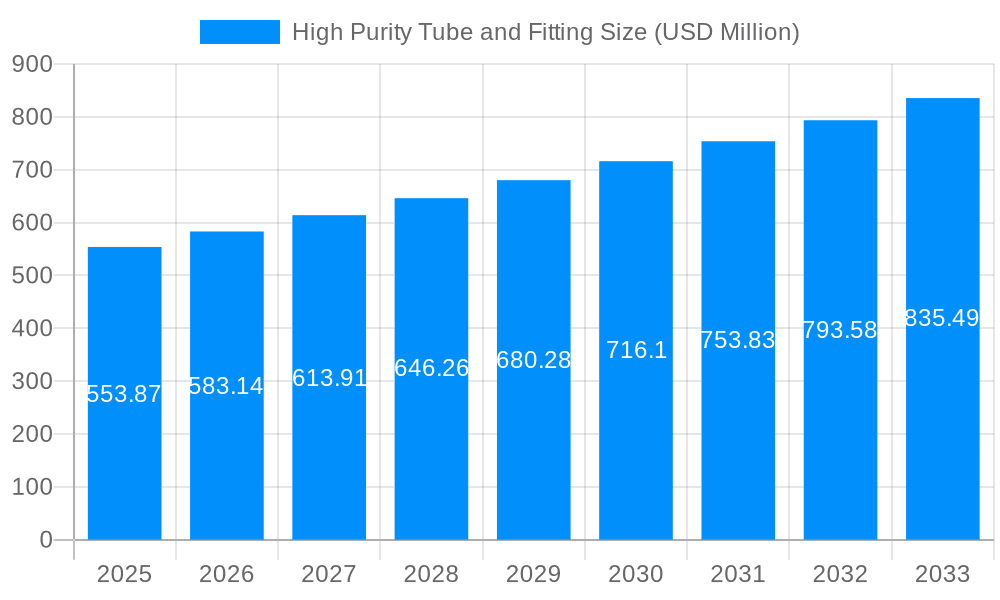

The High Purity Tube and Fitting market is poised for substantial growth, projected to reach an estimated \$553.87 million in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 5.37% through the forecast period ending in 2033. The increasing demand for ultra-pure fluids and gases across critical industries such as semiconductors, pharmaceuticals, and chemicals is the primary catalyst for this upward trajectory. In the semiconductor sector, advancements in microchip manufacturing necessitate highly controlled environments and contamination-free fluid delivery systems, directly boosting the need for high-purity tubes and fittings. Similarly, the pharmaceutical industry's stringent quality standards and the development of complex biologics require impeccable fluid handling to ensure product integrity and patient safety. The chemical industry also contributes significantly, with evolving processes demanding reliable and inert materials for handling sensitive or corrosive substances.

Further fueling market expansion are key trends like the growing adoption of advanced materials, particularly fluoropolymers, which offer superior chemical resistance and low surface reactivity, making them ideal for demanding high-purity applications. Innovations in manufacturing technologies, leading to enhanced precision and tighter tolerances in tube and fitting production, also play a crucial role. While the market is largely propelled by these positive drivers and trends, certain restraints warrant attention. The high initial cost of specialized high-purity materials and manufacturing equipment can be a barrier for smaller players. Additionally, the complexity of regulatory compliance in highly sensitive industries, especially pharmaceuticals, requires significant investment in quality control and documentation, potentially slowing down adoption in some segments. However, the overarching demand for reliability, safety, and contamination prevention in critical industrial processes ensures a strong and sustained growth outlook for the High Purity Tube and Fitting market.

Here's a unique report description on the High Purity Tube and Fitting market, incorporating your specifications:

The global High Purity Tube and Fitting market, projected to reach hundreds of millions of US dollars by the end of the forecast period, is experiencing a dynamic evolution driven by escalating demands for ultra-clean environments and precise fluid handling across critical industries. During the historical period (2019-2024), the market witnessed steady growth, fueled by increasing investments in advanced manufacturing and research and development. The base year, 2025, sets the stage for a projected expansion, with the estimated year also being 2025, highlighting the immediate significance of current market conditions. The forecast period (2025-2033) anticipates a substantial surge, indicating a compound annual growth rate that will redefine market valuations in the coming decade. Key trends shaping this landscape include a pronounced shift towards sophisticated materials offering superior chemical resistance and minimal particulate generation. The semiconductor industry, a cornerstone of technological advancement, continues to be a dominant consumer, requiring highly inert and contamination-free conduits for wafer fabrication and sensitive process gases. Similarly, the pharmaceutical sector's stringent regulatory requirements and the pursuit of ever-purer active pharmaceutical ingredients (APIs) are driving demand for specialized high-purity solutions. Furthermore, emerging applications in advanced chemical synthesis and specialized research laboratories are contributing to market diversification. Innovations in manufacturing techniques, such as advanced welding and surface finishing, are paramount in achieving the ultra-low surface roughness and minimal dead-volume required for these applications. The market is also seeing an increasing emphasis on integrated solutions, where manufacturers offer not just individual components but complete fluid path systems designed for optimal performance and reliability. This holistic approach is becoming a key differentiator for leading players striving to meet the complex needs of their discerning clientele.

Several formidable forces are propelling the growth of the High Purity Tube and Fitting market. The relentless march of technological innovation, particularly within the semiconductor industry, is a primary catalyst. As chip manufacturing processes become more intricate and demand higher levels of precision, the need for ultra-pure gas and liquid delivery systems escalates. The development of next-generation microprocessors and advanced memory technologies directly translates into a greater requirement for specialized high-purity tubing and fittings that can withstand extreme temperatures, corrosive chemicals, and prevent any form of contamination. Simultaneously, the pharmaceutical and biotechnology sectors are experiencing unprecedented expansion, driven by an aging global population, an increasing prevalence of chronic diseases, and significant advancements in drug discovery and development. The production of biologics, vaccines, and highly potent APIs necessitates the utmost purity and sterility throughout the manufacturing process, making high-purity fluid handling systems indispensable. Furthermore, the growing emphasis on environmental sustainability and stringent regulatory compliance across various industrial sectors are also contributing to market expansion. Industries are increasingly investing in advanced systems that minimize waste, reduce emissions, and ensure the safe handling of hazardous materials, all of which rely on the integrity and purity offered by specialized tubing and fittings. The global pursuit of higher quality and greater safety standards across manufacturing operations is creating a sustained demand for reliable and contamination-free fluid management solutions.

Despite its robust growth trajectory, the High Purity Tube and Fitting market faces several significant challenges and restraints that warrant careful consideration. One of the most prominent hurdles is the inherently high cost associated with the production and procurement of high-purity components. The specialized materials, sophisticated manufacturing processes, and stringent quality control measures required to achieve ultra-high purity levels translate into premium pricing. This can be a deterrent for smaller companies or those operating in cost-sensitive segments of the market. The complex and often lengthy qualification and validation processes, particularly in regulated industries like pharmaceuticals, can also present a significant challenge. Ensuring that new materials and components meet the rigorous standards set by regulatory bodies requires substantial time, resources, and expertise, thereby slowing down the adoption of novel solutions. Moreover, the market is susceptible to fluctuations in raw material prices, particularly for specialty alloys and advanced polymers used in high-purity applications. Supply chain disruptions and volatility in the cost of these essential inputs can impact manufacturers' margins and the overall affordability of the products. The highly technical nature of high-purity systems also necessitates specialized knowledge for installation, maintenance, and troubleshooting. A shortage of skilled labor or limited access to expert technical support can hinder the widespread adoption and efficient utilization of these advanced components. Finally, the presence of established players with strong brand recognition and long-standing customer relationships can create barriers to entry for new market participants, making it challenging for them to gain market share.

The Semiconductor application segment, alongside the Stainless Steel type, is poised to dominate the High Purity Tube and Fitting market, with a significant concentration of demand emanating from Asia Pacific and North America.

The Semiconductor segment's preeminence is driven by the insatiable global demand for advanced electronic devices, from smartphones and computers to artificial intelligence hardware and 5G infrastructure. The intricate manufacturing processes involved in semiconductor fabrication are critically dependent on ultra-high purity gas and liquid delivery systems. These systems must prevent even the slightest contamination, as even a few particles can render an entire wafer useless, leading to substantial financial losses. The continuous miniaturization of transistors and the development of new fabrication techniques, such as extreme ultraviolet (EUV) lithography, demand even more sophisticated and inert materials for tubing and fittings. Companies are constantly investing in R&D to develop alloys and surface treatments that offer superior resistance to process chemicals, higher temperature stability, and minimal outgassing. The relentless pace of innovation in this sector ensures a sustained and growing demand for high-purity solutions.

The Stainless Steel type of high-purity tube and fitting is expected to maintain its leading position due to its inherent properties. Specifically, certain grades of stainless steel, such as 316L, offer an exceptional balance of corrosion resistance, mechanical strength, and surface finishability, making them ideal for a wide range of demanding applications. The ability to achieve ultra-low surface roughness through electropolishing and other advanced finishing techniques minimizes particle adhesion and facilitates thorough cleaning, which is paramount in high-purity environments. Furthermore, stainless steel's robustness and long service life make it a cost-effective choice for many applications, despite its initial investment. The established infrastructure and expertise in manufacturing and working with stainless steel further solidify its dominance.

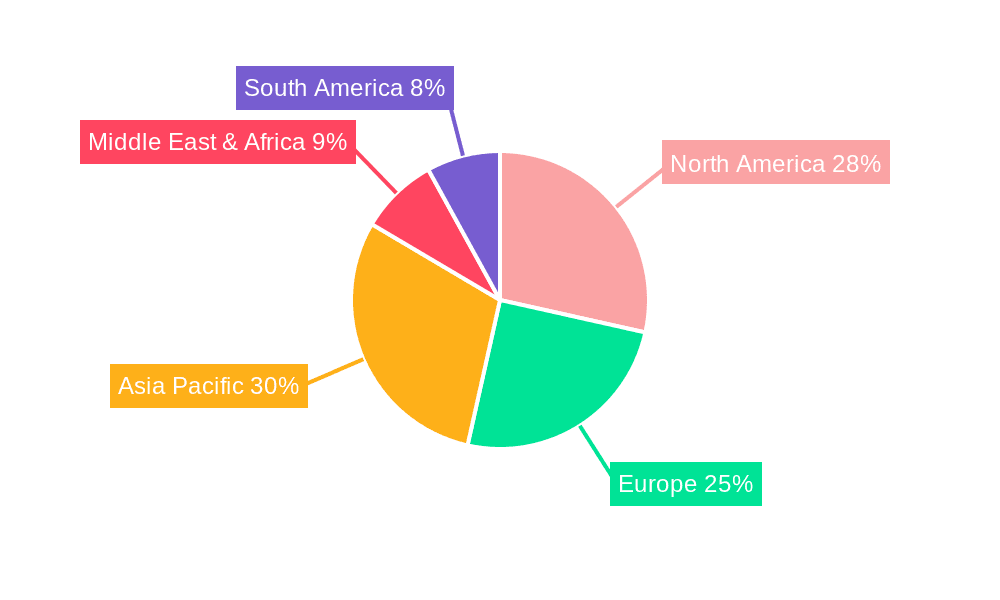

Geographically, Asia Pacific is set to emerge as the largest and fastest-growing market for high-purity tube and fittings. This dominance is primarily attributed to the region's robust semiconductor manufacturing ecosystem, with countries like South Korea, Taiwan, Japan, and increasingly China, housing major wafer fabrication plants and electronic component manufacturers. The region's strong focus on technological advancement and the expansion of its digital infrastructure are fueling significant investments in advanced manufacturing capabilities. North America, particularly the United States, also represents a significant market, driven by its leading-edge semiconductor research and development initiatives, a growing biopharmaceutical industry, and advanced chemical manufacturing sectors. The presence of major industry players and a strong emphasis on innovation further bolster this region's market share.

Several key factors are acting as potent growth catalysts for the High Purity Tube and Fitting industry. The relentless innovation in the semiconductor sector, pushing the boundaries of miniaturization and performance, directly fuels demand for increasingly sophisticated fluid handling systems. Concurrently, the booming pharmaceutical and biotechnology industries, with their focus on biologics and complex drug formulations, require the utmost purity and sterility. The increasing stringency of regulatory standards across various industries is also a significant driver, compelling manufacturers to adopt higher-purity solutions for safety and quality assurance.

This comprehensive report offers an in-depth analysis of the global High Purity Tube and Fitting market from 2019 to 2033. It provides granular insights into market size, growth drivers, and segmentation across applications like Semiconductor, Pharmaceutical, and Chemical, as well as types such as Stainless Steel and Fluoropolymer. The study meticulously details historical trends, current market dynamics, and future projections, employing the base year 2025 and forecast period 2025-2033. It also identifies key regional influences and significant industry developments. The report aims to equip stakeholders with actionable intelligence to navigate this critical and evolving market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.37% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.37%.

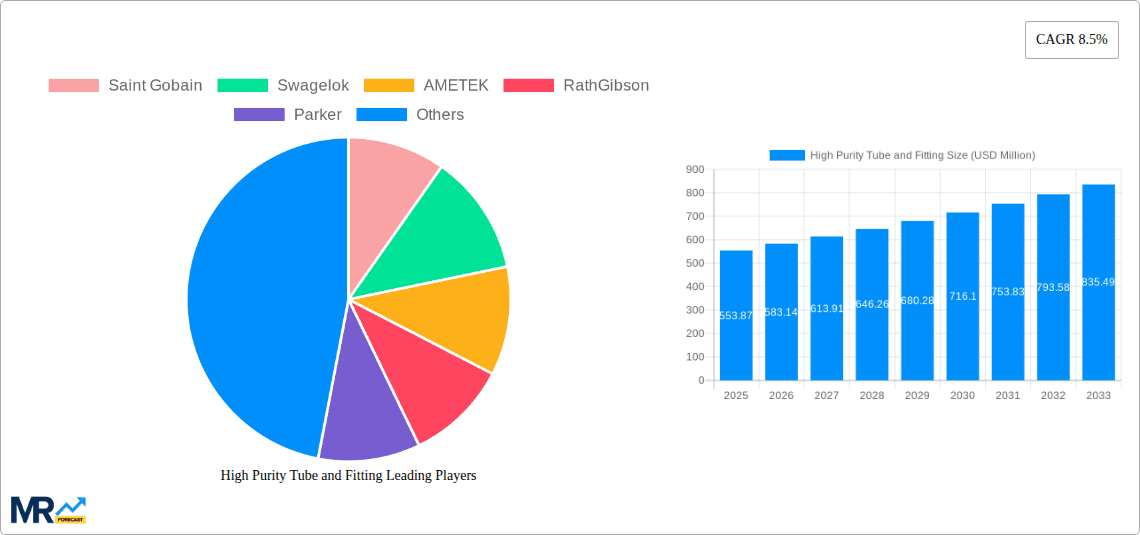

Key companies in the market include Saint Gobain, Swagelok, AMETEK, RathGibson, Parker, Sani-Tech West, Dockweiler AG, Neumo Ehrenberg(SciMax), IPolymer, Valex, SMC Corporation, Watts, Entegris, Topline, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "High Purity Tube and Fitting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Purity Tube and Fitting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.