1. What is the projected Compound Annual Growth Rate (CAGR) of the High Purity Pharmaceutical Excipient?

The projected CAGR is approximately 7.93%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Purity Pharmaceutical Excipient

High Purity Pharmaceutical ExcipientHigh Purity Pharmaceutical Excipient by Application (Oral Medications, Injectable Medications, Medications Inhaled Through the Nose or Mouth, Ocular Medications, Others), by Type (Natural Excipients, Semi-natural Excipients, Completely Synthetic Excipients), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

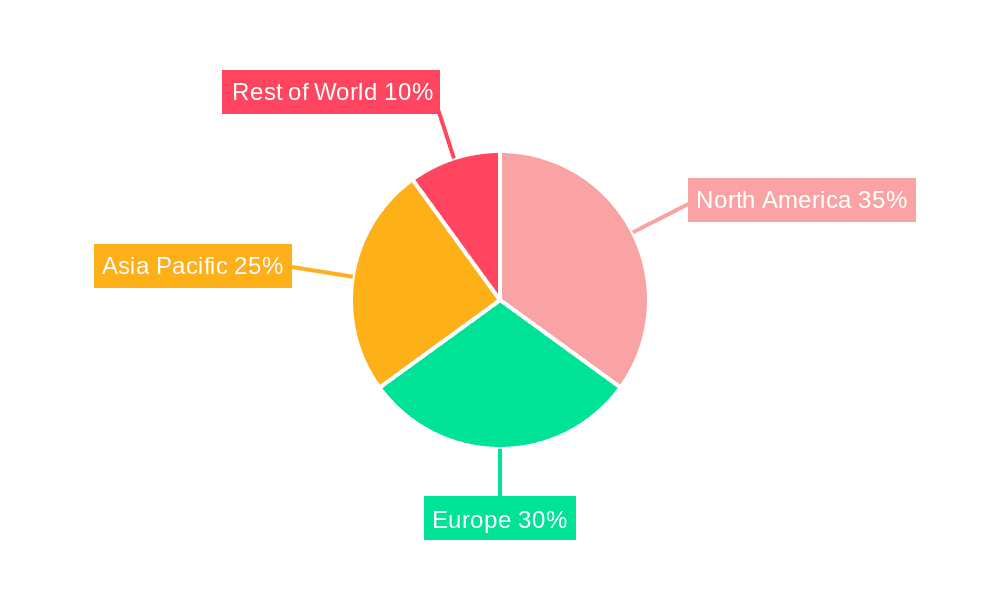

The global high-purity pharmaceutical excipient market is poised for significant expansion, driven by advancements in drug delivery systems and a heightened emphasis on therapeutic efficacy and patient safety. Key growth drivers include the increasing incidence of chronic diseases, the burgeoning generic drug sector, and the widespread adoption of innovative drug formulations such as injectables and inhalers. Natural excipients currently lead, favored for their perceived safety and consumer preference. However, semi-synthetic and synthetic alternatives are gaining traction for their consistency and cost-effectiveness in mass production. Stringent pharmaceutical quality standards and increasingly complex drug formulations necessitate the use of high-purity excipients. North America and Europe dominate the market, supported by robust pharmaceutical infrastructure and high healthcare expenditure. The Asia-Pacific region is projected for substantial growth, fueled by developing healthcare systems and rising disposable incomes in emerging economies.

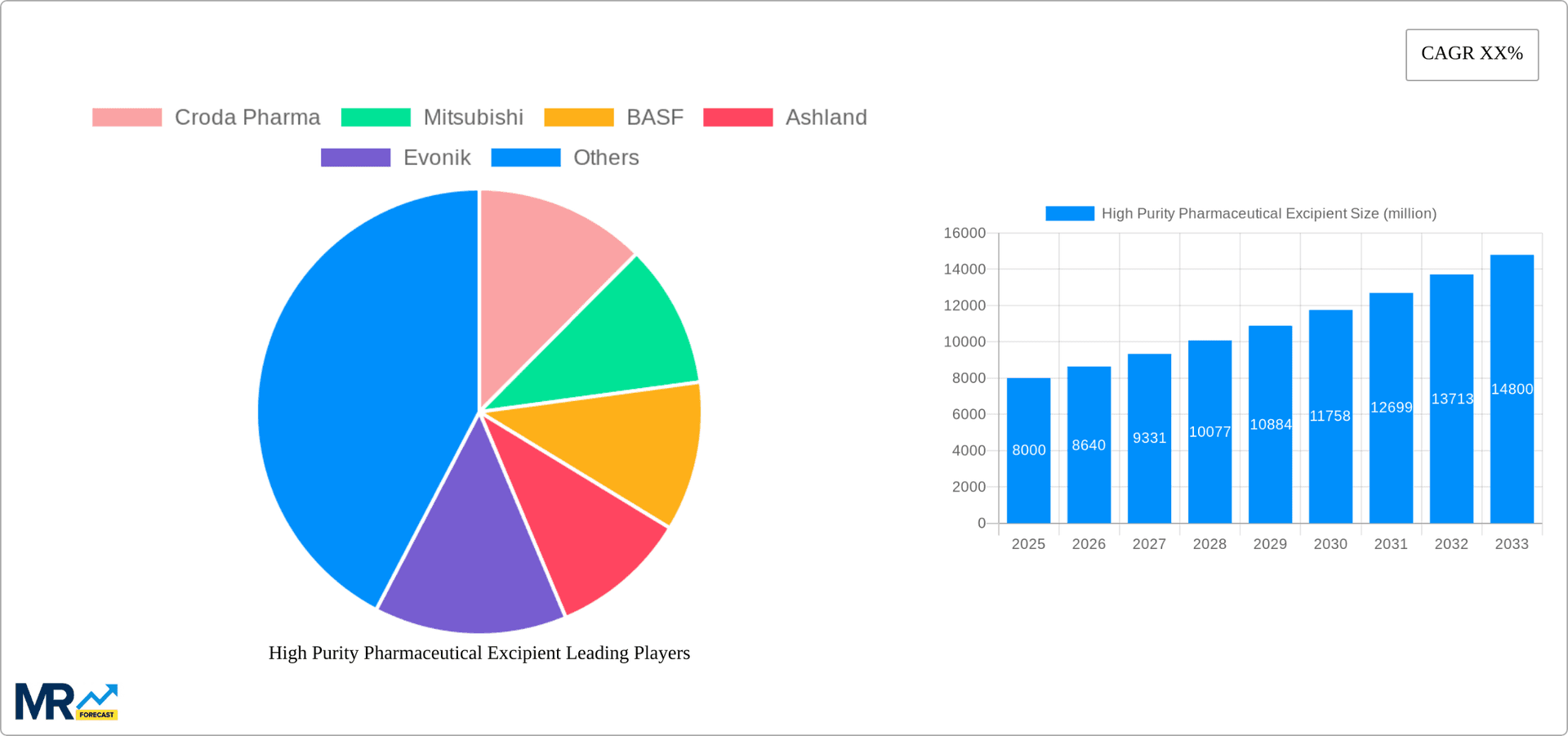

The competitive environment features established multinational corporations and specialized manufacturers. Strategic alliances, mergers, and ongoing innovation are central to maintaining market leadership. The market is segmented by application, including oral, injectable, inhalation, and ocular, and by type: natural, semi-synthetic, and synthetic. While oral medications represent the largest segment, injectables are exhibiting accelerated growth due to their increasing utilization. Market expansion faces challenges from regulatory complexities and potential raw material supply chain disruptions. Nevertheless, continuous advancements in excipient technology and novel drug delivery systems are expected to propel sustained market growth. The estimated market size for 2025 is $10.72 billion, with a projected Compound Annual Growth Rate (CAGR) of 7.93% from the base year 2025 to 2033.

The global high-purity pharmaceutical excipient market is experiencing robust growth, driven by the increasing demand for safe and effective pharmaceutical formulations. The market, valued at approximately $XX billion in 2025, is projected to reach $YY billion by 2033, exhibiting a significant Compound Annual Growth Rate (CAGR). This expansion is fueled by several factors, including the rising prevalence of chronic diseases necessitating long-term medication, the surge in generic drug production which places a high demand on cost-effective excipients, and the stringent regulatory requirements for pharmaceutical purity. The market is witnessing a shift towards advanced excipients with enhanced functionalities, such as controlled release and targeted drug delivery systems. This trend is particularly pronounced in the injectable medications segment, which demands the highest purity levels to minimize adverse reactions. Furthermore, the increasing adoption of innovative manufacturing technologies is contributing to improved production efficiency and lower costs. However, challenges such as stringent regulatory compliance and the potential for supply chain disruptions are factors that need careful consideration. The market is highly competitive, with established players and emerging companies vying for market share. The ongoing innovation in excipient development, focusing on enhanced functionalities and improved biocompatibility, will continue to shape the market landscape in the coming years. Key trends include the growing preference for natural and semi-natural excipients due to their perceived safety and biocompatibility profiles, and the simultaneous rise of completely synthetic excipients engineered for specific performance characteristics. The increasing demand for personalized medicine also presents an opportunity for the development of tailored excipients to optimize drug delivery and efficacy.

Several factors are propelling the growth of the high-purity pharmaceutical excipient market. The escalating prevalence of chronic diseases like diabetes, cardiovascular ailments, and cancer necessitates consistent medication, driving up the demand for safe and effective excipients. Stringent regulatory frameworks worldwide, such as those enforced by the FDA and EMA, mandate high purity standards to ensure patient safety, stimulating the growth of this market. The burgeoning generic drug sector, which relies heavily on cost-effective yet high-quality excipients, further fuels market expansion. The rising adoption of advanced drug delivery systems, like controlled-release formulations and targeted therapies, necessitates specialized excipients that meet stringent purity and performance criteria. Moreover, the pharmaceutical industry's ongoing pursuit of innovation in drug development and delivery translates to increased demand for novel excipients with improved biocompatibility and functionalities. The growth of the biotechnology sector and the development of complex biologics are also significant contributing factors, as these often require highly specialized and purified excipients for effective formulation. Finally, investments in research and development focused on improving excipient synthesis and characterization techniques are fostering market expansion.

Despite the significant growth potential, several challenges hinder the expansion of the high-purity pharmaceutical excipient market. Stringent regulatory compliance and the associated costs of testing and certification pose a major hurdle for manufacturers. Maintaining consistent supply chain integrity and mitigating the risks of raw material sourcing and potential disruptions are critical concerns. The high cost associated with producing and purifying excipients can impact profitability, especially for smaller companies. Furthermore, competition from low-cost producers in emerging economies can pressure profit margins. The industry also faces increasing pressure to adopt sustainable manufacturing practices and minimize environmental impact, requiring significant investment in eco-friendly technologies. Finally, the ever-evolving regulatory landscape and the need for constant adaptation to new guidelines add complexity to the market. These factors demand careful strategic planning and resource allocation from manufacturers to ensure long-term success in this demanding market.

The injectable medications segment is projected to dominate the high-purity pharmaceutical excipient market throughout the forecast period (2025-2033). This dominance stems from the extremely stringent purity requirements for injectable drugs to avoid potentially life-threatening adverse reactions. Even minute impurities can have significant consequences in this application. The segment's high value contribution is further fueled by the increasing demand for biologics and specialized injectable therapies to treat complex diseases.

Geographically, North America and Europe are currently leading the market, primarily due to advanced healthcare infrastructure, stringent regulatory environments, and high adoption rates of innovative drug delivery systems. However, Asia-Pacific is expected to witness significant growth in the coming years due to rising healthcare expenditure, increasing prevalence of chronic diseases, and a burgeoning generic pharmaceutical industry.

The high-purity pharmaceutical excipient industry is experiencing substantial growth due to the confluence of factors like increasing demand for advanced drug delivery systems, rising prevalence of chronic illnesses, and the stringent regulatory landscape mandating higher purity standards for pharmaceutical products. Moreover, ongoing R&D efforts focused on developing novel excipients with enhanced functionalities, such as targeted drug delivery and controlled release, further propel market expansion. The rising adoption of personalized medicine also contributes to the industry's growth by creating demand for customized excipients tailored to specific patient needs.

(Note: Specific company developments and dates would need to be researched and added here. This list provides examples.)

This report provides a comprehensive overview of the high-purity pharmaceutical excipient market, covering key trends, drivers, challenges, and leading players. The analysis encompasses market sizing and forecasting, segmentation by application and type, regional analysis, and competitive landscape. Detailed profiles of major market participants are included, along with an assessment of recent industry developments and future growth prospects. The report is designed to offer valuable insights to stakeholders involved in the pharmaceutical industry, including manufacturers, suppliers, and regulatory bodies. The information provided is meticulously researched and compiled to provide a thorough understanding of this crucial segment of the pharmaceutical supply chain.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.93% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.93%.

Key companies in the market include Croda Pharma, Mitsubishi, BASF, Ashland, Evonik, JRS Pharma, Syensqo, Roquette, Seqens.

The market segments include Application, Type.

The market size is estimated to be USD 10.72 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "High Purity Pharmaceutical Excipient," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Purity Pharmaceutical Excipient, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.