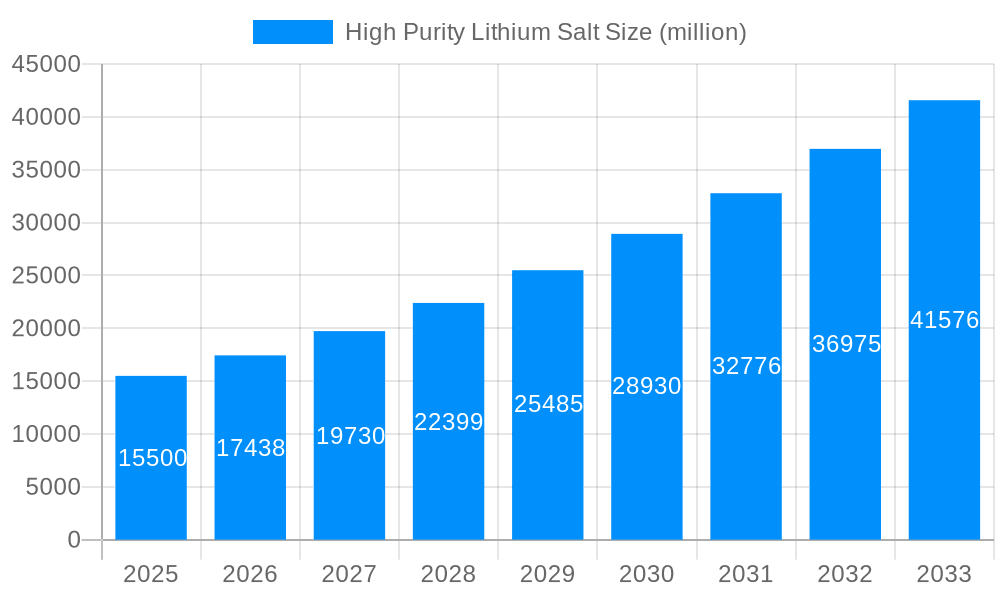

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Purity Lithium Salt?

The projected CAGR is approximately 14.46%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Purity Lithium Salt

High Purity Lithium SaltHigh Purity Lithium Salt by Type (Battery Grade High Purity Lithium Salt, Industrial Grade High Purity Lithium Salt, World High Purity Lithium Salt Production ), by Application (Electric Batteries, Chemical Energy Storage, Consumer Batteries, Lubricant, Ceramic Glass, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

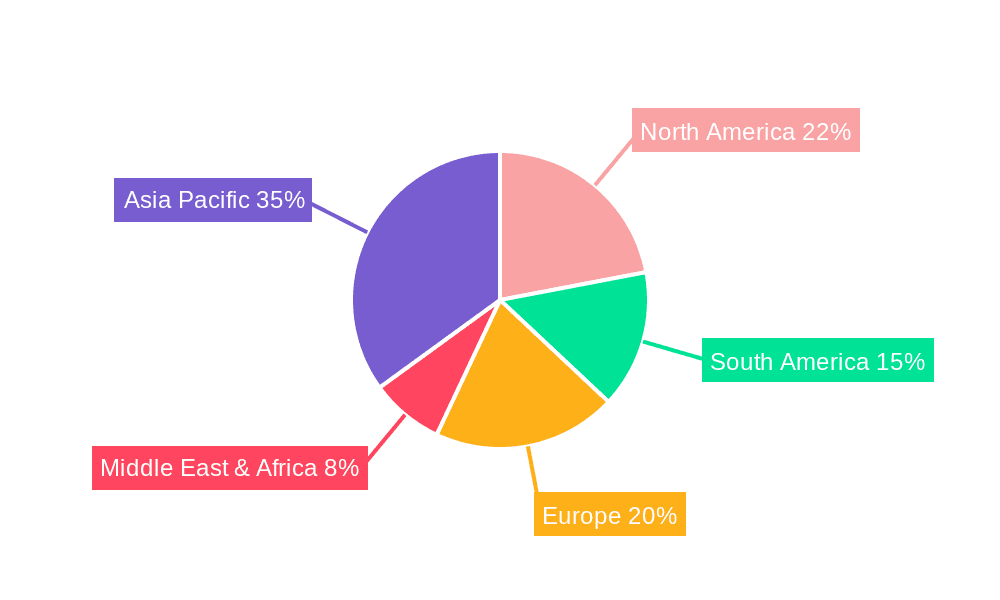

The high-purity lithium salt market is poised for substantial expansion, fueled by the rapid growth of the electric vehicle (EV) sector and the increasing demand for energy storage solutions. The escalating need for lithium-ion batteries, alongside technological advancements that necessitate higher purity lithium salts, are primary growth drivers. Projections indicate a market size of 7.9 billion in the base year 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 14.46 over the forecast period. Key market segments include battery-grade high-purity lithium salts, which hold the largest share, followed by industrial-grade variants. Asia Pacific, led by China, currently dominates the market due to its robust manufacturing infrastructure and significant lithium reserves. However, North America and Europe are expected to experience considerable growth as EV adoption accelerates in these regions. Market challenges encompass lithium price volatility, supply chain disruptions due to geopolitical factors, and environmental considerations associated with lithium extraction. Industry participants are actively addressing these challenges through sustainable practices, strategic collaborations, and vertical integration.

Several pivotal trends are influencing the high-purity lithium salt market. The increasing adoption of lithium-iron-phosphate (LFP) batteries, known for their cost-effectiveness and enhanced safety, is a significant development. Furthermore, a growing emphasis on battery recycling and responsible lithium sourcing will play a crucial role in the market's long-term trajectory. Innovations in lithium extraction and purification technologies, aimed at cost reduction and efficiency improvements, represent another key trend. The competitive landscape is characterized by intense rivalry among established and emerging players, with strategic alliances, mergers, and acquisitions anticipated to shape market consolidation and geographic expansion. The outlook for the high-purity lithium salt market is exceptionally strong, propelled by the global shift towards sustainable energy and continuous advancements in battery technology.

The high-purity lithium salt market is experiencing explosive growth, projected to reach several million units by 2033. Driven primarily by the burgeoning electric vehicle (EV) sector and the increasing demand for energy storage solutions, this market is poised for sustained expansion throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a consistent upward trajectory, exceeding expectations in several key segments. The base year (2025) marks a crucial point, showing significant market consolidation and the emergence of new players. While the estimated year (2025) data points to strong growth, the forecast period promises even more substantial increases, driven by technological advancements and evolving applications. The market is characterized by intense competition, with established players like Albemarle and Sociedad Química y Minera de Chile S.A. facing challenges from rapidly expanding Chinese producers. This competitive landscape is further complicated by ongoing innovation in extraction and processing techniques, leading to improved purity levels and cost reductions. The increasing focus on sustainability and ethical sourcing of lithium further shapes the market dynamics, influencing consumer preferences and regulatory landscapes. Strategic partnerships, mergers, and acquisitions are becoming increasingly prevalent as companies seek to secure their position in this rapidly evolving market. The shift towards more sustainable and efficient battery technologies is also a prominent trend, impacting demand for specific types and grades of high-purity lithium salts.

The phenomenal growth of the high-purity lithium salt market is primarily fueled by the exponential rise in electric vehicle adoption globally. Governments worldwide are incentivizing EV adoption through various subsidies and policies, leading to a surge in demand for lithium-ion batteries, the key component where high-purity lithium salts play a vital role. Furthermore, the growing demand for energy storage solutions in renewable energy applications, such as solar and wind power, is significantly contributing to the market's expansion. These stationary storage systems require high-capacity and long-life batteries, again relying on high-purity lithium salts for optimal performance. Beyond the energy sector, increasing applications in consumer electronics, such as smartphones and laptops, further drive demand. The advancement of battery technologies, leading to increased energy density and improved battery lifespan, also contributes to the market's growth, as higher purity enhances battery performance and longevity. Finally, the expanding industrial applications of high-purity lithium salts, including lubricants and ceramic glass production, represent a significant, albeit smaller, contributing factor to overall market growth.

Despite the robust growth, several challenges and restraints hinder the high-purity lithium salt market. The most significant is the volatile pricing of lithium raw materials, directly impacting the production cost and market stability. Fluctuations in lithium prices can significantly affect profitability, making long-term planning and investment challenging for producers. Geopolitical instability in regions with significant lithium reserves also poses a risk, potentially disrupting supply chains and affecting overall market availability. Environmental concerns associated with lithium mining and processing are another considerable challenge, prompting increased scrutiny from regulatory bodies and a growing emphasis on sustainable mining practices. Competition for lithium resources is intensifying, with various countries vying for control of lithium-rich regions, creating potential bottlenecks and price volatility. Furthermore, technological advancements in alternative battery chemistries might, in the long term, reduce the dependence on lithium-ion batteries and thus impact the demand for high-purity lithium salts.

The Battery Grade High Purity Lithium Salt segment is projected to dominate the market, driven by the massive growth of the electric vehicle industry and the expansion of energy storage solutions. China is expected to remain the leading producer and consumer of high-purity lithium salts throughout the forecast period, with its robust EV market and extensive manufacturing capabilities. However, other regions, particularly in North America and Europe, are witnessing rapid growth as the electric vehicle revolution takes hold in these markets.

China: The largest producer and consumer, benefiting from a strong domestic EV market and integrated supply chains. Their dominance is expected to continue, although other regions are catching up. This dominance is fueled by government support for the EV industry and significant investments in lithium processing and refining capabilities. The sheer scale of manufacturing in China gives them a significant cost advantage.

North America (US): Significant growth is anticipated driven by the increasing adoption of electric vehicles and government incentives. However, a considerable portion of North American demand is still met through imports. The focus on domestic sourcing and the development of local processing facilities will be crucial in strengthening its position.

Europe: Similar to North America, significant growth is anticipated. However, European countries are heavily reliant on imports, although efforts are underway to secure their domestic supply of lithium. Stringent environmental regulations might influence choices of suppliers and processing methods.

Other Regions (e.g., Australia, South America): These regions are major lithium producers, but their processing capabilities often lag, leading to substantial reliance on export of raw materials. Developing robust domestic processing industries will be vital for economic growth and energy security.

The Electric Batteries application segment also holds the largest market share. This is primarily due to the dominant role of lithium-ion batteries in powering electric vehicles and portable electronics. The increase in the number of electric vehicles sold, combined with the growth of other applications of lithium-ion batteries in renewable energy, are the key drivers for this segment’s growth.

The high-purity lithium salt industry's growth is significantly bolstered by ongoing technological advancements in battery technology, increasing demand for energy storage solutions, and supportive government policies promoting renewable energy and electric vehicle adoption. These factors are synergistically driving market expansion, further fueled by investments in lithium mining and processing capacity.

This report provides a comprehensive overview of the high-purity lithium salt market, covering historical data, current market trends, and future projections. It includes in-depth analysis of key market drivers, challenges, and opportunities, as well as detailed profiles of major market players. The report is an invaluable resource for businesses and investors seeking to understand the dynamics of this rapidly evolving sector and make informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.46% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.46%.

Key companies in the market include Albemarle, Sociedad Química y Minera de Chile S.A, Sinochem, Livent, Ganfeng Lithium, Shenzhen Chengxin Lithium Group Co., Ltd., Sichuan Yahua Industrial, China Lithium Products Technology Co., Ltd., YIN LI NEW ENERGY, Jiangxi Jinhui Lithium, Tianqi Lithium, Ruifu Lithium, Jiuling Lithium, Jiangxi Yongxing Special Steel New Energy Technology Co., Ltd., NANSHI Lithium, GENERAL Lithium, YOUNGY Co.,Ltd., Tibet Mineral Development, Suzhou TA&A Ultra Clean Technolgy Co Ltd, Sinomine Resource Group, Qinghai Salt Lake Potash, Zangge Mining, Shanghai China Lithium Industrial Co.,Ltd, Keda Industrial Co., Ltd., RecycLiCo Battery Materials, Lithium Power International.

The market segments include Type, Application.

The market size is estimated to be USD 7.9 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "High Purity Lithium Salt," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Purity Lithium Salt, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.