1. What is the projected Compound Annual Growth Rate (CAGR) of the High Purity Germanium Tetrafluoride?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Purity Germanium Tetrafluoride

High Purity Germanium TetrafluorideHigh Purity Germanium Tetrafluoride by Type (Purity 4N, Purity 5N, Purity 6N, Purity 7N, Others, World High Purity Germanium Tetrafluoride Production ), by Application (Silicon Germanium Microcrystals, Doping and Ion Implantation, Others, World High Purity Germanium Tetrafluoride Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

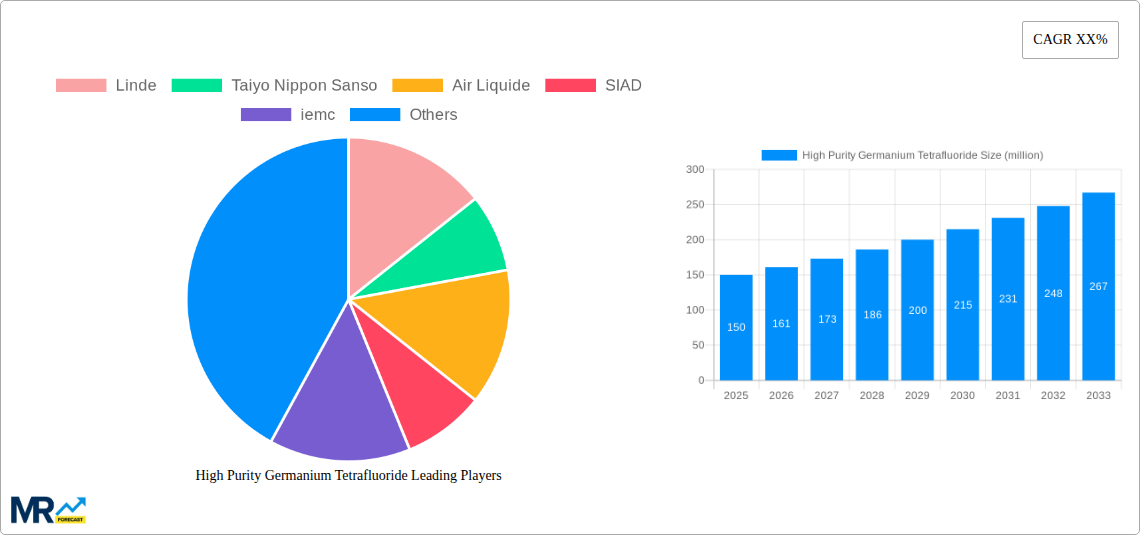

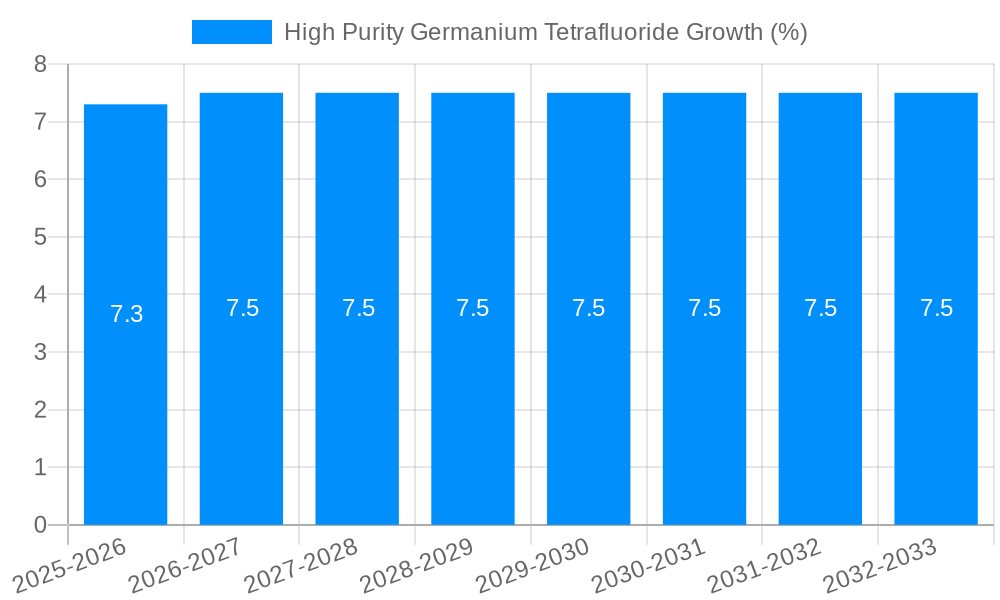

The global High Purity Germanium Tetrafluoride (GeF4) market is poised for significant expansion, driven by its critical role in advanced semiconductor manufacturing and its burgeoning applications in cutting-edge technologies. With an estimated market size of approximately USD 150 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by the increasing demand for high-performance semiconductors, particularly those utilizing Silicon Germanium (SiGe) microcrystals, which are integral to modern integrated circuits for faster processing and enhanced efficiency. Furthermore, the compound's utility in precise doping and ion implantation processes for creating specialized semiconductor materials is a key market accelerant. The expansion of the electronics industry, coupled with advancements in nanotechnology and materials science, is creating sustained demand for high-purity GeF4.

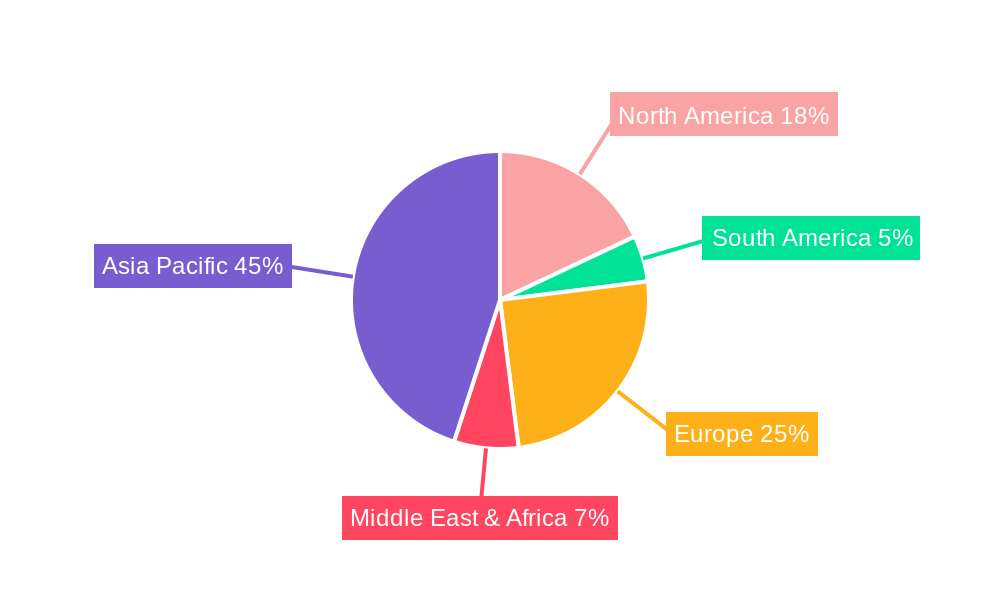

Despite the promising outlook, the market faces certain restraints, including the complex and potentially hazardous nature of GeF4 production and handling, which necessitates stringent safety protocols and specialized infrastructure. Fluctuations in the availability and cost of raw materials, primarily germanium, can also impact market dynamics. However, ongoing research and development efforts are focused on optimizing production methods and exploring new applications, which are expected to mitigate these challenges. The market is characterized by a strong presence of key players like Linde, Taiyo Nippon Sanso, and Air Liquide, who are investing in expanding their production capacities and global reach. Asia Pacific, led by China, is anticipated to be the largest and fastest-growing regional market, owing to its dominance in semiconductor manufacturing and increasing investments in high-tech industries.

The global High Purity Germanium Tetrafluoride (GeF4) market is poised for significant expansion driven by its critical role in advanced semiconductor manufacturing and specialized material science applications. During the study period of 2019-2033, with a base year of 2025, the market has witnessed and is projected to continue experiencing robust growth. The estimated year of 2025 marks a pivotal point where production volumes are expected to reach millions of units, reflecting increased demand from various industries. For instance, the burgeoning demand for high-performance integrated circuits, particularly in the telecommunications, consumer electronics, and automotive sectors, is a primary driver. The development of advanced semiconductor materials like Silicon Germanium (SiGe) microcrystals, which offer superior speed and power efficiency compared to traditional silicon, directly translates into a higher need for high-purity GeF4 as a precursor material. The purity levels of GeF4 are paramount, with the market segment of Purity 7N (99.99999%) witnessing substantial interest due to its stringent requirements in cutting-edge applications like advanced doping and ion implantation processes for next-generation microprocessors and memory devices. The historical period of 2019-2024 laid the foundation for this growth, with incremental increases in production and adoption. Looking ahead to the forecast period of 2025-2033, analysts anticipate an acceleration in market penetration, spurred by technological advancements in semiconductor fabrication and the increasing complexity of electronic devices. The market's trajectory indicates a shift towards higher purity grades, as manufacturers strive for enhanced device performance and reliability. This trend is supported by ongoing research and development efforts aimed at optimizing GeF4 synthesis and purification techniques, making higher purity grades more accessible and cost-effective for a wider range of applications. Furthermore, the evolving landscape of quantum computing and advanced photonics also presents emerging opportunities for high-purity GeF4, further solidifying its importance in the technological ecosystem. The continuous innovation in material science and semiconductor technology ensures that high-purity GeF4 will remain a cornerstone in the development of future electronic marvels.

The propulsion of the High Purity Germanium Tetrafluoride (GeF4) market is primarily orchestrated by the relentless pursuit of enhanced semiconductor performance and miniaturization. The insatiable demand for faster, more powerful, and energy-efficient electronic devices across myriad sectors, including telecommunications, artificial intelligence, and autonomous systems, directly fuels the need for advanced precursor materials like GeF4. Specifically, the application of GeF4 in the synthesis of Silicon Germanium (SiGe) microcrystals is a significant catalyst. SiGe alloys offer superior electron mobility and heterojunction bipolar transistor (HBT) performance compared to pure silicon, making them indispensable for high-frequency applications such as 5G communication modules and radar systems. Furthermore, the critical role of GeF4 in doping and ion implantation processes cannot be overstated. As semiconductor fabrication pushes the boundaries of device scaling, achieving precise doping profiles becomes increasingly challenging. High-purity GeF4 enables more controlled and accurate introduction of germanium atoms into silicon substrates, leading to improved transistor characteristics, reduced leakage currents, and enhanced device reliability. The continuous innovation in semiconductor manufacturing, aimed at developing smaller transistors with higher densities, necessitates materials with exceptional purity and predictable chemical behavior, a niche that high-purity GeF4 perfectly fills. The evolution of quantum computing and advanced photonics, areas that often leverage germanium's unique optoelectronic properties, also represents a nascent yet powerful driving force, hinting at future expansions in demand.

Despite the robust growth potential, the High Purity Germanium Tetrafluoride (GeF4) market is not without its hurdles. A primary challenge revolves around the high cost and complex manufacturing processes associated with achieving and maintaining extreme purity levels, particularly for grades like Purity 7N. The extraction and purification of germanium itself are energy-intensive and can be resource-constrained, contributing to the overall elevated cost of its fluorinated compound. This cost factor can limit the adoption of high-purity GeF4 in applications where cost-effectiveness is a critical consideration, potentially favoring alternative materials or less stringent purity grades where feasible. Another significant restraint stems from supply chain vulnerabilities and geopolitical factors that can impact the availability and price of germanium, a key raw material. Geographically concentrated sources of germanium can lead to price volatility and potential disruptions, affecting the stability of GeF4 production. Furthermore, the specialized handling and safety requirements associated with highly reactive and corrosive gases like GeF4 necessitate significant investment in infrastructure, equipment, and personnel training, adding to operational costs and complexity. The development and scaling of alternative semiconductor materials and fabrication techniques also pose a potential threat, as ongoing research continuously seeks to improve the performance of silicon-based devices or explore entirely new material systems that could reduce reliance on germanium compounds. Finally, stringent environmental regulations and waste management protocols associated with the production and use of fluorinated compounds can add to the compliance burden and operational expenditure for manufacturers.

The High Purity Germanium Tetrafluoride (GeF4) market's dominance is intricately linked to the global semiconductor manufacturing landscape, with Asia-Pacific, particularly East Asian countries like China, South Korea, and Taiwan, emerging as a pivotal region. This dominance is multifaceted, stemming from a combination of advanced technological infrastructure, significant government investment in the semiconductor industry, and a high concentration of leading semiconductor fabrication plants. The presence of major foundries and integrated device manufacturers (IDMs) in this region creates an insatiable demand for high-purity precursors essential for cutting-edge chip production.

Within the Type segment, the Purity 7N grade is projected to witness the most significant growth and exert considerable influence on market dynamics. This is directly driven by the increasing sophistication of semiconductor technology, which demands materials with ultra-high purity to enable the fabrication of next-generation microprocessors, memory chips, and specialized components for advanced applications. As the industry pushes towards smaller feature sizes and improved electrical performance, even minute impurities can lead to device failures and reduced yields. Consequently, the demand for Purity 7N GeF4, essential for advanced doping and ion implantation processes, is escalating. This is particularly relevant for the production of advanced Silicon Germanium (SiGe) microcrystals, which are increasingly incorporated into high-performance logic and RF devices. The ability of Purity 7N GeF4 to facilitate precise doping and ensure the integrity of the SiGe alloy makes it indispensable for these applications.

In terms of Application, the Doping and Ion Implantation segment is a key driver of market dominance. The precision and control offered by high-purity GeF4 in these processes are paramount for creating complex semiconductor architectures. As Moore's Law continues its relentless march, the ability to accurately implant dopant atoms at specific locations and concentrations within semiconductor substrates becomes critically important for optimizing transistor performance, reducing power consumption, and enhancing device speed. GeF4 plays a crucial role in achieving these intricate doping profiles, especially when germanium is integrated into silicon.

The World High Purity Germanium Tetrafluoride Production segment itself, particularly the expansion and optimization of production capacities, will be a defining characteristic of market dominance. Countries and companies that can efficiently and reliably produce high volumes of ultra-high purity GeF4 will hold a significant competitive advantage. This includes investments in advanced purification technologies, stringent quality control measures, and robust supply chain management. The ability to meet the growing global demand for high-purity GeF4, especially from the dominant Asia-Pacific region, will be a critical factor in determining market leadership.

The synergy between the demand for Purity 7N GeF4 and its application in advanced doping and ion implantation within the Asia-Pacific region forms a self-reinforcing cycle, solidifying these segments and regions as the primary forces shaping the global High Purity Germanium Tetrafluoride market.

The high purity Germanium Tetrafluoride (GeF4) industry is experiencing significant growth catalysts. The relentless advancement in semiconductor technology, particularly the increasing demand for high-performance integrated circuits in 5G infrastructure, AI-powered devices, and autonomous vehicles, is a primary driver. The growing adoption of Silicon Germanium (SiGe) microcrystals, offering superior speed and power efficiency, directly fuels the need for high-purity GeF4 as a critical precursor. Furthermore, the development of advanced doping and ion implantation techniques, crucial for achieving precise control over semiconductor properties, relies heavily on the availability of ultra-pure GeF4. Emerging applications in quantum computing and advanced photonics also present promising avenues for future growth.

This comprehensive report delves into the intricate dynamics of the High Purity Germanium Tetrafluoride (GeF4) market, offering an in-depth analysis spanning the study period of 2019-2033. It meticulously examines market trends, key drivers, and significant challenges, providing a holistic view of the industry's trajectory. The report highlights the growing importance of high-purity grades, such as Purity 7N, driven by advancements in semiconductor fabrication, particularly in Silicon Germanium microcrystals and precision doping applications. It forecasts market performance based on the estimated year of 2025 and projects future growth during the forecast period of 2025-2033, all while considering the historical context of 2019-2024. The analysis encompasses leading global players and explores significant developments that are shaping the future of GeF4 production and application.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Linde, Taiyo Nippon Sanso, Air Liquide, SIAD, iemc, Fujian Shaowu Yongfei Chemical, Yunnan Chihong Zn & Ge, Shandong Zhongshan Photoelectric Materials, Wuhan New Silicon Technology Qianjiang, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Purity Germanium Tetrafluoride," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Purity Germanium Tetrafluoride, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.