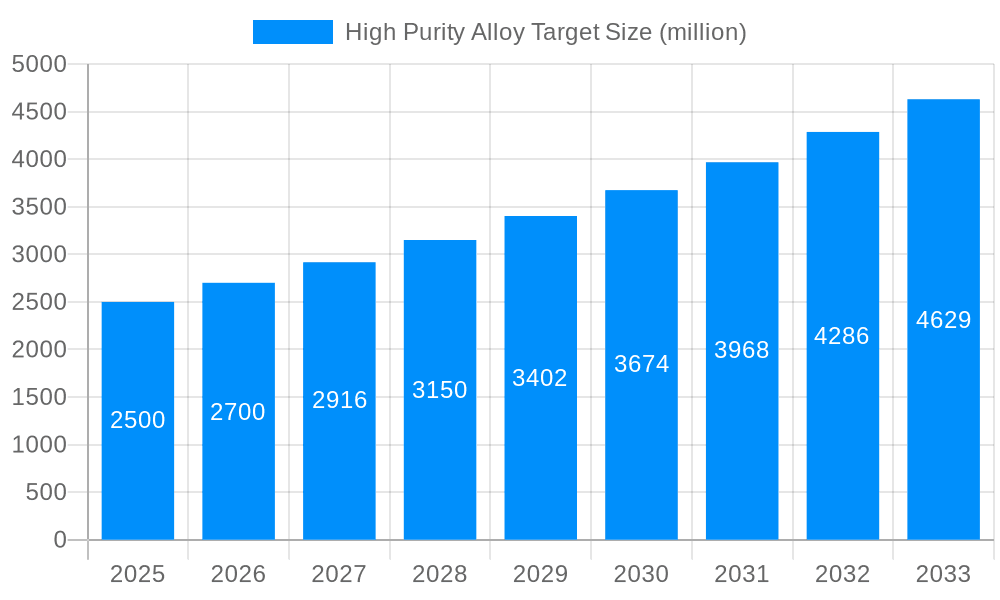

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Purity Alloy Target?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Purity Alloy Target

High Purity Alloy TargetHigh Purity Alloy Target by Type (Iron (Fe) Based Alloy Target, Copper (Cu) Based Alloy Target, Cobalt (Co) Based Alloy Target, Nickel (Ni) Based Alloy Target, Titanium (Ti) Based Alloy Target, Zirconium (Zr) Based Alloy Target, Tungsten (W) Based Alloy Target, Zinc (Zn) Based Alloy Target, Silver (Ag) Based Alloy Target, World High Purity Alloy Target Production ), by Application (Semiconductor, Flat Panel Display, Others, World High Purity Alloy Target Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The high-purity alloy target market is experiencing significant expansion, propelled by the escalating demand from the semiconductor and flat panel display industries. These sectors require advanced materials with superior purity for enhanced performance and device miniaturization. Technological advancements in electronics, driving higher resolution displays and more efficient semiconductors, are key growth catalysts. Substantial investments in research and development for novel materials and manufacturing processes further contribute to market proliferation. The estimated market size for 2025 is $359.2 billion, with a projected CAGR of 4.5% from the base year 2025. Iron, copper, and nickel-based alloys are anticipated to dominate due to their cost-effectiveness and versatility. Geographically, North America and Asia-Pacific are key markets, with significant manufacturing presence in the United States, China, Japan, and South Korea. Challenges include raw material costs, stringent quality demands, and the imperative for sustainable manufacturing.

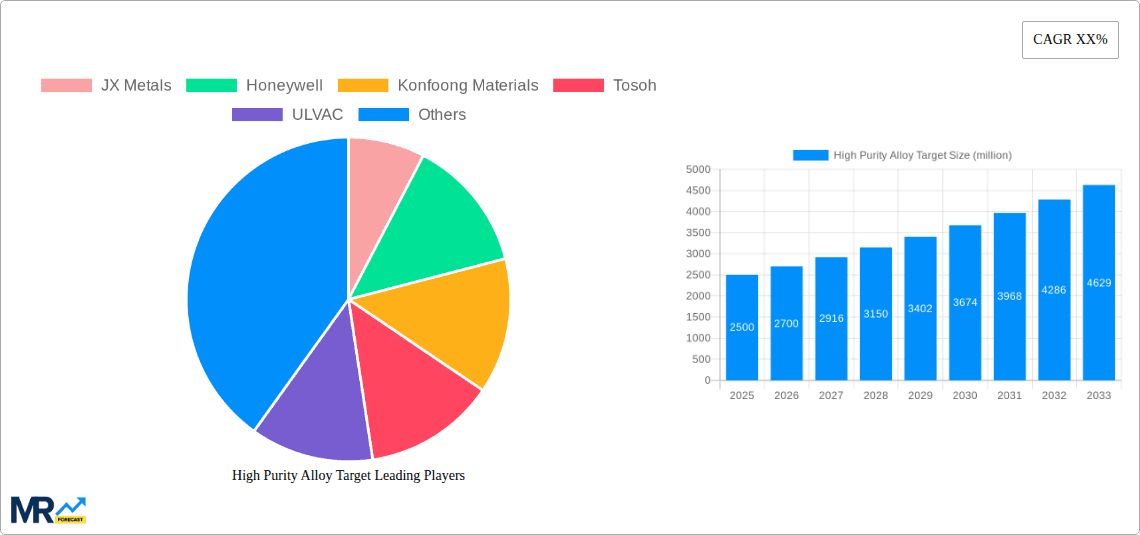

The competitive landscape features established leaders and innovative new entrants. Key players like JX Metals, Honeywell, and Materion (Heraeus) leverage their expertise and technological prowess. Emerging companies are focusing on specialized materials for niche applications. Future growth will be driven by materials science innovation, the development of advanced alloys, and increasing emphasis on sustainability in semiconductor and display manufacturing. Strategic collaborations will foster market acceleration. Understanding market segmentation by alloy type and application is critical for targeted business strategies and product development.

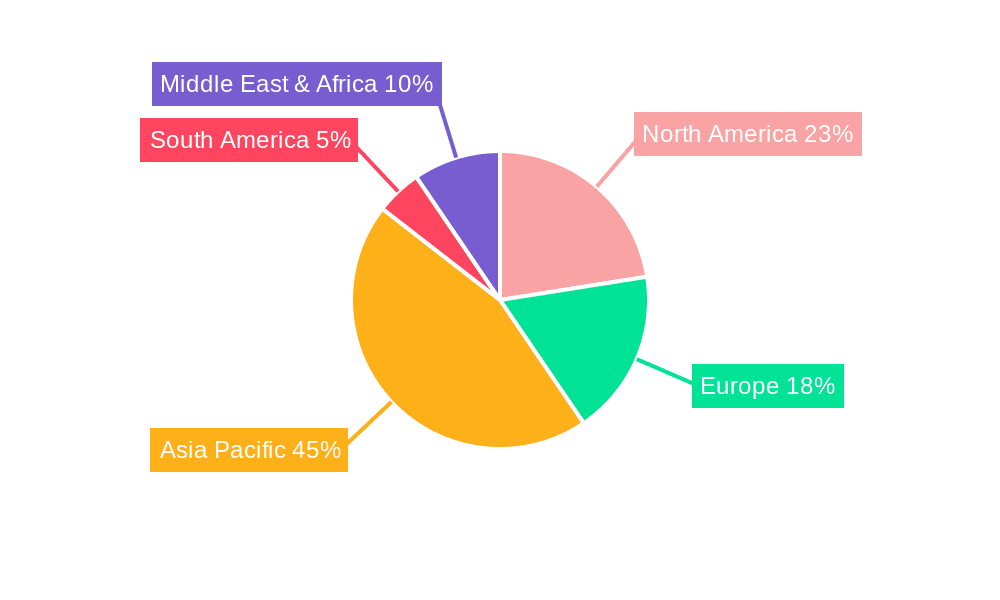

The global high-purity alloy target market is experiencing robust growth, projected to reach several billion USD by 2033. Driven by the burgeoning semiconductor and flat panel display industries, demand for these materials with ultra-high purity levels is surging. The market witnessed significant expansion during the historical period (2019-2024), exceeding USD X billion in 2024. This upward trajectory is expected to continue throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) exceeding Y%. Key market insights reveal a strong preference for specific alloy types based on application needs, with copper and nickel-based alloys dominating due to their superior electrical conductivity and thermal properties. The increasing sophistication of electronic devices and the relentless pursuit of miniaturization are primary drivers of this trend. Furthermore, advancements in manufacturing techniques are enabling the production of targets with even higher purity levels, leading to enhanced device performance and yield. The Asia-Pacific region, particularly China, South Korea, and Taiwan, remains a key growth engine, owing to the concentration of semiconductor and display manufacturing facilities. However, growing demand from North America and Europe, fueled by investments in advanced manufacturing and R&D, is contributing significantly to global market expansion. Competitive dynamics are characterized by a mix of established players and emerging companies, leading to continuous innovation in material science and manufacturing processes. The market is also witnessing an increasing adoption of sustainable manufacturing practices, driven by environmental concerns and regulatory pressures. This holistic perspective paints a picture of sustained growth for the high-purity alloy target market, driven by technological innovation and expanding industrial applications.

Several factors are driving the phenomenal growth of the high-purity alloy target market. The relentless miniaturization of electronic devices, particularly in the semiconductor and flat panel display sectors, demands materials with exceptional purity to ensure optimal performance and reliability. Any impurities can significantly impact device yield and functionality, making high-purity alloys essential. The rising demand for high-resolution displays and advanced semiconductor technologies, such as 5G and beyond, further fuels this demand. Furthermore, advancements in thin-film deposition techniques, such as sputtering and evaporation, rely heavily on high-quality alloy targets to achieve precise and uniform film deposition. The continuous innovation in these deposition techniques also contributes to the demand for more sophisticated and specialized high-purity alloys. Government initiatives and substantial investments in research and development in the semiconductor and electronics industries globally are further boosting the market growth. The increasing adoption of electric vehicles and renewable energy technologies also presents a burgeoning market opportunity for specific high-purity alloy targets. These technologies utilize materials with superior electrical conductivity and resistance to corrosion, driving demand for high-purity copper, nickel, and other alloy targets.

Despite its strong growth trajectory, the high-purity alloy target market faces several challenges. The production of these materials requires sophisticated and expensive manufacturing processes, often involving rigorous purification techniques and stringent quality control measures. This high production cost can limit market accessibility and impact profitability. The availability and cost of raw materials also represent potential constraints. The purity levels demanded are exceptionally high, necessitating complex and resource-intensive processes. Fluctuations in raw material prices can affect the overall cost of the targets and impact market competitiveness. Furthermore, stringent environmental regulations related to the manufacturing process and waste disposal pose another significant challenge. Companies must invest in advanced technologies and sustainable practices to comply with environmental standards, adding to their operational costs. Finally, the highly specialized nature of the market presents a barrier to entry for new players, resulting in a relatively consolidated market landscape.

The Asia-Pacific region, specifically China, South Korea, and Taiwan, is projected to dominate the high-purity alloy target market throughout the forecast period. This dominance is attributed to the concentration of leading semiconductor and flat panel display manufacturers in this region.

High Demand from Semiconductor Industry: The region's robust semiconductor industry is a major driver of demand for high-purity copper (Cu) and nickel (Ni) based alloy targets used in various semiconductor manufacturing processes. The continuous expansion of fabs (fabrication plants) and increasing production capacity fuel this demand.

Dominance in Flat Panel Display Manufacturing: The Asia-Pacific region's leading role in flat panel display production creates significant demand for high-purity zinc (Zn) and indium tin oxide (ITO) targets. The ongoing development of larger and higher-resolution displays further intensifies this demand.

Significant Investments in R&D: Significant investments in research and development in materials science and semiconductor technology within the region ensure a steady stream of innovation and enhanced demand for high-purity alloy targets with advanced properties.

Government Support and Policies: Supportive government policies and initiatives focused on technological advancements and industrial growth within the electronics sector further contribute to the region's market dominance.

Specific Segment Dominance: Within the alloy types, Copper (Cu) Based Alloy Targets are anticipated to dominate the market due to their widespread application in semiconductor manufacturing processes and their superior electrical conductivity. The forecast indicates a market size exceeding USD Z billion by 2033 for this segment alone, representing a significant share of the overall high-purity alloy target market. This dominance is further reinforced by the continuous growth of the semiconductor industry and the ongoing miniaturization trends in electronics.

The high-purity alloy target industry's growth is fueled by several key catalysts. The continuous advancements in semiconductor technology, pushing towards smaller, faster, and more energy-efficient chips, necessitate the use of even higher-purity targets. Simultaneously, the expanding flat panel display market, with its demand for high-resolution and larger screens, is a significant driver of growth. Government initiatives promoting technological advancement and domestic semiconductor manufacturing are also playing a crucial role in stimulating market expansion. Finally, the rising adoption of renewable energy technologies, such as solar panels and electric vehicles, creates a new demand for specific high-purity alloys with unique properties, further bolstering industry growth.

This report provides a comprehensive overview of the high-purity alloy target market, analyzing historical trends, current market dynamics, and future growth projections. It covers key segments, including various alloy types and their applications in semiconductors, flat panel displays, and other industries. The report also examines the competitive landscape, highlighting key players, their market shares, and strategic initiatives. Detailed analysis of driving forces, challenges, and growth catalysts provide valuable insights into market trends and future opportunities. Regional market breakdowns offer a granular understanding of geographical dynamics and potential investment areas. The report concludes with strategic recommendations for businesses operating in or considering entry into this rapidly expanding market. The report's detailed analysis provides a robust foundation for informed decision-making and strategic planning within the high-purity alloy target industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include JX Metals, Honeywell, Konfoong Materials, Tosoh, ULVAC, Grikin Advanced MATERIALS, Luoyang Sifon Electronic, Praxair, Materion (Heraeus), Sumitomo Chemical, Heesung.

The market segments include Type, Application.

The market size is estimated to be USD 359.2 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "High Purity Alloy Target," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Purity Alloy Target, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.