1. What is the projected Compound Annual Growth Rate (CAGR) of the High Jewellery?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Jewellery

High JewelleryHigh Jewellery by Type (Diamond, Pearl, Crystal, Other), by Application (Collections, Wedding, Festive, Fashion, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

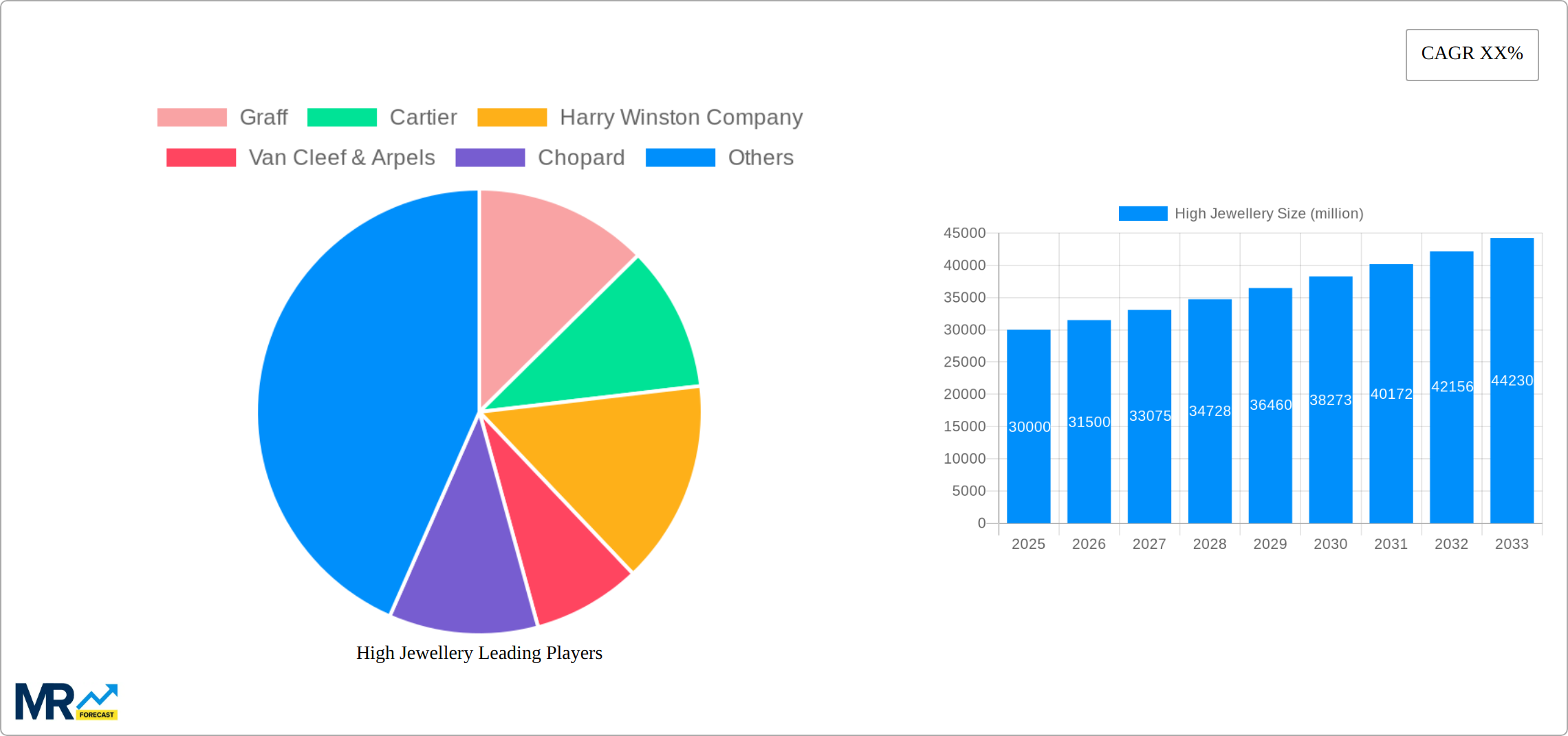

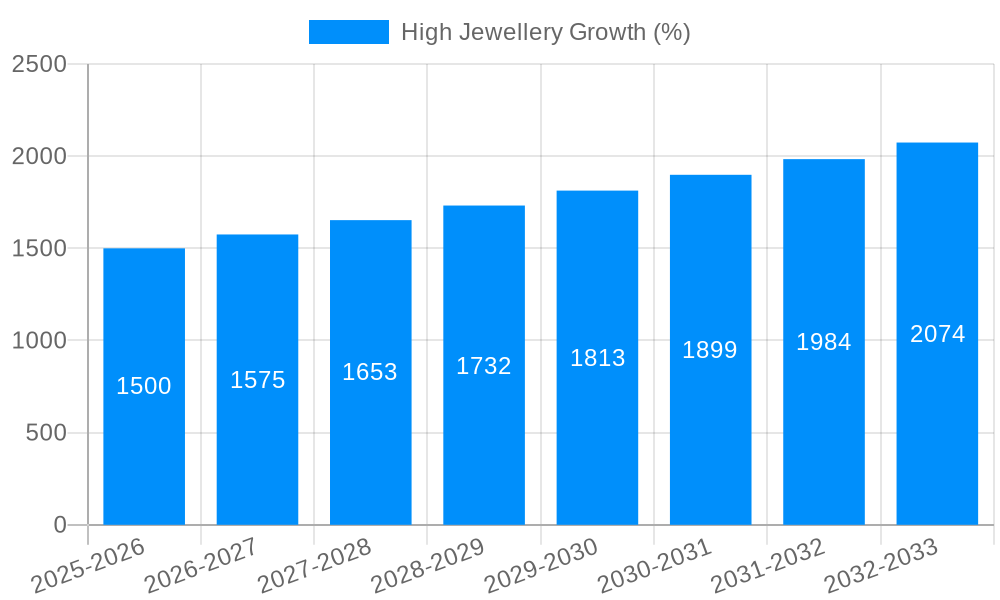

The global high jewelry market, encompassing luxury brands like Graff, Cartier, and Tiffany & Co., is a highly lucrative sector characterized by consistent growth and evolving consumer preferences. While precise market sizing data is unavailable, based on the presence of major players like LVMH and Richemont, and considering the substantial value of individual high-jewelry pieces, a conservative estimate places the 2025 market size at approximately $30 billion USD. A Compound Annual Growth Rate (CAGR) of 5-7% is reasonable, projecting significant expansion over the forecast period (2025-2033). This growth is propelled by several factors: increasing high-net-worth individual (HNWI) populations in emerging markets, a rising appreciation for bespoke and heritage pieces, and the growing influence of social media in shaping luxury consumption patterns. Furthermore, innovative designs incorporating sustainable materials and ethical sourcing are driving a new segment of conscious luxury consumers. However, economic downturns and geopolitical instability can act as significant restraints, potentially impacting consumer spending on discretionary luxury goods. Segmentation within the market is primarily based on product type (necklaces, rings, earrings, etc.), material (diamonds, precious stones, metals), and price point (high-end, ultra-high-end). Competition is fierce, with established brands vying for market share against emerging designers and digitally native luxury brands.

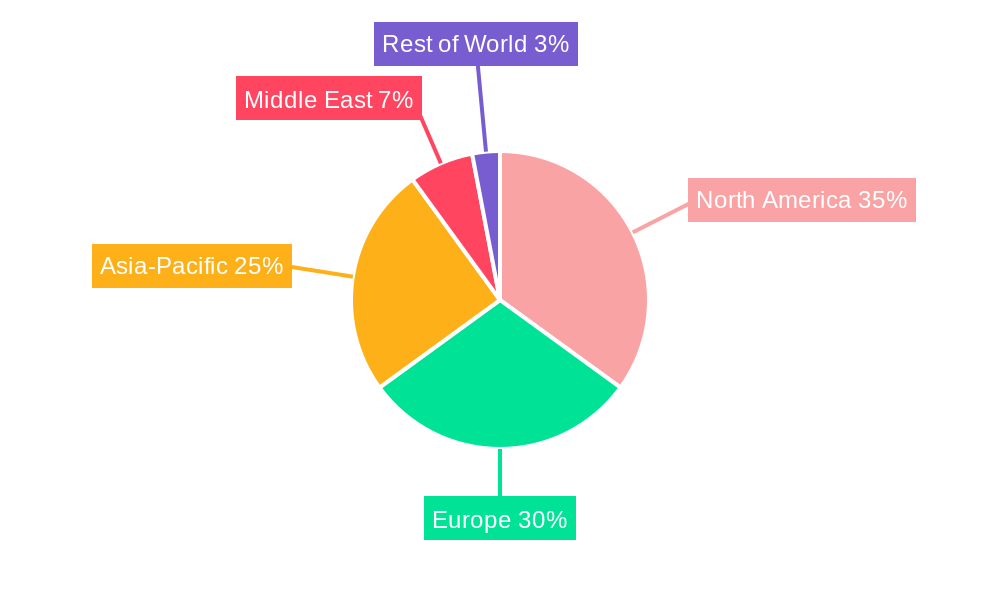

The competitive landscape is marked by a blend of heritage houses and contemporary brands. Established players like Cartier and Van Cleef & Arpels leverage their strong brand heritage and craftsmanship, while newer brands focus on unique designs and digital marketing strategies. Geographic distribution is likely concentrated in mature markets like North America, Europe, and the Middle East, with increasing growth potential in Asia-Pacific driven by rising affluence and a burgeoning luxury goods market. The market is expected to see increased personalization and customization of high jewelry, reflecting the desire for unique pieces that reflect individual style. Furthermore, investments in technology and e-commerce platforms will be crucial for brands to maintain competitiveness and reach a broader audience. Overall, the high jewelry market presents both significant opportunities and challenges, requiring adaptability, innovation, and a deep understanding of evolving consumer preferences.

The high jewellery market, valued at several billion dollars annually, is witnessing a fascinating evolution. The historical period (2019-2024) showcased a steady growth trajectory, propelled by a confluence of factors including increased disposable incomes in emerging markets, a growing appreciation for luxury goods, and the enduring allure of bespoke craftsmanship. The estimated market value in 2025 stands at a significant figure, projected to reach even higher levels by 2033. Key market insights reveal a shift towards personalized experiences, with consumers increasingly seeking unique pieces reflecting their individual style and stories. This has led to a surge in demand for bespoke designs and collaborations with independent artists and designers, pushing the boundaries of traditional jewellery aesthetics. Sustainability is also gaining traction, with ethically sourced materials and responsible manufacturing practices becoming increasingly important purchase considerations for discerning consumers. Furthermore, the rise of e-commerce and digital marketing strategies are transforming how high jewellery is showcased and sold, reaching new audiences globally. While classic styles remain highly sought after, innovative designs using unconventional materials and incorporating technological advancements, such as incorporating augmented reality experiences into the purchasing journey, are also gaining popularity. The forecast period (2025-2033) anticipates continued growth, though potential economic fluctuations and geopolitical instability might influence market dynamics. However, the long-term outlook remains positive, driven by the enduring appeal of high jewellery as a symbol of status, heritage, and personal expression. The increasing influence of social media and celebrity endorsements further fuels market growth. Brands are actively leveraging this trend to enhance their brand image and connect with a younger generation of luxury consumers.

Several powerful forces are propelling the high jewellery market's growth. Firstly, the expanding global affluent population, particularly in Asia and the Middle East, fuels demand for luxury goods, including high jewellery. Secondly, the increasing desire for unique, handcrafted pieces, reflecting a move away from mass-produced items, drives consumers to invest in bespoke and limited-edition designs. Thirdly, technological advancements, from 3D printing to improved gem-setting techniques, allow for the creation of exquisitely intricate and innovative pieces, thereby attracting new customers. Fourthly, strategic collaborations between high jewellery houses and renowned designers, artists, and celebrities significantly broaden brand reach and create highly coveted collections. The growing interest in investment-grade jewellery, viewed as a store of value comparable to art or real estate, further strengthens market appeal. The increasing popularity of vintage and antique high jewellery pieces adds another dimension to market growth. This is coupled with the heightened focus on sustainable and ethical sourcing practices, which resonate strongly with a growing segment of environmentally and socially conscious consumers. Finally, innovative marketing and sales strategies, leveraging digital platforms and personalized experiences, have expanded market access and customer engagement.

Despite its significant growth potential, the high jewellery market faces several challenges. Economic downturns and geopolitical instability can significantly impact luxury spending, leading to decreased demand. Fluctuations in precious metal and gemstone prices present considerable risk management issues for both manufacturers and consumers. The intricate craftsmanship of high jewellery necessitates skilled artisans, and a shortage of qualified professionals could constrain production capacity. Counterfeit products pose a major threat to the industry's integrity and consumer trust. Moreover, stringent regulations and ethical sourcing requirements can increase production costs and complicate supply chains. Maintaining brand exclusivity and differentiation in a highly competitive market remains a continuous challenge for established brands. Finally, the evolving consumer preferences towards more personalized, sustainable, and digitally-driven experiences necessitate brands to adapt their strategies continuously.

Key Regions: The Asia-Pacific region, particularly China and India, consistently demonstrates the strongest growth in the high jewellery market due to a rapidly expanding wealthy population with a strong cultural affinity for jewellery. The Middle East, especially the UAE, also boasts substantial market size driven by high levels of discretionary spending and a tradition of opulent jewellery ownership. Europe and North America continue to maintain significant market shares, driven by established luxury consumer bases and a strong appreciation for heritage brands.

Key Segments: The high-end segment, encompassing pieces with exceptionally rare and valuable gemstones and intricate designs, commands the highest price points and growth rates. This segment is characterized by exclusivity, bespoke creations, and a strong emphasis on heritage and craftsmanship. While the mid-range segment also experiences considerable growth, the luxury sector is the prime driver of revenue growth for the industry. The bespoke segment within high-end jewellery shows particularly strong growth, reflecting the desire for personalized pieces with unique stories.

The paragraph expands on the above points: The confluence of strong cultural appreciation for jewellery in Asia, especially India and China, combined with the substantial wealth concentrated in these regions fuels market growth beyond other geographical locations. The Middle East's historical affinity for lavish jewellery, coupled with high per capita income, makes it a particularly significant market. Europe and North America maintain strong positions due to the established luxury market and the heritage and craftsmanship associated with their established luxury brands. The dominance of the high-end segment stems from the exclusive nature of the products and the substantial investment these items represent, making them less susceptible to economic fluctuations. The strong emphasis on bespoke and customized designs within this segment shows a consumer preference for personalized luxury, a trend projected to continue driving the industry's growth.

Several factors are propelling the high jewellery market's growth. The rising global affluent population, particularly in Asia and the Middle East, coupled with increasing disposable incomes, fuels demand for luxury goods. The rising popularity of high jewellery as an investment asset further bolsters market growth. Innovative design, incorporating new technologies and materials, coupled with strong brand marketing, continually attracts new customers. Finally, the growing focus on ethically sourced materials and sustainable practices adds another layer of appeal to socially responsible consumers.

This report provides a detailed analysis of the high jewellery market, covering key trends, drivers, challenges, and leading players. It encompasses historical data (2019-2024), an estimated market value for 2025, and a forecast extending to 2033. The report delves into regional and segment-specific growth patterns, offering insights into consumer behaviour and market dynamics. It also analyses the competitive landscape, highlighting the strategies employed by key players to maintain market share and drive innovation. The report concludes by offering valuable insights into future market opportunities and potential risks.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Graff, Cartier, Harry Winston Company, Van Cleef & Arpels, Chopard, Piaget, Mikimoto, Bvlgari, Buccellati, Damiani, Tiffany, Swatch Group, Richemont, Pandora, Stuller, Signet Jewellers, Malabar Gold and Diamonds, LVMH Moet Hennessy, Rajesh Exports, Luk Fook, Gitanjali Group, Lao Feng Xiang, Chow Tai Fook, Damas International, CHANEL, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Jewellery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Jewellery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.