1. What is the projected Compound Annual Growth Rate (CAGR) of the High-gluten Flour?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High-gluten Flour

High-gluten FlourHigh-gluten Flour by Type (Machine Milled Flour, Stone Ground Flour), by Application (Commercial Use, Home Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

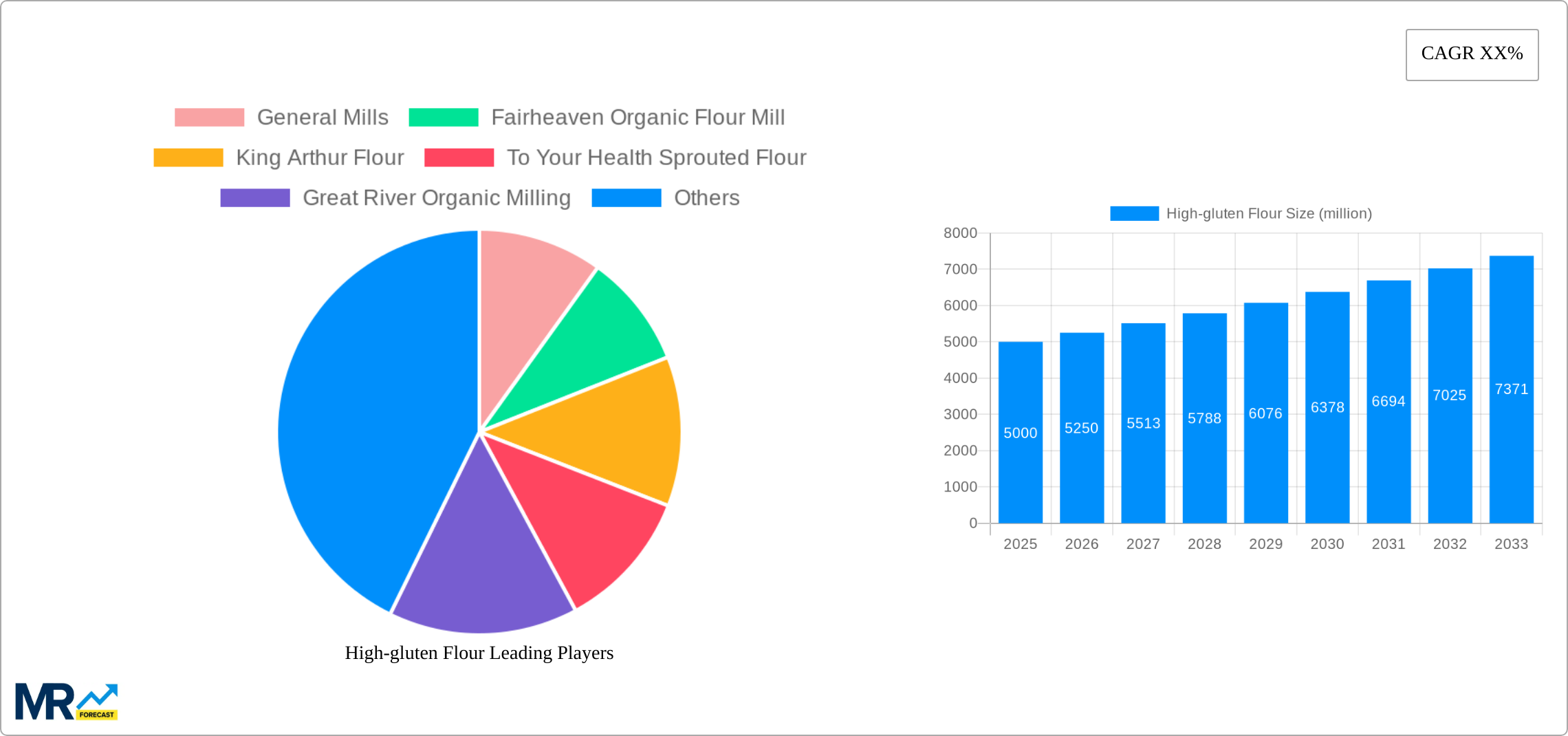

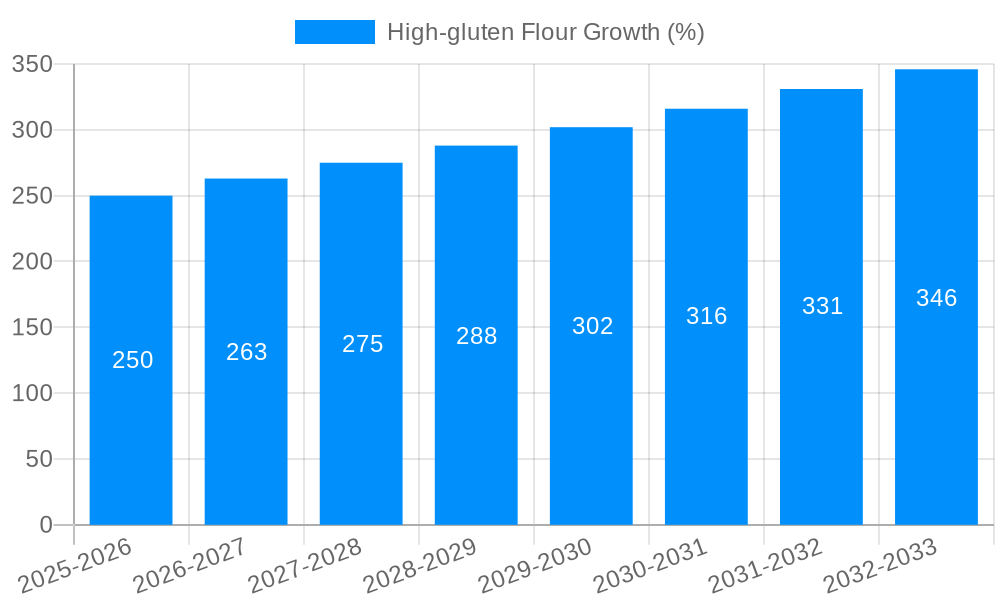

The high-gluten flour market is experiencing robust growth, driven by increasing demand for bakery products and a rising preference for high-protein diets. The market, estimated at $5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033, reaching an estimated $7.5 billion by 2033. This growth is fueled by several key factors. The expanding food service industry, particularly the rise of artisan bakeries and specialty cafes, contributes significantly to the demand for high-gluten flour, which delivers superior texture and volume in baked goods. Furthermore, the increasing awareness of health and nutrition is driving consumer preference towards products made with high-protein flours, thereby boosting market expansion. The market is segmented by type (wheat, spelt, etc.), application (bread, pasta, etc.), and distribution channel (retail, foodservice). Key players like General Mills, Ardent Mills, and Bob's Red Mill are leveraging strong brand recognition and extensive distribution networks to maintain their market dominance. However, the market faces challenges like fluctuating wheat prices and increasing competition from alternative flours.

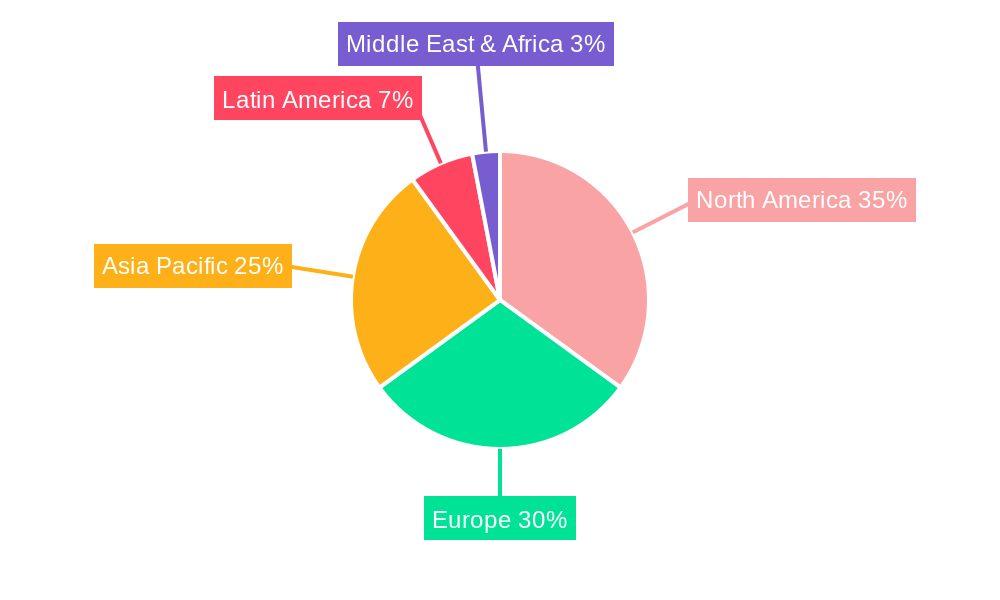

Despite these challenges, the long-term outlook remains positive. Innovation within the high-gluten flour sector is evident in the development of specialty flour blends catering to specific dietary needs (e.g., gluten-free options with added protein) and improved processing technologies enhancing flour quality and consistency. The geographical distribution of the market is diverse, with North America and Europe representing significant market shares. Emerging markets in Asia and Latin America present considerable growth potential due to increasing urbanization and changing dietary habits. Companies are strategically focusing on expansion into these new markets through joint ventures, acquisitions, and direct investments to capitalize on the burgeoning demand for high-quality baking ingredients. The continued emphasis on product quality, innovation, and strategic partnerships will shape the future trajectory of the high-gluten flour market.

The global high-gluten flour market exhibited robust growth throughout the historical period (2019-2024), exceeding several million units in annual sales. The estimated market value for 2025 surpasses the previous year's figures significantly, projecting continued expansion throughout the forecast period (2025-2033). This growth trajectory is fueled by several key factors, including the rising popularity of artisan bread and specialty baked goods. Consumers are increasingly seeking out products made with high-quality ingredients, driving demand for high-gluten flour which delivers superior texture and volume in baked goods. The increasing prevalence of home baking, particularly during periods of economic uncertainty and stay-at-home orders, has also boosted demand. Furthermore, the growing awareness of the nutritional benefits of whole grains, although not always directly linked to high-gluten flours, indirectly contributes to increased demand for flours in general, creating an environment conducive to growth in the specialized high-gluten segment. The market is also seeing innovation in product offerings, with companies introducing specialized high-gluten flour blends tailored to specific baking needs. This diversification caters to a wider range of consumers and culinary applications, further stimulating market growth. However, fluctuations in grain prices and supply chain disruptions remain potential challenges, which could impact the market's overall growth trajectory. Despite these concerns, the overall outlook for the high-gluten flour market remains positive, with consistent growth expected over the coming decade. Competition among established players and emerging brands is fierce, leading to continuous product improvement and marketing strategies to capture market share. This competitiveness ultimately benefits the consumer with a wider choice of high-quality products.

The high-gluten flour market's expansion is propelled by several interconnected forces. The burgeoning popularity of artisan bread and specialty baked goods plays a significant role. Consumers are increasingly discerning, seeking products with superior texture and rise, characteristics readily delivered by high-gluten flour. The rise of the home baking trend, boosted by lockdowns and increased interest in culinary pursuits, has further accelerated demand. Consumers are experimenting with more sophisticated recipes, which often call for high-gluten flour to achieve optimal results. Simultaneously, the food service industry, including bakeries, restaurants, and cafes, is increasingly using high-gluten flour to enhance the quality of their baked goods, creating an additional demand stream. The growth in health-conscious consumerism, though initially seemingly at odds, plays a part: the desire for higher-quality ingredients naturally leads to an increased interest in flour quality and its impact on overall product healthiness. The continuous development of new and improved high-gluten flour blends, catering to niche needs and preferences, further fuels market growth. The incorporation of additives to enhance texture and shelf life contributes to this trend.

Despite its promising growth trajectory, the high-gluten flour market faces significant challenges. Fluctuations in the price of wheat and other raw materials directly impact production costs and market prices, potentially limiting profitability and influencing consumer purchasing decisions. Supply chain disruptions, exacerbated by global events and logistical challenges, can disrupt production and distribution, causing shortages and impacting market stability. Furthermore, increasing transportation and energy costs add to the overall production expense, which can be passed onto consumers, potentially affecting sales volume. Competition from other flour types, such as all-purpose flour and gluten-free alternatives, represents a constant pressure. Gluten-free options are continually improving, attracting a subset of consumers seeking to avoid gluten. Finally, stringent food safety regulations and quality standards necessitate significant investment in production and testing, increasing the overall operational cost for businesses. Managing these challenges efficiently is key to sustained growth in the high-gluten flour market.

The North American region is projected to dominate the high-gluten flour market throughout the forecast period, driven by high consumption of baked goods and a strong preference for artisan bread. European countries, particularly those with established baking traditions, also hold substantial market share. Within the segments, the artisan bread and specialty baked goods segments show the most significant growth potential, closely followed by the commercial baking sector. Several factors contribute to this dominance:

In summary, the combination of established baking traditions, high consumer demand for quality ingredients, and a burgeoning artisan baking sector positions North America and Europe as the leading markets for high-gluten flour in the coming years.

The high-gluten flour market's continued growth is driven by the increasing consumer preference for artisan and specialty baked goods, the rising popularity of home baking, and the expansion of the food service industry. Innovation in product offerings, with blends tailored to specific needs, also adds to market momentum. This confluence of factors creates a robust and expanding market for high-quality, high-gluten flour.

This report offers a detailed analysis of the high-gluten flour market, encompassing historical data, current market trends, and future projections. The study covers key market segments, influential players, and significant industry developments, providing a comprehensive overview of this dynamic market. The report's analysis and forecasts provide valuable insights for businesses operating within the high-gluten flour industry, allowing them to make informed strategic decisions for future growth and success.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include General Mills, Fairheaven Organic Flour Mill, King Arthur Flour, To Your Health Sprouted Flour, Great River Organic Milling, Ardent Mills, Doves Farm Foods, Bay State Milling Company, Bob's red mill, Aryan International, Archer Daniels Midland(ADM), Dunany Flour, Shipton Mill Ltd, Beidahuang, WuGu-Kang Food, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High-gluten Flour," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High-gluten Flour, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.