1. What is the projected Compound Annual Growth Rate (CAGR) of the High-end Purified Water?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High-end Purified Water

High-end Purified WaterHigh-end Purified Water by Type (Natural Purified Water, Artificial Purified Water, World High-end Purified Water Production ), by Application (Supermarket, Department Store, Online Retail, Others, World High-end Purified Water Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

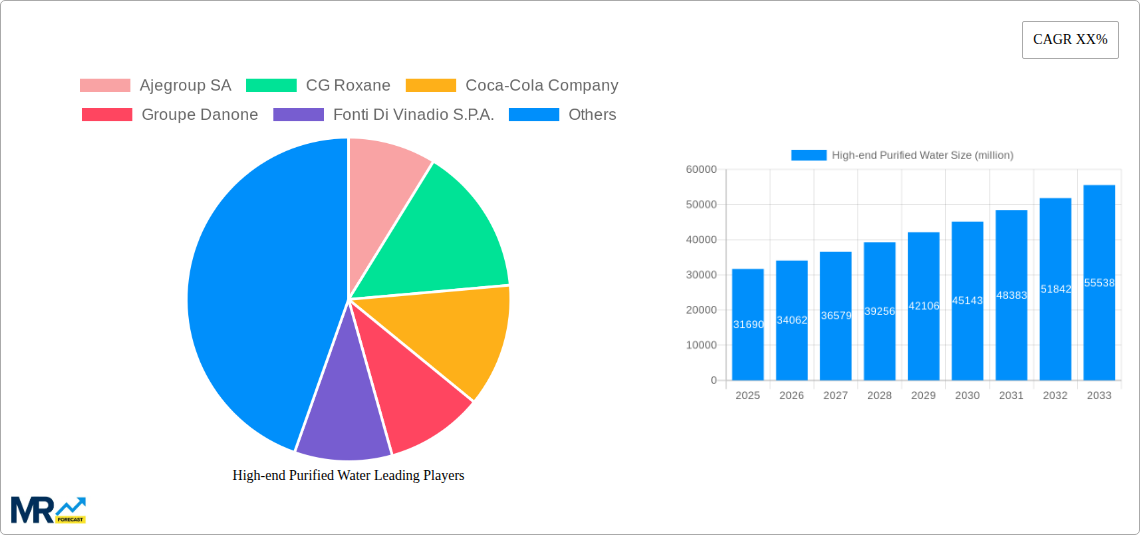

The global high-end purified water market is poised for significant expansion, with a current market size estimated at $31,690 million. This growth is fueled by a rising consumer consciousness regarding health and wellness, a growing preference for premium and artisanal products, and an increasing disposable income among target demographics. Consumers are actively seeking purified water options that offer superior taste, purity, and often, a differentiated brand story, moving beyond basic hydration to a lifestyle choice. The market's trajectory is further bolstered by the convenience of online retail channels, which are expanding access to niche and premium brands, and a growing appreciation for the perceived health benefits associated with naturally sourced or meticulously purified water.

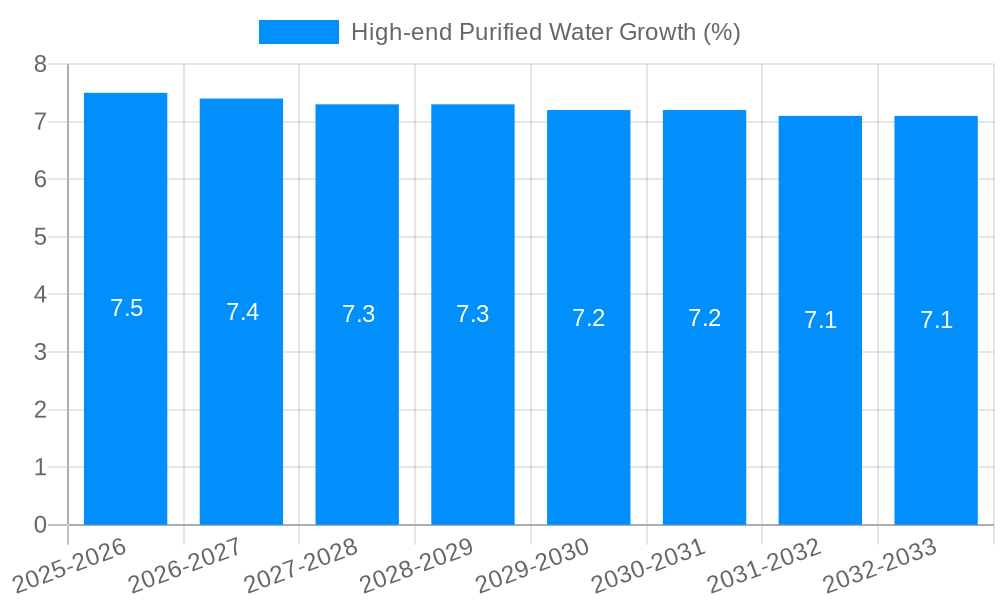

The market is expected to exhibit a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033. Key drivers include increasing health awareness, premiumization trends in the beverage industry, and the growing influence of social media showcasing aspirational lifestyles associated with high-end consumables. Emerging markets, particularly in Asia Pacific, are anticipated to contribute significantly to this growth, driven by rapid urbanization and an expanding middle class with a taste for premium products. While the market presents substantial opportunities, potential restraints such as high production costs for premium water sources, intense competition, and the need for continuous innovation in branding and packaging could pose challenges for new entrants and smaller players. The dominant segments within the market are Natural Purified Water and Artificial Purified Water, catering to diverse consumer preferences for origin and processing.

Here's a unique report description for High-end Purified Water, incorporating your specific requirements:

This comprehensive report delves into the dynamic and evolving global market for high-end purified water, offering an in-depth analysis of trends, growth drivers, challenges, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, this report provides critical insights for stakeholders navigating this premium beverage segment. The analysis includes a thorough examination of the historical period (2019-2024) to establish a baseline for future predictions. The global market for high-end purified water, valued in the millions, is projected to witness significant expansion as consumer preferences shift towards premium health and wellness offerings.

XXX The high-end purified water market is experiencing a profound metamorphosis, driven by an escalating consumer consciousness regarding health, wellness, and sophisticated hydration solutions. This segment transcends mere refreshment, evolving into a lifestyle statement and a perceived investment in well-being. Consumers are increasingly discerning, seeking purity, unique mineral profiles, and ethical sourcing. The notion of "water as a luxury" is gaining traction, with brands differentiating themselves through origin stories, proprietary filtration techniques, and aesthetically appealing packaging. The market is witnessing a proliferation of niche offerings, catering to specific dietary needs, athletic performance enhancement, and even mood elevation through the addition of specific minerals or electrolytes. Natural purified water, sourced from pristine glacial melt or deep underground springs, holds a significant premium, appealing to consumers who value untouched purity. Conversely, artificial purified water, meticulously crafted through advanced purification processes, is also carving out its space, emphasizing scientific precision and controlled mineral content, which appeals to a segment that prioritizes consistency and targeted benefits. The overarching trend is a move away from mass-market commodity water towards artisanal, curated, and health-centric hydration. This shift is amplified by a growing understanding of the vital role water plays in overall bodily function and the desire for a superior, unadulterated drinking experience. The market’s trajectory indicates a sustained premiumization, with consumers willing to allocate substantial budgets for water that offers tangible health benefits or an exclusive sensory experience. The demand for products that align with a holistic approach to health, encompassing both physical and mental well-being, is a cornerstone of this market's growth, and high-end purified water is perfectly positioned to meet these evolving consumer aspirations.

The rapid ascent of the high-end purified water market is fueled by a confluence of powerful socioeconomic and psychological factors. A primary driver is the intensifying global focus on health and wellness. Consumers are proactively seeking ways to optimize their physical and mental well-being, and purified water, perceived as the purest form of hydration, is a natural choice. This extends to a growing awareness of the potential contaminants in tap water, prompting individuals to invest in safer and more refined alternatives. Furthermore, the premiumization trend across the broader consumer goods landscape has permeated the beverage industry. Consumers are increasingly willing to spend more on products that offer superior quality, a unique brand narrative, and a perceived status symbol. The influence of social media and celebrity endorsements also plays a significant role, showcasing high-end water as a desirable lifestyle accessory. The growing prevalence of chronic diseases and an aging global population further amplifies the demand for products that contribute to a healthy lifestyle, positioning purified water as a fundamental element of preventative health. The pursuit of hydration that offers more than just quenching thirst, but actively contributes to bodily function and overall vitality, is a key motivator.

Despite its robust growth trajectory, the high-end purified water market is not without its hurdles. A significant challenge lies in consumer perception and education. While the demand for premium products is rising, there remains a segment of the market that struggles to justify the premium price point for what is fundamentally water. Educating consumers about the distinct benefits, sourcing, and purification processes that differentiate high-end offerings from standard bottled water is crucial. High production and distribution costs also pose a restraint. Sourcing water from pristine, often remote locations, employing sophisticated purification technologies, and maintaining premium packaging all contribute to elevated operational expenses, which are ultimately reflected in the retail price. Intense competition from both established beverage giants and nimble artisanal brands creates a crowded marketplace, making it challenging for new entrants to establish a significant market share. Furthermore, environmental concerns surrounding single-use plastic packaging, even for premium products, are a growing area of scrutiny. Brands are under pressure to adopt sustainable packaging solutions, which can add to production costs and complexity. Finally, economic downturns or recessions can impact discretionary spending, potentially leading consumers to trade down to more affordable alternatives, thereby posing a cyclical challenge to the market.

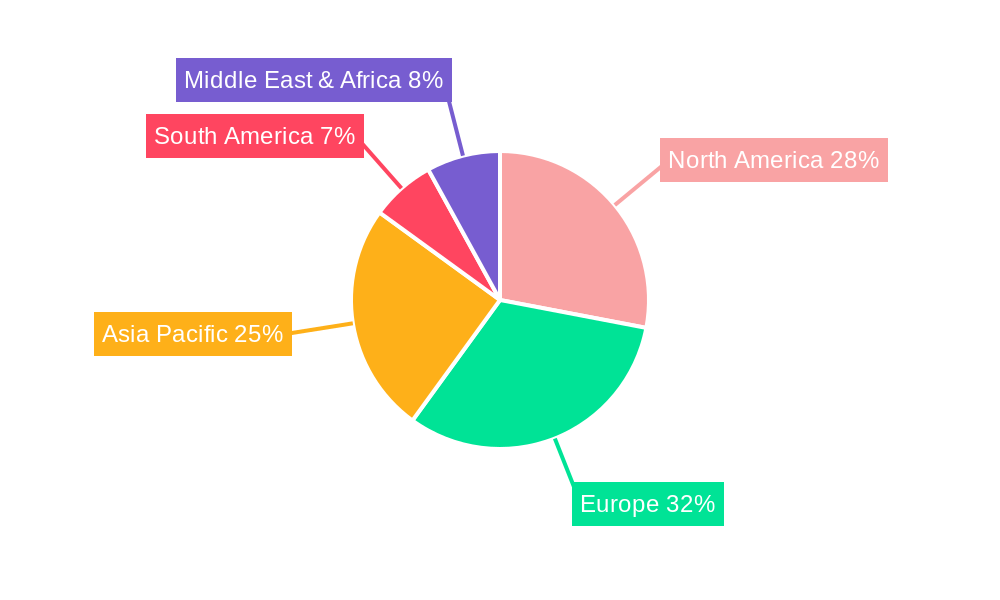

The global high-end purified water market is poised for significant regional and segmental dominance, with distinct areas poised to lead in production and consumption.

Key Regions and Countries:

Key Segments:

The interplay of these regions and segments creates a dynamic market landscape, with North America and Europe likely to lead in established consumption patterns, while Asia-Pacific emerges as a significant growth frontier. Within product types, the allure of natural purity will continue to drive demand, supported by robust global production efforts and strategic placement in key retail environments.

Several catalysts are accelerating the growth of the high-end purified water industry. The escalating global focus on preventative healthcare and wellness is a primary driver, with consumers actively seeking products that contribute to a healthier lifestyle. The increasing disposable incomes in emerging economies are creating a burgeoning middle class with the means and desire for premium goods, including specialized beverages. Furthermore, the growing influence of social media and celebrity endorsements continues to elevate the aspirational status of high-end water, positioning it as a lifestyle choice. The development of innovative packaging and advanced purification technologies also plays a crucial role in enhancing product appeal and perceived value.

This report offers a holistic view of the high-end purified water market, encompassing every facet from historical performance to future projections. It meticulously analyzes market size, segmentation by type and application, and regional dynamics. The report delves into the underlying market trends and identifies the key drivers and restraints shaping the industry's trajectory. It provides an in-depth look at the competitive landscape, highlighting the strategies and innovations of leading players. Furthermore, the report scrutinizes significant industry developments and offers a granular forecast for the years to come, providing actionable intelligence for businesses looking to capitalize on this burgeoning market. The comprehensive nature of this analysis ensures that stakeholders are equipped with the insights needed to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ajegroup SA, CG Roxane, Coca-Cola Company, Groupe Danone, Fonti Di Vinadio S.P.A., Hangzhou Wahaha, Grupo Vichy Catalan, Icelandic Water Holdings ehf., Mountain Valley Spring, Nestle Waters, Bling H2O Inc., Roiwater LLC., Beverly Hills Drink Company, LLC., NEVAS GmbH., Lofoten Arctic Water AS., MINUS 181 GmbH., Alpine Glacier Water Inc., BLVD Water, LLC., Berg Water, LLC., Uisge Source Ltd., VEEN Water Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 31690 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High-end Purified Water," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High-end Purified Water, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.