1. What is the projected Compound Annual Growth Rate (CAGR) of the High-end Dental Implants?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High-end Dental Implants

High-end Dental ImplantsHigh-end Dental Implants by Type (Endosteal Implants, Subperiosteal Implants, Others, World High-end Dental Implants Production ), by Application (Public Hospital, Private Hospital, Dental Clinic, World High-end Dental Implants Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

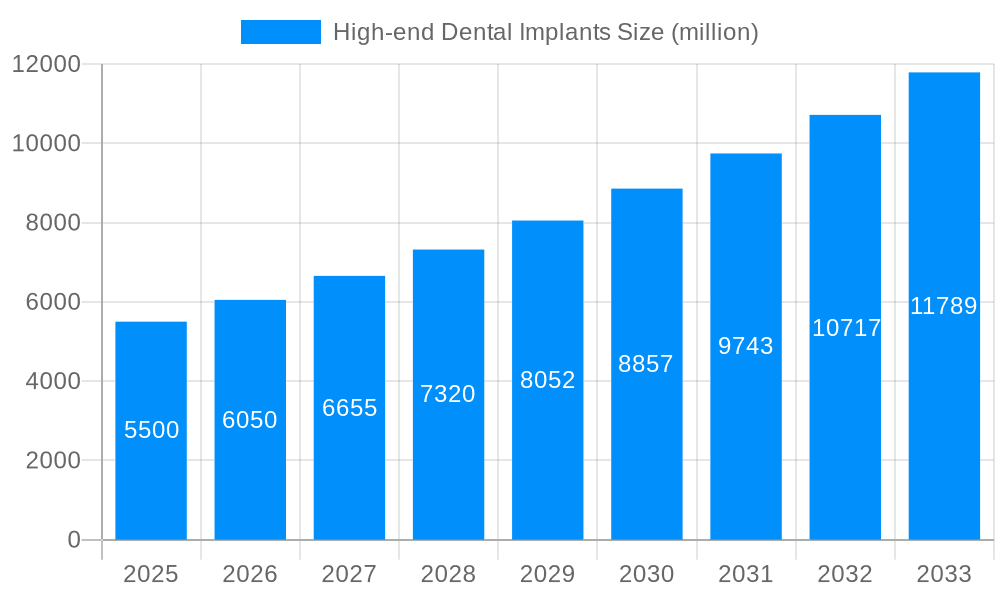

The high-end dental implants market is experiencing robust growth, driven by a rising geriatric population with increased dental issues, advancements in implant technology leading to improved aesthetics and functionality, and a growing preference for minimally invasive procedures. The market is segmented by implant type (endosteal, subperiosteal, and others), application (public hospitals, private hospitals, and dental clinics), and geography. While precise market sizing data is unavailable, based on industry reports and observable trends, we can estimate the 2025 market value to be approximately $5 billion, considering the presence of major players like Straumann, Danaher, and Zimmer Biomet, along with a substantial number of regional players. A conservative Compound Annual Growth Rate (CAGR) of 7% is projected for the forecast period (2025-2033), reflecting steady market expansion. This growth is fueled by technological advancements such as digital dentistry, improved implant materials (like zirconia and titanium alloys), and the development of guided surgery techniques offering quicker recovery times and better patient outcomes.

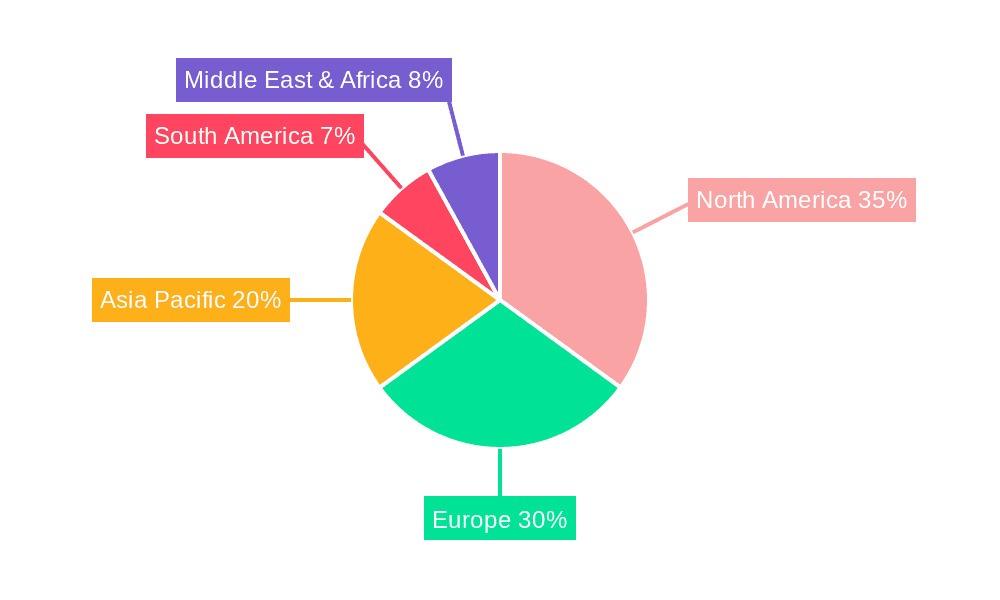

Market restraints include high procedure costs limiting accessibility for a significant portion of the population, potential complications associated with implant surgery, and regulatory hurdles in some regions regarding product approval and reimbursement policies. However, these restraints are partially mitigated by the increasing affordability of dental insurance, the rising awareness of dental hygiene and the associated health benefits, and ongoing technological innovation that aims to improve both effectiveness and cost-efficiency. The Asia-Pacific region is expected to witness the fastest growth, driven by rising disposable incomes, improving healthcare infrastructure, and increasing dental awareness in countries like China and India. North America and Europe will maintain significant market shares due to established healthcare systems and high adoption rates of advanced dental technologies. Competition among established players and emerging companies will likely intensify, driving innovation and potentially affecting pricing strategies within this lucrative and expanding market sector.

The global high-end dental implants market, valued at approximately USD X million in 2025, is poised for substantial growth during the forecast period (2025-2033). This expansion is driven by a confluence of factors, including an aging global population with increasing prevalence of tooth loss, rising disposable incomes in emerging economies leading to greater affordability of premium dental care, and advancements in implant technology resulting in improved longevity and aesthetic outcomes. The market is witnessing a shift towards minimally invasive procedures and digital dentistry, enabling faster recovery times and enhanced precision. Demand for high-end implants, offering superior biocompatibility, strength, and osseointegration, is particularly strong in developed nations with established dental infrastructure. However, the market also presents opportunities in developing countries as awareness of advanced dental solutions grows and healthcare infrastructure improves. The increasing preference for single-tooth restorations and full-arch rehabilitations using high-end implants is also fueling market expansion. Competition is intense among established players and emerging innovative companies, leading to continuous product development and strategic partnerships. The overall trend indicates a sustained and robust growth trajectory for the high-end dental implants market throughout the forecast period, reaching an estimated USD Y million by 2033. Market segmentation based on implant type (endosteal, subperiosteal, others), application (public hospitals, private hospitals, dental clinics), and geographic region provides a granular understanding of the market dynamics and allows for more targeted market penetration strategies. Detailed analysis reveals that specific regions and applications will experience faster growth rates compared to others, offering significant opportunities for key market players. The adoption of advanced materials, such as zirconia and titanium alloys, alongside the incorporation of digital technologies in the implant placement process, contributes significantly to market expansion and innovation. The long-term outlook for the high-end dental implants market remains optimistic, underpinned by favorable demographic trends, technological advancements, and increasing patient demand for superior dental solutions.

Several key factors are propelling the growth of the high-end dental implants market. Firstly, the global population is aging, leading to a higher incidence of tooth loss due to periodontal disease, decay, and trauma. This aging demographic presents a substantial pool of potential patients requiring dental implant solutions. Secondly, a rise in disposable incomes, especially in emerging economies, makes premium dental care, including high-end implants, more accessible. Consumers are increasingly willing to invest in improving their oral health and aesthetics. Thirdly, significant technological advancements in implant design, materials, and surgical techniques have led to improved implant success rates, longer lifespans, and better cosmetic outcomes. This drives demand for advanced implant systems offering superior biocompatibility and durability. Furthermore, the growing adoption of digital dentistry techniques, such as CAD/CAM technology and guided surgery, enhances the precision and efficiency of implant placement, further contributing to the market's expansion. The increasing awareness of the benefits of dental implants, coupled with effective marketing and educational initiatives by manufacturers and dental professionals, also plays a crucial role in market growth. Finally, the trend toward minimally invasive procedures reduces patient discomfort and recovery time, boosting the appeal of high-end dental implants.

Despite the promising growth trajectory, the high-end dental implants market faces several challenges. The high cost of implants remains a significant barrier to entry for many patients, particularly in regions with limited healthcare access or insurance coverage. This price sensitivity necessitates the development of more affordable, yet high-quality, implant solutions to broaden market penetration. The market is also characterized by stringent regulatory requirements and safety protocols, which can increase the time and cost involved in product development and approval. Competition is fierce among established players and emerging companies, leading to price wars and the need for constant innovation to maintain a competitive edge. Variations in dental practices and procedures across different regions can create challenges in standardization and consistency of treatment protocols. Moreover, potential complications such as infection, osseointegration failure, or nerve damage, although rare with high-quality implants and skilled practitioners, can lead to negative publicity and affect market perception. Finally, the evolving landscape of dental insurance coverage and reimbursement policies can impact market access and affordability. Addressing these challenges requires a multi-faceted approach involving technological innovation, streamlined regulatory processes, strategic partnerships, and effective patient education.

The high-end dental implants market demonstrates regional variations in growth and adoption. North America and Europe currently hold a significant market share due to their established dental infrastructure, high disposable incomes, and greater awareness of advanced dental treatments. However, Asia-Pacific is expected to exhibit the fastest growth rate due to rising middle-class populations, increasing healthcare expenditure, and growing awareness of dental implants. Within segments, Endosteal implants dominate the market due to their versatility, effectiveness, and wide range of applications. The private hospital segment holds a larger market share compared to public hospitals because of higher patient affordability and greater access to advanced technology. While dental clinics contribute significantly, private hospitals often offer comprehensive treatment plans including sophisticated diagnostics and post-operative care, making them a preferred choice for high-end implant procedures.

Several factors are accelerating the growth of the high-end dental implants industry. Technological advancements, such as the development of biocompatible materials and digital dentistry tools, are improving implant success rates and patient outcomes. The rising prevalence of chronic diseases that lead to tooth loss is fueling the demand for high-quality replacements. Increasing awareness of dental implants' aesthetic and functional benefits is also driving market expansion. The growth is also supported by greater access to financing options and dental insurance coverage.

This report provides a comprehensive analysis of the high-end dental implants market, covering market size and forecasts, key drivers and challenges, competitive landscape, and significant developments. It offers detailed segment analysis across implant types, applications, and geographic regions, enabling a deep understanding of market dynamics and trends. The report also includes detailed profiles of leading market players, their strategies, and their market positions. In addition to quantitative data and analysis, the report provides valuable insights into future market opportunities and potential challenges, allowing stakeholders to make informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

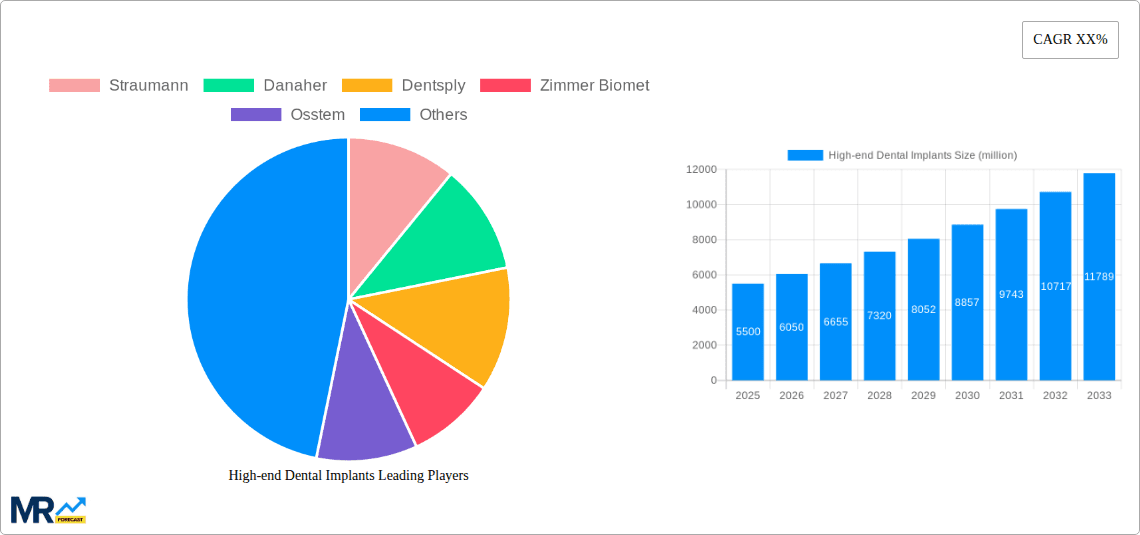

Key companies in the market include Straumann, Danaher, Dentsply, Zimmer Biomet, Osstem, Henry Schein, GC, Kyocera Medical, Dyna Dental, Keystone Dental, Neobiotech, B & B Dental, Hiossen, Biohorizons, Euroteknika.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High-end Dental Implants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High-end Dental Implants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.