1. What is the projected Compound Annual Growth Rate (CAGR) of the High Current Ferrite Bead Chips?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Current Ferrite Bead Chips

High Current Ferrite Bead ChipsHigh Current Ferrite Bead Chips by Type (Surface Mount, Wire Wound), by Application (Automotive Electronics, Consumer Electronics, Industrial Equipments, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

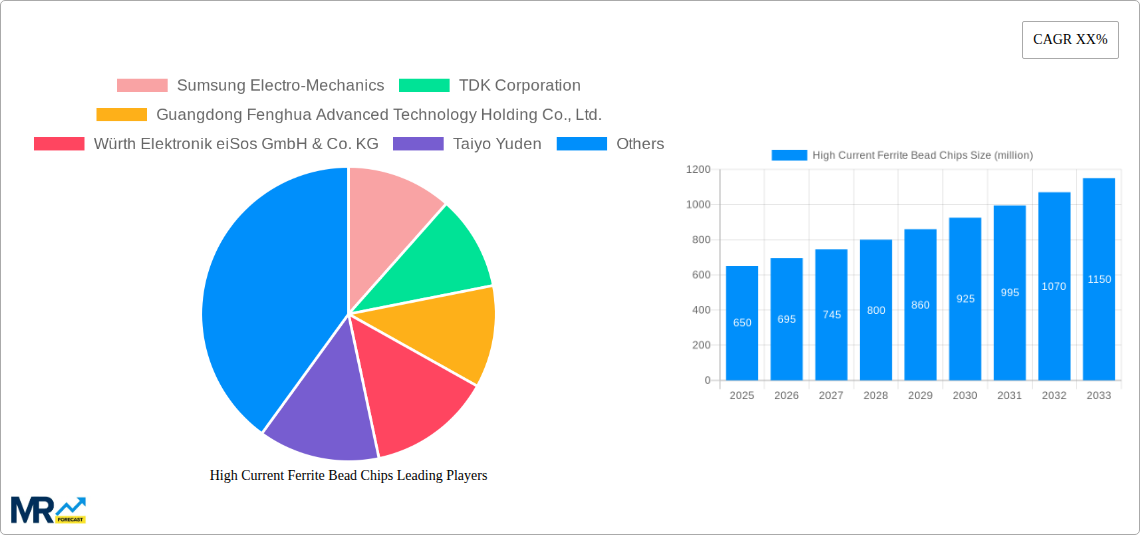

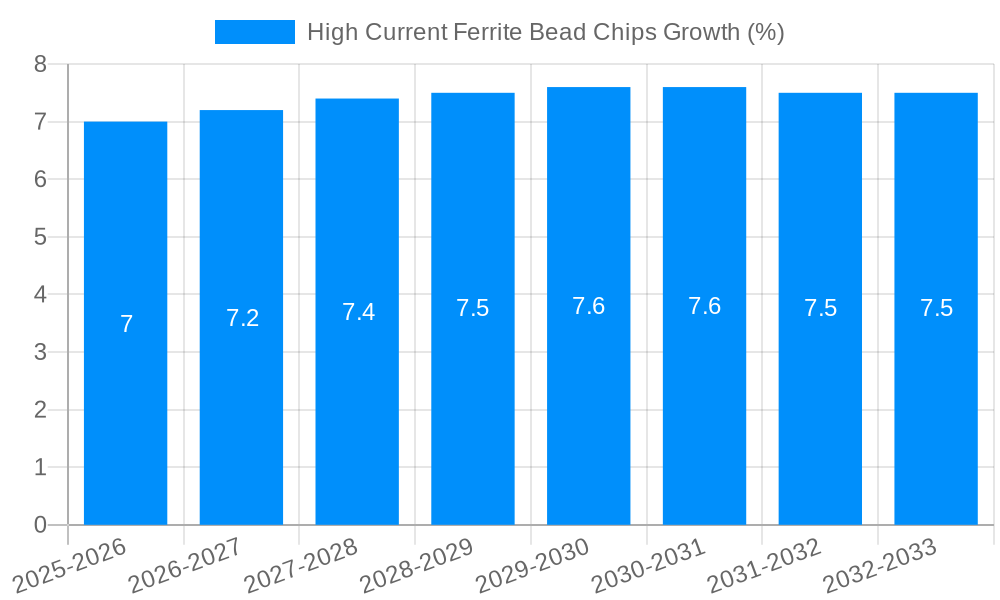

The High Current Ferrite Bead Chips market is poised for substantial expansion, driven by the ever-increasing demand for efficient power management solutions across a multitude of electronic devices. With a projected market size in the hundreds of millions of US dollars and a robust Compound Annual Growth Rate (CAGR) of approximately 7.5%, this segment is set to witness significant value appreciation through 2033. The primary growth catalysts stem from the relentless proliferation of consumer electronics, the exponential rise in automotive electronics, particularly within the electric vehicle (EV) sector, and the sophisticated requirements of industrial equipment. These sectors demand reliable and compact solutions for noise suppression and current filtering, areas where high current ferrite bead chips excel. The shift towards miniaturization and higher power densities in electronic components further amplifies the need for advanced ferrite bead solutions capable of handling elevated current levels without compromising performance or reliability.

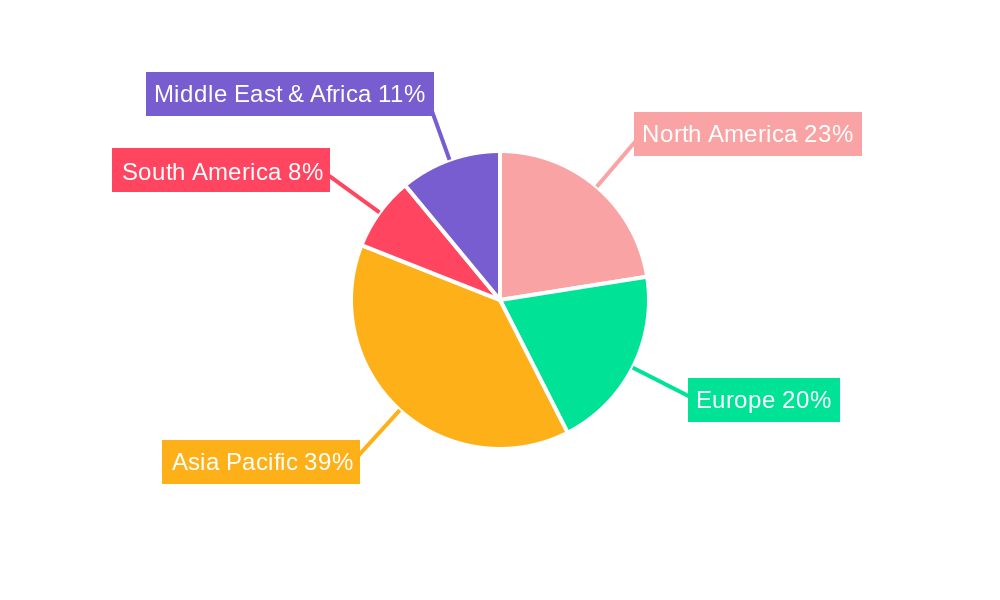

The market is characterized by dynamic trends, including the development of higher current density materials, multi-layer ferrite bead chip designs for enhanced performance in compact footprints, and the integration of ferrite bead functionalities into more complex power management modules. Innovations focusing on improved thermal management and wider operating temperature ranges are also key trends, catering to the demanding environments of automotive and industrial applications. However, the market faces certain restraints, such as the volatility in raw material prices, particularly for ferrite materials, and the increasing price sensitivity in high-volume consumer electronics segments. Despite these challenges, the strong underlying demand from burgeoning end-use industries, coupled with continuous technological advancements by leading manufacturers like Murata Manufacturing, TDK Corporation, and Sumsung Electro-Mechanics, ensures a positive trajectory for the high current ferrite bead chips market. The Asia Pacific region, led by China and Japan, is expected to remain the dominant force due to its extensive manufacturing base for electronics and its rapid adoption of advanced technologies.

The global market for High Current Ferrite Bead Chips is poised for substantial growth, with projections indicating a significant upward trajectory over the Study Period of 2019-2033. During the Base Year of 2025, the market is estimated to have reached a valuation in the millions of dollars, a figure expected to expand considerably by the end of the Forecast Period in 2033. This robust expansion is underpinned by several interwoven trends, primarily driven by the relentless miniaturization and increasing power demands of modern electronic devices. The pervasive integration of advanced functionalities in consumer electronics, coupled with the stringent noise suppression requirements in automotive and industrial sectors, are acting as powerful accelerators for the adoption of these critical passive components. Furthermore, the ongoing shift towards higher switching frequencies in power management circuits necessitates effective EMI/RFI filtering solutions, a role expertly fulfilled by high current ferrite beads.

The historical performance from 2019 to 2024 has laid a solid foundation for this anticipated surge. During this period, the market witnessed steady growth fueled by the expanding digital infrastructure, the proliferation of IoT devices, and the increasing complexity of electronic designs. As device manufacturers strive to reduce physical footprints without compromising performance, the demand for compact yet high-performance ferrite bead chips that can handle significant current loads without overheating or saturation has intensified. The report will delve into the nuanced dynamics of these trends, analyzing how evolving technological landscapes and evolving consumer expectations are shaping the demand for specific types and applications of high current ferrite bead chips. Key market insights will highlight the growing importance of materials science advancements, enabling ferrite beads with enhanced impedance characteristics and higher current handling capabilities at higher frequencies, thereby offering superior noise attenuation. This strategic focus on performance enhancement is directly translating into market expansion.

The high current ferrite bead chips market is experiencing an unprecedented surge, propelled by an confluence of powerful driving forces that are reshaping the electronics industry. Foremost among these is the unyielding demand for enhanced noise suppression and electromagnetic interference (EMI) mitigation in increasingly complex electronic systems. As devices become more sophisticated and packed with more components in smaller spaces, the potential for signal interference escalates dramatically. High current ferrite beads act as a crucial line of defense, absorbing unwanted high-frequency noise and ensuring the stable and reliable operation of sensitive circuits, especially in power delivery networks.

The relentless pursuit of miniaturization in consumer electronics, from smartphones and wearables to smart home devices, directly fuels the need for compact and efficient EMI filtering solutions. Ferrite bead chips, with their surface mount form factor and ability to integrate seamlessly into dense circuit designs, are ideally suited for these applications. Simultaneously, the automotive sector's rapid evolution, driven by the electrification of vehicles and the proliferation of advanced driver-assistance systems (ADAS), presents a massive growth opportunity. These systems demand robust power integrity and stringent EMI compliance to ensure safety and performance, making high current ferrite beads indispensable. Industrial equipment, likewise, is becoming more automated and connected, necessitating reliable power and signal integrity in harsh environments.

Despite the promising growth trajectory, the high current ferrite bead chips market is not without its hurdles. One significant challenge lies in the sensitivity of ferrite materials to temperature and DC current bias. As current levels increase, ferrite materials can saturate, leading to a drastic reduction in their impedance and thus their effectiveness in suppressing noise. This necessitates careful selection of bead types and accurate calculation of current requirements to avoid performance degradation. Manufacturers are continuously investing in R&D to develop ferrite formulations that exhibit higher saturation current characteristics and wider operating temperature ranges.

Another restraining factor can be the cost of high-performance ferrite materials and advanced manufacturing processes. Producing ferrite beads capable of handling very high currents with excellent impedance characteristics can be more expensive than standard components, potentially impacting the overall cost of electronic devices. This can lead to price-sensitive applications opting for less effective, or sometimes multiple, alternative noise suppression solutions. Furthermore, design complexity and integration challenges can pose a restraint. While ferrite beads are designed for ease of integration, optimizing their placement and selection within complex multi-layer PCB designs requires a deep understanding of circuit dynamics and electromagnetic principles. Inefficient integration can lead to suboptimal performance or unintended side effects, requiring specialized expertise and potentially increasing development cycles.

The Automotive Electronics segment, within the broader High Current Ferrite Bead Chips market, is poised to be a dominant force, both in terms of regional consumption and overarching market influence. This dominance is intrinsically linked to the transformative shifts occurring within the automotive industry globally, particularly in regions like Asia Pacific, spearheaded by China, and to a significant extent, North America and Europe. The sheer volume of electronic components integrated into modern vehicles, from powertrain management and infotainment systems to advanced driver-assistance systems (ADAS) and the rapidly expanding electric vehicle (EV) sector, creates an immense and continuously growing demand for reliable noise suppression solutions.

In the Automotive Electronics segment, high current ferrite bead chips are crucial for several reasons:

Asia Pacific, with China at its forefront, is expected to lead this charge due to its status as the world's largest automotive manufacturing hub and its aggressive push towards EV adoption. The region's extensive electronics manufacturing ecosystem, coupled with substantial government support for the automotive sector, positions it as a key growth engine.

The High Current Ferrite Bead Chips industry is propelled by several key growth catalysts. The accelerating pace of 5G network deployment globally necessitates highly reliable electronic components that can handle increased data traffic and power demands without signal degradation, driving demand for effective EMI suppression. Furthermore, the relentless growth of the Internet of Things (IoT) ecosystem, encompassing a vast array of connected devices from smart appliances to industrial sensors, generates significant EMI, requiring robust filtering solutions. The increasing complexity and power requirements of consumer electronics, such as advanced gaming consoles and high-definition displays, also contribute to this growth.

This report offers an exhaustive examination of the High Current Ferrite Bead Chips market, providing a deep dive into trends, market dynamics, and future projections. It meticulously analyzes key market insights, identifying crucial growth drivers and potential restraints that will shape the industry landscape. The report delves into the significant impact of specific application segments, such as Automotive Electronics, and highlights the leading regional markets, with a particular focus on their consumption patterns and growth potential.

The comprehensive coverage includes detailed market sizing and forecasts in the millions of units, along with a thorough competitive landscape analysis of the leading players. Furthermore, the report scrutinizes significant industry developments and technological advancements that are poised to redefine the market. This in-depth analysis equips stakeholders with the strategic intelligence necessary to navigate the evolving market, identify new opportunities, and make informed business decisions within the Study Period of 2019-2033, with a precise focus on the Base Year of 2025 and the Forecast Period of 2025-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sumsung Electro-Mechanics, TDK Corporation, Guangdong Fenghua Advanced Technology Holding Co., Ltd., Würth Elektronik eiSos GmbH & Co. KG, Taiyo Yuden, Murata Manufacturing Co., Ltd., Yageo Group, Vishay Intertechnology, Inc., Meritek Electronics, NIC Components Corp., Multicomp Pro, Viking Tech Corporation, CAL-CHIP Electronics, Inc., Abracon, ZXcompo, Laird Technologies, Inc., MAX ECHO, Coilmaster Electronics Co., Ltd., EATON, Bourns, Inc., INPAQ Technology Co., Ltd., Sunlord.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Current Ferrite Bead Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Current Ferrite Bead Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.