1. What is the projected Compound Annual Growth Rate (CAGR) of the HID Floodlight?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HID Floodlight

HID FloodlightHID Floodlight by Type (Mercury Lamp, Metal Halide Lamp, Halogen Lamp), by Application (Outdoor, Indoor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

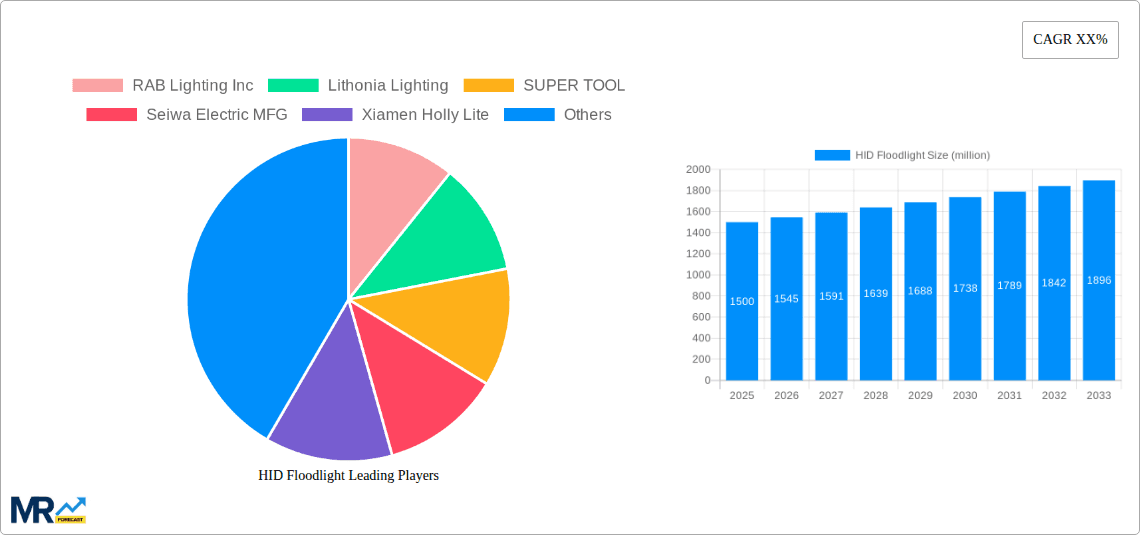

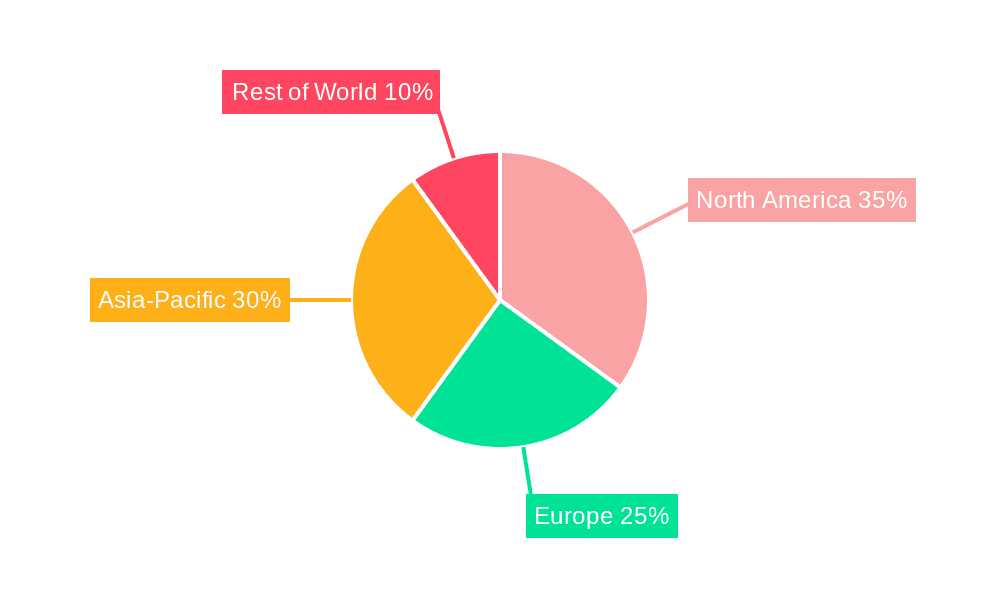

The HID floodlight market, while facing pressure from LED alternatives, maintains a significant presence, particularly in applications requiring high-intensity illumination and where cost remains a primary factor. The market's size in 2025 is estimated at $1.5 billion, reflecting a steady but decelerating growth trajectory. A Compound Annual Growth Rate (CAGR) of 3% from 2025 to 2033 is projected, indicating a gradual market maturation. Key drivers include ongoing demand in industrial settings, outdoor sports facilities, and security lighting applications where HID's robust performance and established infrastructure remain advantageous. However, stringent environmental regulations concerning mercury disposal and the increasing energy efficiency and cost-effectiveness of LED lighting present significant restraints. This competitive pressure necessitates manufacturers to focus on developing more energy-efficient HID technologies and explore niche applications where HID's unique properties still hold sway, such as specific high-intensity requirements not easily met by current LED solutions. Segmentation within the market includes various wattages, mounting types, and applications. Leading companies like RAB Lighting, Lithonia Lighting, and Emerson Electric are leveraging their established distribution networks and expertise to navigate this evolving landscape.

The forecast period (2025-2033) will see a continued shift towards energy-efficient solutions within the HID floodlight market. Manufacturers will likely focus on innovation to improve lamp lifespan, reduce energy consumption, and enhance overall performance. This includes exploring improved lamp designs and ballast technologies. Regional variations will exist, with developed markets experiencing slower growth due to higher LED adoption rates compared to emerging economies where cost considerations still favor HID solutions. The market’s future success will hinge on addressing environmental concerns and proactively adapting to technological advancements in lighting. Companies that successfully integrate sustainability initiatives and strategically target niche applications will be best positioned for growth in this competitive landscape.

The HID floodlight market, valued at several million units in 2024, is exhibiting a complex interplay of growth and decline. While the overall market demonstrates maturity, specific segments and geographic regions are experiencing robust expansion. The historical period (2019-2024) saw a gradual increase in adoption, primarily driven by established infrastructure projects and replacements in industrial and commercial sectors. However, the shift towards more energy-efficient lighting technologies like LEDs is significantly impacting the market trajectory. The estimated year 2025 reveals a plateauing effect, with the forecast period (2025-2033) projecting a modest growth rate, largely fueled by niche applications requiring the specific characteristics of HID lighting (high lumen output, durability in extreme weather conditions). This moderate growth anticipates a continued demand in areas where the higher initial cost of LEDs is a significant deterrent, or where the specific color rendering capabilities of HID lights are indispensable. The transition is not a complete displacement, but rather a strategic realignment, with HID floodlights retaining market share in specific, specialized niches. The base year, 2025, serves as a pivotal point, marking the transition from a primarily growth-oriented phase to a more stable, niche-driven market. This report delves into the specific dynamics of this transition, highlighting the factors driving continued demand while acknowledging the inherent challenges associated with the technological shift toward more energy-efficient alternatives. Further analysis will unpack the regional disparities and identify those segments where HID floodlights are expected to maintain a strong presence in the coming years.

Several factors continue to contribute to the sustained, albeit modest, growth of the HID floodlight market. In certain industrial settings, the exceptionally high lumen output and robust construction of HID floodlights remain unparalleled. These lights prove exceptionally reliable in demanding environments characterized by harsh weather conditions, vibrations, or frequent on/off cycles. This resilience translates to lower maintenance costs over the long term, making them a cost-effective solution despite higher upfront investment. Furthermore, in some specific applications, like high-mast lighting for large outdoor spaces or specialized industrial processes needing a particular color temperature or spectrum, HID lights remain the preferred choice. The existing infrastructure of HID lighting systems also plays a significant role; the replacement of existing systems often involves repairing or upgrading rather than complete overhauls, sustaining a steady demand for replacement parts and compatible units. While LED technology offers superior energy efficiency, the substantial upfront investment in a complete system replacement often outweighs the long-term cost savings for smaller businesses or those with limited budgets, thus prolonging the lifespan of existing HID installations. This complex interplay of cost-benefit analysis, specialized application requirements, and the existing infrastructure helps explain the continued demand for HID floodlights despite the ongoing shift toward LED technology.

The primary challenge facing the HID floodlight market is the undeniable rise of LED technology. LEDs offer significantly higher energy efficiency, resulting in lower operational costs and a reduced environmental footprint. This advantage is becoming increasingly crucial, particularly in light of growing environmental concerns and rising energy prices. Furthermore, the lifespan of LEDs drastically surpasses that of HID lights, leading to reduced maintenance and replacement costs over the long term. This considerable cost difference is pushing many consumers and businesses towards LED solutions, even if the initial investment is higher. Another challenge is the increasing stringency of regulations concerning energy consumption and environmental impact. Governments worldwide are implementing stricter standards and incentives to promote the adoption of energy-efficient lighting solutions, further squeezing the market share of less efficient technologies like HID. Finally, the relatively high mercury content in HID lamps contributes to disposal challenges and environmental concerns, attracting regulatory scrutiny and adding to the overall cost of ownership. This combination of factors poses a significant threat to the long-term sustainability of the HID floodlight market.

Developing Economies: Developing nations in Asia, Africa, and South America are expected to contribute significantly to market growth, although at a slower rate compared to historical growth. These regions often prioritize cost-effectiveness and durability over energy efficiency, creating a continued niche for HID floodlights in infrastructure projects and industrial settings.

Industrial Applications: The industrial sector remains a key driver of HID floodlight demand. Industries requiring robust, high-lumen lighting in challenging environments will continue to utilize HID technology, even with the increasing availability of LED counterparts.

Specific Niche Markets: The need for specialized lighting applications, such as those needing a very specific color temperature or high color rendering index (CRI), will maintain a steady, if small, demand for HID floodlights.

The market growth in these segments is projected to be moderate, reflecting a shift from significant expansion to sustained, albeit niche-based, demand. The increasing adoption of LEDs is a powerful disruptive force, yet the characteristics of HID floodlights — their high intensity, durability, and suitability for certain specialized tasks — ensure they maintain a position within the lighting market, albeit a smaller one than in previous years. The forecast period will likely showcase a gradual decline in overall market size, but focused growth within specific industrial and geographical segments will temper the overall reduction.

Despite the challenges, certain factors can catalyze growth within specific segments of the HID floodlight market. Continued investment in infrastructure projects in developing economies, coupled with a focus on cost-effective solutions, can sustain demand for HID lights. Furthermore, innovations in HID technology, particularly those focused on improving energy efficiency and lifespan, could create new opportunities. Targeted marketing efforts highlighting the specific advantages of HID lights for niche applications can also stimulate sales. The key to growth in this mature market lies in identifying and catering to the specific needs of particular industries and geographies where the unique benefits of HID floodlights outweigh the advantages of more energy-efficient alternatives.

This report provides a comprehensive analysis of the HID floodlight market, covering historical data, current market dynamics, and future projections. It offers insights into market drivers, restraints, and growth opportunities, along with detailed profiles of leading market players. The report segments the market by region, application, and type, providing a granular view of the industry's complexities and allowing readers to understand the evolving landscape of this mature but still relevant technology. The insights within this report serve as a valuable resource for industry stakeholders, investors, and anyone interested in the future of the HID floodlight market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include RAB Lighting Inc, Lithonia Lighting, SUPER TOOL, Seiwa Electric MFG, Xiamen Holly Lite, Venus Manufacture, HiSupplier.com Online Inc., Emerson Electric, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "HID Floodlight," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HID Floodlight, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.