1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Payload Robot?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy Payload Robot

Heavy Payload RobotHeavy Payload Robot by Type (Below 1000Kg, 1000Kg to 2000Kg, Above 2000Kg), by Application (Palletizing, Packaging, Part Transfer, Machine Loading, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

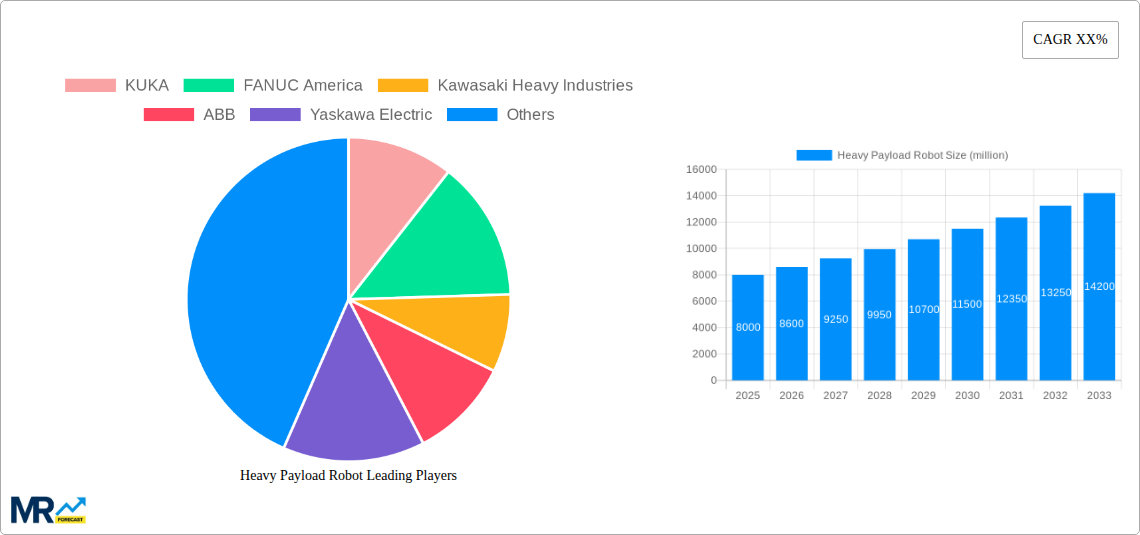

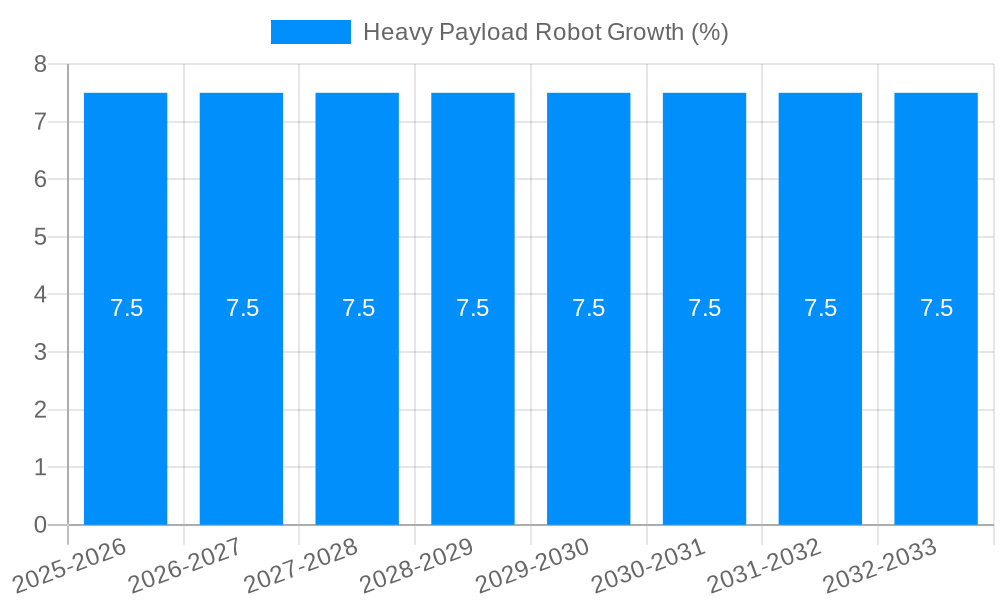

The global Heavy Payload Robot market is poised for substantial growth, projected to reach an impressive $15 billion by 2033, expanding from an estimated $8 billion in 2025. This significant expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period of 2025-2033. The increasing demand for automation in heavy industries such as automotive, aerospace, and logistics, where robots are crucial for tasks like material handling, assembly, and welding of large components, is a primary catalyst. Furthermore, advancements in robotic technology, including enhanced payload capacities, greater precision, and improved safety features, are making these robots more attractive for a wider range of applications. The rising adoption of Industry 4.0 principles and the subsequent push for smart factories further fuel this market, as businesses seek to optimize production efficiency, reduce operational costs, and enhance worker safety in environments with physically demanding or hazardous tasks.

Key trends shaping the Heavy Payload Robot market include the growing integration of AI and machine learning for smarter operations, enabling predictive maintenance and optimized task execution. The development of collaborative heavy payload robots, designed to work alongside human operators safely, is also a significant emerging trend. While the market exhibits strong growth potential, certain restraints need to be considered. High initial investment costs for these sophisticated robotic systems can be a barrier for some small and medium-sized enterprises. Additionally, the need for skilled personnel for installation, operation, and maintenance, coupled with potential challenges in integrating these robots into existing manufacturing lines, represent ongoing hurdles. The market segments are expected to see significant adoption in the "Above 2000Kg" category for specialized heavy lifting and manipulation, while the "Palletizing" and "Machine Loading" applications are projected to witness the highest growth due to their widespread use in logistics and manufacturing.

This report provides a comprehensive analysis of the global Heavy Payload Robot market, offering invaluable insights for stakeholders aiming to navigate this dynamic sector. With a study period spanning from 2019 to 2033, including a historical review from 2019-2024, a base year of 2025, and an estimated year of 2025, the report meticulously details market trends, growth drivers, challenges, and future projections. The forecast period of 2025-2033 will be pivotal in understanding the long-term trajectory of this market, expected to reach values in the tens of millions of US dollars.

The global Heavy Payload Robot market is experiencing a significant surge, driven by an insatiable demand for automation in industries that handle substantial weights and volumes. During the historical period (2019-2024), we witnessed a steady adoption of these powerful machines, primarily in established manufacturing hubs. However, the base year of 2025 marks a turning point, with the market poised for exponential growth. The forecast period (2025-2033) is anticipated to see this market evolve from a niche solution to a mainstream necessity across a broader spectrum of industries. Key insights reveal a pronounced shift towards robots with payloads Above 2000Kg, signifying a growing capability to tackle the most demanding industrial tasks. This upward trend is directly correlated with the increasing complexity of manufacturing processes and the need for enhanced efficiency in handling large components. Furthermore, the Palletizing and Packaging applications are emerging as dominant forces, accounting for a substantial portion of the market share due to the sheer volume of goods that require automated movement and storage. Innovations in end-effector technology and advancements in safety features are also contributing to the expanding applicability of heavy payload robots, making them more versatile and user-friendly. The integration of AI and machine learning is further augmenting their capabilities, enabling predictive maintenance and optimized operational cycles, which will undoubtedly shape the market landscape over the coming years. The overall market valuation, projected to reach millions of US dollars by the end of the study period, underscores the significant economic impact and strategic importance of heavy payload robots in modern industrial operations.

The ascension of the Heavy Payload Robot market is fueled by a confluence of powerful economic and technological drivers. Foremost among these is the relentless pursuit of enhanced productivity and operational efficiency across industries. As businesses grapple with increasing labor costs and the need to optimize throughput, heavy payload robots offer a compelling solution for handling substantial materials and components with unparalleled speed and precision. The Above 2000Kg segment, in particular, is benefiting from advancements that allow for the manipulation of extremely heavy objects, thereby streamlining processes in sectors like automotive manufacturing, construction, and logistics. Furthermore, the critical importance of safety in environments where manual handling of heavy items poses significant risks cannot be overstated. Heavy payload robots are instrumental in reducing workplace injuries and creating safer working conditions. The growing emphasis on Industry 4.0 principles, including the integration of smart manufacturing and the Industrial Internet of Things (IIoT), is also a significant catalyst, as these robots are designed to be interconnected and adaptable within complex automated systems.

Despite the robust growth trajectory, the Heavy Payload Robot market faces several significant challenges and restraints that warrant careful consideration. A primary hurdle is the substantial initial investment required for the acquisition and integration of these sophisticated systems. The cost of robots with payloads Above 2000Kg, coupled with the necessary infrastructure modifications, programming, and skilled personnel, can be a considerable barrier for small and medium-sized enterprises (SMEs). Furthermore, the complexity of integration into existing production lines often necessitates specialized expertise and can lead to extended downtime during implementation. The availability of skilled labor to operate, maintain, and program these advanced robots remains a bottleneck in many regions. Without a sufficient pool of qualified technicians and engineers, the full potential of heavy payload robots cannot be realized. Additionally, concerns regarding safety and regulatory compliance persist, especially in dynamic work environments. While advancements in safety features are ongoing, ensuring absolute safety in close proximity to powerful robotic systems requires rigorous protocols and continuous monitoring. Finally, the perceived inflexibility of some heavy payload robots can also be a restraint, particularly in industries with rapidly changing product demands, although this is being addressed through more modular and reconfigurable designs.

The Above 2000Kg payload segment is poised to dominate the Heavy Payload Robot market, driven by its indispensable role in core industrial applications and its significant growth potential across key regions. This segment is not merely about handling brute force; it represents the pinnacle of robotic capability in tackling the most demanding industrial challenges. The sheer weight and bulk of materials in sectors like heavy manufacturing, construction, and large-scale logistics necessitate robots that can reliably and safely manipulate objects weighing well over two thousand kilograms.

Key Segments Dominating the Market:

Type: Above 2000Kg: This payload category is the primary engine of growth. Its dominance stems from:

Application: Palletizing: This application is a major contributor to the dominance of heavy payload robots. The efficiency and speed at which these robots can stack and unstack heavy loads onto pallets are unmatched by manual labor.

Industry Developments: The continuous evolution of end-effector technology, including advanced grippers and manipulators, specifically designed for heavy objects, further solidifies the dominance of the Above 2000Kg segment. Furthermore, advancements in artificial intelligence and vision systems are enabling these robots to perform more complex tasks like adaptive palletizing and sophisticated part transfer of very heavy items.

Key Regions to Drive Dominance:

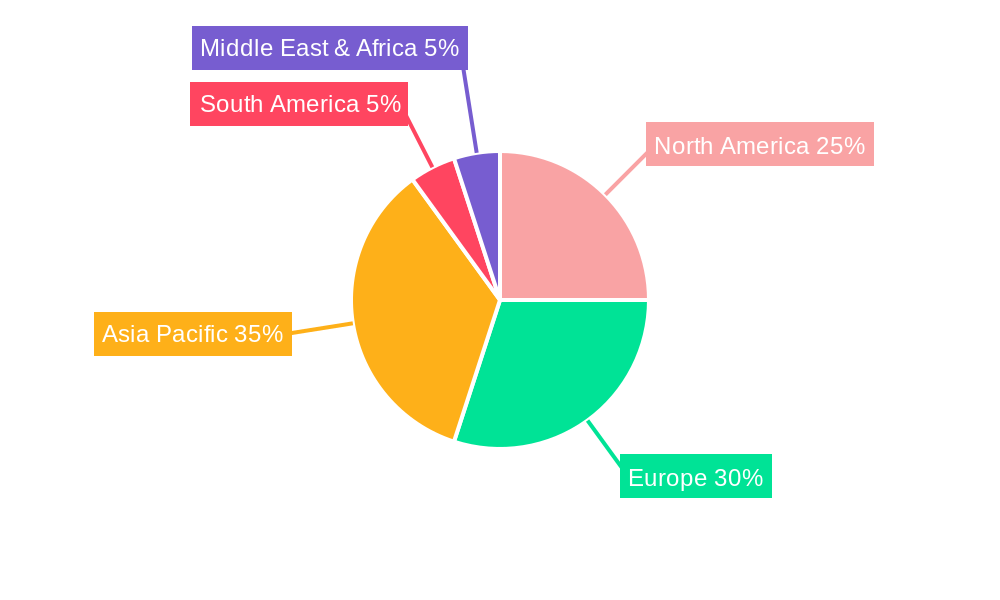

The synergy between the Above 2000Kg payload type and the Palletizing application, especially within the manufacturing powerhouses of the Asia-Pacific, North America, and Europe, will unequivocally position these segments and regions at the forefront of the global Heavy Payload Robot market throughout the forecast period (2025-2033).

The Heavy Payload Robot industry is experiencing robust growth propelled by several key catalysts. The escalating need for enhanced productivity and operational efficiency in heavy industries is paramount. Automation with robots capable of handling substantial loads reduces cycle times and increases throughput, directly impacting profitability. Furthermore, stringent safety regulations and the drive to minimize workplace injuries in environments with hazardous materials and heavy components are pushing industries towards robotic solutions. The ongoing advancements in AI, machine learning, and sensor technology are enabling heavier payload robots to perform more complex and adaptive tasks, expanding their application scope. The increasing global adoption of Industry 4.0 principles and smart manufacturing initiatives further fuels demand for these integrated robotic systems.

This report delves into the intricate landscape of the Heavy Payload Robot market, providing an exhaustive analysis from 2019 to 2033. It offers a detailed breakdown of market dynamics, including key trends, segmentation by payload type (Below 1000Kg, 1000Kg to 2000Kg, Above 2000Kg) and application (Palletizing, Packaging, Part Transfer, Machine Loading, Others). The report meticulously examines the driving forces behind market growth, such as the quest for enhanced productivity and safety, while also addressing critical challenges like high initial investment and the need for skilled labor. Furthermore, it highlights the dominant regions and segments expected to shape the market's future, with a focus on the Above 2000Kg payload type and the Palletizing application. The comprehensive analysis includes significant developments, leading players, and future growth catalysts, offering a strategic roadmap for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include KUKA, FANUC America, Kawasaki Heavy Industries, ABB, Yaskawa Electric, Stäubli International, Shandong Mining Machinery, JANOME, Mitsubishi, Teledyne FLIR, Universal Robots, Güdel, Chaifu, Nachi-Fujikoshi, Fuji Robotics, FANUC, Comau, Clearpath Robotics, Robotnik, Omron Robotics, Denso Robotics, Siasun, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Heavy Payload Robot," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy Payload Robot, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.