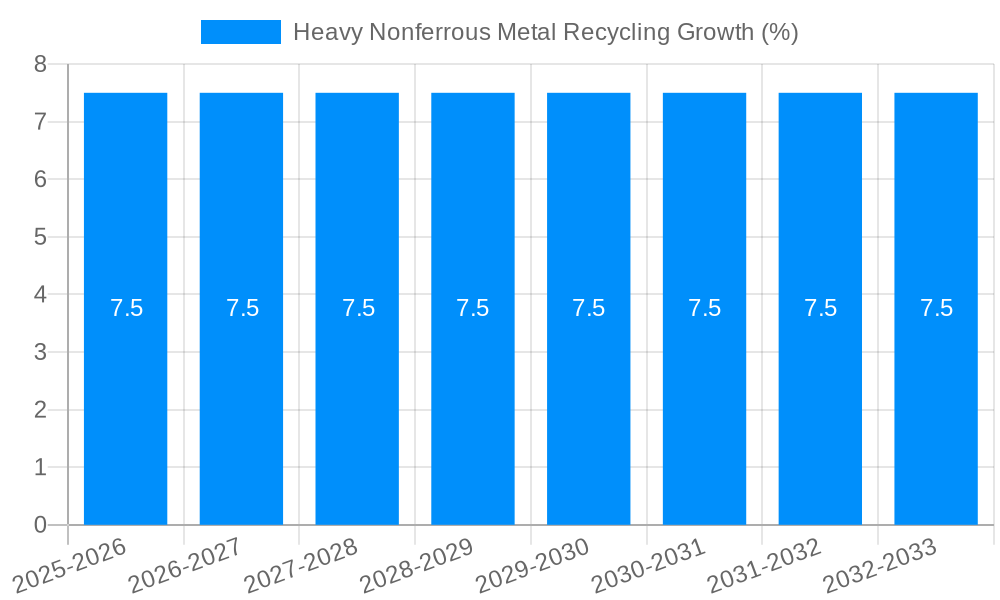

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Nonferrous Metal Recycling?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy Nonferrous Metal Recycling

Heavy Nonferrous Metal RecyclingHeavy Nonferrous Metal Recycling by Type (/> Copper Metal, Lead Metal, Tin Metal, Rare Metal), by Application (/> Catalysts, Electronic Products, Battery, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

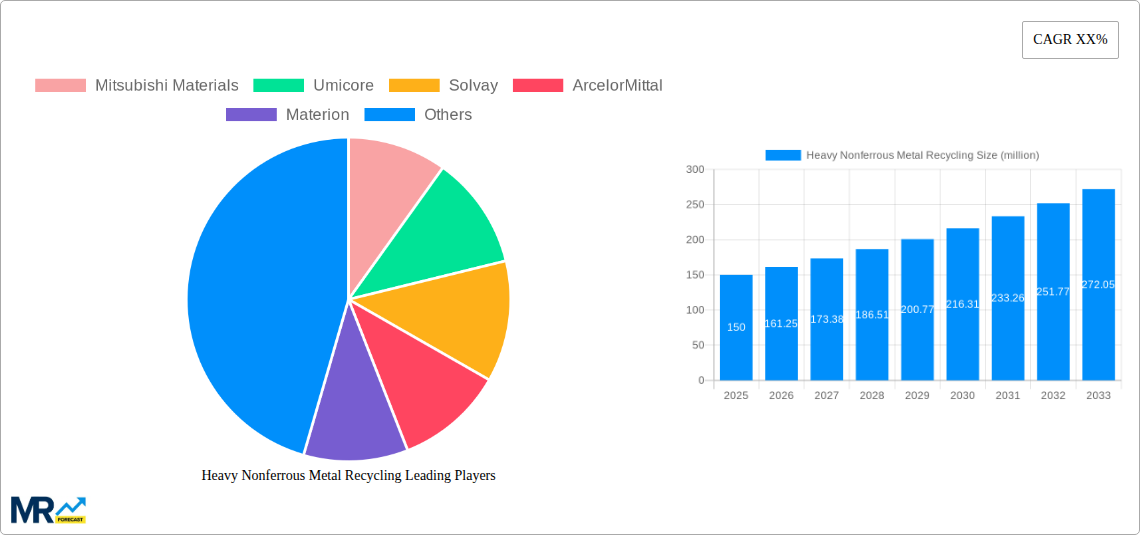

The Heavy Nonferrous Metal Recycling market is projected to experience robust growth, reaching an estimated Market Size of USD 150 million in 2025 and expanding at a CAGR of 7.5% through 2033. This upward trajectory is primarily fueled by increasing environmental regulations and a growing global emphasis on sustainable resource management. The scarcity of virgin nonferrous metals, coupled with escalating prices, is a significant driver, pushing industries to adopt circular economy principles. Furthermore, technological advancements in sorting and refining processes are enhancing the efficiency and economic viability of recycling these valuable metals. Copper, lead, and tin metals represent the dominant segments within this market, driven by their extensive use in critical applications such as electronics, batteries, and catalysts. The burgeoning demand for electric vehicles and renewable energy infrastructure is further accelerating the need for recycled nonferrous metals.

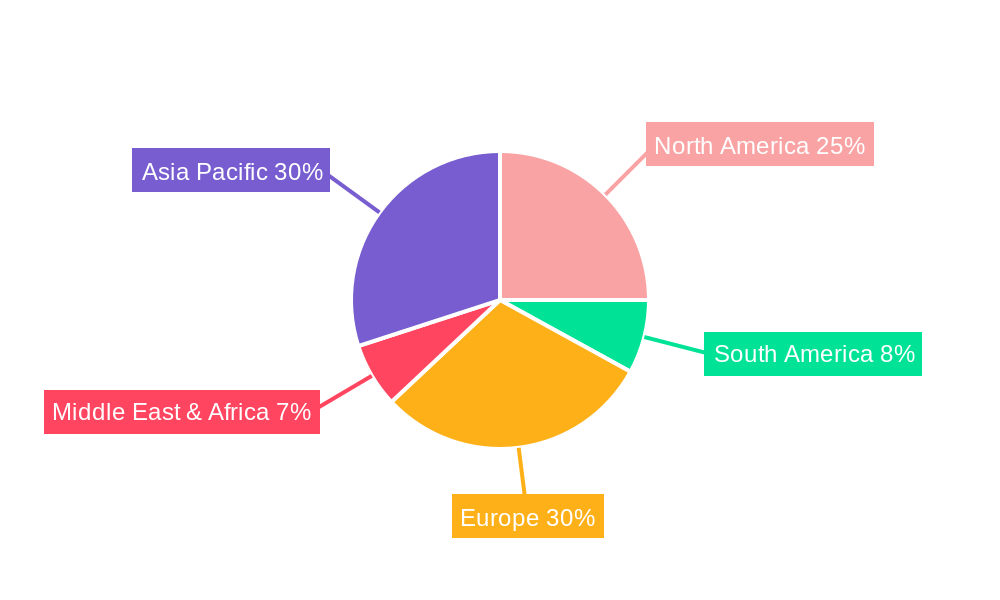

The market's expansion, however, faces certain restraints, including the high initial investment required for advanced recycling facilities and the complexities associated with collecting and segregating diverse metal scrap streams. Geopolitical factors and fluctuating commodity prices can also introduce volatility. Despite these challenges, emerging trends like the development of specialized recycling techniques for rare metals and increased corporate social responsibility initiatives are poised to bolster market performance. Geographically, Asia Pacific is anticipated to lead the market, owing to its vast manufacturing base and increasing investments in recycling infrastructure. North America and Europe also present substantial opportunities due to stringent environmental policies and a well-established recycling ecosystem. Key players like Mitsubishi Materials, Umicore, and Solvay are actively investing in R&D and strategic partnerships to capitalize on these evolving market dynamics and secure a competitive edge.

This report offers a deep dive into the global Heavy Nonferrous Metal Recycling market, providing a comprehensive analysis of trends, drivers, challenges, and growth opportunities from the Historical Period of 2019-2024 through to the Forecast Period of 2025-2033, with a Base Year and Estimated Year set at 2025. We project a robust market expansion, anticipating the global Heavy Nonferrous Metal Recycling market to reach approximately $120,500 million by 2033, a significant increase from an estimated $75,000 million in 2025. The Study Period encompasses a broader timeframe of 2019-2033 to capture long-term shifts and emerging patterns. This report is meticulously crafted to equip stakeholders with actionable intelligence, enabling informed strategic decisions within this dynamic and increasingly critical industry.

XXX Market Insights: The global Heavy Nonferrous Metal Recycling market is experiencing a period of significant transformation, driven by a confluence of environmental imperatives, technological advancements, and evolving economic landscapes. During the Historical Period (2019-2024), the market witnessed steady growth, with an estimated market size of $50,000 million in 2019, primarily fueled by increasing awareness of resource scarcity and the economic benefits of secondary material recovery. As we transition to the Base Year of 2025, the market is poised for accelerated expansion. A key trend is the increasing sophistication of recycling technologies, enabling the recovery of a wider array of valuable nonferrous metals, including copper, lead, tin, and rare metals, with greater efficiency and purity. This technological evolution is directly impacting the value proposition of recycling, making it more competitive against primary extraction. The growing demand for these metals in high-growth sectors such as electric vehicles, renewable energy infrastructure, and advanced electronics is further intensifying the focus on recycling as a sustainable and reliable supply chain solution. For instance, the burgeoning battery segment, a critical component of the electric mobility revolution, is a significant driver, demanding substantial volumes of materials like copper and lead, which can be effectively sourced through recycling. Similarly, the demand for rare metals in catalysts for emission control and advanced electronic components underscores the strategic importance of their recycling. The circular economy paradigm is gaining considerable traction, encouraging manufacturers and consumers alike to embrace product lifecycle management that prioritizes material recovery. This shift is not only driven by regulatory pressures but also by growing consumer preference for environmentally responsible products. Furthermore, geopolitical factors and supply chain vulnerabilities associated with the sourcing of primary nonferrous metals are increasingly pushing industries towards localized and resilient recycling solutions. The market is also observing a trend towards consolidation and strategic partnerships among key players, aiming to enhance operational efficiencies, expand geographical reach, and secure feedstock supply. The overarching trend is a move towards a more integrated and resource-efficient future, where recycling is no longer an alternative but an essential component of the global metals economy.

The Heavy Nonferrous Metal Recycling market is being propelled by a powerful confluence of factors that are reshaping the global industrial landscape. Foremost among these is the escalating global demand for nonferrous metals, driven by the rapid growth of key end-use industries. The transition towards a low-carbon economy, characterized by the proliferation of electric vehicles, solar panels, and wind turbines, necessitates significant quantities of copper, aluminum, and various rare metals. Consequently, the recycling of these materials emerges as a crucial and cost-effective strategy to meet this surging demand, circumventing the environmental and geopolitical challenges associated with primary mining. Regulatory frameworks are also playing a pivotal role. Governments worldwide are implementing stricter environmental regulations, promoting extended producer responsibility, and incentivizing recycling initiatives. These policies create a more favorable operating environment for recycling businesses and encourage greater material recovery. Furthermore, the economic viability of nonferrous metal recycling is increasingly attractive. Fluctuating commodity prices for primary metals can make recycled materials a more stable and predictable source of supply. The advanced separation and refining technologies available today allow for the extraction of high-purity metals, making recycled content a competitive alternative to virgin materials. The increasing awareness and concern for environmental sustainability among consumers and corporations alike are also acting as a significant catalyst. Businesses are proactively seeking to reduce their environmental footprint and enhance their corporate social responsibility credentials by incorporating recycled materials into their products. This growing demand for sustainable sourcing is creating a robust market for recycled nonferrous metals.

Despite the robust growth trajectory, the Heavy Nonferrous Metal Recycling market is not without its significant challenges and restraints. A primary hurdle is the complexity and cost associated with the collection and transportation of end-of-life products, particularly from dispersed sources. The fragmented nature of waste streams, especially in developing regions, can lead to inefficient logistics and increased operational expenses. Furthermore, the presence of hazardous materials within some electronic products and batteries can pose environmental and safety risks during the dismantling and processing phases, necessitating specialized handling and disposal protocols, thereby adding to the cost. Technological limitations, while improving, can still be a restraint for certain complex alloys or highly contaminated materials, leading to lower recovery rates or the production of lower-grade secondary materials. The economic viability of recycling can also be volatile, influenced by fluctuations in the prices of primary metals. A sharp decline in primary metal prices can sometimes make recycled materials less competitive, impacting investment decisions and the overall profitability of recycling operations. Establishing consistent and high-quality feedstock supply remains a persistent challenge, as the availability and composition of end-of-life products can vary significantly. Moreover, stringent regulations regarding waste management and cross-border transportation of scrap materials, while necessary for environmental protection, can also create logistical complexities and delays for international recycling operations.

The Heavy Nonferrous Metal Recycling market is characterized by regional variations in infrastructure, regulatory frameworks, and industrial demand. However, certain regions and segments are poised to dominate the market in the coming years.

Dominant Regions:

Dominant Segments:

Among the various types and applications of heavy nonferrous metals, certain segments are projected to exhibit particularly strong growth and dominance:

These segments, driven by technological advancements and evolving market demands, will be instrumental in shaping the future landscape of the Heavy Nonferrous Metal Recycling market.

The growth of the Heavy Nonferrous Metal Recycling industry is significantly catalyzed by a robust interplay of environmental consciousness and economic incentives. The increasing global emphasis on sustainability and the adoption of circular economy principles by governments and industries alike are creating a fertile ground for recycling. Escalating demand for critical nonferrous metals in high-growth sectors such as electric vehicles, renewable energy, and advanced electronics directly fuels the need for efficient and scalable recycling solutions. Furthermore, technological advancements in sorting, separation, and refining processes are enhancing recovery rates and the purity of recycled metals, making them more competitive with virgin materials. The implementation of supportive government policies, including extended producer responsibility schemes and financial incentives for recycling, also plays a crucial role in stimulating market growth.

This report offers unparalleled depth in its analysis of the Heavy Nonferrous Metal Recycling market. It provides a granular breakdown of market size and growth projections across key segments, including Copper Metal, Lead Metal, Tin Metal, and Rare Metal. Furthermore, it meticulously examines the application-specific demand drivers for Catalysts, Electronic Products, and Batteries. The report meticulously details the industry's trajectory from 2019-2024 (Historical Period) to 2025-2033 (Forecast Period), utilizing 2025 as both the Base Year and Estimated Year, and encompassing the entire Study Period of 2019-2033. It identifies the leading players and their strategic initiatives, alongside significant industry developments, ensuring stakeholders are equipped with comprehensive and actionable market intelligence.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mitsubishi Materials, Umicore, Solvay, ArcelorMittal, Materion, Nucor, CMC Recycling, Sims Recycling Solutions, TANAKA, Sino-Platinum Metals, Aurubis, Dowa Holdings, Heraeus, Asahi Holdings, Great Metal Recycling, Greener Recycling, Eldan Recycling, Metal & Waste Recycling.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Heavy Nonferrous Metal Recycling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy Nonferrous Metal Recycling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.