1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Load Handling Exoskeleton?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy Load Handling Exoskeleton

Heavy Load Handling ExoskeletonHeavy Load Handling Exoskeleton by Type (Lower, Upper, Full Body), by Application (Healthcare, Defense, Industrial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

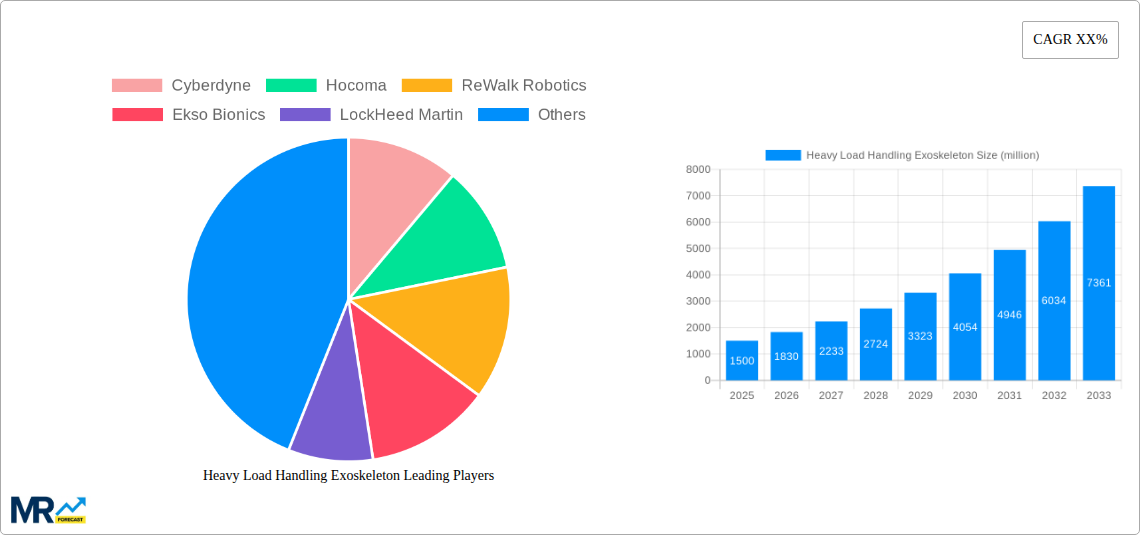

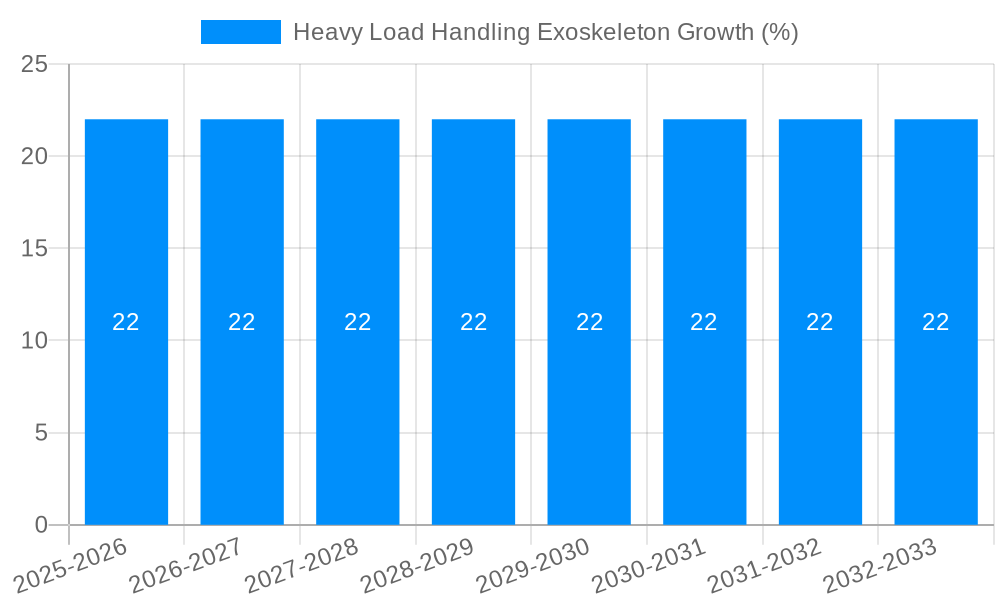

The Heavy Load Handling Exoskeleton market is projected to reach a substantial market size of approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 22% anticipated to extend through 2033. This significant expansion is primarily fueled by the escalating demand for enhanced worker safety and productivity in physically demanding industries. The growing adoption of these advanced robotic suits in sectors such as manufacturing, logistics, construction, and healthcare is a testament to their capability in mitigating musculoskeletal injuries and improving operational efficiency. As aging workforces become more prevalent and the need for specialized support in complex tasks increases, the market is poised for continued upward momentum. Further driving this growth is the increasing investment in research and development by leading companies, leading to more sophisticated, ergonomic, and user-friendly exoskeleton designs.

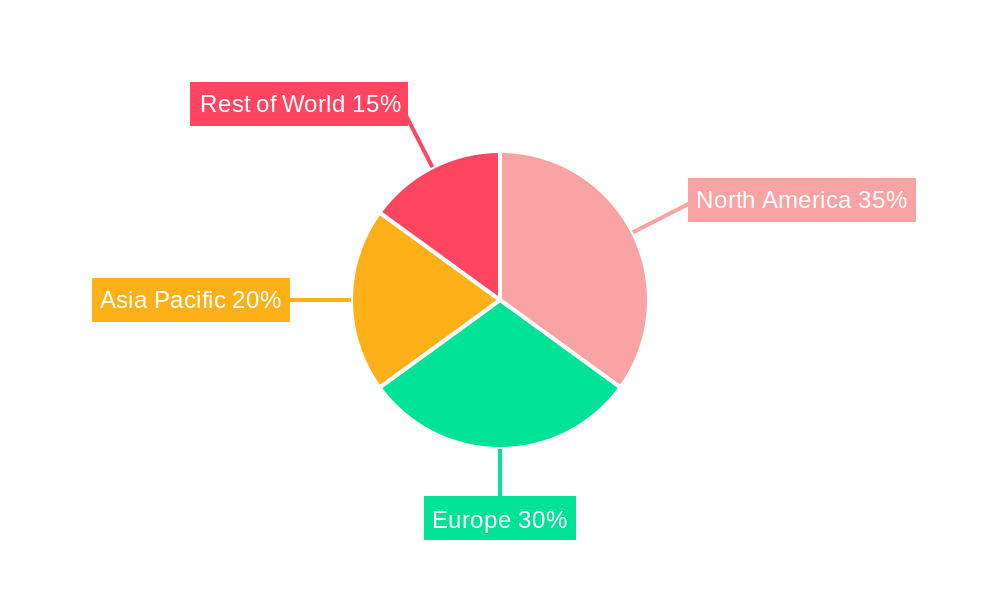

The market's growth trajectory is shaped by several key drivers and evolving trends. The critical need to reduce workplace injuries and associated costs, coupled with advancements in materials science and AI, are propelling innovation and adoption. Emerging trends include the development of lighter, more flexible, and intelligent exoskeletons with enhanced power management and adaptive control systems. However, the market also faces certain restraints, notably the high initial cost of these sophisticated devices and the need for comprehensive training programs for widespread adoption. Furthermore, regulatory hurdles and concerns regarding user comfort and long-term physiological effects require ongoing attention. Geographically, North America and Europe currently lead the market due to strong industrial bases and early adoption rates, with the Asia Pacific region exhibiting significant growth potential driven by its expanding industrial sector and increasing focus on worker well-being.

Here's a unique report description on Heavy Load Handling Exoskeletons, incorporating your specified elements:

The global Heavy Load Handling Exoskeleton market is experiencing a significant inflection point, projected to reach a valuation exceeding $5,000 million by the end of the Study Period (2019-2033). This robust growth is underpinned by an escalating need for enhanced human capabilities in physically demanding sectors, coupled with advancements in robotics and artificial intelligence. The Base Year (2025) serves as a pivotal point, with projections indicating a market size of approximately $1,500 million in this same year. During the Historical Period (2019-2024), the market witnessed nascent adoption, primarily driven by research and development initiatives and early-stage military applications. However, the Forecast Period (2025-2033) is poised for exponential expansion, fueled by increasing commercial viability, greater awareness of worker safety, and the development of more sophisticated and affordable exoskeleton technologies. Emerging trends include the integration of AI for adaptive load management, the miniaturization of power sources for enhanced portability, and the development of intuitive user interfaces that reduce the learning curve for operators. Furthermore, there is a discernible shift towards personalized exoskeletons, tailored to individual anthropometrics and specific job requirements, moving beyond one-size-fits-all solutions. The market is also seeing increased investment in R&D for lighter, more flexible materials that improve user comfort and endurance, a critical factor for widespread adoption in sectors beyond defense. The overall market trajectory suggests a move from niche applications to mainstream integration across various industries.

Several powerful forces are collectively driving the rapid ascent of the Heavy Load Handling Exoskeleton market. Foremost among these is the escalating emphasis on occupational safety and health. Industries grappling with high rates of musculoskeletal injuries, such as manufacturing, logistics, and construction, are actively seeking solutions to mitigate risks associated with manual material handling. Exoskeletons offer a tangible way to reduce the physical strain on workers, leading to fewer injuries, decreased workers' compensation claims, and improved employee well-being. This, in turn, contributes to a more sustainable and productive workforce. Secondly, the increasing complexity and scale of logistical operations, particularly within e-commerce and global supply chains, necessitate more efficient and less physically taxing methods for handling heavy goods. Exoskeletons empower workers to lift and move heavier loads with greater ease and less fatigue, thereby boosting operational efficiency and throughput. The growing awareness of these benefits, coupled with technological advancements that are making exoskeletons more accessible and effective, is creating a fertile ground for market expansion.

Despite the promising growth trajectory, the Heavy Load Handling Exoskeleton market faces several significant challenges and restraints. A primary hurdle is the substantial initial cost of these advanced technologies. High purchase prices can be a deterrent for many businesses, especially small and medium-sized enterprises, limiting widespread adoption. The perceived complexity of operation and training requirements also poses a barrier; workers may be hesitant to adopt new technologies that require extensive learning curves or feel cumbersome. Furthermore, concerns regarding the long-term physiological effects of prolonged exoskeleton use on the human body are still being thoroughly investigated. While designed to reduce strain, the potential for unintended consequences, such as altered biomechanics or muscle atrophy, requires ongoing research and careful monitoring. Regulatory frameworks and standardization for exoskeleton use are still evolving, creating uncertainty for manufacturers and users alike. Finally, the need for robust and reliable power sources that offer extended operational life without compromising on weight or bulk remains a continuous engineering challenge.

The Industrial segment, particularly within the Lower Body and Full Body exoskeleton types, is poised to dominate the Heavy Load Handling Exoskeleton market in terms of revenue and adoption. This dominance is expected to be most pronounced in regions with strong manufacturing bases, advanced logistics networks, and a high emphasis on worker safety.

Industrial Segment Dominance:

Dominant Segments within Type:

Key Regions Driving Growth:

The convergence of these segments and regions, driven by the fundamental need to augment human physical capabilities safely and efficiently in industrial environments, will undoubtedly shape the future landscape of the Heavy Load Handling Exoskeleton market.

The Heavy Load Handling Exoskeleton industry is propelled by several significant growth catalysts. The relentless pursuit of enhanced worker safety and the reduction of occupational injuries is a primary driver, leading to increased investment in protective technologies. Advances in materials science, resulting in lighter, more durable, and flexible exoskeleton components, are making these devices more practical and comfortable for users. Furthermore, the continuous innovation in AI and sensor technology is enabling exoskeletons to become more intuitive, responsive, and adaptive to individual user movements and varying load conditions, thereby expanding their applicability across diverse tasks.

This comprehensive report delves into the intricate landscape of the Heavy Load Handling Exoskeleton market, providing an in-depth analysis of its evolution from 2019 to 2033. It meticulously examines market dynamics, including key trends, driving forces, and prevailing challenges that shape its trajectory. The report offers granular insights into segment-specific growth, particularly highlighting the dominance of the Industrial segment and the critical roles of Lower Body and Full Body exoskeleton types. Furthermore, it identifies key geographical regions poised for significant market expansion, driven by economic factors and technological adoption. Detailed company profiles of leading players like Cyberdyne, Ekso Bionics, and Lockheed Martin are provided, alongside an analysis of their strategic initiatives and product portfolios. The report also forecasts significant developments and technological advancements expected to materialize throughout the Forecast Period (2025-2033), painting a clear picture of future market potential and strategic opportunities for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cyberdyne, Hocoma, ReWalk Robotics, Ekso Bionics, LockHeed Martin, Parker Hannifin, Interactive Motion Technologies, Panasonic, Myomo, B-TEMIA Inc., Alter G, US Bionics.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Heavy Load Handling Exoskeleton," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy Load Handling Exoskeleton, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.