1. What is the projected Compound Annual Growth Rate (CAGR) of the Heat Transfer Fluids for Data Centers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heat Transfer Fluids for Data Centers

Heat Transfer Fluids for Data CentersHeat Transfer Fluids for Data Centers by Type (Low Temperature Heat Transfer Fluids, Glycol based Heat Transfer Fluids, High Temperature Heat Transfer Fluids, Low Electrical Conductivity Heat Transfer Fluids, World Heat Transfer Fluids for Data Centers Production ), by Application (Computing Systems, Electronic Applications, World Heat Transfer Fluids for Data Centers Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

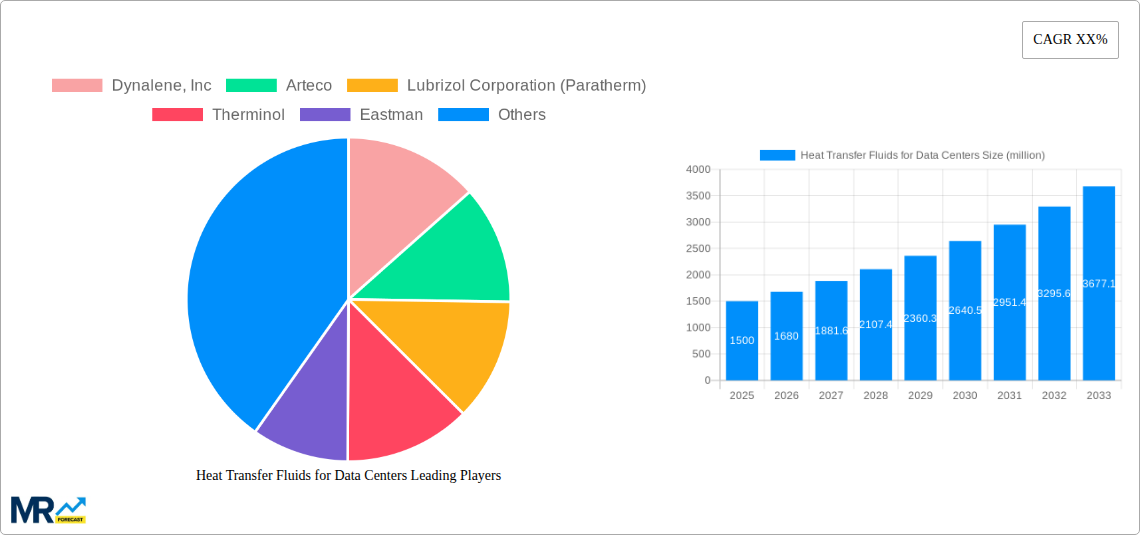

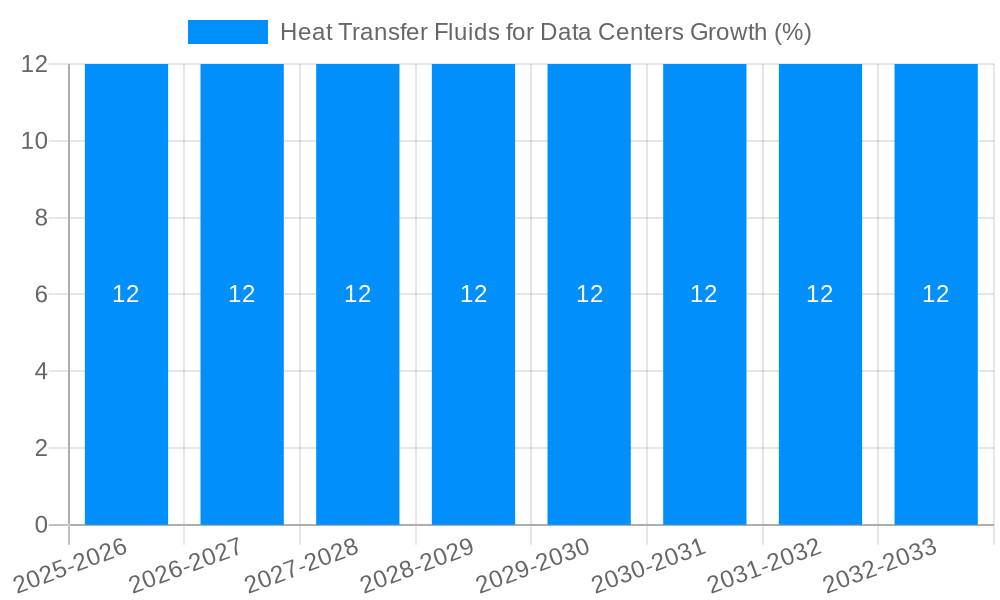

The global market for Heat Transfer Fluids (HTFs) in data centers is experiencing robust growth, driven by the escalating demand for efficient and reliable cooling solutions to manage the immense heat generated by modern computing infrastructure. With an estimated market size of approximately $1.5 billion in 2025, the industry is projected to expand at a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This significant expansion is fueled by the rapid proliferation of hyperscale data centers, the increasing density of servers, and the growing adoption of liquid cooling technologies to achieve superior thermal management compared to traditional air cooling. The need to enhance energy efficiency, reduce operational costs, and extend the lifespan of critical IT equipment are paramount drivers pushing data center operators towards advanced HTF solutions.

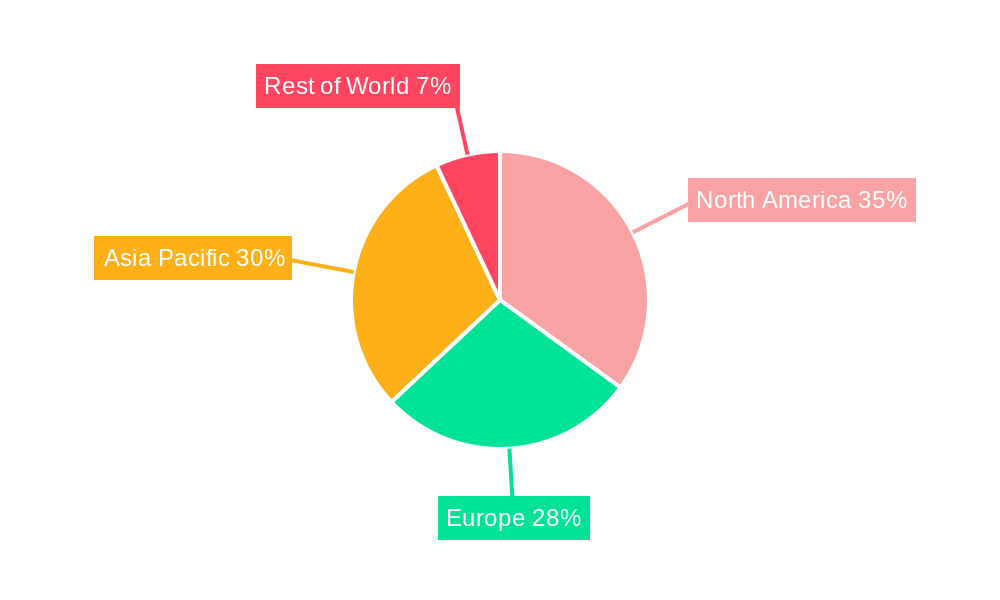

The market is segmented by fluid type, with Glycol-based Heat Transfer Fluids and High-Temperature Heat Transfer Fluids expected to dominate due to their versatility and performance across a wide range of operating temperatures. Low Electrical Conductivity Heat Transfer Fluids are also gaining traction as they offer enhanced safety and protection for sensitive electronic components. Geographically, the Asia Pacific region, led by China and India, is anticipated to witness the highest growth, owing to the rapid digital transformation and increasing data center investments in these economies. North America and Europe remain substantial markets, characterized by established data center ecosystems and a strong focus on technological advancements. Key industry players are actively involved in product innovation, strategic partnerships, and expansions to cater to the evolving demands of this dynamic market. Challenges such as the initial cost of implementing liquid cooling systems and the need for specialized maintenance can act as restraints, but the overwhelming benefits in performance and energy savings are propelling the market forward.

The global market for heat transfer fluids (HTFs) within data centers is experiencing a significant upswing, driven by the relentless demand for more powerful computing and the increasing density of electronic components. Throughout the study period of 2019-2033, with a base year in 2025, a clear trajectory towards innovative and efficient cooling solutions is evident. During the historical period (2019-2024), the market primarily relied on established glycol-based and mineral oil formulations. However, the estimated year of 2025 marks a pivotal point, where the market is increasingly embracing specialized fluids designed for higher thermal performance and enhanced safety. The forecast period (2025-2033) is poised to witness a substantial CAGR, with market revenue projected to reach over 3,500 million USD by the end of the forecast. This growth is intrinsically linked to the exponential increase in data generation, the proliferation of AI and machine learning applications, and the consequent demand for sophisticated cooling technologies to manage the immense heat loads generated by these advanced systems. Low-temperature heat transfer fluids are gaining prominence for direct liquid cooling applications, while fluids with exceptionally low electrical conductivity are becoming indispensable for immersion cooling, a segment poised for significant expansion. The trend towards sustainable and eco-friendly HTFs is also gaining traction, with manufacturers exploring bio-based and biodegradable options to meet environmental regulations and corporate sustainability goals. The integration of advanced analytics and AI for predictive maintenance of cooling systems will further influence the selection and utilization of HTFs, emphasizing reliability and longevity. Industry developments, such as advancements in fluid chemistry and manufacturing processes, are continuously pushing the boundaries of thermal efficiency, leading to more compact and energy-efficient data center designs. The market is thus evolving from a commodity-driven sector to one focused on high-performance, specialized solutions catering to the intricate needs of modern data infrastructure.

The escalating demand for high-performance computing (HPC) and the explosive growth of data centers globally are the primary catalysts fueling the heat transfer fluids market for data centers. The continuous evolution of server technology, characterized by increasingly powerful processors and graphics processing units (GPUs), generates unprecedented levels of heat. To maintain optimal operating temperatures and prevent thermal throttling, which degrades performance, efficient cooling solutions are paramount. Heat transfer fluids, as the medium for dissipating this heat, are therefore in high demand. The burgeoning adoption of artificial intelligence (AI), machine learning (ML), and big data analytics across various industries necessitates massive computational power, directly translating to higher heat densities within server racks. This, in turn, drives the need for advanced HTFs that can handle these extreme thermal loads effectively. Furthermore, the trend towards denser server configurations and the increasing adoption of liquid cooling technologies, including direct-to-chip and immersion cooling, are creating a significant surge in the demand for specialized heat transfer fluids. These technologies offer superior cooling efficiency compared to traditional air cooling, leading to substantial energy savings and improved data center reliability. The market revenue is projected to exceed 3,500 million USD by 2033, underscoring the powerful economic forces at play.

Despite the robust growth trajectory, the heat transfer fluids market for data centers faces several challenges and restraints that could impede its full potential. One significant hurdle is the high initial cost associated with implementing advanced liquid cooling systems, which often require specialized infrastructure and compatible heat transfer fluids. This can be a deterrent for smaller data center operators or those with budget constraints. Another concern revolves around the long-term reliability and lifespan of certain heat transfer fluids, particularly in demanding operating environments. Degradation of fluid properties over time can lead to reduced cooling efficiency and potential equipment damage, necessitating regular fluid replacement and maintenance, which adds to operational costs. Safety concerns, including flammability and toxicity of some fluid formulations, also present a challenge, requiring stringent handling protocols and regulatory compliance. The availability of a limited number of suppliers for highly specialized or proprietary heat transfer fluids can also lead to supply chain vulnerabilities and price fluctuations. Furthermore, the development and adoption of new, unproven fluid technologies can be met with resistance from industry stakeholders who prioritize proven, reliable solutions. The need for specialized maintenance expertise to manage liquid cooling systems and their associated heat transfer fluids can also be a limiting factor for widespread adoption.

The North America region is poised to emerge as a dominant force in the heat transfer fluids for data centers market, driven by its advanced technological infrastructure, significant investments in cloud computing, and the presence of major hyperscale data center operators. The United States, in particular, is at the forefront of data center innovation and expansion, consistently investing in cutting-edge cooling technologies to support its burgeoning digital economy. The region’s strong emphasis on research and development, coupled with favorable government initiatives and a highly skilled workforce, further solidifies its leading position. Within North America, Computing Systems as an application segment is anticipated to showcase substantial growth, directly correlating with the increasing demand for high-performance servers and the expansion of cloud infrastructure.

In terms of dominating segments by Type, Low Electrical Conductivity Heat Transfer Fluids are expected to witness the most significant surge in demand. This is intrinsically linked to the rapid adoption of immersion cooling technologies. Immersion cooling, which involves submerging electronic components directly into a dielectric fluid, offers superior heat dissipation capabilities compared to traditional air cooling or even direct-to-chip liquid cooling. This method requires fluids that are non-conductive to prevent short circuits and protect sensitive electronic components. The ability of these fluids to manage the extreme heat generated by high-density server racks, particularly those housing advanced processors and GPUs for AI and machine learning workloads, makes them indispensable. The global production of such fluids is projected to grow substantially, with market revenue for this specific segment alone expected to contribute a significant portion of the overall market value, potentially reaching over 1,200 million USD by 2033. The increasing focus on energy efficiency and reducing the overall footprint of data centers further bolsters the adoption of immersion cooling and, consequently, low electrical conductivity heat transfer fluids. Manufacturers are investing heavily in research and development to enhance the thermal performance, dielectric properties, and environmental sustainability of these fluids. Companies like Dynalene, Inc., Sigma Thermal, and Dow Inc. are actively innovating in this space, offering advanced formulations designed to meet the stringent requirements of next-generation data center designs. The synergy between technological advancements in server hardware and the development of specialized cooling fluids is creating a powerful feedback loop, propelling the dominance of low electrical conductivity heat transfer fluids in the market. The projected market size for heat transfer fluids for data centers in North America alone could exceed 1,500 million USD by 2033, with the low electrical conductivity segment playing a pivotal role in this expansion.

The persistent demand for enhanced processing power and the exponential growth of data-driven applications, such as AI and IoT, are major growth catalysts. The continuous innovation in server hardware, leading to higher heat densities, necessitates more efficient cooling solutions. This, in turn, drives the adoption of advanced heat transfer fluids. Furthermore, the increasing global push towards sustainability and energy efficiency in data center operations favors advanced liquid cooling technologies that utilize specialized HTFs, leading to significant operational cost reductions.

This report offers a comprehensive analysis of the global heat transfer fluids market for data centers, providing in-depth insights into its current state and future potential. It delves into market segmentation by type, application, and region, with a detailed examination of key trends, drivers, and challenges. The study period spans from 2019 to 2033, with a base year of 2025, offering historical context, current market estimations, and robust forecasts. The report quantifies market revenue, projected to exceed 3,500 million USD by 2033, and analyzes the Compound Annual Growth Rate (CAGR) across various segments. It highlights the dominance of North America and the significant growth of low electrical conductivity heat transfer fluids within the immersion cooling segment. Leading industry players are identified, alongside their strategic developments and contributions to market evolution, providing a holistic understanding of this critical sector for modern data infrastructure.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dynalene, Inc, Arteco, Lubrizol Corporation (Paratherm), Therminol, Eastman, Sigma Thermal, Weber Scientific, Interstate Chemical Co. Inc, Hubbard Hall, Thermic Fluids Pvt, Dow Inc., E.W. Process, Exxon Mobil, Chevron, Paratherm, BASF, Lanxess, Huntsman, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Heat Transfer Fluids for Data Centers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heat Transfer Fluids for Data Centers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.