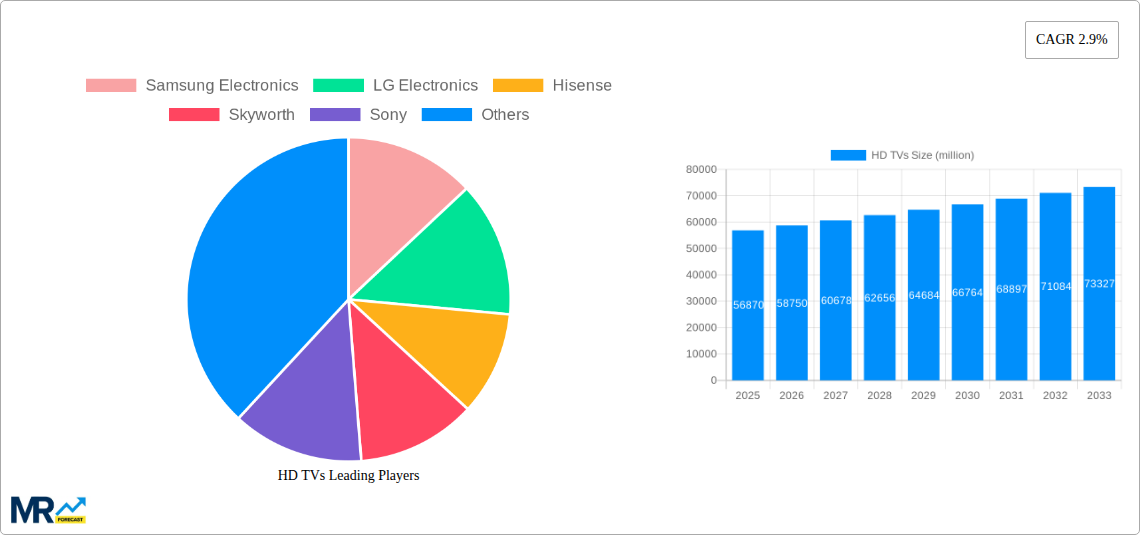

1. What is the projected Compound Annual Growth Rate (CAGR) of the HD TVs?

The projected CAGR is approximately 2.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HD TVs

HD TVsHD TVs by Application (Commercial, Residential), by Type (Below 50 inch, Between 50 and 65 inch, Above 65 inch), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

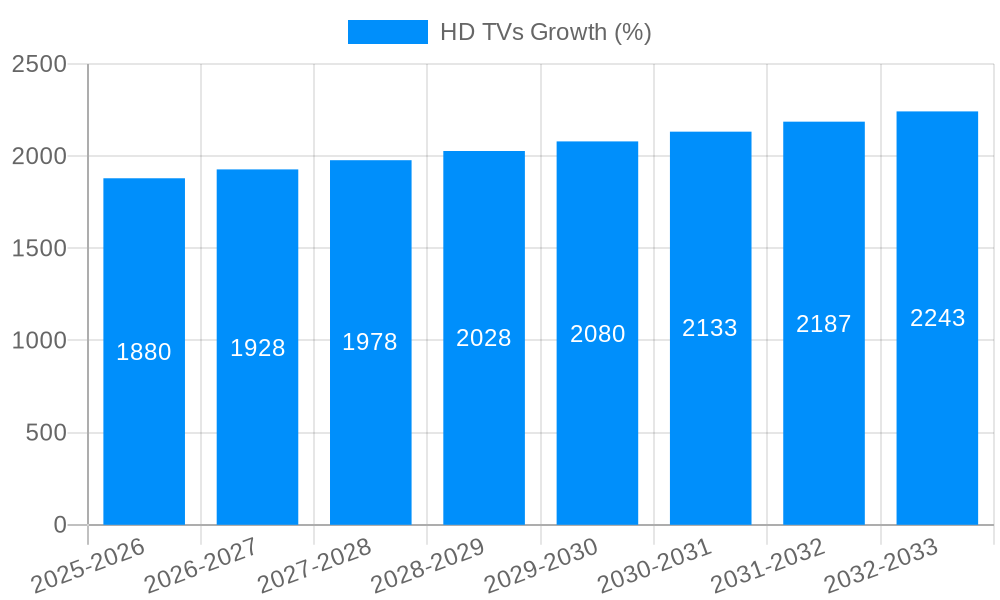

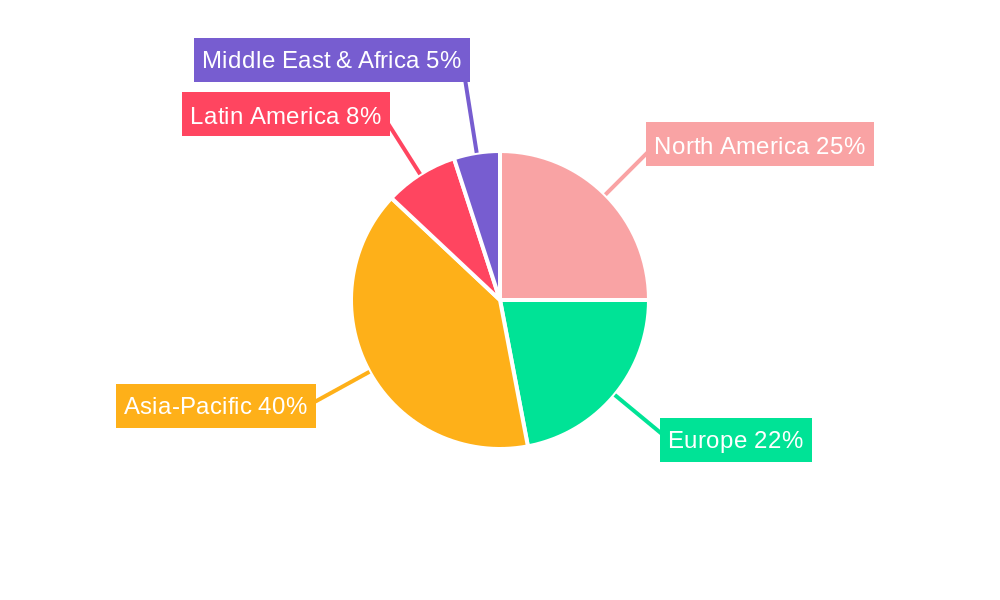

The global HD TV market, valued at $56.87 billion in 2025, is projected to experience steady growth, driven primarily by increasing disposable incomes in developing economies and the ongoing demand for larger screen sizes and enhanced features like 4K resolution and HDR. The market's Compound Annual Growth Rate (CAGR) of 2.9% from 2025 to 2033 reflects a mature but stable market segment. While the rapid adoption of newer technologies like OLED and QLED TVs has impacted HD TV sales somewhat, the cost-effectiveness and wide availability of HD TVs continue to maintain a significant market presence, especially in price-sensitive segments. Key players like Samsung, LG, and TCL are leveraging economies of scale and technological advancements to offer competitive pricing and feature sets, fueling ongoing market competition. The market’s growth is expected to be more pronounced in regions experiencing rapid urbanization and rising middle-class populations, particularly in Asia-Pacific and Latin America. Factors such as the increasing penetration of streaming services and the continued replacement of older, lower-resolution TVs also contribute to consistent demand.

However, certain restraints limit market expansion. The rise of streaming devices and smart TVs incorporating integrated streaming capabilities might lessen the demand for standalone HD TVs. Furthermore, the technological advancements in display technology are pushing consumers towards higher-resolution options, potentially slowing the growth of the HD TV market in the long term. Despite these factors, the substantial installed base of older TVs needing replacement, coupled with the affordability of HD TVs, ensures a consistent demand throughout the forecast period. Market segmentation is likely driven by screen size, resolution (with a focus on full HD 1080p), smart TV functionality, and brand preference. Competition remains intense amongst leading manufacturers who are continually innovating to maintain market share and attract new consumers.

The global HD TV market, valued at several million units in 2024, is experiencing a complex evolution. While the rise of 4K and 8K Ultra HD technologies has undeniably captured significant market share, the HD TV segment continues to hold relevance, particularly in price-sensitive markets and among consumers prioritizing affordability over the highest resolution. This report analyzes the market trends from 2019 to 2033, focusing on the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The estimated market size in 2025, while substantial, is projected to witness a moderate growth rate during the forecast period. This tempered growth is a result of several factors, including the saturation of the market in developed regions, the ongoing shift towards higher resolution displays, and the increasing prevalence of streaming services that offer content in varying resolutions, potentially impacting the demand for new dedicated HD TVs. However, continued demand in emerging economies, coupled with the enduring appeal of smaller screen sizes for specific applications (e.g., bedrooms, kitchens), sustains the HD TV market's relevance. Price competitiveness remains a crucial factor, with manufacturers strategically positioning HD TVs to cater to budget-conscious consumers. This report delves deeper into the key market segments and geographic regions driving this ongoing demand, offering insights into sales figures, market share analysis, and future predictions. The impact of technological advancements, changing consumer preferences, and economic fluctuations on the HD TV market will also be thoroughly examined. The continued role of HD TVs in secondary or supplementary display applications, such as gaming monitors or secondary TVs in larger households, is also a key factor underpinning this segment’s continued existence. Finally, the report incorporates data on various brands and their market strategies, as well as projections based on observed trends, allowing stakeholders to make well-informed decisions.

Several factors continue to drive the HD TV market, albeit at a slower pace than previously witnessed. The most significant is the enduring affordability of HD TVs compared to their higher-resolution counterparts. This price advantage makes them an attractive option for budget-conscious consumers, particularly in developing economies experiencing rapid urbanization and rising disposable incomes. The extensive availability of HD content across various platforms, from broadcast television to streaming services, further bolsters demand. Furthermore, the continuing presence of legacy broadcasting infrastructure in many regions ensures a consistent supply of HD content. Small screen size HD TVs also continue to find a niche market, especially in areas like bedrooms, kitchens, or as secondary screens in larger households. Lastly, the robust and well-established supply chain for HD TV manufacturing continues to make production costs relatively low, making HD TVs remain a competitive option in the overall TV market. This balance between affordability and functional capability keeps HD TVs relevant in a market increasingly dominated by higher-resolution alternatives.

The primary challenge facing the HD TV market is the increasing dominance of 4K and 8K Ultra HD televisions. Consumers are increasingly drawn to the superior visual quality offered by these higher-resolution displays, prompting many to upgrade or opt for a higher resolution TV from the outset. The technological advancements in display technology, such as HDR (High Dynamic Range) and improved color gamuts, also favor Ultra HD, further reducing the appeal of standard HD. Moreover, the proliferation of streaming services offering 4K and even 8K content adds another layer to this challenge. This shift in consumer preference leads to a decrease in demand for HD TVs and creates pressure on manufacturers to adapt or risk market share erosion. Furthermore, the saturation of the market in developed regions poses another restraint, with many households already owning multiple TVs, including those with higher resolutions. Finally, while price remains a competitive advantage for HD TVs, any price increases may directly impact sales, potentially reducing the appeal of this more cost-effective option.

Emerging Markets: Developing economies in Asia, Africa, and Latin America are expected to be significant growth drivers for the HD TV market during the forecast period. These regions have a large population base with growing disposable incomes and increasing urbanization, creating a substantial demand for affordable electronic devices like HD TVs. The sustained popularity of affordable HD TVs in these markets helps counteract slower growth in mature markets.

Smaller Screen Sizes: The segment of smaller screen size HD TVs (below 40 inches) will likely continue to perform relatively well. This is due to their suitability for secondary screen applications (bedrooms, kitchens) and affordability, making them appealing for households that may already own a larger, higher-resolution TV.

Specific Use Cases: HD TVs are also likely to remain strong in niche market segments such as dedicated gaming monitors (where resolution is sometimes less critical than refresh rates) and secondary screens within commercial environments.

The overall market share of HD TVs is declining, but this isn't necessarily a sign of market failure. The relatively stable demand in emerging markets coupled with the continued appeal of smaller and secondary HD TVs means the segment will persist, albeit with a smaller overall market share compared to Ultra HD TVs. The strategy for HD TV manufacturers needs to adapt accordingly, focusing on cost-effectiveness and specialized market segments to maintain profitability.

The sustained growth of HD TV sales in developing economies, the continued relevance of smaller screen sizes for specific uses and the sustained competitiveness of price points are key catalysts driving the growth in the HD TV industry, albeit a slower growth than in previous years. This ongoing demand, even in a shifting market landscape dominated by higher resolution displays, ensures the continuation of the HD TV sector.

This report provides a comprehensive overview of the HD TV market, encompassing historical data, current market trends, and future projections. The analysis includes detailed market segmentation, regional breakdowns, competitive landscapes, and key growth drivers. It offers valuable insights for industry stakeholders, including manufacturers, distributors, retailers, and investors, enabling them to make informed strategic decisions within this evolving market. The report utilizes robust forecasting methodologies to present a clear picture of future growth potential, taking into account both challenges and opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.9%.

Key companies in the market include Samsung Electronics, LG Electronics, Hisense, Skyworth, Sony, Konka, TCL, Chang hong, Sharp, Haier, Panasonic, Toshiba, .

The market segments include Application, Type.

The market size is estimated to be USD 56870 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "HD TVs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HD TVs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.