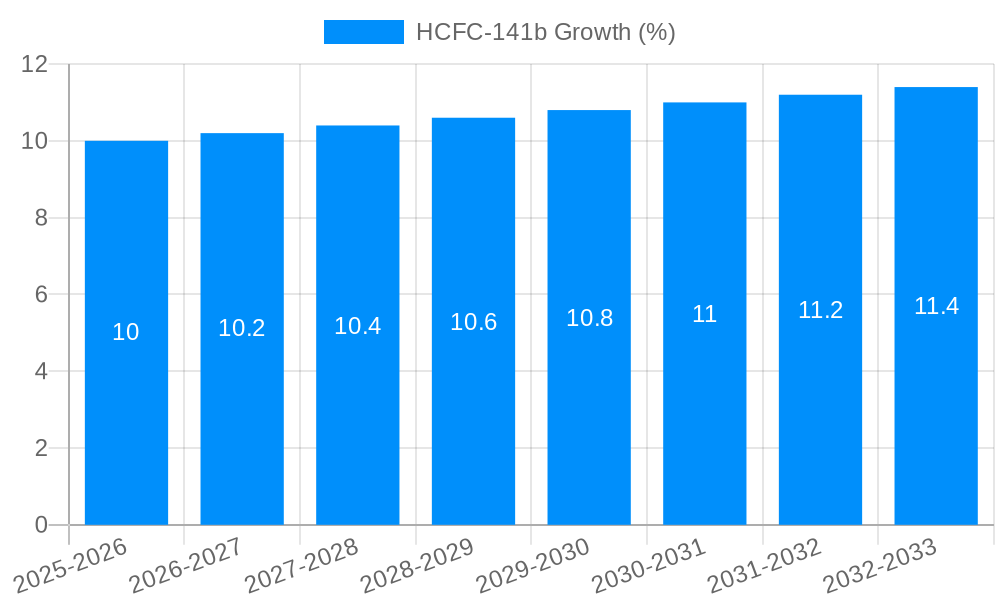

1. What is the projected Compound Annual Growth Rate (CAGR) of the HCFC-141b?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HCFC-141b

HCFC-141bHCFC-141b by Type (Purity ≥ 99.9%, Purity, World HCFC-141b Production ), by Application (Foaming Agent, Refrigerant, Semiconductor Cleaning Agent, Others, World HCFC-141b Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The HCFC-141b market, while facing regulatory pressures due to its ozone-depleting potential, continues to demonstrate resilience driven by its persistent applications in specific industrial sectors. The market size, estimated at $500 million in 2025, reflects a balance between declining demand in phased-out applications and ongoing niche uses. A Compound Annual Growth Rate (CAGR) of approximately 2% is projected for the forecast period (2025-2033), indicating a slow but steady growth trajectory. This modest growth is primarily attributed to its ongoing use in certain foam blowing applications, particularly in the construction and insulation industries where complete replacements haven't yet fully materialized. Furthermore, the market's regional distribution is likely skewed towards developing economies where transition to environmentally friendly alternatives is occurring at a slower pace. Major players like Rhodia Chemicals, Chemours, and Arkema maintain a significant presence, competing primarily on price and specialized formulations. However, the emergence of stringent environmental regulations and the increasing adoption of hydrofluoroolefin (HFO) and other environmentally sustainable alternatives pose a significant restraint, shaping the future landscape of the market.

The long-term outlook for HCFC-141b hinges on the pace of regulatory changes and the availability of cost-effective, high-performing substitutes. While the market is projected to contract gradually over the next decade, pockets of demand are expected to persist due to existing infrastructure and the inherent properties of HCFC-141b in certain applications. Factors such as technological advancements in substitute materials, governmental policies promoting sustainable alternatives, and the pricing dynamics between HCFC-141b and its replacements will significantly affect the future market trajectory. Companies are expected to increasingly focus on specialized applications and cater to specific regional demands, creating a niche market characterized by slower growth and a higher focus on sustainability. The development of more efficient and economical substitutes remains a key factor determining the longevity of the HCFC-141b market.

The global HCFC-141b market, valued at approximately XXX million units in 2025, is poised for significant transformation during the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a complex interplay of factors influencing market dynamics. While the overall market size fluctuated due to shifting regulatory landscapes and the increasing adoption of environmentally friendly alternatives, the demand for HCFC-141b remains surprisingly resilient in specific niche applications. This resilience stems from the continued use of HCFC-141b as a blowing agent in certain foam applications, particularly in developing economies where the transition to HFCs and other substitutes has been slower due to cost considerations. However, this trend is projected to gradually decline as stricter environmental regulations gain traction globally. The market witnessed a period of moderate growth in the early part of the study period (2019-2024), followed by a slight downturn in the later years before experiencing a modest rebound in 2025. This rebound is largely attributed to short-term supply chain disruptions affecting alternative blowing agents. Looking ahead, the market trajectory is expected to be influenced by factors such as the pace of technological advancements in alternative blowing agent technologies, the enforcement of environmental regulations, and the economic growth of key consumer markets. The market is expected to witness a gradual decline in the long term due to the global phase-out of HCFCs, however the rate of decline will likely vary by region depending on the level of enforcement of environmental policies and the availability and cost of alternative materials. The focus is shifting towards sustainable alternatives, and companies are actively investing in research and development to meet the growing demand for environmentally benign solutions. This is significantly impacting the long-term forecast for HCFC-141b, signifying the end of an era for this once-popular chemical. The report provides a detailed breakdown of these market trends, offering valuable insights into regional variations and specific application segments.

Several factors are currently driving the HCFC-141b market, despite the global push towards phasing out ozone-depleting substances. The relatively low cost of HCFC-141b compared to some of its more environmentally friendly alternatives remains a significant factor, particularly in price-sensitive markets. This cost advantage allows continued usage in certain applications where the immediate switch to substitutes presents significant financial barriers. Furthermore, the established infrastructure and supply chains for HCFC-141b contribute to its sustained demand. Changing these established systems to incorporate new materials requires significant investment and time, creating a temporary advantage for existing HCFC-141b production and distribution networks. In some niche applications, HCFC-141b's unique physical properties remain unmatched by currently available alternatives, leading to continued, although dwindling, demand. While the overall market is contracting, some regions, particularly those with less stringent environmental regulations or slower adoption of alternatives, experience higher demand. This creates pockets of growth for HCFC-141b producers even as the global phase-out accelerates. Finally, the continued existence of legacy equipment designed for HCFC-141b is another factor delaying the complete transition to substitutes. Replacing existing infrastructure represents a considerable investment that many companies are postponing until absolutely necessary. These factors, while not long-term sustainable, continue to contribute to the current market dynamics.

The primary challenge facing the HCFC-141b market is the worldwide phase-out of HCFCs under the Montreal Protocol. This international agreement has accelerated the development and adoption of environmentally friendly alternatives, placing significant pressure on HCFC-141b producers. Stricter environmental regulations and increased enforcement globally are further constricting the market's growth potential. Growing awareness of the environmental impact of HCFCs among consumers and businesses is leading to a shift in demand towards more sustainable options. This pressure from stakeholders, including governments, NGOs, and environmentally conscious consumers, places a considerable burden on the industry's long-term viability. The increasing cost of compliance with environmental regulations adds to the financial burden on HCFC-141b producers, potentially impacting their competitiveness. Fluctuations in raw material prices and energy costs also present challenges to maintaining stable production and pricing. The development of superior alternative blowing agents, offering similar performance characteristics at competitive prices, further accelerates the market's decline. These alternatives, often possessing better thermal insulation properties and environmental profiles, are actively replacing HCFC-141b in a variety of applications. Therefore, HCFC-141b faces a multi-faceted challenge requiring substantial adaptation or eventual market exit.

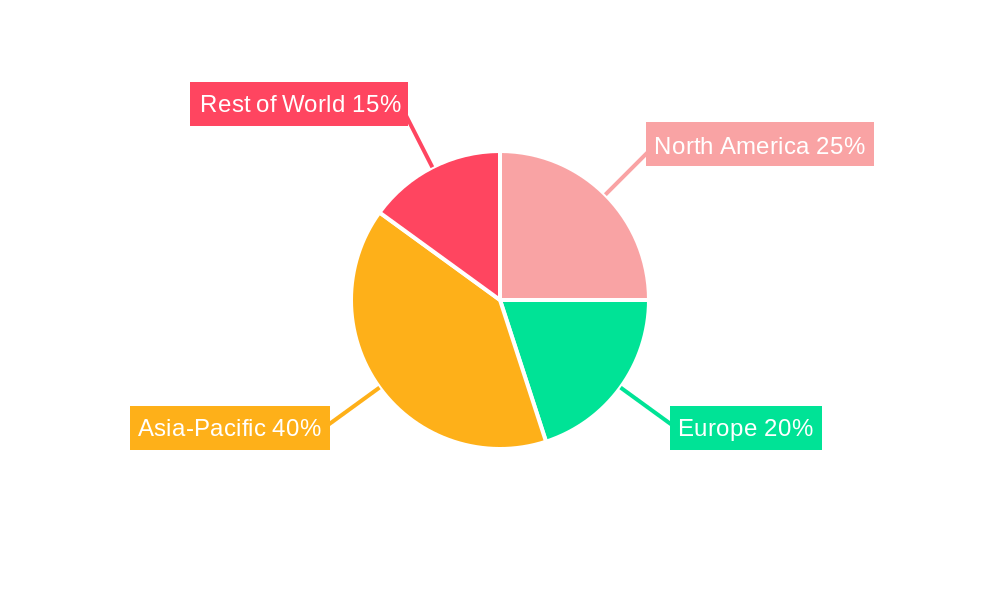

The HCFC-141b market is expected to witness a diverse landscape of regional and segmental performance in the coming years.

Developing Economies: Developing countries, particularly in Asia and parts of Africa, are expected to account for a significant portion of the remaining HCFC-141b demand due to cost-sensitive industries and a slower transition to alternative solutions. However, even in these regions, the market will eventually contract as environmental regulations become stricter and the availability of substitutes increases.

Foam Applications: The primary segment driving HCFC-141b demand remains its use as a blowing agent in the production of various types of foam. However, this segment faces the most significant decline due to the rapid development and adoption of HFCs and other environmentally friendly alternatives.

Refrigeration Industry: While significant progress has been made in phasing out HCFCs in the refrigeration sector, a small segment of the market still relies on HCFC-141b, primarily in legacy systems. This segment's contribution to the overall market is anticipated to shrink rapidly.

Paragraph: While no single region or segment will "dominate" in the context of a shrinking market, the developing economies will likely account for the largest share of the remaining HCFC-141b demand in the forecast period. This is due to a combination of factors, including lower production costs, slower adoption rates of alternative technologies, and sometimes weaker regulatory frameworks. However, the overall trend points towards a steady decline in demand across all regions and segments as the global phase-out of HCFCs progresses. The foam application segment, although experiencing a downturn, will still remain the largest user of HCFC-141b. The key challenge for all segments lies in adapting to the stringent regulatory environment and the increasing availability of eco-friendly solutions. The strategic response from both producers and users will significantly impact the speed and manner of HCFC-141b's ultimate market exit.

Despite the overall decline, short-term growth catalysts for HCFC-141b might arise from unexpected supply chain disruptions impacting substitute chemicals. A temporary shortage of environmentally friendly alternatives could lead to a short-lived resurgence in demand for HCFC-141b. Additionally, the presence of specific niche applications which are yet to find suitable substitutes can create small pockets of growth. However, these are short-term factors and do not alter the long-term downward trend in the market's overall trajectory.

This report provides a comprehensive analysis of the HCFC-141b market, considering historical data, current market trends, and future projections. It encompasses detailed regional breakdowns, segmental analysis, competitive landscaping, and an in-depth examination of the driving forces and challenges shaping the market. The report also highlights key players, regulatory changes, and technological advancements impacting the industry, ultimately offering valuable insights for stakeholders interested in understanding the evolution of this market and its transition to more sustainable alternatives.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rhodia Chemicals, Refex Industries, Chemours, Arkema, Linde, Juhua, Sinochem Group, Shandong Dongyue Group, Bychem, Dongyang Weihua Refrigerants, Sinotc Chemicals, Hangzhou Fumin Refrigeration Technology, Zhejiang Quzhou Youpont Fluoro Material, Zhejiang Sanmei Chemicals, Hangzhou Fine Fluorotech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "HCFC-141b," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HCFC-141b, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.