1. What is the projected Compound Annual Growth Rate (CAGR) of the Hatchback Wheel?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hatchback Wheel

Hatchback WheelHatchback Wheel by Type (Casting, Forging, Other), by Application (Gasline, Disel, World Hatchback Wheel Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

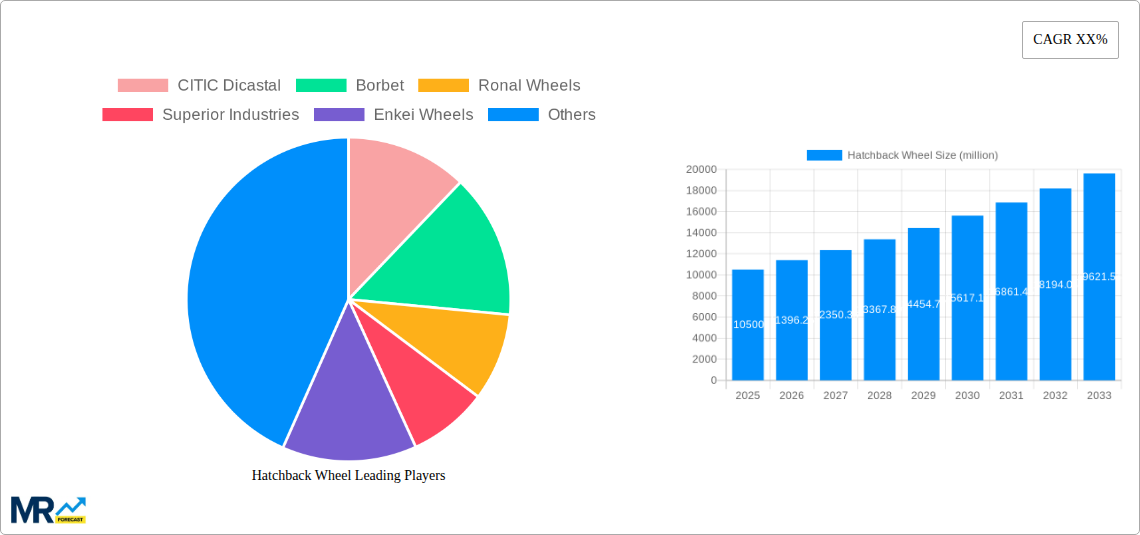

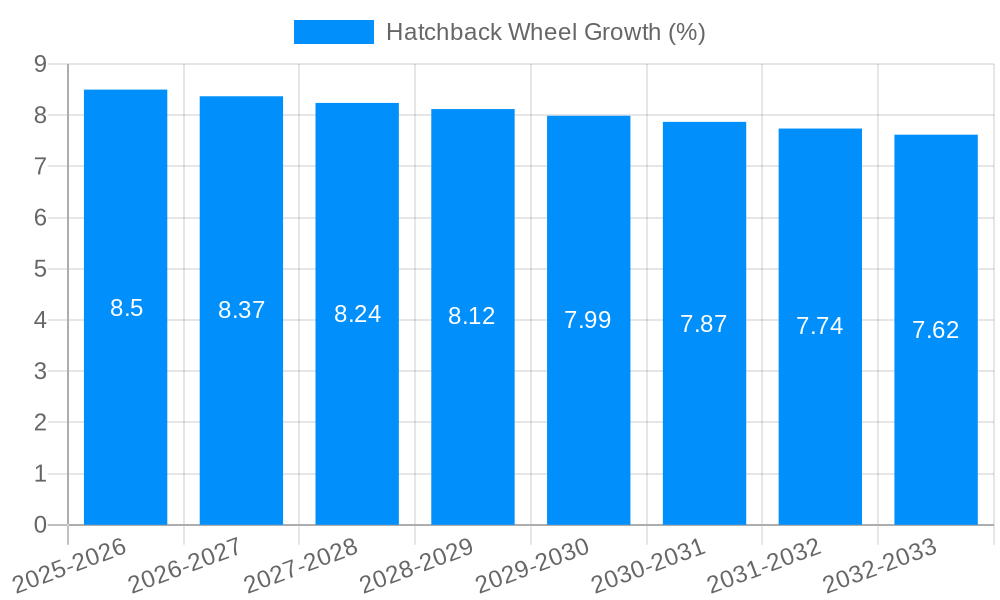

The global hatchback wheel market is poised for significant expansion, projected to reach an estimated $10,500 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% expected to drive its valuation to $22,000 million by 2033. This remarkable growth is primarily fueled by the enduring popularity of hatchbacks worldwide, driven by their fuel efficiency, affordability, and practicality, making them a preferred choice across diverse consumer segments. The increasing demand for lighter, stronger, and more aesthetically appealing wheels, particularly those made through advanced casting and forging techniques, further propels market expansion. Key players are investing heavily in R&D to develop innovative wheel designs and materials that enhance performance, safety, and fuel economy, aligning with evolving consumer preferences and stringent automotive regulations. The burgeoning automotive industry in emerging economies, coupled with the growing middle-class population, also contributes significantly to the upward trajectory of this market.

The market's dynamism is further shaped by key trends such as the rising adoption of aluminum alloys for their superior strength-to-weight ratio, leading to improved vehicle performance and reduced emissions. The integration of smart technologies in wheel production, including advanced manufacturing processes and quality control measures, is also a notable trend. However, the market faces certain restraints, including the volatility in raw material prices, particularly for aluminum and steel, which can impact production costs and profitability. Intense competition among established manufacturers and the emergence of new players also exert pressure on pricing strategies. Despite these challenges, the continuous innovation in wheel design, the increasing focus on sustainable manufacturing practices, and the strong underlying demand for hatchbacks worldwide are expected to sustain the market's healthy growth trajectory throughout the forecast period.

This report offers an in-depth analysis of the global Hatchback Wheel market, providing critical insights and projections for stakeholders. Leveraging extensive historical data and sophisticated forecasting models, the study covers the Study Period from 2019 to 2033, with a Base Year of 2025 and an Estimated Year of 2025. The Forecast Period spans from 2025 to 2033, building upon the Historical Period of 2019-2024. This report aims to equip industry participants with the knowledge to navigate the evolving landscape, identify lucrative opportunities, and mitigate potential risks.

The global Hatchback Wheel market is experiencing a dynamic evolution, driven by a confluence of factors that are reshaping manufacturing processes, product designs, and consumer preferences. A significant trend observed is the increasing demand for lightweight yet robust wheels. This is directly linked to the automotive industry's overarching push towards fuel efficiency and reduced emissions. Manufacturers are actively exploring advanced materials and innovative manufacturing techniques, such as improved casting and forging processes, to achieve these weight reduction goals without compromising structural integrity. The rise of electric vehicles (EVs) within the hatchback segment further amplifies this trend, as lighter wheels contribute to extended battery range and overall performance. Consumers are also becoming more discerning, seeking wheels that not only enhance performance but also elevate the aesthetic appeal of their vehicles. This has led to a surge in demand for customizability, with a growing preference for diverse finishes, spoke designs, and larger diameters. The aftermarket sector is a particularly vibrant hub for these trends, with consumers actively seeking to personalize their hatchbacks. Furthermore, the industry is witnessing a growing emphasis on sustainability. Manufacturers are increasingly adopting eco-friendly production methods, including the use of recycled materials and energy-efficient manufacturing processes, to align with global environmental regulations and growing consumer awareness. The integration of smart technologies, although nascent in the current landscape, is also a burgeoning trend. While not yet mainstream, the incorporation of sensors for tire pressure monitoring and even dynamic adjustments in response to road conditions represents a potential future trajectory for hatchback wheels. The competitive landscape is also evolving, with established players continually investing in research and development to stay ahead of the curve, while emerging players are carving out niches by focusing on specialized designs or cost-effective solutions. The interplay between technological advancements, evolving consumer demands, and a growing environmental consciousness is creating a complex yet exciting market for hatchback wheels.

Several potent forces are driving the growth and innovation within the global Hatchback Wheel market. Foremost among these is the sustained global demand for hatchbacks, a vehicle segment that continues to be popular due to its versatility, affordability, and suitability for urban environments. As this segment maintains its strong sales figures, the demand for its essential components, including wheels, naturally follows. The automotive industry's relentless pursuit of improved fuel efficiency and reduced emissions is another significant propellant. Lightweight wheel technologies, achieved through advanced materials and manufacturing processes like sophisticated casting and forging techniques, are crucial in this endeavor. This is further exacerbated by the increasing adoption of electric vehicles, where every kilogram saved directly translates into enhanced battery range and overall efficiency. Consumer preferences are also playing a pivotal role. Beyond functionality, aesthetics are increasingly influencing purchasing decisions. The desire for personalized vehicles has spurred demand for wheels with unique designs, finishes, and sizes, fostering innovation in the aftermarket and OEM segments alike. Moreover, advancements in manufacturing technology, including automation, precision engineering, and the exploration of novel alloys, are enabling the production of wheels that are not only lighter and stronger but also more cost-effective to produce. The continuous investment in research and development by leading manufacturers ensures a steady stream of innovative products that cater to evolving market needs. Finally, a growing emphasis on safety standards and performance regulations mandates the production of wheels that meet stringent quality and durability requirements, thereby driving technological advancements in their design and manufacturing.

Despite the promising growth trajectory, the Hatchback Wheel market is not without its hurdles. One of the primary challenges is the intense price sensitivity within certain segments of the hatchback market. Manufacturers often face pressure to deliver high-quality wheels at competitive price points, which can impact profit margins, particularly for suppliers relying on mass production. The volatility of raw material prices, especially for aluminum and steel, presents another significant restraint. Fluctuations in the cost of these essential commodities can directly affect production expenses and, consequently, the final pricing of wheels. Moreover, the ongoing global supply chain disruptions, exacerbated by geopolitical events and unforeseen circumstances, can lead to production delays and increased logistical costs, impacting timely delivery and overall market efficiency. Stringent and evolving environmental regulations worldwide necessitate significant investments in cleaner production technologies and sustainable manufacturing practices. While this is a positive long-term trend, the initial capital expenditure and adaptation costs can pose a challenge for smaller manufacturers. The increasing complexity of vehicle designs and the demand for specialized wheel types can also create manufacturing challenges. Producing wheels with intricate designs and meeting specific performance requirements for a wide array of hatchback models requires advanced tooling, skilled labor, and sophisticated quality control measures. Furthermore, the ever-present threat of counterfeiting and the proliferation of substandard wheels in the aftermarket can undermine brand reputation and pose safety risks, requiring diligent efforts in intellectual property protection and market surveillance.

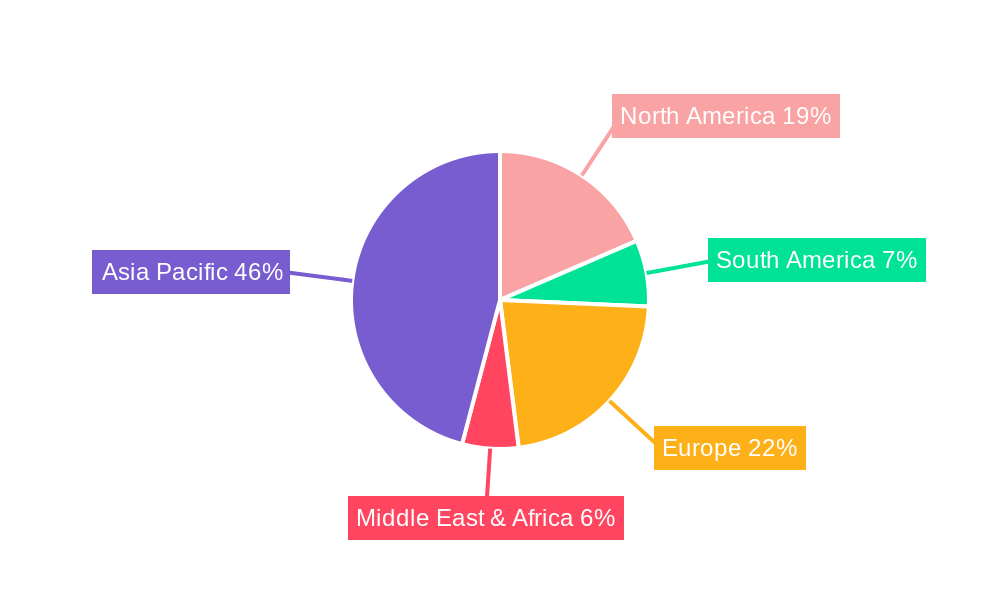

The global Hatchback Wheel market exhibits distinct regional and segment dominance, shaped by varying economic conditions, automotive manufacturing hubs, and consumer preferences. Among the Segments, Casting is projected to be a dominant force in the World Hatchback Wheel Production over the forecast period. This dominance is fueled by its cost-effectiveness and versatility in producing a wide range of designs suitable for the mass-market hatchback segment. The Application of Gasoline-powered hatchbacks will likely continue to hold a significant market share, particularly in developing economies where gasoline vehicles remain the primary choice for affordability and infrastructure availability. However, the influence of Diesel applications, while potentially facing stricter emissions regulations in some regions, will persist in specific markets with established diesel infrastructure and consumer preference for its fuel economy characteristics.

Key Regions/Countries Dominating the Market:

Asia Pacific: This region is poised to remain the largest and fastest-growing market for hatchback wheels.

Europe: Europe is another critical region, characterized by a strong consumer preference for hatchbacks and stringent automotive regulations that drive innovation.

North America: While SUVs and trucks dominate the overall automotive landscape, the hatchback segment, especially in certain niches and for specific urban driving needs, continues to be relevant.

Dominance of the Casting Segment:

The Casting segment's leadership can be attributed to its ability to produce complex shapes and intricate designs at a lower cost compared to forging. This makes it the preferred method for the majority of OEM (Original Equipment Manufacturer) wheels used in mass-produced hatchbacks. The cost-effectiveness of casting allows manufacturers to meet the high-volume demands of the hatchback market without compromising on aesthetics or basic performance requirements. Advancements in casting technologies, such as low-pressure die casting and gravity casting, have further enhanced the quality and structural integrity of cast wheels, making them increasingly competitive. While forging offers superior strength and lighter weight, its higher production cost typically positions it in the premium or performance-oriented segments, which constitute a smaller portion of the overall hatchback wheel market. Therefore, for the vast majority of hatchbacks produced globally, cast wheels represent the optimal balance of cost, design flexibility, and acceptable performance, solidifying its dominant position in the World Hatchback Wheel Production.

The Hatchback Wheel industry's growth is being propelled by several key catalysts. The sustained popularity of hatchbacks, particularly in emerging economies, ensures a consistent demand for wheels. Furthermore, the automotive industry's increasing focus on fuel efficiency and emission reduction is driving the adoption of lightweight wheel materials and manufacturing processes. The burgeoning electric vehicle (EV) segment within hatchbacks further amplifies this trend, as lighter wheels directly contribute to improved range. Evolving consumer preferences towards personalized aesthetics are also spurring innovation in wheel design and finishes, creating opportunities in both OEM and aftermarket sectors.

This report provides a comprehensive overview of the Hatchback Wheel market, covering crucial aspects from historical trends to future projections. It delves into the driving forces such as evolving consumer preferences for lightweight and aesthetically pleasing wheels, the automotive industry's emphasis on fuel efficiency, and the growing adoption of electric vehicles. The report also meticulously analyzes the challenges, including raw material price volatility and stringent environmental regulations. Furthermore, it identifies key regions and segments poised for dominance, with a detailed examination of the Casting segment's likely leadership in World Hatchback Wheel Production, driven by its cost-effectiveness and versatility. The report is an invaluable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions within the global Hatchback Wheel industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CITIC Dicastal, Borbet, Ronal Wheels, Superior Industries, Enkei Wheels, Lizhong Group, Alcoa, Wanfeng Auto, Iochpe-Maxion, Zhejiang Jinfei Holding Group, Topy Group, Zhongnan Aluminum Wheels, Accuride, Steel Strips Wheels, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hatchback Wheel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hatchback Wheel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.