1. What is the projected Compound Annual Growth Rate (CAGR) of the Halogen Lamps?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Halogen Lamps

Halogen LampsHalogen Lamps by Type (GU10, GU5.3, G4, G9, E27, B22, E14, B15, Others, World Halogen Lamps Production ), by Application (Industrial, Automotive, Medical, Consumer Goods, World Halogen Lamps Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

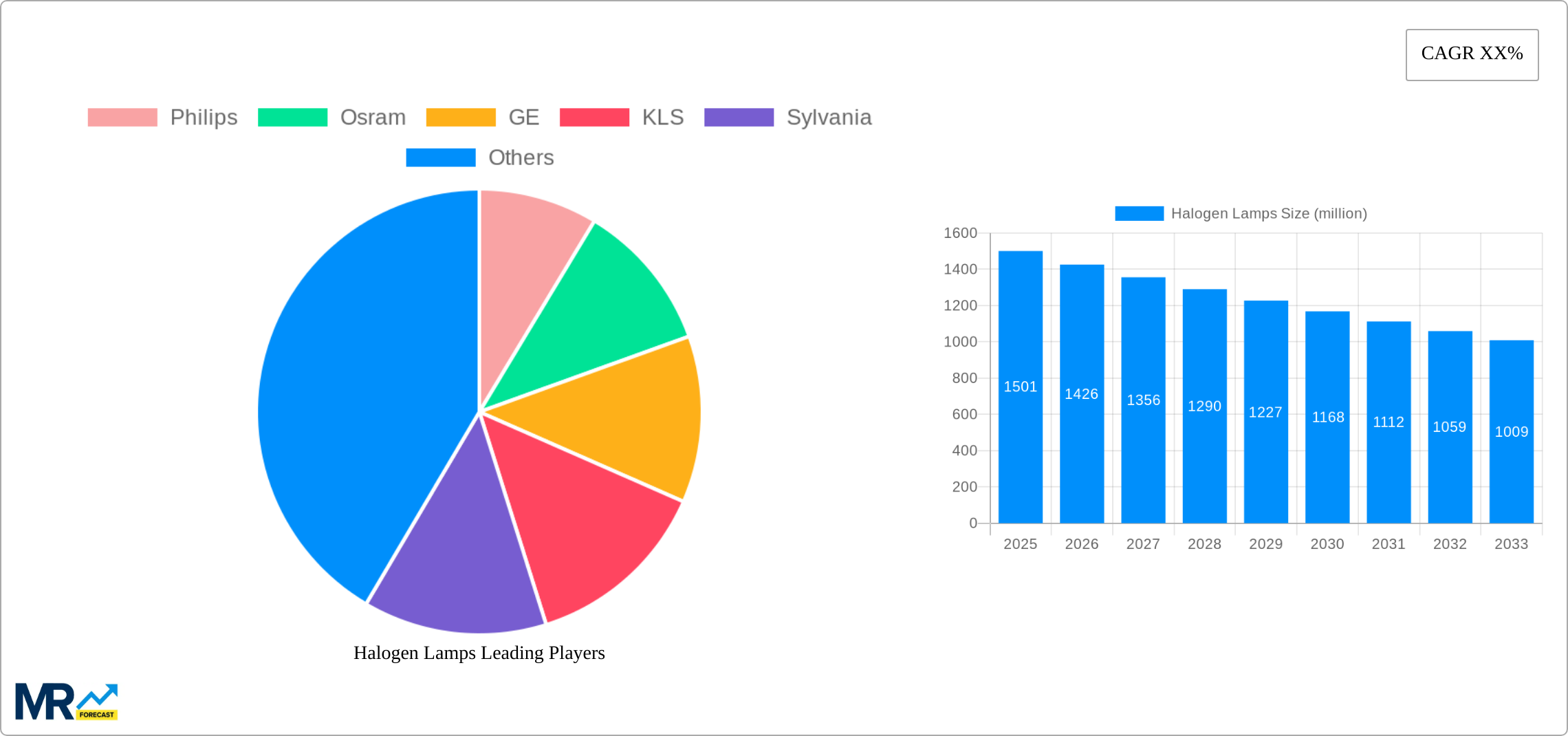

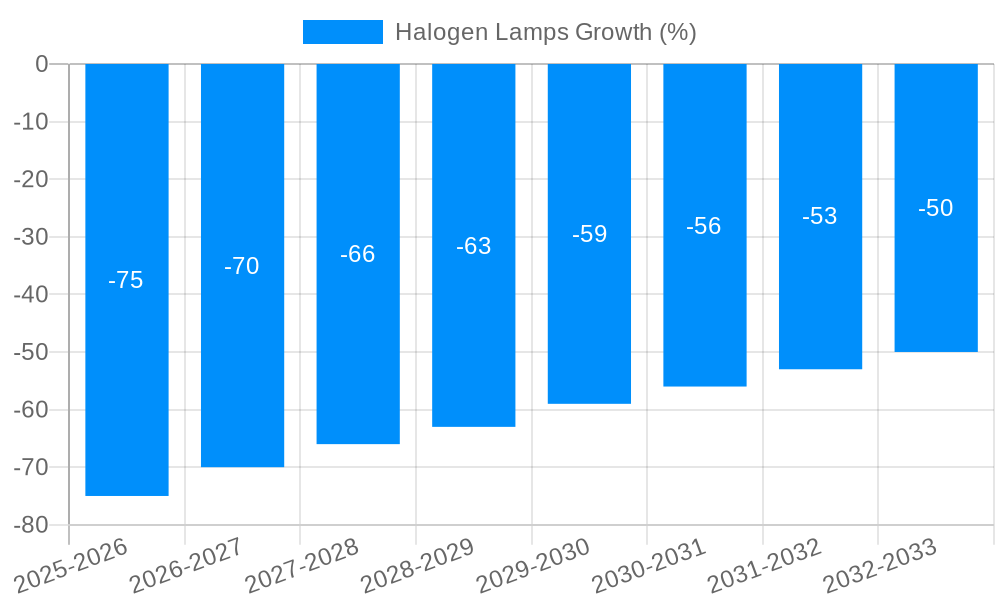

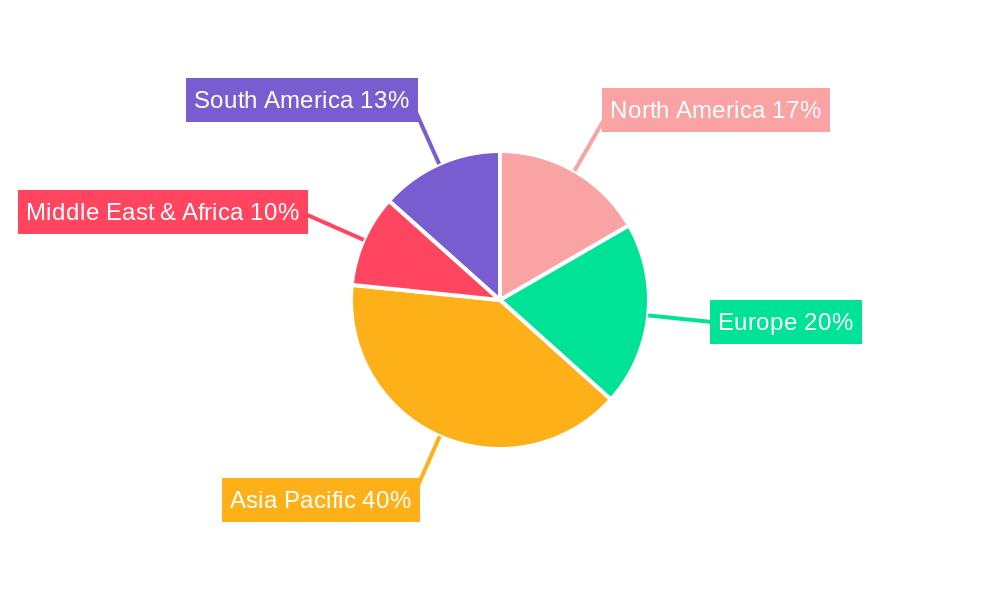

The global halogen lamp market, while facing pressure from LED technology, maintains a significant presence, particularly in niche applications. The market size in 2025 is estimated at $1501 million. While a precise CAGR isn't provided, considering the steady, albeit declining, nature of the halogen lamp market and the penetration of LEDs, a conservative estimate of a -5% CAGR from 2025-2033 seems reasonable, reflecting the ongoing market shift. Key drivers include the relatively lower initial cost compared to LEDs, making them attractive for budget-conscious consumers in certain segments. Furthermore, halogen lamps offer superior color rendering and instant light output, characteristics advantageous in specific industrial and medical applications requiring precise color accuracy and immediate illumination. However, significant restraints exist, primarily the energy inefficiency of halogen lamps compared to LEDs, leading to higher operating costs and environmental concerns. This has fueled stringent energy efficiency regulations globally, further impacting demand. Market segmentation by lamp type (GU10, GU5.3, etc.) highlights varied growth rates, with certain types retaining stronger demand in specific applications, such as automotive lighting for GU5.3. Application-wise, the consumer goods segment might be experiencing the most significant decline, while industrial and medical applications retain stronger resilience due to their specific needs. Leading companies such as Philips, Osram, and GE continue to hold considerable market share, leveraging their established distribution networks and brand recognition. Regional variations exist, with developed markets in North America and Europe showing slower growth compared to emerging economies in Asia-Pacific, where the demand for cost-effective lighting solutions persists.

The forecast period (2025-2033) will witness a gradual decline in the overall market size, driven by the continuous adoption of energy-efficient alternatives. However, niche applications and the established installed base in certain segments will ensure a sustained, albeit reduced, market for halogen lamps. Competitive pressures will intensify, necessitating strategic adjustments by manufacturers, possibly involving diversification into LED technology or focusing on specialized, high-value applications where halogen lamps maintain a competitive edge. This could involve partnerships and acquisitions to consolidate market share and leverage innovative technologies to improve efficiency or cater to emerging needs. Geographical expansion into developing markets with less stringent regulations could provide some growth opportunities. The overall outlook for the halogen lamp market suggests a period of gradual contraction, but not a complete demise, as specialized applications and cost-sensitive markets will continue to support a residual demand.

The global halogen lamp market, while facing pressure from LED technology, continues to maintain a significant presence, particularly in niche applications. Over the historical period (2019-2024), the market witnessed a gradual decline in overall unit sales, with production figures hovering around the high hundreds of millions. However, the estimated year 2025 shows a stabilization, indicating a potential market floor. This is partly due to the continued demand for halogen lamps in specific sectors that value their superior color rendering and instantaneous light output. While the forecast period (2025-2033) predicts further decline, the rate of decrease is expected to slow. This suggests a long tail for halogen technology, particularly in areas where cost and immediate illumination remain prioritized over energy efficiency. The market is becoming increasingly segmented, with certain lamp types and applications showing stronger resilience than others. Manufacturers are focusing on higher-margin, specialized products to compensate for the overall volume reduction. This strategic shift involves tailoring offerings to meet unique requirements in areas like automotive lighting (where halogen remains a standard in some vehicles), medical equipment, and industrial settings needing precise and consistent light. The key players are actively diversifying their portfolios, including introducing more energy-efficient halogen designs and exploring synergies with other lighting technologies. The market’s overall trajectory indicates a shift from mass-market dominance to a specialized, niche player status, with production likely remaining in the hundreds of millions of units annually throughout the forecast period.

Several factors contribute to the continued, albeit diminished, demand for halogen lamps. Firstly, the inherent advantages of halogen technology, such as superior color rendering index (CRI) and instant-on capabilities, remain crucial for specific applications. This is particularly true in professional settings like medical procedures, where accurate color reproduction is paramount, and in industrial scenarios that require immediate illumination without warm-up times. Secondly, the relatively low cost of halogen lamps compared to LEDs, especially in certain types and volumes, continues to attract budget-conscious consumers and businesses. This price advantage is a significant factor, particularly in developing economies. Thirdly, the extensive existing infrastructure supporting halogen lighting contributes to its persistence. Replacing vast numbers of existing fixtures with LED equivalents is often a costly and time-consuming undertaking, leading to a gradual rather than abrupt market shift. Finally, robust supply chains and established manufacturing processes ensure a consistent and reliable supply of halogen lamps, offering stability in an otherwise rapidly evolving lighting landscape. These factors, while not driving explosive growth, contribute to the continued presence of halogen lamps within the market, especially in niche segments.

The primary challenge facing the halogen lamp market is the relentless rise of LED technology. LEDs offer significantly higher energy efficiency, longer lifespans, and a growing range of form factors, making them a compelling alternative in most applications. Government regulations promoting energy efficiency and the phasing out of less efficient lighting technologies globally further intensify the pressure on halogen lamps. Moreover, the manufacturing costs associated with halogen lamps, although currently lower than some high-end LEDs, may not remain competitive in the long term due to economies of scale in the LED sector. Fluctuations in raw material prices, especially for tungsten and halogen gases, can impact profitability, posing further challenges to manufacturers. Finally, consumer perceptions heavily favour LEDs, associating them with modernity, environmental consciousness, and cost savings over their extended lifespan. Overcoming these challenges requires innovative strategies from halogen manufacturers, including focusing on niche applications where their specific strengths outweigh the drawbacks and exploring technological advancements to improve efficiency and extend lifespan.

The E27 base type halogen lamp is likely to retain a significant market share due to its widespread compatibility with existing fixtures. This legacy infrastructure minimizes the upfront investment required for consumers and businesses to adopt halogen technology, giving it a competitive edge over alternatives. Further, the E27 segment’s compatibility spans various applications, from domestic lighting to small industrial settings, broadening its appeal.

Dominant Segment: E27 base type lamps. The sheer volume of existing E27 fixtures globally creates substantial ongoing demand. Millions of units are still sold annually, and this segment is expected to continue to be a major contributor to overall halogen lamp sales, even in the face of the LED transition.

Key Regions: Developing economies, particularly in Asia and parts of Africa and South America, represent a significant market for halogen lamps due to lower purchasing power and a preference for cost-effective solutions. While these regions are also experiencing LED adoption, the cost advantage of halogen lamps ensures ongoing demand for years to come. The replacement market in developed economies also still supports significant sales, though at a decreasing rate.

Market Dynamics: While the overall market is shrinking, the E27 segment, due to its established user base and widespread application, will maintain higher sales volumes than other base types. The global manufacturing base for E27 halogen lamps is diversified, allowing for resilience to shifts in individual regional markets.

The paragraph above provides a more comprehensive explanation of the key region and segment dominance.

Despite the challenges, focused innovation can create growth catalysts. Developing higher-efficiency halogen lamps that approach the energy performance of some LEDs, while retaining the advantages of superior CRI and instant-on operation, could carve out a niche market among professionals valuing these specific characteristics. Furthermore, exploring applications requiring specific light qualities that LEDs currently struggle to match could offer a pathway to continued market relevance. Finally, strategic partnerships with LED manufacturers to develop hybrid solutions could lead to innovative products that combine the benefits of both technologies.

(Note: Many companies lack readily available single global links. Therefore, a list format is used.)

The report delivers a detailed analysis of the halogen lamp market, covering historical performance, current trends, and future projections. It offers insightful market segmentation, exploring diverse lamp types, applications, and geographical regions to provide a granular understanding of market dynamics. The report pinpoints key players, their market share, and competitive strategies. Furthermore, it identifies emerging technological advancements and their potential to influence the market’s future trajectory. This comprehensive overview equips businesses and stakeholders with the knowledge needed to navigate this evolving landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Philips, Osram, GE, KLS, Sylvania, Eiko Global, Havells India, Larson Electronics, Bulbrite, International Light Technologies, North American Signal, Kahoku Lighting Solutions, PIAA, LEDVANCE, Visual Comfort, Litetronics, PQL, Heraeus Group, Meiji Techno, Halogen Lighting Products, Suprajit Group, CEC Industries, Binex Controls, Radium, Tunsgram, Casell.

The market segments include Type, Application.

The market size is estimated to be USD 1501 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Halogen Lamps," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Halogen Lamps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.