1. What is the projected Compound Annual Growth Rate (CAGR) of the Half In-Ear Wired Headsets?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Half In-Ear Wired Headsets

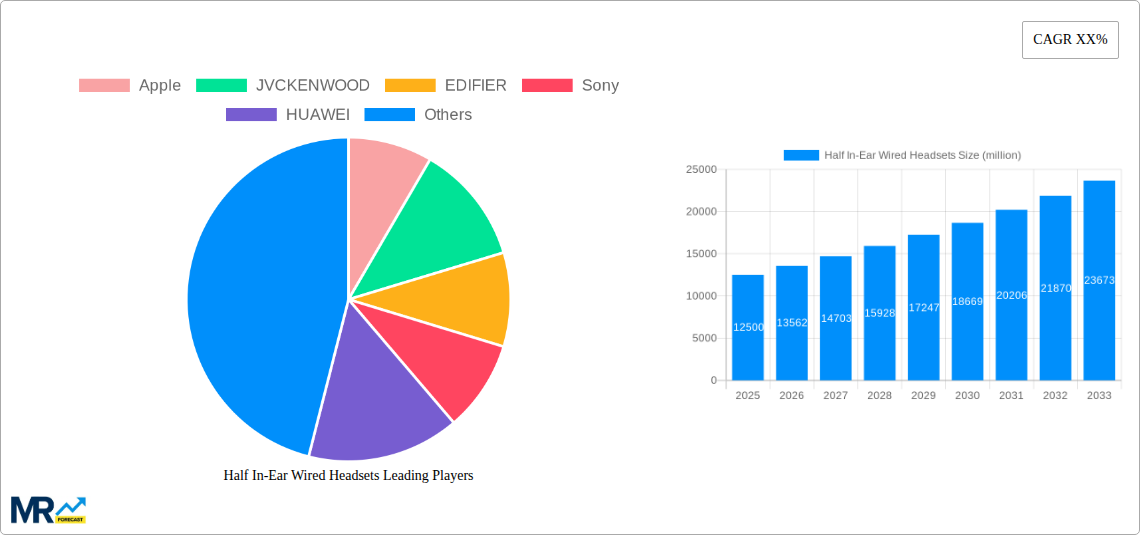

Half In-Ear Wired HeadsetsHalf In-Ear Wired Headsets by Type (Noise-Canceling headsets, General Headsets, Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

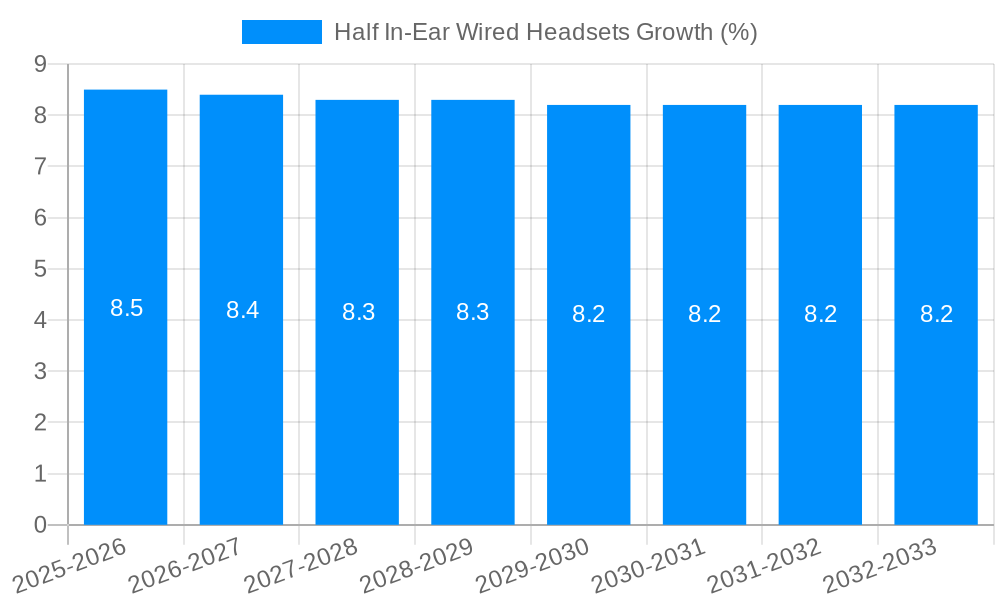

The global market for half in-ear wired headsets is a dynamic landscape shaped by several key factors. While precise figures for market size and CAGR are unavailable, industry analysis suggests a substantial market, likely exceeding $1 billion in 2025, given the continued popularity of wired headphones, especially amongst budget-conscious consumers and those prioritizing reliable audio quality without the need for charging. The market's Compound Annual Growth Rate (CAGR) is estimated to be between 3-5% over the forecast period (2025-2033), driven by increasing smartphone penetration in developing economies and the consistent demand for affordable, dependable audio solutions. Key drivers include the enduring appeal of wired headsets for their simplicity, reliability, and lack of battery dependency, while trends point towards increased adoption of headsets with improved ergonomics, noise-reduction features, and enhanced microphone quality. Restraints include the growing popularity of wireless earbuds and headphones, which are perceived as more convenient and aesthetically pleasing by many consumers. Major players such as Apple, Sony, and Xiaomi continue to compete aggressively, while smaller brands offer competitive pricing and features. Segmentation within this market includes variations in audio quality, cable length, material, and additional features such as in-line microphones and controls.

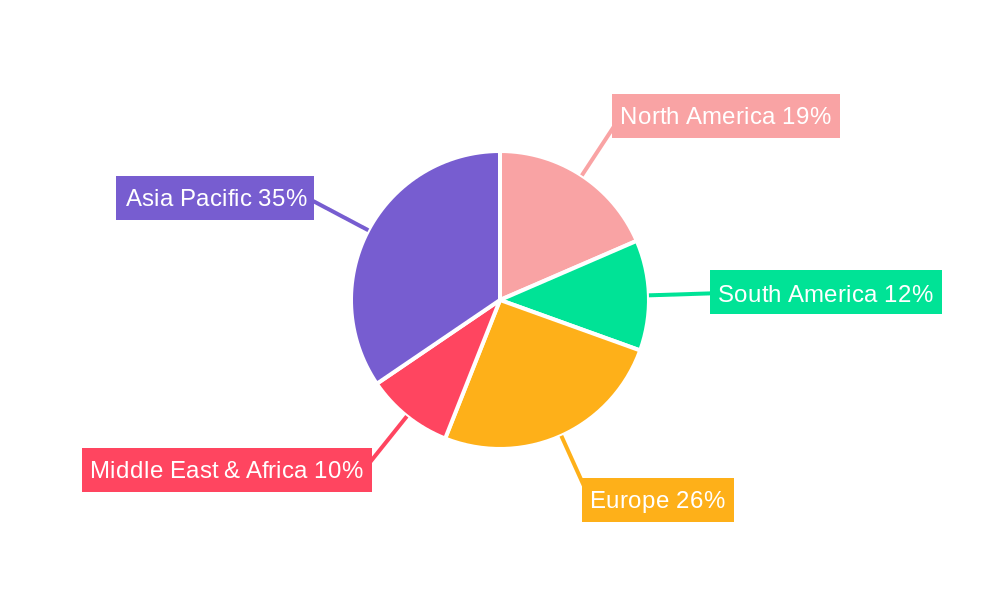

The competitive landscape is characterized by established electronics giants alongside smaller, specialized audio brands. The strategic focus for many companies is on differentiating their products through superior sound quality, durable construction, or unique design features. Regional variations exist, with mature markets in North America and Europe showing a slower growth rate compared to emerging economies in Asia and Latin America where strong smartphone adoption and increased affordability are boosting demand. The forecast period (2025-2033) will likely see a gradual shift towards higher-quality materials and features within the wired headset segment, driven by consumer demand for improved listening experiences and increased product longevity. While wireless technology continues its upward trajectory, a substantial portion of the market will likely remain dedicated to the affordability and reliable performance of wired half in-ear headsets.

The global half in-ear wired headset market, valued at several million units in 2025, is experiencing a complex interplay of growth and decline. While the overall market shows a mature trajectory, certain segments and regions continue to demonstrate resilience. The historical period (2019-2024) saw steady growth driven by the affordability and wide availability of these headsets, particularly in emerging markets. However, the rise of wireless technologies, particularly truly wireless earbuds (TWS), has presented a significant challenge. The forecast period (2025-2033) suggests a gradual decline in overall unit sales as consumer preference shifts towards wireless options. Nevertheless, a niche market remains for half in-ear wired headsets, fueled by specific consumer needs and preferences. These include users seeking superior audio quality at a lower price point, those working in environments where wireless connectivity is unreliable or prohibited, and individuals prioritizing durability and longevity over wireless convenience. Furthermore, certain segments, such as those catering to professional applications like call centers or industrial settings, continue to show stable demand. The competition within the market is fierce, with established players like Apple and Sony competing against rapidly expanding brands like Xiaomi and Baseus. This competitive landscape has led to price wars and innovation in features such as improved cable durability and enhanced audio drivers, aimed at maintaining market share within the shrinking segment. Understanding this nuanced market dynamic is crucial for both manufacturers and investors in navigating the future of half in-ear wired headsets.

Several factors continue to support the enduring presence of half in-ear wired headsets in the market, despite the rise of wireless alternatives. The most significant driver is cost-effectiveness. Wired headsets consistently remain significantly cheaper to produce and purchase than their wireless counterparts, making them an accessible option for budget-conscious consumers, particularly in developing economies with vast populations. Moreover, the reliability and lack of connectivity issues are key advantages. Unlike wireless headsets which are susceptible to signal interference, battery drain, and pairing problems, wired headsets offer a consistent, predictable audio experience, a critical factor in certain professional settings or environments with unreliable Wi-Fi. The durability of wired headsets is another crucial factor. The absence of complex electronics and rechargeable batteries makes them more robust and less prone to damage from drops or wear and tear, making them preferable in demanding environments. Finally, the simplicity and ease of use of wired headsets, requiring no pairing or charging, are attractive to a segment of consumers who prefer straightforward technology. These factors collectively contribute to the continued demand for half in-ear wired headsets, albeit within a niche segment of the overall audio market.

The primary challenge facing the half in-ear wired headset market is the overwhelming popularity and technological advancements in wireless audio solutions. Truly Wireless Stereo (TWS) earbuds and other wireless headphone types offer unparalleled convenience and portability, leading to a significant shift in consumer preferences. This trend is particularly strong among younger demographics, who are more likely to adopt new technologies. Furthermore, the perception of wired headsets as outdated or inconvenient negatively impacts their appeal. The limitations of wired headsets, such as tangled wires and restricted mobility, are increasingly perceived as significant drawbacks in comparison to the freedom and convenience offered by wireless technology. Moreover, the industry faces pressure to continuously improve the sound quality and comfort of wired models to remain competitive. This requires ongoing investment in research and development, which can be challenging given the relatively smaller market share and profit margins compared to the booming wireless segment. The lack of technological innovation in the wired segment further contributes to its diminishing appeal, as consumers seek advanced features and better sound experiences.

The Asia-Pacific region is projected to hold a significant market share in the half in-ear wired headset market due to the large population base and increasing affordability of electronic devices. Within this region, countries like India and China, with their massive consumer markets, are key drivers of growth. Furthermore, the segment focusing on budget-conscious consumers will continue to be the most significant, as the affordability of wired headsets remains a primary purchasing driver.

Asia-Pacific: High population density, rising disposable incomes, and a large base of budget-conscious consumers contribute to significant market share. India and China are key growth drivers.

Budget Segment: Affordability remains the primary driver in this segment, making it the largest and most resilient part of the market.

Professional/Industrial Segment: Demand remains stable in specific sectors requiring reliable, uninterruptible audio communication. This segment demonstrates resilience to the trend toward wireless.

Latin America: Growing adoption of smartphones and other portable devices contributes to a steadily growing, albeit smaller, market.

In summary, while the overall market may be declining, the combination of specific regional markets and price-sensitive segments ensures ongoing sales, albeit at a slower pace than in previous years. The focus for manufacturers will likely shift towards catering to specific niche needs rather than attempting mass-market appeal.

Continued innovation in materials science, focusing on improved cable durability and comfortable ear-tip designs, can sustain the market share by addressing common consumer complaints. Furthermore, emphasizing the reliability and consistent audio quality of wired headsets over their wireless counterparts can attract a segment of customers who prioritize these aspects. Finally, targeted marketing towards professional and industrial sectors, where reliability is paramount, can secure a stable and consistent revenue stream.

This report provides a comprehensive analysis of the global half in-ear wired headset market, encompassing historical data (2019-2024), an estimated market valuation for 2025, and a forecast extending to 2033. The report delves into market trends, growth drivers, challenges, key regional and segmental contributions, major players, and significant industry developments. This detailed analysis offers valuable insights for businesses operating in or considering entry into the half in-ear wired headset sector, allowing for informed strategic decision-making in a dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Apple, JVCKENWOOD, EDIFIER, Sony, HUAWEI, UGREEN, VIVO, Baseus, Xiaomi, Audio-Technica, Koss Corporation, .

The market segments include Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Half In-Ear Wired Headsets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Half In-Ear Wired Headsets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.