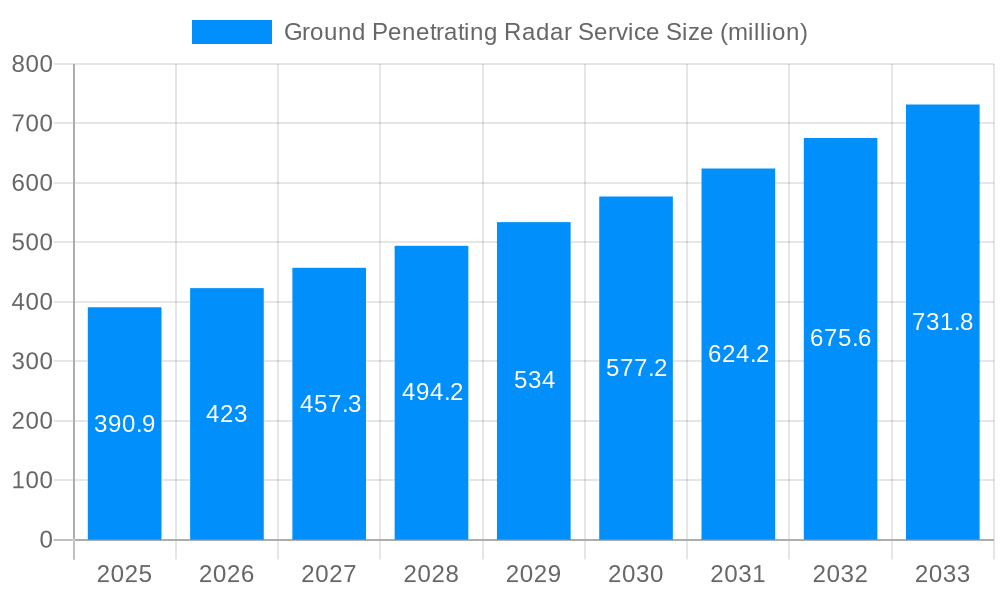

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ground Penetrating Radar Service?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ground Penetrating Radar Service

Ground Penetrating Radar ServiceGround Penetrating Radar Service by Type (Concrete Scanning, Underground Utility Locating, GIS Mapping, Other), by Application (Geotechnical, Environmental, Transportation, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Ground Penetrating Radar (GPR) service market is experiencing robust growth, driven by increasing infrastructure development, stricter environmental regulations, and the rising adoption of non-destructive testing methods. The market's expansion is fueled by several key factors. Firstly, the construction and infrastructure sectors are leveraging GPR technology extensively for utility location, minimizing excavation risks and accelerating project timelines. Secondly, environmental remediation projects increasingly utilize GPR to identify and map subsurface contaminants, aligning with stricter environmental compliance requirements. Furthermore, the integration of GPR with Geographic Information Systems (GIS) mapping enhances data accuracy and management, boosting efficiency and decision-making. The transportation sector also contributes significantly, employing GPR for road and bridge assessments, ensuring structural integrity and safety. While the market faces challenges such as high initial investment costs for GPR equipment and the need for skilled personnel, technological advancements, including improved sensor technology and data processing software, are mitigating these limitations. The diverse applications across various sectors suggest a promising outlook for continued market expansion.

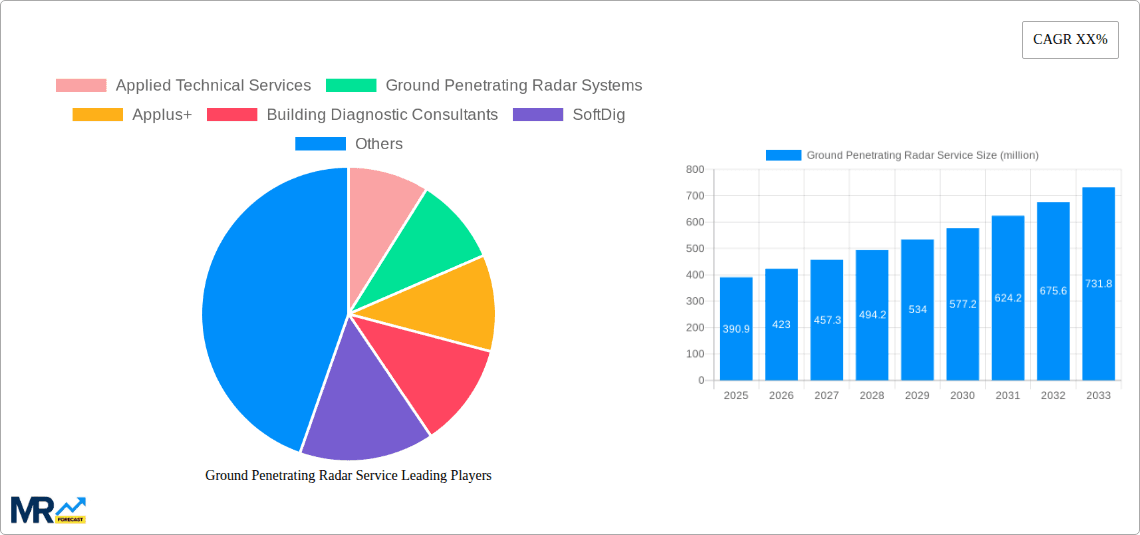

The global GPR service market is segmented by type (Concrete Scanning, Underground Utility Locating, GIS Mapping, Other) and application (Geotechnical, Environmental, Transportation, Other). Underground utility locating currently holds the largest market share, driven by its crucial role in preventing damage to underground infrastructure during excavation. However, the demand for concrete scanning is also growing rapidly due to increased construction activity and the need for non-destructive testing of concrete structures. Geotechnical applications represent the largest segment by application, followed by environmental and transportation. North America and Europe are currently leading the market, owing to high infrastructure spending and stringent regulatory frameworks. However, rapid infrastructure development in Asia-Pacific is expected to propel regional market growth in the coming years. Companies like Applied Technical Services, Applus+, and others are major players in the market, contributing to innovation and expansion of services. Considering a plausible CAGR of 8% (a reasonable estimate given industry growth trends), and a 2025 market size of approximately $1.5 billion (an educated guess based on similar industry market sizes), the market is poised for considerable expansion over the forecast period.

The global ground penetrating radar (GPR) service market is experiencing robust growth, projected to reach several billion USD by 2033. Driven by increasing urbanization, infrastructure development, and stringent environmental regulations, the demand for non-destructive testing methods like GPR is surging. Over the historical period (2019-2024), the market witnessed a steady expansion, exceeding the USD 1 billion mark by 2024. The estimated market value for 2025 stands at approximately USD 1.2 billion, signaling a robust growth trajectory. This expansion is fueled by diverse applications across geotechnical, environmental, and transportation sectors. The forecast period (2025-2033) promises continued growth, with an expected Compound Annual Growth Rate (CAGR) exceeding 7%. Key market insights reveal a shift towards advanced GPR technologies, including higher-frequency antennas and 3D imaging capabilities, enhancing the accuracy and detail of subsurface investigations. The integration of GPR data with Geographic Information Systems (GIS) is also gaining traction, facilitating efficient data management and analysis for large-scale projects. Furthermore, the increasing adoption of GPR services by government agencies and private contractors for utility mapping, site assessment, and construction monitoring is contributing significantly to market growth. Competition among service providers is intensifying, leading to price optimization and the emergence of specialized services catering to niche applications. The market is witnessing an increasing demand for faster turnaround times and higher data quality, pushing service providers to invest in advanced equipment and skilled personnel. Overall, the GPR service market presents significant opportunities for growth and innovation in the coming years.

Several factors are driving the expansion of the ground penetrating radar service market. Firstly, the rising need for efficient and accurate underground utility mapping is paramount. Utilities such as pipelines, cables, and conduits often pose significant risks during construction and excavation. GPR services provide a non-destructive means of locating these utilities, minimizing the risk of damage and downtime. Secondly, environmental regulations are increasingly strict, necessitating thorough site assessments prior to development. GPR helps evaluate soil conditions, identify contamination, and assess the presence of buried objects, supporting environmental impact assessments and remediation projects. Thirdly, advancements in GPR technology are significantly improving its accuracy and efficiency. Higher resolution images, faster data processing, and the integration of GPS and GIS capabilities are making GPR a more attractive and powerful tool for a broader range of applications. Finally, the growing construction industry, particularly in rapidly urbanizing regions, fuels demand. Construction projects rely heavily on ground investigations to plan foundations, assess site suitability, and monitor construction progress, and GPR fills this need effectively. The increased adoption of GPR services in transportation infrastructure projects, including road and railway construction, further bolsters market growth.

Despite the positive outlook, the GPR service market faces certain challenges. Firstly, the high initial investment in equipment and specialized expertise can be a barrier to entry for smaller companies. The cost of advanced GPR systems and the need for skilled personnel to operate and interpret the data can limit market accessibility. Secondly, environmental factors such as soil conditions can significantly affect the effectiveness of GPR. Highly conductive or heterogeneous soils can hinder signal penetration, reducing the accuracy of the results. This necessitates careful consideration of site conditions and the selection of appropriate equipment and techniques. Thirdly, the interpretation of GPR data requires specialized expertise. Accurate interpretation is crucial for drawing meaningful conclusions and making informed decisions. The availability of skilled GPR specialists is a potential bottleneck to market expansion. Lastly, competition among service providers is growing, leading to price pressures. This requires companies to optimize operational efficiencies and offer value-added services to remain competitive.

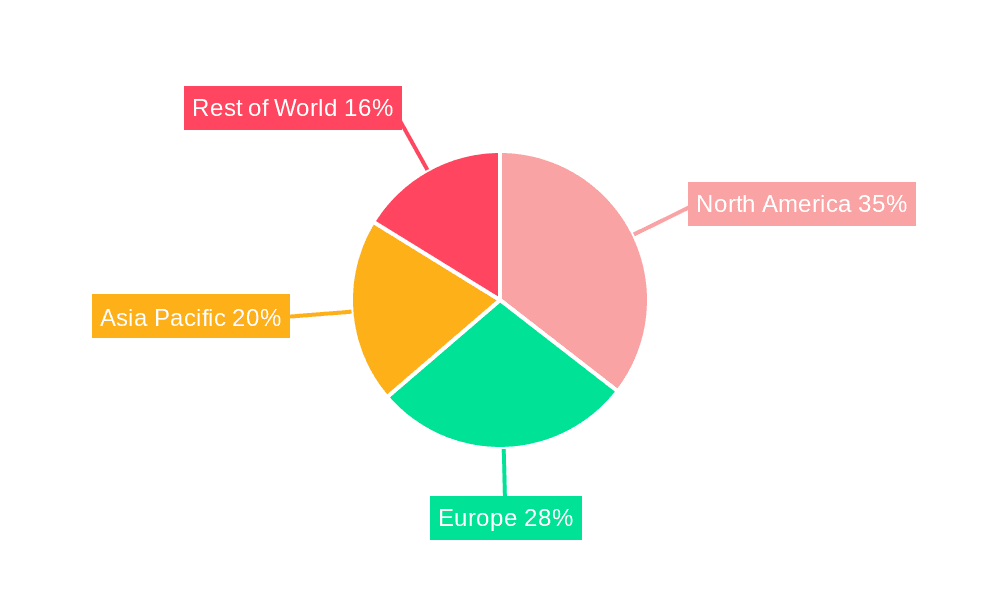

The Underground Utility Locating segment is projected to dominate the GPR service market throughout the forecast period. This is driven by the increasing need to prevent damage to underground utilities during excavation and construction. The growth of urbanization and infrastructure development projects significantly fuels this demand. North America and Europe are expected to hold significant market shares due to advanced infrastructure, stringent safety regulations, and high adoption rates of GPR technologies. However, the Asia-Pacific region shows high growth potential due to rapid urbanization, robust infrastructure development, and a rising number of construction projects.

North America: High adoption of advanced GPR technologies and stringent regulations related to utility damage prevention drive market growth. The region is characterized by a well-established infrastructure and high spending on infrastructure projects.

Europe: Similar to North America, Europe demonstrates robust growth due to advanced infrastructure development and stringent safety regulations. Government initiatives promoting efficient underground utility management further bolster market expansion.

Asia-Pacific: Rapid urbanization and infrastructure development across countries like China, India, and Japan contribute significantly to the growing demand for GPR services. The region presents a substantial growth opportunity due to a large number of upcoming construction projects.

Underground Utility Locating: This segment's dominance stems from its critical role in preventing damage to underground utilities during excavation, construction, and maintenance. The growing emphasis on safety and efficiency in infrastructure projects significantly fuels the demand for these services.

The increasing integration of GPR data with GIS mapping systems is also a significant development, enhancing data management and analysis, particularly for large-scale projects. This integration allows for efficient data visualization and analysis, contributing to improved decision-making and project efficiency.

Several factors catalyze growth within the GPR service industry. These include the rising demand for non-destructive testing methods in various sectors, the continuous advancement in GPR technology leading to improved accuracy and efficiency, and the increasing integration of GPR data with GIS systems for better data management and analysis. Government regulations emphasizing safety and minimizing damage to underground utilities also play a significant role, pushing for wider adoption of GPR services.

The ground penetrating radar (GPR) service market is poised for significant growth driven by robust infrastructure development, stringent environmental regulations, and technological advancements. The continued focus on safety and efficiency in construction and utility management will further propel demand for these services in the coming years. The integration of GPR with GIS technology is streamlining data management, providing further impetus to market expansion across various industries and geographic regions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include Applied Technical Services, Ground Penetrating Radar Systems, Applus+, Building Diagnostic Consultants, SoftDig, GPR Services, Acuren, multiVIEW Locates, PM Environmental, Echo GPR Services, GPR Professional Services, Geoscope Utility Detection Services, LiveLocates, Control Point Associates, Vosburg Welsh, Tadco Engineering & Environmental Services, Provac Australia (VIC), Xenogenesis, Sandberg, GeoScan Utility Location Service, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Ground Penetrating Radar Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ground Penetrating Radar Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.