1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Fluorescent Protein?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Green Fluorescent Protein

Green Fluorescent ProteinGreen Fluorescent Protein by Type (Wild-type GFP, Enhanced GFP), by Application (University and Research Institutions, Biopharmaceutical Manufacturers, Hospital and Commercial Laboratories, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

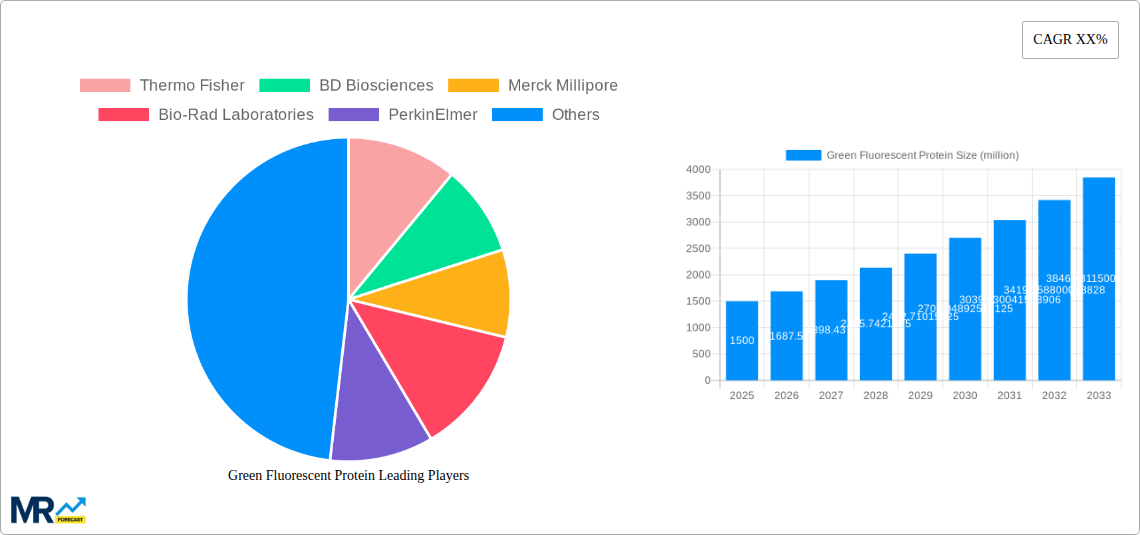

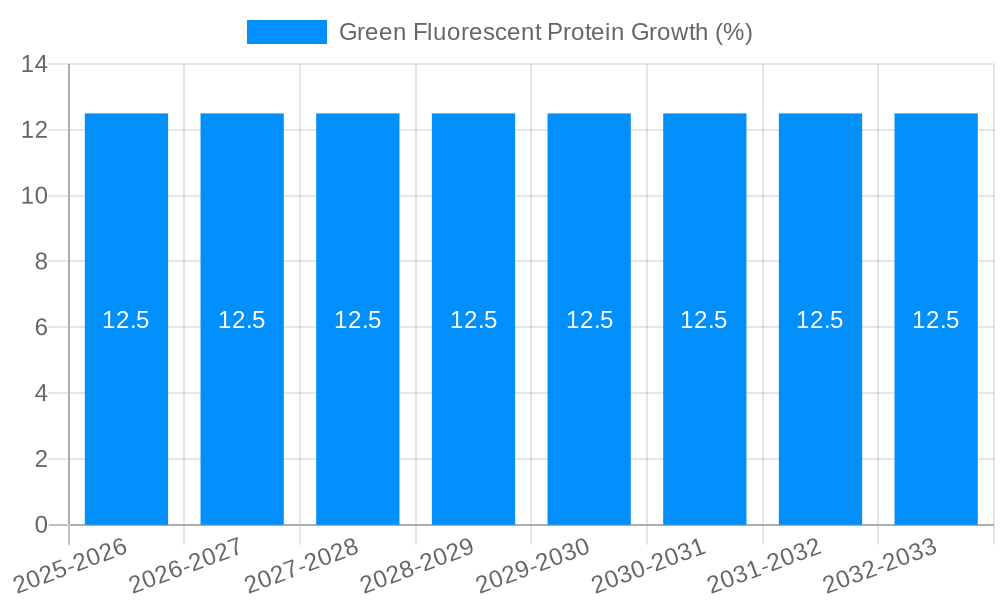

The Green Fluorescent Protein (GFP) market is experiencing robust growth, projected to reach approximately USD 1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 12.5% from 2025 to 2033. This expansion is primarily fueled by the increasing demand for advanced imaging techniques in biological research, drug discovery, and diagnostics. The versatility of GFP and its engineered variants, offering diverse spectral properties and functionalities, has made them indispensable tools for visualizing cellular processes, protein localization, and gene expression in real-time. Key drivers include significant investments in life sciences research by both academic institutions and the biopharmaceutical sector, coupled with a growing emphasis on personalized medicine and the development of novel therapeutics. The market's dynamism is further propelled by continuous innovation in GFP technology, leading to brighter, more photostable, and spectrally distinct fluorescent proteins that enable more precise and sensitive biological investigations.

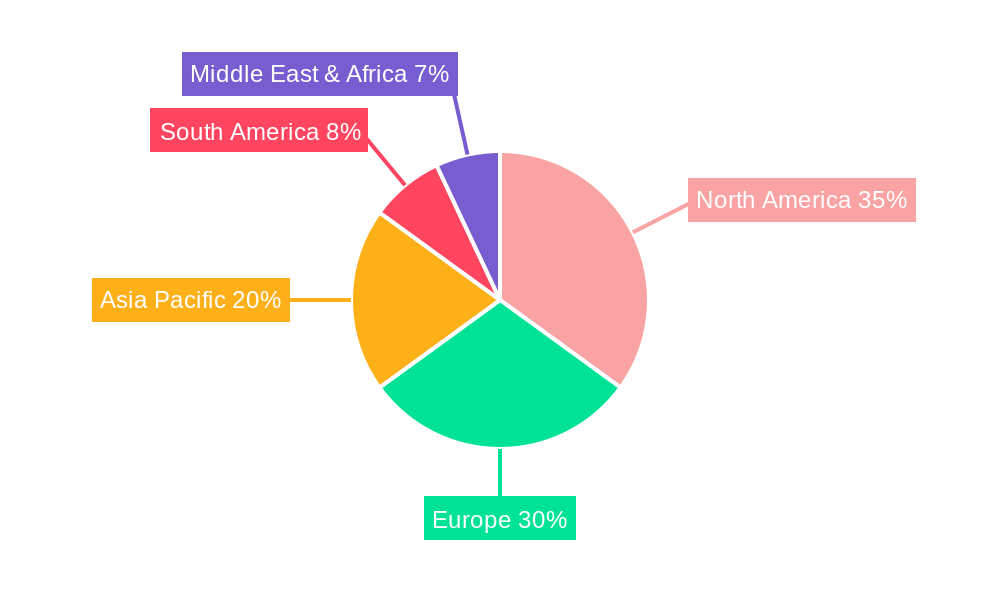

The market is segmented by type into Wild-type GFP and Enhanced GFP, with Enhanced GFP variants commanding a larger share due to their superior performance characteristics. Application-wise, University and Research Institutions represent a significant segment, followed closely by Biopharmaceutical Manufacturers, underscoring the critical role GFP plays in both fundamental scientific inquiry and applied pharmaceutical development. Hospital and Commercial Laboratories also contribute to market demand, utilizing GFP for diagnostic applications. Geographically, North America and Europe currently lead the market due to established research infrastructure and substantial R&D spending. However, the Asia Pacific region is poised for rapid growth, driven by increasing government support for biotechnology and a burgeoning research ecosystem in countries like China and India. Restraints such as the cost of advanced GFP variants and the availability of alternative fluorescent technologies are present, but the ongoing innovations and expanding applications are expected to outweigh these challenges, ensuring sustained market expansion.

The Green Fluorescent Protein (GFP) market is poised for substantial expansion, projected to reach a valuation of over \$1,200 million by 2033. This impressive growth trajectory is underpinned by a confluence of factors, including escalating research and development investments in life sciences and a growing demand for advanced bio-imaging techniques. The historical period (2019-2024) witnessed a steady ascent, driven by the foundational applications of GFP in molecular biology. As we move into the base year of 2025, the market is expected to stand strong at over \$600 million, setting a robust foundation for future expansion. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of approximately 10%, demonstrating the increasing adoption and diversification of GFP applications.

Within this dynamic landscape, Enhanced GFP (EGFP) has emerged as a dominant subtype, accounting for over 65% of the market share in 2025. Its superior brightness, photostability, and excitation/emission characteristics have made it the preferred choice for a multitude of scientific investigations. Wild-type GFP, while foundational, is increasingly being superseded by its engineered counterparts for more demanding applications. The demand from University and Research Institutions remains the largest application segment, contributing over 45% of the market revenue in 2025, reflecting the continuous need for these fluorescent markers in academic research and discovery. However, the Biopharmaceutical Manufacturers segment is exhibiting the fastest growth, with an anticipated CAGR exceeding 12% during the forecast period. This surge is attributed to the critical role of GFP in drug discovery, target validation, and preclinical studies, where precise visualization of cellular processes is paramount. The market also sees significant contributions from Hospital and Commercial Laboratories, particularly in diagnostic applications and personalized medicine research.

The global market for GFP is characterized by a rich ecosystem of innovative companies, each contributing to its advancement and accessibility. Leading entities such as Thermo Fisher, BD Biosciences, Merck Millipore, and Bio-Rad Laboratories are instrumental in providing a broad spectrum of GFP-related products, from recombinant proteins to advanced imaging systems. These established players are consistently investing in R&D to enhance the properties of existing GFP variants and develop novel fluorescent proteins with unique spectral properties and functionalities. Smaller, yet agile companies like AAT Bioquest, ATTO-TEC GmbH, Biotium, and Miltenyi Biotec are carving out niches by focusing on specialized applications and proprietary technologies, often offering customized solutions and highly purified reagents. PerkinElmer, with its comprehensive portfolio of detection and imaging instruments, further strengthens the market by providing the necessary hardware for GFP-based analyses. AnaSpec and Abberior, on the other hand, are contributing significantly through their expertise in peptide synthesis and super-resolution microscopy, respectively, pushing the boundaries of what can be visualized and understood using fluorescent proteins. This collaborative and competitive environment fosters continuous innovation, ensuring that the GFP market remains at the forefront of biological research and biotechnological advancements, with projected market revenues exceeding \$1,200 million by 2033.

The unwavering demand for Green Fluorescent Protein (GFP) in scientific research and its expanding applications are the primary drivers behind its robust market growth. The escalating investments in life sciences R&D globally, particularly in areas like genomics, proteomics, and drug discovery, necessitate sophisticated tools for visualizing biological processes at the molecular and cellular levels. GFP and its variants offer an unparalleled advantage in this regard, allowing researchers to track protein localization, gene expression, and cellular dynamics with high precision and sensitivity. The increasing sophistication of microscopy techniques, such as confocal and super-resolution microscopy, further amplifies the utility of GFP, enabling scientists to resolve finer details and gain deeper insights into cellular mechanisms. Moreover, the growing emphasis on personalized medicine and the development of novel therapeutics are fueling the need for advanced bio-imaging platforms, where GFP plays a crucial role in understanding disease progression and evaluating treatment efficacy. The intrinsic biocompatibility and versatility of GFP, allowing for its seamless integration into various biological systems and experimental setups, further solidify its position as an indispensable tool for modern biological sciences.

Despite its widespread utility, the Green Fluorescent Protein (GFP) market faces certain challenges that could potentially temper its growth. One significant restraint is the inherent photobleaching property of some GFP variants, which can limit the duration of imaging experiments and compromise data integrity, especially in long-term live-cell imaging. While advancements have led to more photostable variants, this remains a concern for specific research protocols. Furthermore, the development of specific antibodies or binding agents for GFP can sometimes lead to immunogenicity issues in certain experimental contexts, requiring careful consideration and potential modifications. The cost associated with highly purified GFP variants and advanced imaging equipment can also be a barrier for smaller research institutions or laboratories with limited budgets, thereby restricting widespread adoption. Competition from alternative fluorescent labeling technologies, such as Quantum Dots or other fluorescent dyes, while not directly replacing GFP's unique advantages, can offer alternative solutions for specific applications, potentially diverting some market share. Lastly, the complexity of certain experimental designs involving GFP, requiring expertise in molecular biology, cell culture, and advanced microscopy, can also pose a hurdle for less experienced researchers.

The global Green Fluorescent Protein (GFP) market is characterized by a dynamic regional and segmental landscape, with specific areas and applications poised for significant dominance.

Key Regions/Countries:

Key Segments:

The Green Fluorescent Protein (GFP) industry is fueled by several key growth catalysts. The burgeoning field of biotechnology and its increasing integration into various scientific disciplines, from medicine to agriculture, creates a sustained demand for advanced visualization tools. Furthermore, ongoing innovation in GFP technology, leading to the development of new variants with enhanced brightness, photostability, and spectral properties, opens up new application avenues and appeals to a wider research base. The growing focus on personalized medicine and the development of targeted therapies, which require precise cellular and molecular insights, also act as significant catalysts. Increased global R&D expenditure in life sciences, coupled with supportive government initiatives for scientific research, further propels market expansion.

This comprehensive report offers an in-depth analysis of the Green Fluorescent Protein (GFP) market, providing critical insights for stakeholders across the biotechnology and life sciences sectors. Covering the study period from 2019 to 2033, with a base year of 2025, the report meticulously details market trends, key drivers, and emerging challenges. It offers granular segmentation by GFP type (Wild-type GFP, Enhanced GFP) and application (University and Research Institutions, Biopharmaceutical Manufacturers, Hospital and Commercial Laboratories, Others), providing valuable data on market share and growth potential. Furthermore, the report highlights significant industry developments and profiles leading players like Thermo Fisher, BD Biosciences, and Merck Millipore, offering a holistic view of the competitive landscape. This detailed coverage ensures that readers gain a comprehensive understanding of the GFP market's trajectory and its pivotal role in advancing scientific discovery and biotechnological innovation.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thermo Fisher, BD Biosciences, Merck Millipore, Bio-Rad Laboratories, PerkinElmer, AAT Bioquest, ATTO-TEC GmbH, Biotium, Miltenyi Biotec, AnaSpec, Abberior, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Green Fluorescent Protein," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Green Fluorescent Protein, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.