1. What is the projected Compound Annual Growth Rate (CAGR) of the GPS Radar Detector?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

GPS Radar Detector

GPS Radar DetectorGPS Radar Detector by Type (Laser, Voice Alarm, Others, World GPS Radar Detector Production ), by Application (Car, Communication, Others, World GPS Radar Detector Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

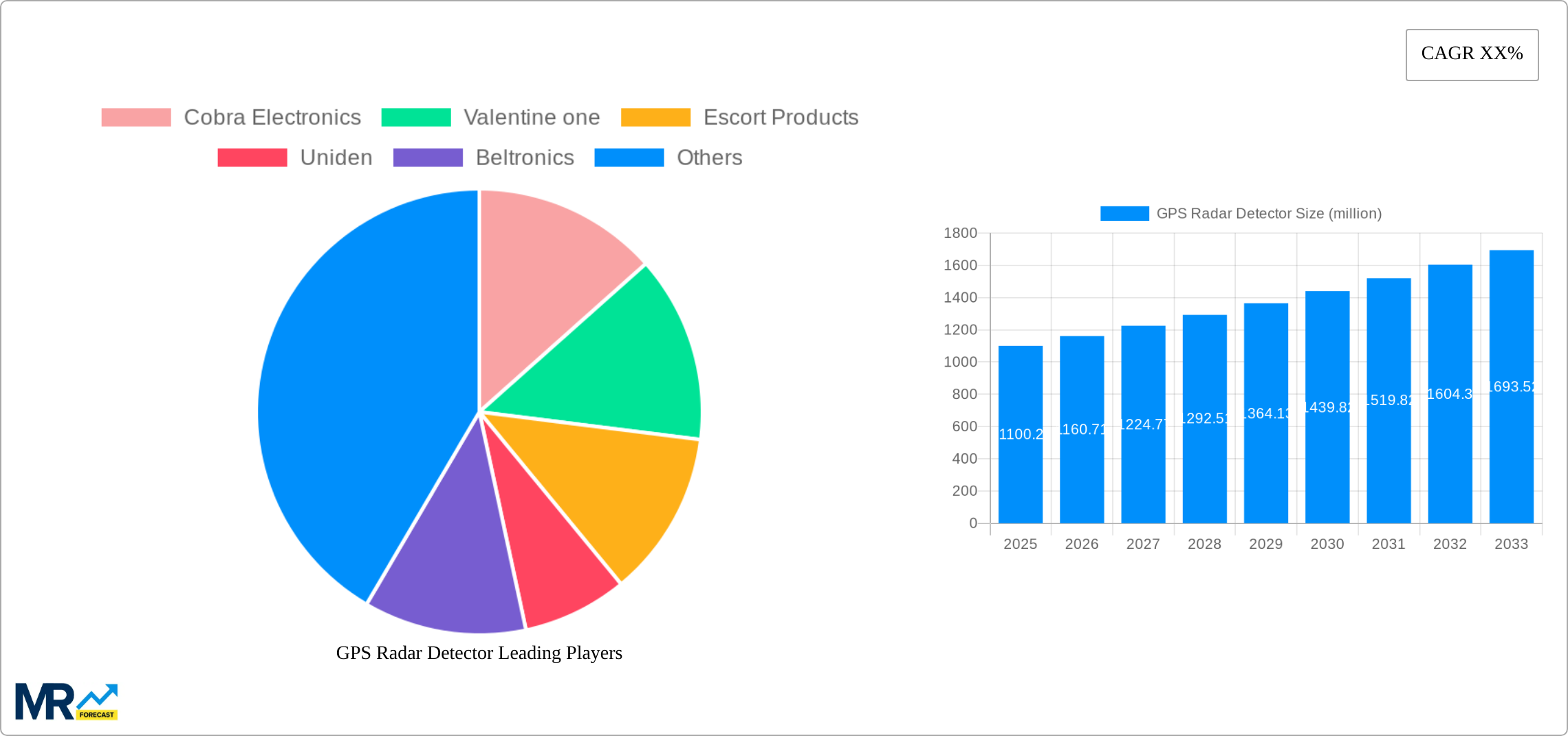

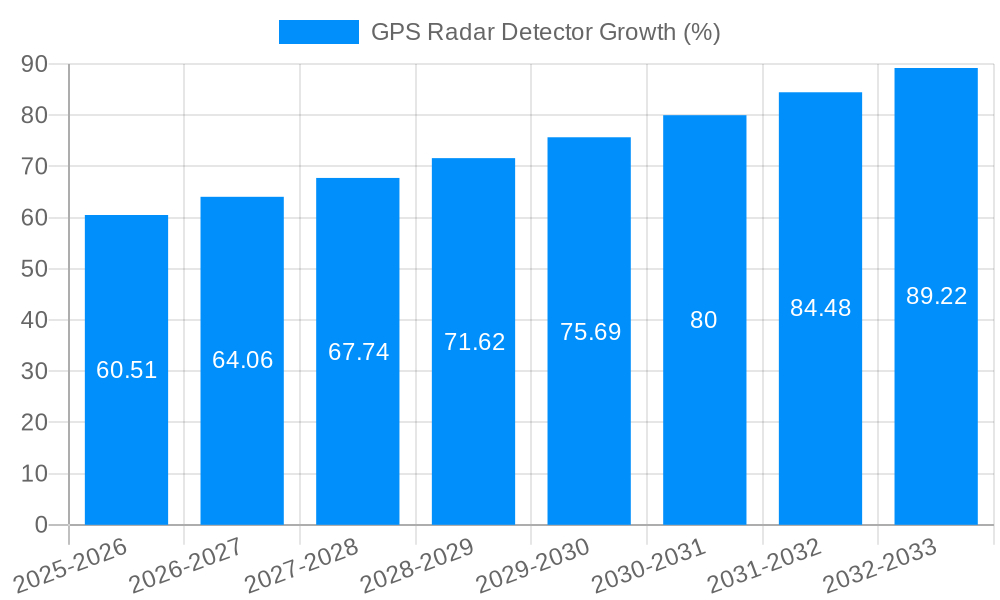

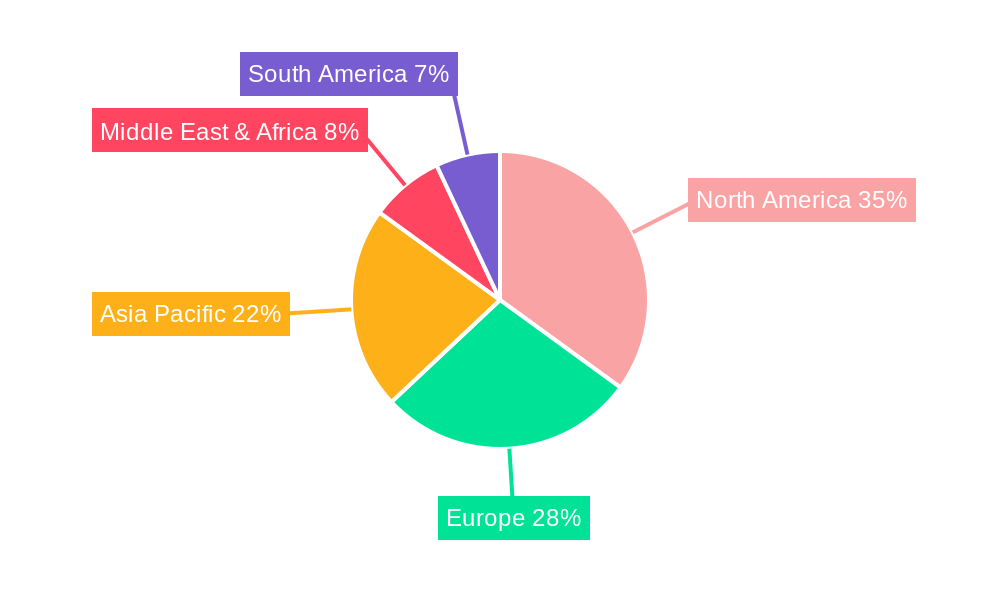

The global GPS radar detector market, valued at $1100.2 million in 2025, is poised for significant growth. While the exact CAGR is unavailable, considering the technological advancements in radar detection and the increasing adoption of driver-assistance systems, a conservative estimate of a 5-7% CAGR over the forecast period (2025-2033) seems plausible. Key drivers include heightened road safety concerns, increasing vehicle ownership, particularly in emerging economies, and the development of sophisticated detectors capable of thwarting advanced radar technologies. Trends indicate a shift towards more compact and user-friendly designs integrated with smartphone apps, offering features like real-time speed limit alerts and speed camera warnings. However, legal restrictions on the use of radar detectors in certain regions, alongside the rising adoption of adaptive cruise control and autonomous driving features in newer vehicles, pose notable restraints to market growth. The market is segmented by type (laser, voice alarm, others) and application (car, communication, others). Major players like Cobra Electronics, Valentine One, and Escort Products compete fiercely, focusing on innovation and brand recognition. Regional analysis indicates strong demand from North America and Europe, but emerging markets in Asia-Pacific are expected to witness substantial growth in the coming years, driven by increasing vehicle sales and rising disposable incomes.

The competitive landscape is characterized by a mix of established brands and emerging players. Established brands leverage their strong brand recognition and robust distribution networks to maintain their market share, while new entrants are focusing on innovation and competitive pricing to gain traction. Technological advancements such as the integration of GPS with advanced signal processing techniques are driving innovation within the industry, enabling the detection of a wider range of radar frequencies and providing more accurate and timely alerts. This increased accuracy and improved functionality are key factors influencing consumer purchasing decisions. Furthermore, the development of countermeasures against newer radar technologies is a critical area of focus for manufacturers, maintaining the relevance and value proposition of GPS radar detectors in the evolving automotive landscape. The long-term outlook for the market remains positive, despite the potential limitations posed by regulatory constraints and advancements in automotive safety technologies.

The global GPS radar detector market is experiencing robust growth, projected to reach multi-million unit sales by 2033. The period from 2019 to 2024 (historical period) witnessed a steady increase in demand, driven by factors such as enhanced road safety concerns and the increasing affordability of advanced features. The estimated market value for 2025 shows a significant jump, indicating a positive trajectory. This growth is being fueled by several key factors including the rising adoption of advanced driver-assistance systems (ADAS) in vehicles, increasing consumer awareness regarding road safety, and technological advancements leading to more sophisticated and feature-rich detectors. The market is also witnessing a shift towards more integrated and connected devices, blurring the lines between traditional radar detectors and broader vehicle safety systems. The forecast period (2025-2033) anticipates continued expansion, with significant contributions from emerging markets and the incorporation of cutting-edge technologies like AI-powered false alert filtering and advanced GPS mapping capabilities. The market is segmented by type (laser, voice alarm, others), application (car, communication, others), and geography, revealing nuanced growth patterns across various regions. Leading players are constantly innovating, launching new models with enhanced functionalities and improved user interfaces to cater to the evolving needs of a discerning consumer base. Competitive pricing strategies and strategic partnerships further contribute to market dynamism and overall growth. The base year for this analysis is 2025, providing a solid benchmark for future projections. Overall, the market exhibits strong potential for sustained expansion, driven by technological progress and an increasing focus on road safety globally.

Several factors are converging to accelerate the growth of the GPS radar detector market. The foremost driver is the rising concern for road safety. Drivers are increasingly seeking ways to enhance their safety on the roads, and GPS radar detectors offer a valuable tool for detecting speed traps and other potential hazards. Furthermore, advancements in technology have led to the development of more sophisticated detectors with improved performance and features, such as advanced false alert filtering, GPS data integration, and user-friendly interfaces. This improved technology makes detectors more attractive to consumers, boosting demand. The increasing affordability of these devices, particularly in developing economies, is another key factor. As production costs decrease, more consumers can afford to purchase these safety devices, leading to expanded market penetration. Government regulations and law enforcement practices also indirectly influence the market. Stricter enforcement of speed limits and increased penalties for speeding can create a stronger incentive for drivers to invest in radar detectors as a preventative measure. Finally, the growing popularity of connected cars and the integration of radar detector functionality into broader vehicle safety systems contribute to market expansion, signifying a shift towards holistic safety solutions rather than individual devices.

Despite the positive growth trajectory, the GPS radar detector market faces certain challenges. The most significant is the legality of radar detectors in various regions. Some countries and jurisdictions have imposed restrictions or outright bans on their use, limiting market potential. The rising effectiveness of advanced radar systems used by law enforcement also poses a challenge. Manufacturers are constantly striving to create detectors capable of outperforming newer radar technologies, driving up research and development costs. Competition among existing players is fierce, leading to price wars and pressure on profit margins. The need to continually innovate and introduce new features to stay ahead of the competition requires substantial investment. Consumer awareness and understanding of the features and benefits of advanced detectors also play a role. Educating consumers about the capabilities of newer models is crucial for boosting sales. Furthermore, the increasing prevalence of autonomous driving technologies may potentially reduce the demand for radar detectors in the long term, although this is a gradual trend.

The car application segment is projected to dominate the GPS radar detector market throughout the forecast period (2025-2033). This is driven by the widespread use of personal vehicles and the growing awareness of road safety among drivers. The segment represents a vast majority of the total market volume.

North America: This region holds a significant market share due to high vehicle ownership, strong consumer spending power, and a higher prevalence of speed cameras and enforcement measures.

Europe: This region also witnesses robust growth, driven by similar factors to North America, though with variations in specific regulations and consumer preferences across individual countries.

Asia-Pacific: This region is expected to show substantial growth due to rising vehicle sales, increasing disposable incomes in developing economies, and growing awareness of road safety.

Within the 'Type' segment, the Laser category is expected to witness accelerated growth due to the increasing adoption of laser-based speed detection systems by law enforcement.

Advanced Features: The increasing demand for GPS radar detectors with advanced features such as real-time GPS updates, advanced false alert filtering, and Bluetooth connectivity is driving market growth and price premiums. Consumers are willing to pay more for increased accuracy and convenience.

Brand Recognition: Established brands with strong reputations for quality and reliability command a higher market share due to consumer trust and preference. New entrants struggle to compete with the established players in this well-known and consumer-driven market.

Technological Advancements: Constant innovations in radar detection technology, such as the development of Ka-band and K-band radar detection, are fueling the market's growth. The incorporation of AI and machine learning algorithms for false alert reduction further enhances the value proposition for customers.

In summary, the car application segment and laser type, coupled with regional growth in North America, Europe and Asia-Pacific, will be the primary growth drivers, shaping the landscape of the GPS radar detector market for the foreseeable future. Millions of units will be sold annually as the market continues to mature.

Several factors are catalyzing growth within the GPS radar detector industry. The rising incidence of traffic accidents and speeding violations is driving demand for safety devices. Technological advancements, such as improved signal processing and AI-powered false alarm reduction, enhance the effectiveness and user experience of these detectors. Additionally, increasing consumer awareness regarding road safety and the availability of more affordable models are expanding the market reach. The integration of GPS mapping and data services adds value and strengthens the appeal of these devices.

This report provides a comprehensive overview of the global GPS radar detector market, encompassing market size, growth drivers, challenges, key players, and future trends. The analysis is based on extensive research, providing valuable insights into market dynamics and offering actionable information for industry stakeholders. The detailed segmentation and regional breakdowns allow for a granular understanding of market opportunities. The forecast period projections offer a clear roadmap for future investment and strategic planning within the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cobra Electronics, Valentine one, Escort Products, Uniden, Beltronics, Whistler Group, Shenzhen Lutu Technology, Snooper, Quintezz, Radenso, .

The market segments include Type, Application.

The market size is estimated to be USD 1100.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "GPS Radar Detector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the GPS Radar Detector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.