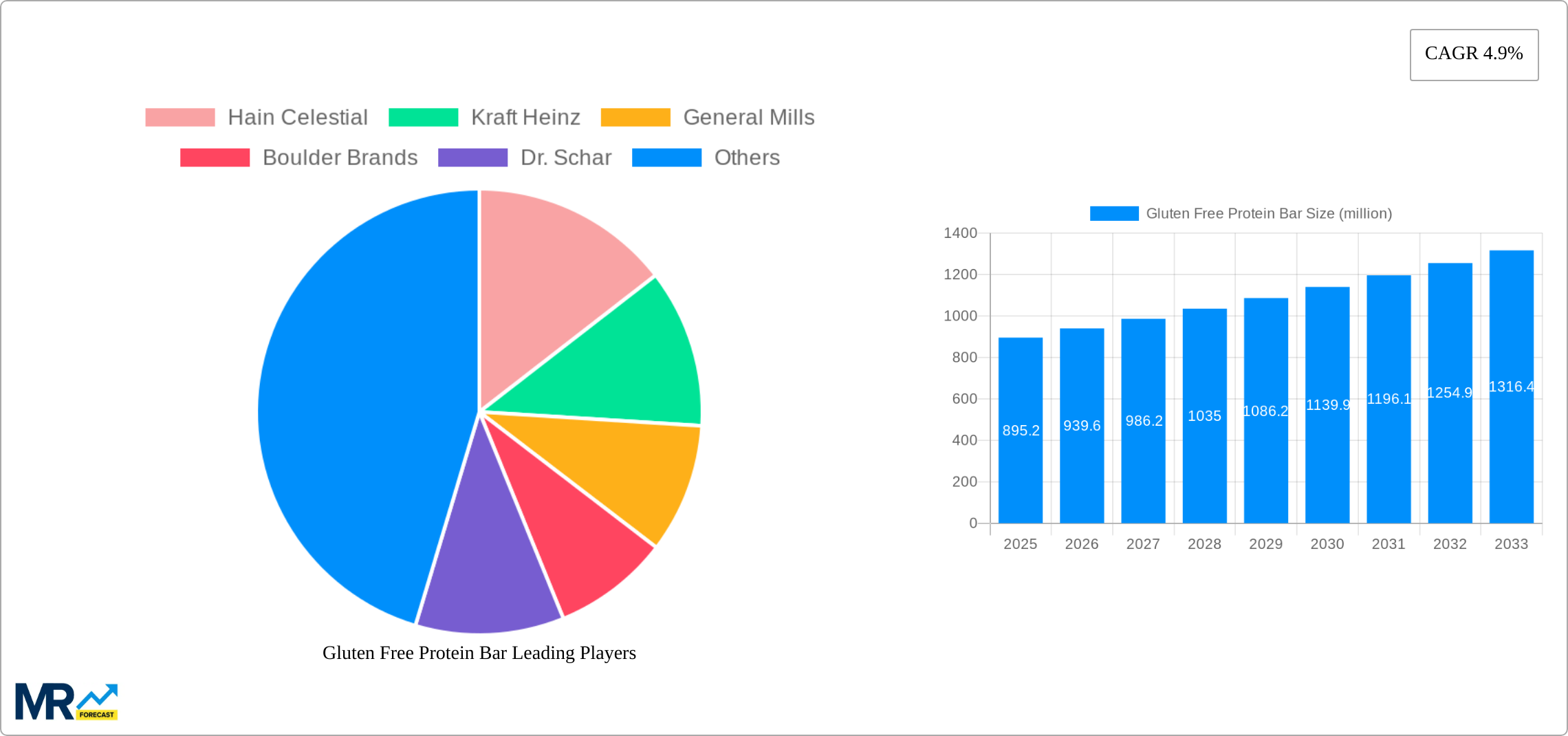

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gluten Free Protein Bar?

The projected CAGR is approximately 4.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gluten Free Protein Bar

Gluten Free Protein BarGluten Free Protein Bar by Type (Vegetable, Nuts, Fruit, Chocolate, Others), by Application (Supermarkets, Convenience Store, Online Stores, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

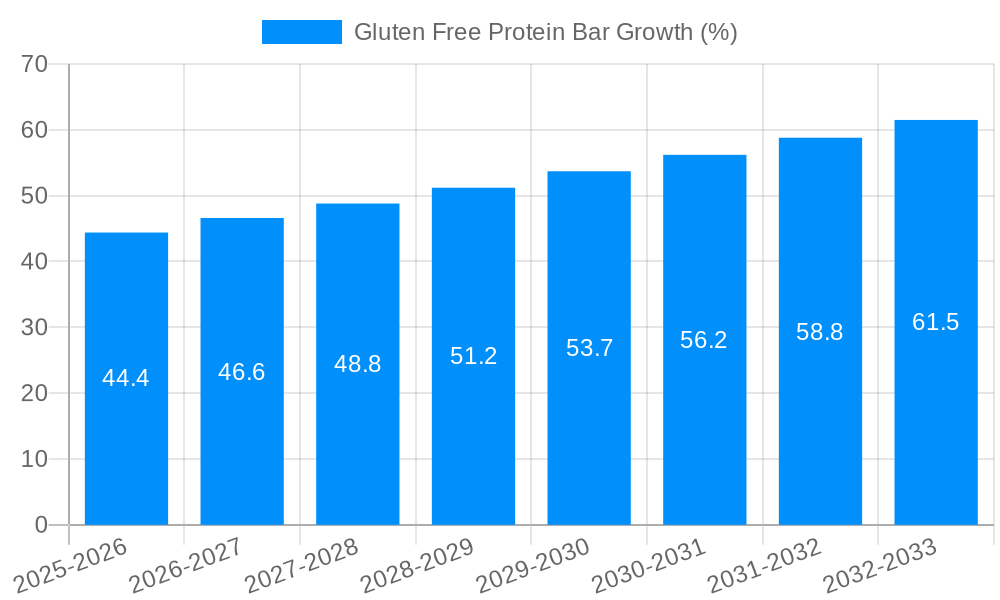

The global gluten-free protein bar market, valued at $895.2 million in 2025, is projected to experience robust growth, driven by increasing consumer awareness of health and wellness, rising prevalence of celiac disease and gluten intolerance, and the growing demand for convenient and nutritious snack options. The market's Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033 indicates a steady expansion, with significant opportunities across various segments. The increasing popularity of vegan and vegetarian diets further fuels the demand for gluten-free protein bars, particularly those derived from plant-based sources like nuts, seeds, and fruits. Supermarkets and convenience stores remain dominant distribution channels, although the online segment is experiencing rapid growth, driven by e-commerce expansion and the convenience of online ordering. Key players like Hain Celestial, Kraft Heinz, and General Mills are continuously innovating with new flavors, formulations, and marketing strategies to capture a larger market share. However, challenges exist, such as maintaining affordability and managing fluctuating raw material prices, especially for organic and specialized ingredients. Furthermore, ensuring the authenticity and transparency of gluten-free claims is paramount to building consumer trust and overcoming any potential negative perceptions about product quality.

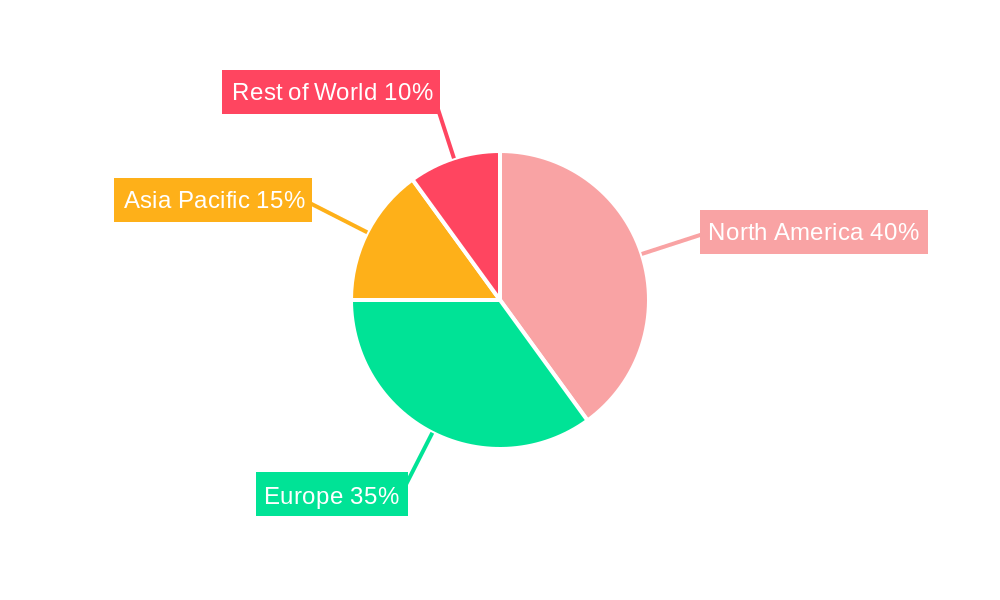

The market segmentation reveals strong performance across various product types, with vegetable-based and fruit-based bars showing significant potential. North America and Europe currently dominate the market, driven by high levels of health consciousness and strong purchasing power. However, Asia-Pacific is expected to show significant growth in the coming years due to rising disposable incomes and increased awareness of health and fitness in developing economies. Competitive landscape analysis suggests that companies are focusing on product diversification, strategic partnerships, and acquisitions to maintain their market position and capitalize on emerging opportunities. Future growth will hinge on catering to evolving consumer preferences, developing sustainable sourcing practices, and addressing the challenges associated with pricing and ingredient availability.

The gluten-free protein bar market exhibits robust growth, driven by the increasing prevalence of gluten intolerance and a rising consumer preference for convenient, healthy snack options. Over the study period (2019-2033), the market has witnessed significant expansion, with sales exceeding several million units annually. The estimated market value in 2025 is projected to be in the hundreds of millions, and the forecast period (2025-2033) anticipates continued strong growth, fueled by evolving consumer lifestyles and the expanding product portfolio of key players. Consumers are increasingly seeking protein bars that cater to dietary restrictions and health goals, leading to innovation in ingredients and formulations. This trend is evident in the burgeoning popularity of bars incorporating natural ingredients, organic certifications, and functional benefits beyond protein content, such as added fiber, vitamins, and antioxidants. The historical period (2019-2024) saw a steady increase in market penetration, particularly in developed nations with high awareness of gluten-related disorders. This upward trajectory is expected to continue, with emerging markets also contributing to overall market expansion. The competitive landscape is characterized by both established food giants and specialized health food brands, driving innovation and ensuring a diverse range of product offerings to satisfy varied consumer needs and preferences. The market’s success hinges on manufacturers' ability to meet the demand for high-quality, delicious, and convenient gluten-free protein bars that cater to the growing health-conscious consumer base. The Base Year (2025) represents a pivotal point, showing a significant market size and setting the stage for future growth.

Several key factors propel the growth of the gluten-free protein bar market. The rising prevalence of celiac disease and non-celiac gluten sensitivity significantly expands the target consumer base. Increased awareness of the health implications of gluten consumption, coupled with readily available diagnostic tools, is further driving demand. The convenience factor of protein bars as a quick and healthy snack or meal replacement is undeniable. Busy lifestyles, particularly among young professionals and athletes, make these bars an attractive option. This is further supported by growing consumer preference for on-the-go nutrition solutions. The industry's response with innovative product offerings, including various flavors, textures, and functional benefits (like added fiber or vitamins), keeps the market vibrant and competitive. Furthermore, the increasing focus on health and wellness, coupled with the rising popularity of fitness and athletic activities, boosts demand for protein bars as a supplement to support muscle growth and recovery. Marketing campaigns emphasizing health benefits and lifestyle integration successfully contribute to market growth, especially in reaching health-conscious demographics. Finally, the expanding distribution channels, including supermarkets, convenience stores, and online retailers, ensure wide product availability, catering to diverse consumer preferences and shopping habits.

Despite strong growth, the gluten-free protein bar market faces certain challenges. Maintaining a balance between taste, texture, and nutritional value in gluten-free formulations can be complex. The removal of gluten sometimes affects the desired mouthfeel and overall palatability, necessitating careful recipe development and ingredient selection. The higher cost of gluten-free ingredients compared to conventional ingredients can impact affordability and price competitiveness, potentially affecting market accessibility for price-sensitive consumers. Regulatory hurdles and compliance requirements for labeling and ingredient sourcing vary across regions, leading to complexities in manufacturing and distribution. Furthermore, maintaining consistency in product quality and preventing cross-contamination during the manufacturing process is crucial for ensuring consumer safety and trust, particularly concerning those with severe gluten sensitivities. Maintaining consumer trust and addressing any negative perceptions about the taste or texture of gluten-free products compared to their gluten-containing counterparts is also a continuing challenge. Lastly, intense competition among established and emerging players requires companies to continually innovate and differentiate their product offerings to remain competitive.

The North American market is expected to dominate the gluten-free protein bar market during the forecast period due to high awareness about gluten-related disorders, a significant health-conscious population, and established distribution networks. Within this region, the United States holds a substantial market share due to factors like high disposable income and prevalence of gluten-free diets.

Dominant Segments:

Type: The chocolate segment enjoys significant popularity due to its widespread appeal and the successful integration of chocolate flavors into various gluten-free protein bars. The fruit segment shows promise owing to consumer demand for healthier options and the versatility of using various fruits for flavor and nutritional enhancement.

Application: Supermarkets maintain the largest market share due to their widespread accessibility and established distribution channels. However, the online segment is exhibiting rapid growth, driven by increased e-commerce penetration and consumer preference for convenient online shopping.

The growth of the chocolate segment is fueled by its broad consumer appeal and the capacity for seamless integration with various protein sources and other healthy ingredients. The widespread preference for chocolate-flavored snacks and the successful development of delicious gluten-free chocolate protein bars contribute significantly to this segment's prominence. Within the application segment, supermarkets remain the most significant distribution channel due to their ubiquitous nature and established supply chains. However, the online retail sector exhibits high growth potential, propelled by the convenience it offers consumers and the ever-increasing reliance on online shopping for groceries and health-related products. The convenience of home delivery is a significant driver in this market segment's expansion. Further, the growing popularity of subscription boxes and online health food stores specifically targeting consumers with dietary restrictions further reinforces the expansion of this sector.

The gluten-free protein bar industry is experiencing significant growth fueled by several key catalysts. The rising prevalence of gluten-related disorders and growing health consciousness amongst consumers are primary drivers. Innovations in product formulation, incorporating natural ingredients, unique flavors, and functional benefits, are significantly expanding the market appeal. Increasing consumer preference for convenient, on-the-go snacking solutions is also a key catalyst, especially amongst health-conscious individuals and athletes.

This report provides a detailed analysis of the gluten-free protein bar market, covering key trends, drivers, challenges, and growth opportunities. It offers a comprehensive overview of the competitive landscape, including leading players, their market strategies, and future projections. The report also includes segmented data based on product type, application, and geographical region, providing a granular understanding of the market dynamics. Detailed historical data and future forecasts further enrich the report's insights, enabling informed decision-making for stakeholders in the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.9%.

Key companies in the market include Hain Celestial, Kraft Heinz, General Mills, Boulder Brands, Dr. Schar, Mondelez International, PepsiCo, Glanbia, PLC, The Balance Bar, Kellogg, Abbott Nutrition, PowerBar, Optimum Nutrition, Labrada Nutrition, .

The market segments include Type, Application.

The market size is estimated to be USD 895.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Gluten Free Protein Bar," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gluten Free Protein Bar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.