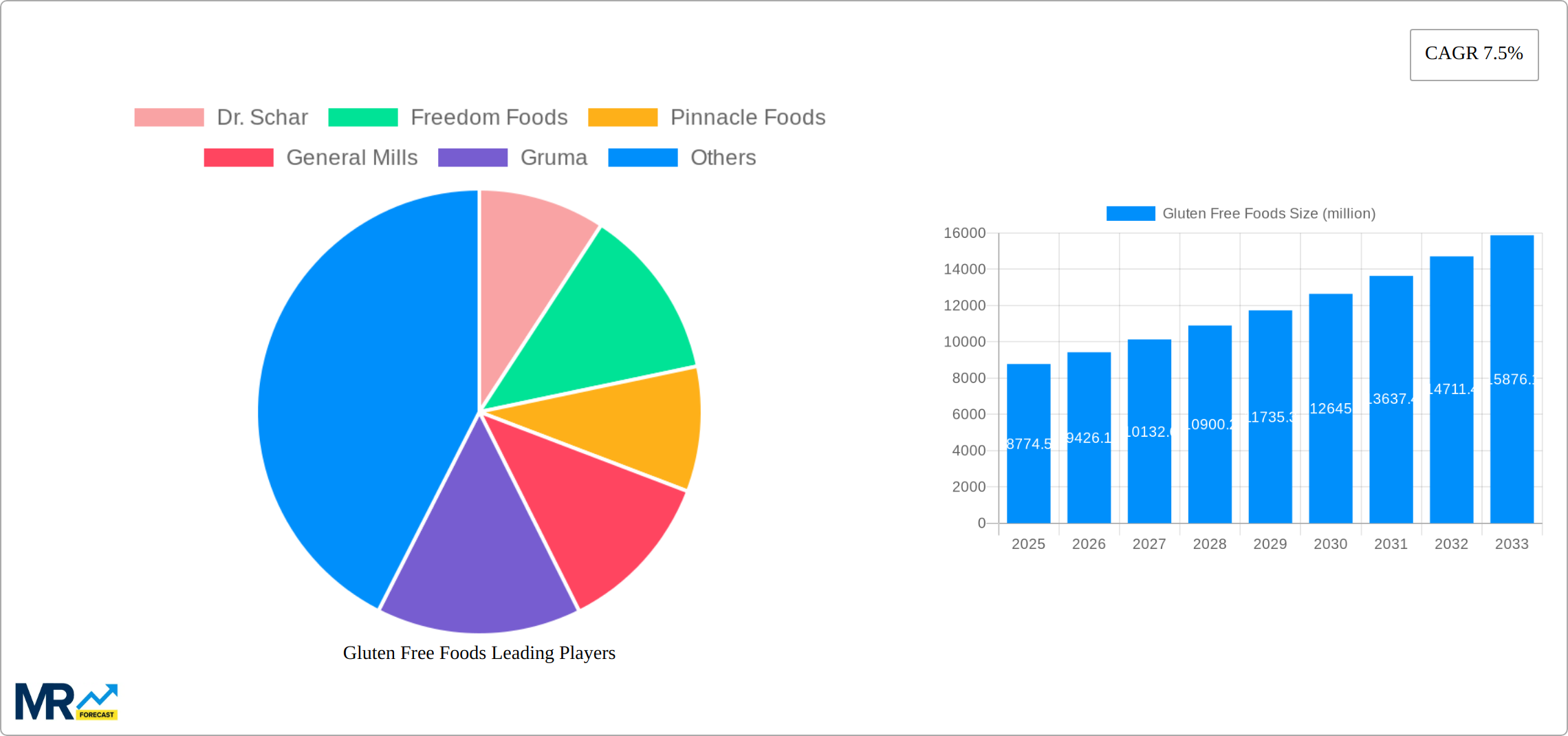

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gluten Free Foods?

The projected CAGR is approximately 7.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gluten Free Foods

Gluten Free FoodsGluten Free Foods by Application (Convenience Stores, Hotels and Restaurants, Educational Institutions, Hospitals and Drug stores, Specialty Services), by Type (Gluten-Free Bakery Products, Gluten-Free Baby Food, Gluten-Free Pasta, Gluten-Free Ready Meals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

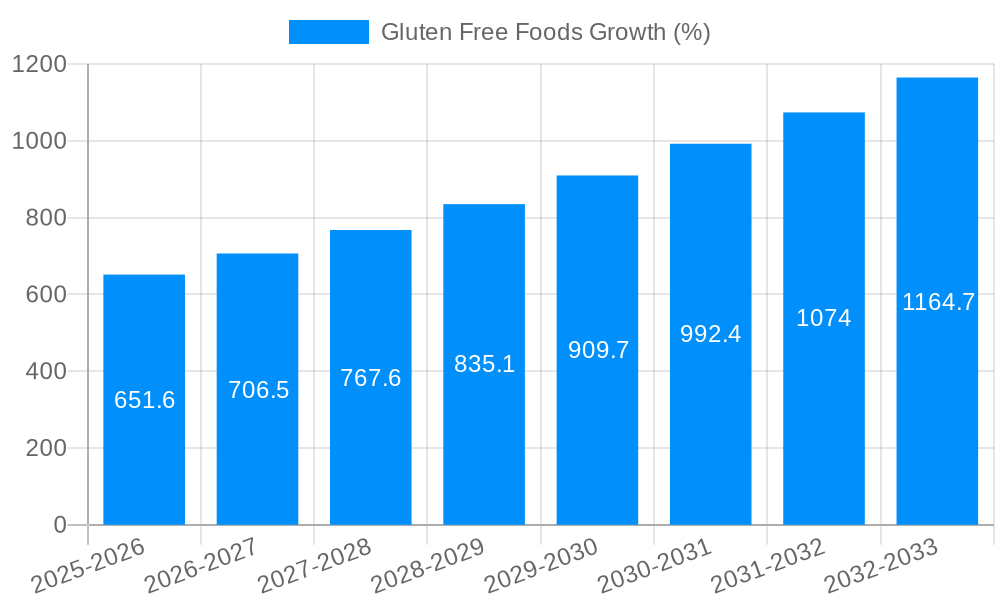

The gluten-free foods market, valued at $8,774.5 million in 2025, is projected to experience robust growth, driven by the rising prevalence of celiac disease and gluten intolerance. Increasing consumer awareness of the health benefits of gluten-free diets, including improved digestion and reduced inflammation, further fuels market expansion. The growing demand for convenient and palatable gluten-free alternatives to traditional products, such as bread, pasta, and snacks, is a significant driver. Key players like Dr. Schar, Freedom Foods, and General Mills are capitalizing on this trend through product innovation and strategic partnerships, expanding their gluten-free product portfolios to cater to diverse consumer preferences. While pricing can be a restraint for some consumers, the increasing availability of gluten-free products in mainstream supermarkets and online retailers is mitigating this challenge. The market segmentation is diverse, encompassing various product categories (bread, pasta, snacks, etc.) and distribution channels (retail, food service), offering numerous opportunities for growth. The North American and European markets currently hold significant shares, but emerging economies are exhibiting substantial growth potential as awareness increases. The market's continued expansion is projected to maintain a compound annual growth rate (CAGR) of 7.5% from 2025 to 2033, indicating a promising future for the industry.

The forecast period from 2025 to 2033 anticipates a steady increase in market size, driven by the factors previously mentioned. Product diversification, including the introduction of gluten-free versions of popular comfort foods, will play a key role in market growth. Furthermore, the increasing integration of gluten-free options into mainstream foodservice establishments will enhance accessibility and adoption. Competitive intensity is expected to remain high, with established players and new entrants vying for market share through innovation, branding, and distribution strategies. Efforts to address the challenges of taste and texture, crucial for maintaining consumer satisfaction, will continue to be central to market success. Technological advancements in gluten-free food processing will improve production efficiency and product quality, further contributing to the market's overall growth trajectory.

The gluten-free foods market experienced robust growth between 2019 and 2024, driven by increasing awareness of celiac disease and gluten sensitivity. The market, valued at several billion units in 2024, is projected to reach tens of billions of units by 2033, showcasing a Compound Annual Growth Rate (CAGR) exceeding 10% during the forecast period (2025-2033). This expansion reflects a broader consumer shift toward health-conscious eating, with gluten-free options perceived as healthier and more beneficial for digestive health. While initially driven by medical necessity for those with diagnosed conditions, the market's growth significantly expanded due to the adoption of gluten-free diets by consumers seeking weight management, improved energy levels, or simply aligning with perceived health benefits. This trend has spurred innovation within the industry, leading to a wider array of products that are not only gluten-free but also address other consumer demands such as organic certification, non-GMO ingredients, and increased nutritional value. Major players, including General Mills and Kellogg's, have recognized this opportunity, investing significantly in research and development to create more palatable and appealing gluten-free alternatives to traditional products. The increasing availability of gluten-free products in mainstream supermarkets and restaurants further fuels market expansion, making these options readily accessible to a wider consumer base. The estimated market value in 2025 sits at a significant level, setting the stage for continued substantial growth in the coming years. This growth isn't merely limited to specific product categories; it reflects a fundamental change in consumer preferences and dietary choices.

The surging demand for gluten-free foods stems from multiple intertwined factors. Firstly, the rising prevalence of celiac disease and non-celiac gluten sensitivity (NCGS) is a fundamental driver. Millions of people worldwide are affected by these conditions, necessitating a consistent supply of gluten-free alternatives for basic food staples. Secondly, the increasing awareness of the potential health benefits of gluten-free diets is expanding the market beyond those with diagnosed conditions. Many consumers believe a gluten-free diet can lead to improved digestion, weight loss, and increased energy levels, even in the absence of diagnosed gluten intolerance. This perception, although debated scientifically, is powerful enough to drive significant market growth. Thirdly, the proliferation of readily available and palatable gluten-free products significantly contributes to market expansion. The industry has made remarkable strides in developing products that closely mimic the taste and texture of their gluten-containing counterparts, overcoming a significant barrier to adoption. Finally, the growing influence of health and wellness trends, coupled with increased consumer spending on premium and specialized foods, fuels demand for premium, certified gluten-free products. This includes organically produced and ethically sourced options, further segmenting the market and catering to a broader range of consumer preferences.

Despite significant growth, the gluten-free foods market faces several challenges. One major hurdle is the higher cost of production compared to gluten-containing foods. Many gluten-free alternatives require specialized ingredients and processing techniques, resulting in higher prices that may limit affordability for some consumers. This price differential is a key barrier to wider market penetration, especially in price-sensitive markets. Secondly, the perception of compromised taste and texture in certain gluten-free products remains a significant challenge. While advancements have been made, some consumers still find gluten-free alternatives less palatable or satisfying compared to their gluten-containing counterparts. Overcoming this perception requires ongoing innovation in food formulation and processing. Thirdly, labeling regulations and the consistent enforcement of gluten-free claims remain a concern. Ensuring that products genuinely meet the required standards for gluten-free certification and avoiding potential mislabeling is crucial for maintaining consumer trust and protecting the integrity of the market. Furthermore, the potential for cross-contamination during manufacturing and handling also presents a significant challenge. Maintaining stringent quality control measures throughout the entire production process is critical to preventing contamination and ensuring the safety of gluten-free products for consumers with celiac disease.

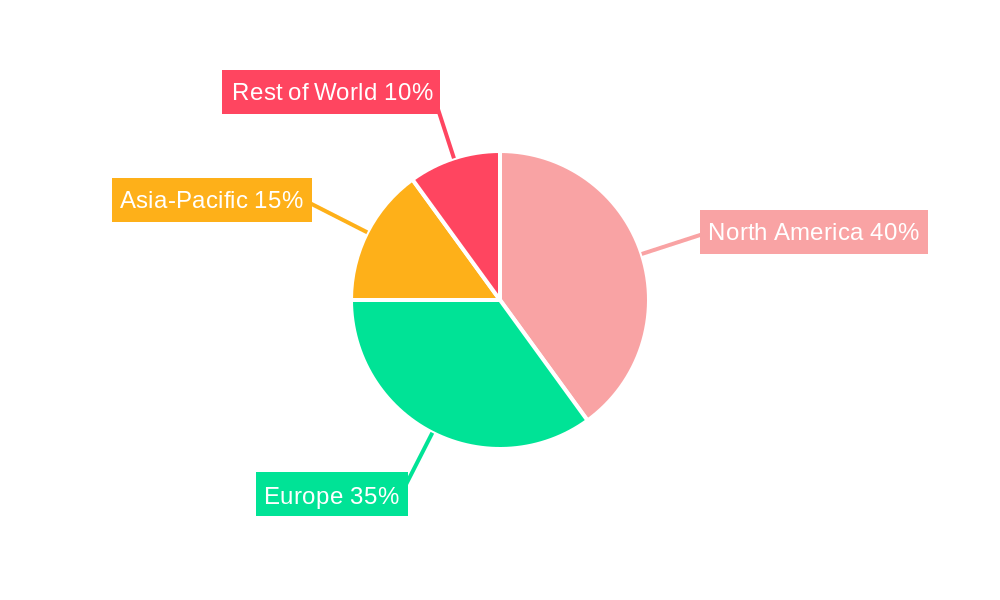

North America: This region is expected to maintain its leading position due to high awareness of gluten-related disorders, strong demand for health foods, and the presence of established players like General Mills and Kellogg's. The high disposable income and focus on convenience foods also drive growth.

Europe: Europe has a significant market share due to a large population with diagnosed celiac disease and a growing number of consumers adopting gluten-free diets for perceived health benefits. Strong regulatory frameworks also support the market's growth.

Asia-Pacific: This region is showing considerable potential for growth. Increasing awareness of gluten-related issues, rising disposable incomes, and changing dietary habits are fueling the market's expansion, particularly in countries like Japan and Australia.

Dominant Segments:

In summary, the North American and European markets are currently dominant, driven by high awareness and strong regulatory environments. However, the Asia-Pacific region shows significant growth potential, with increasing consumer interest and expanding market penetration. Within segments, bakery products, snacks, pasta, and ready meals are particularly important contributors to the overall market value.

The gluten-free foods industry is experiencing growth fueled by several key factors: rising prevalence of celiac disease and gluten sensitivity, increased consumer awareness of health and wellness, and the growing availability of palatable and convenient gluten-free alternatives. Product innovation, particularly in mimicking the taste and texture of traditional foods, is crucial to driving further market expansion. The expansion of distribution channels, including online retailers and mainstream supermarkets, also facilitates broader market reach and accessibility.

This report offers a detailed analysis of the gluten-free foods market, encompassing historical data, current market dynamics, and future projections. It provides valuable insights into market trends, driving factors, challenges, and key players, enabling stakeholders to make informed decisions and navigate the dynamic landscape of this rapidly evolving sector. The report’s comprehensive scope includes market segmentation by product type, region, and distribution channel, delivering a granular understanding of the various market segments' performance and growth prospects. The forecast period (2025-2033) provides a roadmap for future market evolution, allowing businesses to anticipate changing consumer demands and effectively strategize for long-term success.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.5%.

Key companies in the market include Dr. Schar, Freedom Foods, Pinnacle Foods, General Mills, Gruma, Hain Celestial, Amy's Kitchen, Enjoy Life Foods, Kraft Recipes, Kellogg's, .

The market segments include Application, Type.

The market size is estimated to be USD 8774.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Gluten Free Foods," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gluten Free Foods, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.