1. What is the projected Compound Annual Growth Rate (CAGR) of the Glutathione Agarose Resin?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Glutathione Agarose Resin

Glutathione Agarose ResinGlutathione Agarose Resin by Type (Glutathione Reduced, Glutathione Oxidized), by Application (Immunoprecipitation, Protein Purification, Research), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

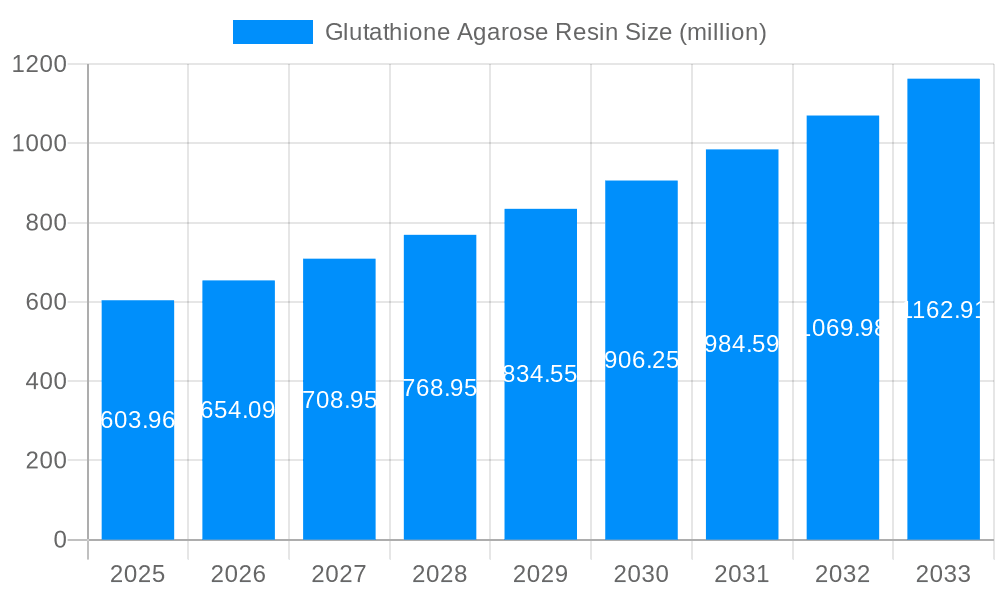

The global Glutathione Agarose Resin market is poised for robust expansion, projected to reach approximately $603.96 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.2% through to 2033. This significant growth is primarily fueled by the escalating demand for efficient protein purification techniques in both academic research and the biopharmaceutical industry. The increasing prevalence of chronic diseases and the continuous development of novel therapeutics, particularly biologics and antibody-based drugs, necessitate highly specific and reliable methods for isolating and purifying target proteins. Glutathione agarose resin, with its high affinity for glutathione S-transferase (GST)-tagged proteins, has become an indispensable tool in this process, offering superior yields and purity compared to conventional methods. The growing investments in biotechnology research and development, coupled with the expanding pipeline of biopharmaceutical products, are key drivers propelling the market forward. Furthermore, advancements in resin technology, leading to enhanced binding capacity and stability, are contributing to its wider adoption.

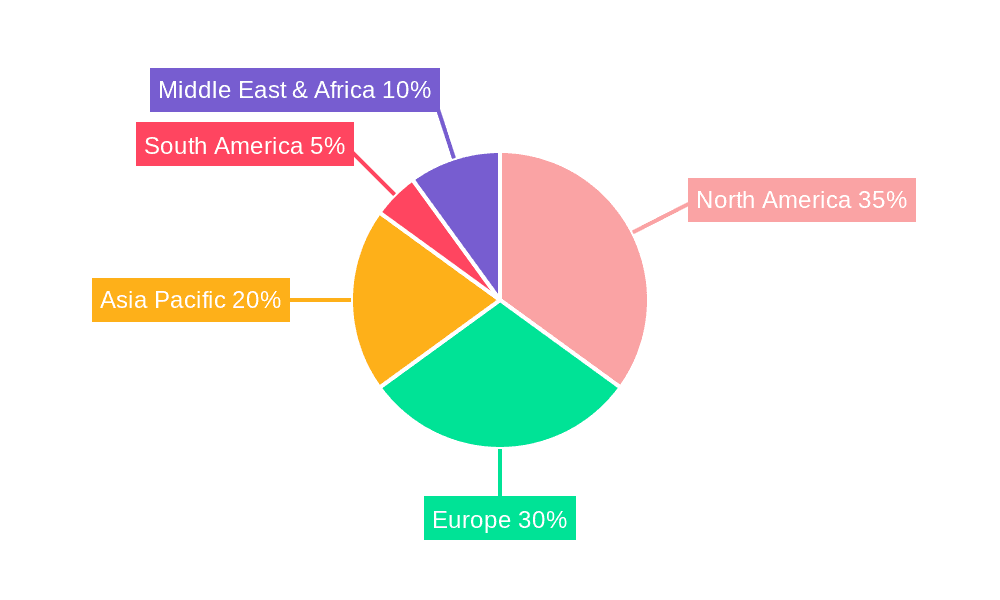

The market segmentation reveals distinct growth patterns. The Glutathione Reduced form is expected to dominate due to its widespread application in various protein purification scenarios. In terms of applications, Immunoprecipitation and Protein Purification are anticipated to witness substantial growth, driven by their critical roles in understanding cellular pathways and developing therapeutic interventions. While restraints such as the high cost of some advanced resins and the availability of alternative purification methods exist, the inherent advantages of glutathione affinity chromatography, including its specificity and cost-effectiveness for certain applications, are expected to outweigh these challenges. Geographically, the Asia Pacific region is emerging as a significant growth area, fueled by burgeoning research infrastructure, increasing government initiatives to promote biotech research, and a growing pharmaceutical manufacturing base in countries like China and India. North America and Europe continue to be dominant markets, owing to well-established biopharmaceutical industries and extensive R&D activities.

The global Glutathione Agarose Resin market is poised for significant expansion, with projections indicating a robust growth trajectory over the study period of 2019-2033, building upon a strong base year of 2025. During the historical period from 2019 to 2024, the market witnessed steady advancements, driven by increasing research activities in life sciences and a growing demand for efficient protein purification techniques. The estimated Year of 2025 marks a pivotal point, with the market expected to continue its upward climb. The forecast period from 2025 to 2033 is anticipated to see an accelerated growth rate, propelled by innovation in resin technologies, expansion of biopharmaceutical manufacturing, and a surge in academic and industrial research.

The market's value, estimated to be in the millions, is projected to reach substantial figures by 2033. Key drivers include the escalating need for high-purity recombinant proteins for therapeutic applications, diagnostics, and fundamental biological research. The increasing complexity of protein targets, particularly those involving glutathione S-transferases (GST) and their associated binding partners, further amplifies the demand for specialized glutathione agarose resins. Furthermore, the growing adoption of affinity chromatography as a primary purification method across various industries, including pharmaceuticals, biotechnology, and academic research, is a significant contributor to market expansion. The market is characterized by a diverse range of product offerings, catering to specific requirements such as the purification of native or denatured proteins, and the capacity for high-throughput applications. The development of novel, high-capacity, and chemically stable glutathione agarose resins is a recurring theme, reflecting the industry's commitment to improving efficiency and cost-effectiveness in protein isolation. The increasing focus on personalized medicine and the development of novel protein-based therapeutics are also expected to fuel the demand for advanced purification solutions, thereby bolstering the Glutathione Agarose Resin market. The market's expansion is further influenced by strategic collaborations and mergers, aimed at enhancing product portfolios and expanding market reach. The robust pipeline of biopharmaceutical drugs in development, many of which rely on recombinant protein expression, directly translates into a sustained demand for glutathione agarose resins. The continuous refinement of conjugation techniques for immobilizing glutathione onto agarose matrices is also a key factor driving market evolution, ensuring greater ligand density and improved binding kinetics.

The growth of the Glutathione Agarose Resin market is primarily propelled by the burgeoning biopharmaceutical industry and the escalating demand for high-purity recombinant proteins. As the development of protein-based therapeutics, vaccines, and diagnostic tools continues to expand, so does the need for efficient and reliable methods for their isolation and purification. Glutathione affinity chromatography, leveraging the specific binding affinity between glutathione and proteins tagged with glutathione S-transferase (GST), has emerged as a gold standard for such applications. The increasing prevalence of research initiatives focused on understanding cellular processes, disease mechanisms, and drug discovery, which heavily rely on the availability of purified proteins, further fuels this demand. Furthermore, advancements in protein engineering, leading to the development of novel affinity tags that enhance purification efficiency and specificity, are indirectly contributing to the market's expansion by driving the adoption of sophisticated purification platforms. The growing emphasis on cost-effectiveness and scalability in biopharmaceutical manufacturing also favors affinity chromatography techniques like those employing glutathione agarose, which offer higher yields and purity compared to traditional methods.

Despite the promising growth outlook, the Glutathione Agarose Resin market faces several challenges and restraints that could temper its expansion. One of the primary concerns is the inherent cost associated with high-quality glutathione agarose resins, particularly those offering superior binding capacity and chemical stability. This can be a limiting factor for smaller research institutions or companies with budget constraints, potentially leading them to opt for less efficient or more time-consuming purification methods. Another significant challenge is the possibility of non-specific binding, where other cellular components may interact with the resin or the tagged protein, compromising the purity of the final product. While manufacturers strive to minimize this through rigorous quality control and optimization of resin matrices, it remains a persistent issue that researchers must address. The development and maintenance of specialized expertise required for effective affinity chromatography, including troubleshooting and optimization of elution conditions, also present a barrier to entry for some users. Furthermore, the emergence of alternative purification technologies, although not yet as widely adopted as glutathione affinity chromatography for GST-tagged proteins, could pose a long-term competitive threat. The reliance on specific affinity tags, primarily GST, also means that the market is inherently tied to the popularity and application of this particular tag, and any significant shift in protein engineering trends away from GST could impact demand. Finally, stringent regulatory requirements in the pharmaceutical and biotechnology sectors necessitate extensive validation and quality assurance for purification media, adding to the overall cost and time associated with market entry and product adoption.

The Glutathione Agarose Resin market is poised for significant dominance in the North America region and the Protein Purification application segment.

North America: This region, encompassing the United States and Canada, has historically been at the forefront of biopharmaceutical research and development. The presence of numerous leading biotechnology and pharmaceutical companies, coupled with extensive government funding for life science research, creates a fertile ground for the adoption of advanced protein purification technologies. The robust academic research ecosystem in North America, characterized by leading universities and research institutes, consistently drives demand for high-quality reagents like glutathione agarose resins for basic and applied scientific investigations. Furthermore, the region boasts a strong manufacturing base for biotherapeutics, requiring large-scale, efficient purification processes. The increasing investment in precision medicine and the development of novel protein-based therapeutics, such as monoclonal antibodies and recombinant enzymes, further solidifies North America's leading position. Regulatory bodies in the region, while stringent, also foster innovation by providing clear pathways for the approval of new biopharmaceuticals, thereby stimulating the upstream demand for purification consumables. The market's value in North America is estimated to be in the tens of millions, with substantial growth anticipated over the forecast period. The established infrastructure for drug discovery and development, combined with a proactive approach to adopting new technologies, ensures that North America will continue to be a key driver of market expansion. The sheer volume of ongoing clinical trials and the pipeline of biologics under development are direct indicators of sustained demand for purification solutions.

Protein Purification (Application Segment): Within the application segments, Protein Purification is unequivocally the dominant force driving the Glutathione Agarose Resin market. This broad category encompasses the isolation and purification of recombinant proteins from various expression systems, including bacteria, yeast, insect cells, and mammalian cells. The widespread use of glutathione S-transferase (GST) as an affinity tag for simplifying the purification of these recombinant proteins makes glutathione agarose resin an indispensable tool. The increasing output of recombinant proteins for therapeutic purposes, diagnostic kits, and fundamental research in molecular biology, enzymology, and structural biology directly translates into a massive demand for effective protein purification methods. The efficiency, specificity, and scalability offered by glutathione affinity chromatography make it the preferred choice for researchers and biomanufacturers alike. The market value within this segment is estimated to be in the hundreds of millions, reflecting its critical role. The ongoing advancements in protein engineering, leading to a wider array of protein targets requiring purification, further solidify the dominance of this application. As more complex protein structures are being investigated and therapeutically targeted, the demand for highly pure and functional proteins will only intensify, ensuring the continued supremacy of the protein purification application for glutathione agarose resins. The ease of use and compatibility with various elution strategies further enhance its appeal.

The Glutathione Agarose Resin industry is experiencing significant growth catalysts, primarily driven by the escalating demand for recombinant proteins in biopharmaceutical development and the increasing complexity of protein targets. The continuous innovation in resin technology, leading to higher binding capacities and improved elution efficiencies, is a key enabler. Furthermore, the expansion of research in areas like personalized medicine and the development of novel diagnostics are creating a sustained need for purified proteins. The growing number of academic research projects and the increasing outsourcing of purification services by smaller biotech firms also contribute to market growth.

This report offers a comprehensive overview of the Glutathione Agarose Resin market, delving into its intricate dynamics from 2019 to 2033. It meticulously analyzes market trends, identifies key driving forces, and delineates the challenges and restraints impacting its growth. The report provides in-depth insights into dominant regions and segments, highlighting the strategic importance of North America and the Protein Purification application. Furthermore, it pinpoints critical growth catalysts and provides an exhaustive list of leading industry players. The report also chronicles significant developments that have shaped the sector, offering a nuanced understanding of the market's past, present, and future trajectory, with an estimated market value expected to reach into the tens of millions by the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

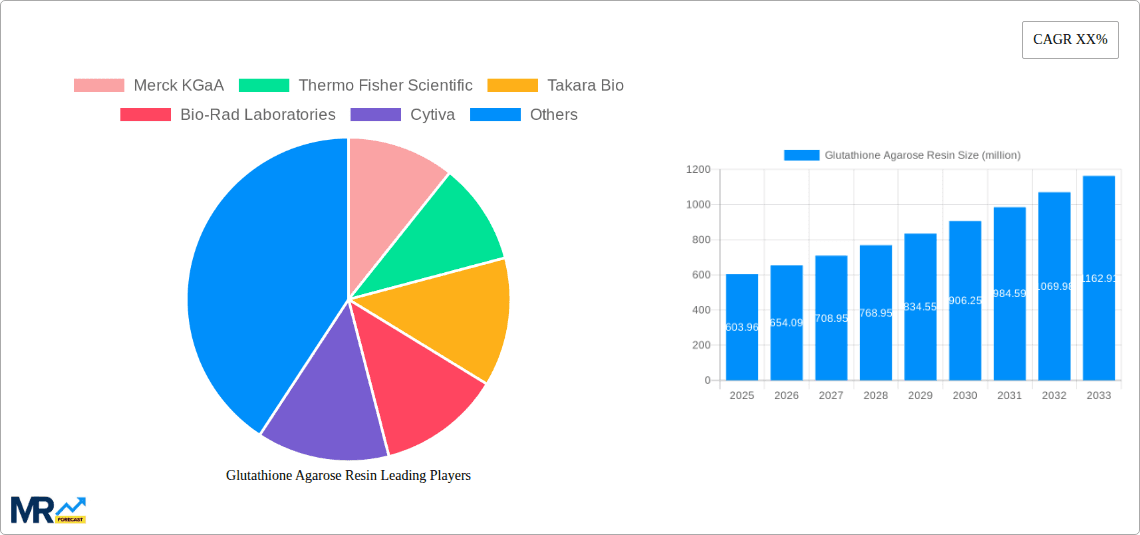

Key companies in the market include Merck KGaA, Thermo Fisher Scientific, Takara Bio, Bio-Rad Laboratories, Cytiva, Mitsubishi Corporation Life Sciences, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Glutathione Agarose Resin," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Glutathione Agarose Resin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.