1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Substrates for TFT-LCD?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Glass Substrates for TFT-LCD

Glass Substrates for TFT-LCDGlass Substrates for TFT-LCD by Type (Gen. 8及以上, Gen. 7和Gen. 7.5, Gen. 6和Gen. 6.5, Gen. 5及以下, World Glass Substrates for TFT-LCD Production ), by Application (TV, Monitor, Laptop, Others, World Glass Substrates for TFT-LCD Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

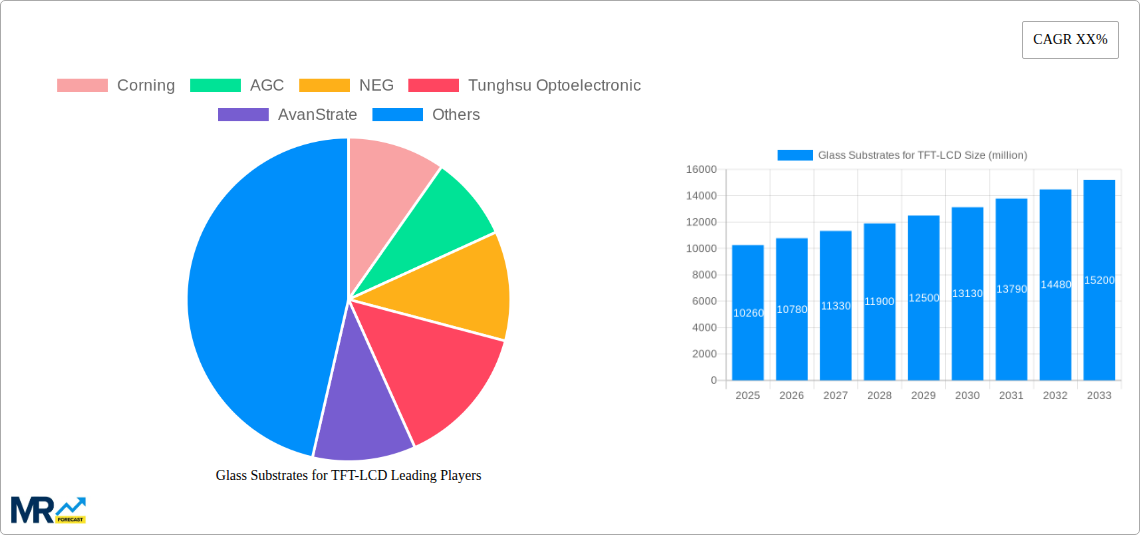

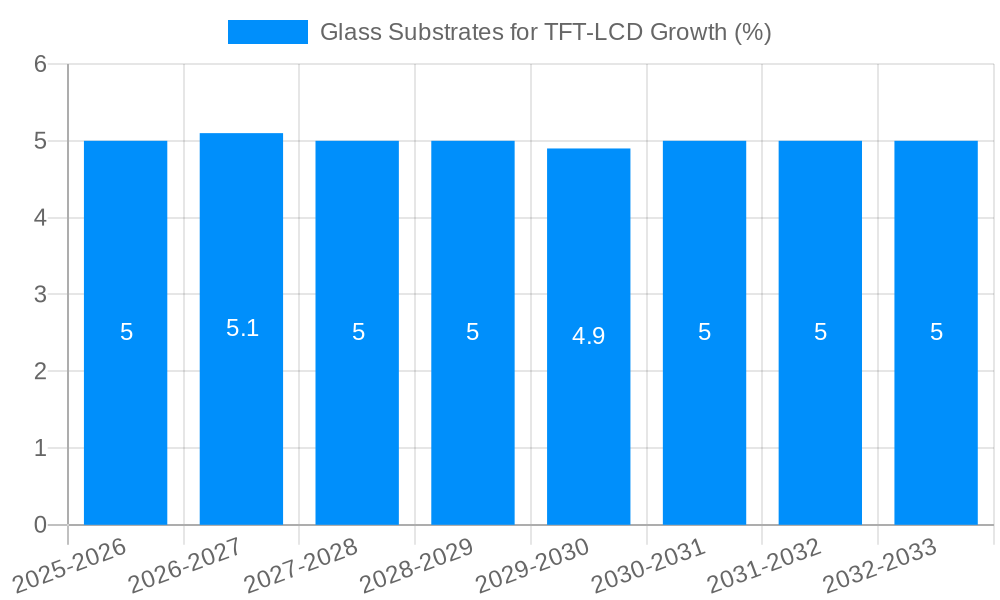

The global market for Glass Substrates for TFT-LCD production is poised for significant growth, with an estimated market size of $10,260 million in 2025. This expansion is primarily driven by the ever-increasing demand for high-resolution displays across a wide spectrum of applications, including televisions, monitors, and laptops. The proliferation of smart devices and the continuous innovation in display technology, such as the move towards larger screen sizes and enhanced refresh rates, are key catalysts for this market. Furthermore, the resurgence of interest in larger format displays for public information systems and digital signage is expected to contribute to sustained market momentum. Emerging economies are also playing a crucial role, as a growing middle class with increased disposable income fuels the adoption of consumer electronics featuring advanced TFT-LCD displays. The industry is witnessing a trend towards thinner and more flexible glass substrates to enable lighter and more versatile electronic devices, further stimulating market expansion.

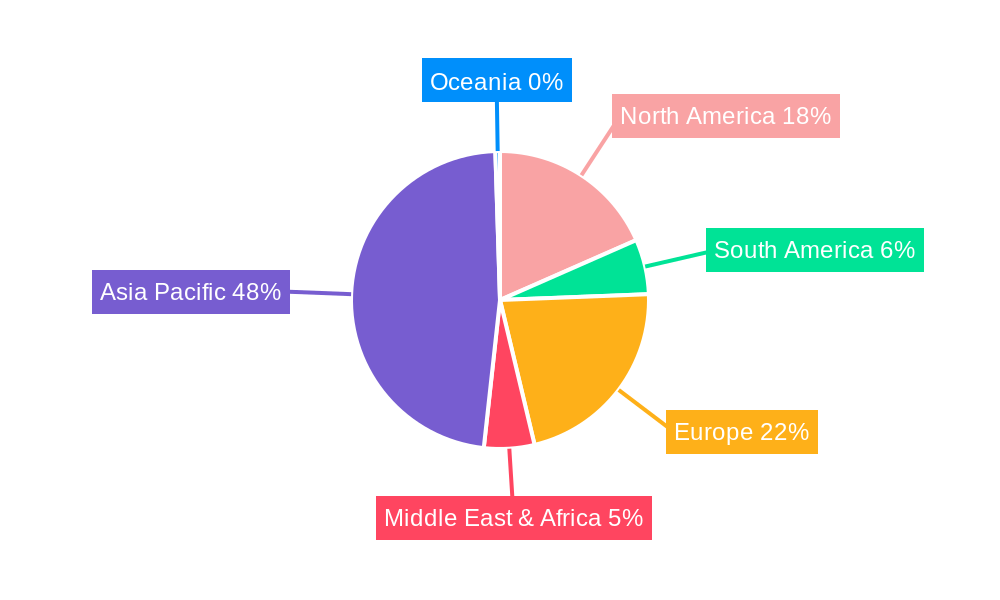

The market is segmented by generation, with Gen. 8 and above dominating due to their application in large-format displays, followed by Gen. 7 and 7.5, Gen. 6 and 6.5, and Gen. 5 and below, which cater to smaller screen sizes. Geographically, the Asia Pacific region, particularly China, is expected to lead the market, owing to its robust manufacturing capabilities and substantial domestic consumption. North America and Europe will also represent significant markets, driven by technological advancements and consumer preferences for premium display experiences. While market growth is robust, potential restraints include the high capital expenditure required for manufacturing new generations of glass substrates and the increasing competition from alternative display technologies such as OLED. However, the inherent advantages of glass substrates in terms of cost-effectiveness for mass production and established manufacturing processes are likely to maintain their dominance in the TFT-LCD sector for the foreseeable future.

This comprehensive report offers an in-depth analysis of the global Glass Substrates for TFT-LCD market, projecting its trajectory from 2019 to 2033, with a strong focus on the Base Year of 2025 and the Forecast Period of 2025-2033. Leveraging extensive data from the Historical Period of 2019-2024, the study aims to provide a holistic understanding of market dynamics, key players, and future opportunities. The market size is meticulously analyzed, with values presented in millions of units, offering precise quantitative insights.

The global Glass Substrates for TFT-LCD market is poised for sustained growth and evolution throughout the Study Period of 2019-2033. A key trend defining this landscape is the relentless pursuit of larger display sizes across various applications, particularly for televisions and monitors. This surge in demand for expansive screens directly translates into a greater need for larger glass substrates, with Gen. 8 and above continuously gaining prominence as the industry standard for high-volume production. The report will delve into the increasing adoption of these advanced generations, showcasing their growing market share, estimated to reach hundreds of millions of square meters by 2025. Furthermore, the market is witnessing a significant shift towards thinner and lighter glass solutions, driven by the desire for more portable and aesthetically pleasing electronic devices. Innovations in glass composition and manufacturing processes are enabling the production of substrates with enhanced strength and reduced thickness without compromising optical performance. This trend is particularly evident in segments catering to laptops and increasingly, even larger displays where weight reduction is a critical factor.

The market is also characterized by a growing emphasis on specialized glass properties. Beyond standard optical clarity, there is an increasing demand for substrates with improved scratch resistance, enhanced thermal stability, and superior uniformity, all crucial for the reliability and longevity of TFT-LCD panels. The development of advanced coating technologies further complements these trends, allowing for the integration of functionalities like anti-glare or energy-saving properties directly onto the glass surface. Environmental considerations are also subtly influencing the market, with a growing interest in recyclable materials and energy-efficient manufacturing practices, although the immediate impact on substrate demand remains incremental. The report will meticulously track these evolving trends, analyzing their influence on market segmentation and technological advancements. The intricate interplay between consumer preferences for larger, thinner, and higher-performance displays, coupled with advancements in manufacturing capabilities, will shape the market's trajectory, with estimated production volumes for glass substrates reaching tens of millions of units annually by 2025.

Several potent forces are collectively propelling the growth of the Glass Substrates for TFT-LCD market. The most significant driver is the ever-increasing consumer demand for larger and more immersive display experiences across a multitude of electronic devices. This is particularly evident in the television segment, where ultra-large screen sizes are becoming increasingly mainstream. Similarly, the monitor and laptop markets are also witnessing a consistent upward trend in average screen dimensions. This escalating demand for larger panels directly fuels the need for larger glass substrates, with the Gen. 8 and above segment emerging as a critical growth engine. The report will quantify this demand, estimating the consumption of millions of units of these larger substrates annually by 2025.

Furthermore, the rapid adoption of TFT-LCD technology in emerging applications, such as digital signage, automotive displays, and industrial monitors, is contributing significantly to market expansion. These burgeoning sectors require a diverse range of display sizes and specifications, thereby increasing the overall volume of glass substrate production. The continuous innovation in display technology itself, including advancements in pixel density, refresh rates, and color reproduction, necessitates the use of high-quality, precisely manufactured glass substrates. These technological leaps inherently drive the demand for superior substrate materials that can support these cutting-edge display features. The report will explore how these technological advancements translate into specific substrate requirements and market opportunities. The ongoing global economic recovery and the increasing disposable income in developing regions are also playing a crucial role by boosting consumer spending on electronics, further amplifying the demand for devices equipped with TFT-LCD panels, and consequently, their glass substrates.

Despite the robust growth trajectory, the Glass Substrates for TFT-LCD market is not without its challenges and restraints. One of the primary concerns is the highly capital-intensive nature of glass substrate manufacturing. Establishing and maintaining state-of-the-art fabrication facilities requires substantial financial investment, creating significant barriers to entry for new players and posing a challenge for smaller companies to scale up production to meet burgeoning demand. The report will analyze the impact of these capital requirements on market competitiveness and potential consolidation. Another significant challenge is the sensitivity of glass production to fluctuations in raw material prices, particularly for specialized chemicals and energy. Volatility in these input costs can directly affect the profitability of glass manufacturers and influence pricing strategies, potentially leading to increased substrate costs for display panel producers.

The market also faces the persistent threat of technological obsolescence. While TFT-LCD technology remains dominant, the continuous emergence of alternative display technologies, such as OLED and MicroLED, presents a long-term challenge. While these technologies are not yet direct substitutes for all TFT-LCD applications, their growing market penetration, especially in premium segments, could gradually erode the market share of traditional LCDs and, consequently, the demand for their associated glass substrates. The report will offer a nuanced perspective on the competitive landscape between display technologies and their impact on substrate demand. Furthermore, geopolitical uncertainties and global supply chain disruptions, as witnessed in recent years, can pose significant challenges to the stable supply of essential raw materials and the timely delivery of finished glass substrates, potentially impacting production schedules and increasing lead times, with millions of units in production cycles being affected. Strict environmental regulations concerning manufacturing processes and waste management also add a layer of complexity and cost for manufacturers.

The global Glass Substrates for TFT-LCD market is characterized by the dominant influence of certain regions and segments, driven by manufacturing capabilities, market demand, and technological advancements.

Key Dominant Region: Asia Pacific, particularly China, South Korea, and Taiwan, stands out as the undisputed leader in the global Glass Substrates for TFT-LCD market. This dominance is a confluence of several factors.

Dominant Segment: Within the glass substrate landscape, the Gen. 8 and above segment is the primary driver of market growth and is poised to maintain its dominance throughout the Forecast Period of 2025-2033.

The interplay between the manufacturing prowess of the Asia Pacific region and the insatiable demand for larger displays, predominantly served by Gen. 8 and above substrates, will continue to define the leading dynamics of the global Glass Substrates for TFT-LCD market.

The Glass Substrates for TFT-LCD industry is experiencing several powerful growth catalysts. The insatiable consumer appetite for larger and more immersive display experiences, particularly in televisions and monitors, directly fuels the demand for larger glass substrates, with the Gen. 8 and above segment leading this charge. The expansion of TFT-LCD technology into new applications like automotive displays, smart home devices, and industrial automation further broadens the market reach. Continuous innovation in display technology, pushing for higher resolutions, improved energy efficiency, and enhanced visual quality, necessitates the use of advanced, high-performance glass substrates. The ongoing recovery of the global economy and increasing disposable incomes in emerging markets also translate into higher consumer spending on electronic devices, indirectly boosting substrate demand.

This comprehensive report provides an exhaustive examination of the Glass Substrates for TFT-LCD market, meticulously dissecting its past, present, and future. The analysis spans from 2019 to 2033, with a deep dive into the Base Year of 2025 and the crucial Forecast Period of 2025-2033, drawing heavily on data from the Historical Period of 2019-2024. The report quantifies market size in millions of units, offering precise volumetric insights. It explores key market trends, identifies the driving forces behind market expansion, and critically analyzes the challenges and restraints that shape the industry landscape. Furthermore, the report pinpoints the dominant regions and segments, providing a clear understanding of where the market's momentum lies. It also highlights growth catalysts and profiles the leading industry players, alongside a timeline of significant developments. This holistic approach ensures stakeholders have a complete and actionable understanding of the global Glass Substrates for TFT-LCD market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Corning, AGC, NEG, Tunghsu Optoelectronic, AvanStrate, IRICO Group, Central Glass (CGC), LG Chem.

The market segments include Type, Application.

The market size is estimated to be USD 10260 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Glass Substrates for TFT-LCD," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Glass Substrates for TFT-LCD, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.