1. What is the projected Compound Annual Growth Rate (CAGR) of the Gin?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gin

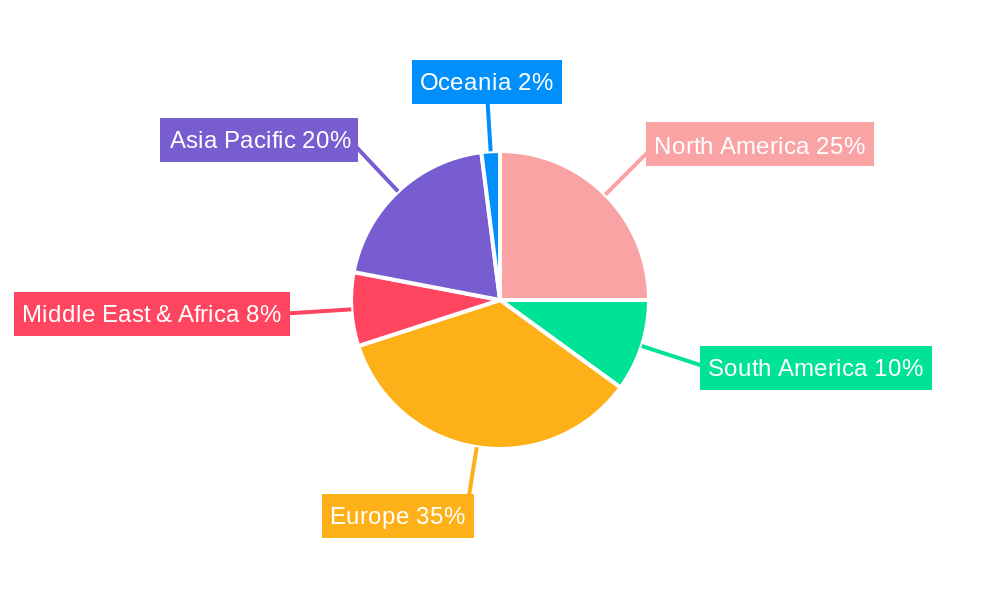

GinGin by Type (Pot Distilled Gin, Column Distilled Gin, Compound Gin, World Gin Production ), by Application (Pub, Household, Others, World Gin Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

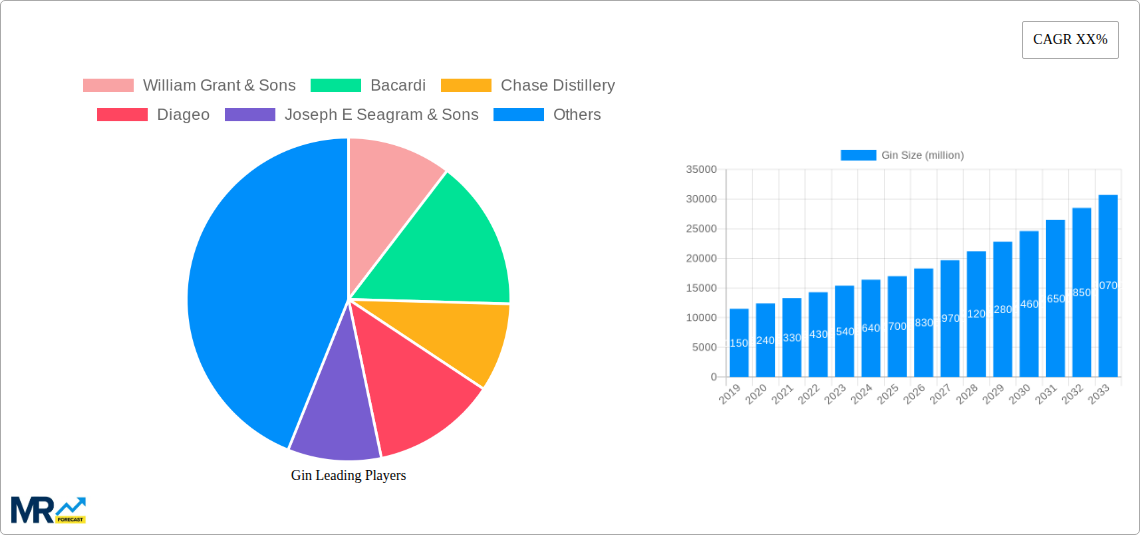

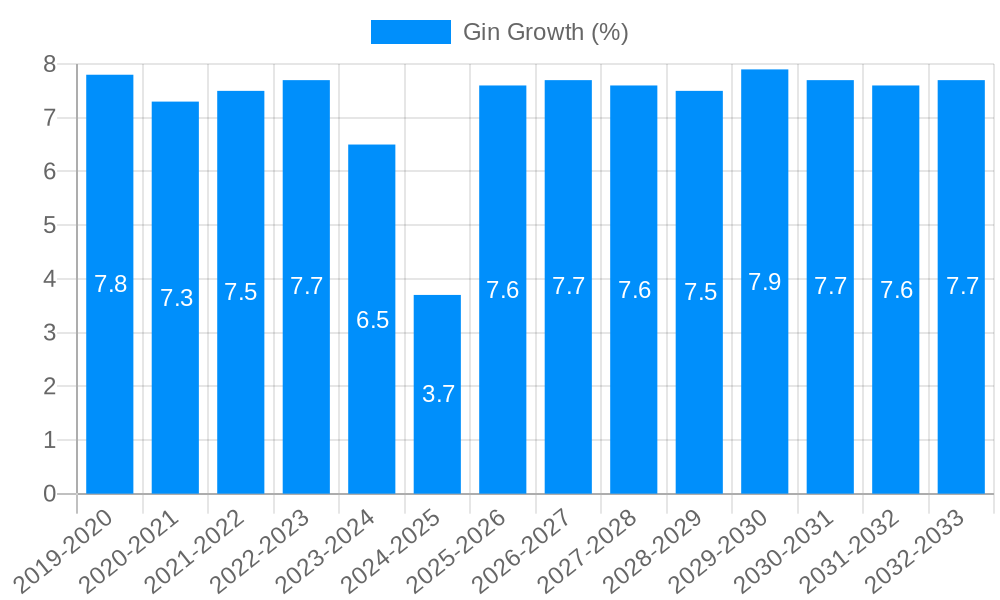

The global gin market is experiencing robust growth, driven by several key factors. Premiumization, a trend towards craft and artisanal gins, and the rising popularity of gin-based cocktails are fueling demand across various regions. The market is segmented by distillation type (pot distilled, column distilled, compound), application (pubs, households, others), and geography. While precise figures for market size and CAGR are unavailable from the provided data, industry reports suggest a global market valued in the billions, experiencing a compound annual growth rate (CAGR) of 5-7% annually. This growth is particularly strong in North America and Europe, but emerging markets in Asia-Pacific are also showing significant potential. The competitive landscape is populated by a mix of large multinational companies and smaller, craft distilleries, indicating ample opportunity for both established players and new entrants. However, challenges remain; increased production costs due to rising raw material prices and regulatory hurdles in some regions may act as constraints.

The market's success hinges on ongoing innovation in flavour profiles, the expansion into new markets, and the strategic development of premium product lines. The continued rise of the cocktail culture, particularly among millennials and Gen Z consumers, further solidifies the gin market's long-term growth potential. While the dominance of key players like William Grant & Sons and Diageo is undeniable, smaller, niche distilleries are carving out successful market segments by emphasizing quality ingredients, unique flavour combinations, and localized marketing strategies. Future growth will likely be influenced by consumer preferences for sustainable practices and the emergence of innovative packaging and distribution models. Understanding these dynamics is crucial for both established and aspiring players to navigate the evolving landscape and secure market share in this dynamic and increasingly competitive sector.

The global gin market, valued at XXX million units in 2025, is experiencing a period of dynamic growth, projected to reach XXX million units by 2033. This expansion is fueled by several key trends. Firstly, the rise of craft distilleries has significantly diversified the gin landscape, offering consumers a wider range of flavor profiles and production methods beyond traditional mass-produced brands. This trend is particularly evident in the burgeoning popularity of pot-distilled gins, prized for their complex flavor characteristics. Secondly, the premiumization of gin continues to gain traction, with consumers increasingly willing to pay more for high-quality, artisanal products. This is reflected in the growing demand for super-premium and ultra-premium gin brands. Thirdly, innovative flavor combinations and unique botanical infusions are driving experimentation and expanding the appeal of gin beyond its traditional consumer base. Flavors ranging from classic citrus notes to more adventurous combinations with spices, fruits, and even vegetables are captivating new palates. The increasing popularity of gin cocktails, particularly those featuring unique twists on classic recipes, further enhances its appeal. Finally, the growing awareness of gin's versatility as a mixer and its adaptability to various occasions (from sophisticated evenings to casual gatherings) broadens its market appeal. The historical period (2019-2024) has demonstrated a consistent upward trend, providing a solid foundation for optimistic future projections. The forecast period (2025-2033) promises continued growth driven by these multifaceted trends. The estimated year 2025 serves as a pivotal point, reflecting the culmination of past trends and the launchpad for future expansion.

Several factors are propelling the gin market's impressive growth. The rising disposable incomes in emerging markets, coupled with a growing preference for premium alcoholic beverages, are significantly contributing to increased demand. Furthermore, the increasing popularity of gin-based cocktails, driven by innovative mixology and the resurgence of classic recipes, is driving consumption. This is particularly true among younger demographics who are more experimental with their drink choices. The craft distilling movement, enabling small-batch production and unique flavor profiles, caters to a consumer preference for authenticity and high-quality ingredients. Marketing and branding initiatives by major players, focusing on the heritage and craftsmanship associated with gin, also enhance the product's image and appeal to a wider audience. Finally, the growing interest in culinary experiences and the use of gin in gourmet food pairings are further expanding its market presence, making it a versatile and adaptable spirit.

Despite its strong growth trajectory, the gin market faces certain challenges. Intense competition among established brands and new entrants can exert downward pressure on pricing and profitability. Fluctuations in the prices of raw materials, particularly botanicals, can affect production costs and margins. Stricter regulations and licensing requirements in certain regions can pose obstacles to market entry and expansion for new players. Consumer health concerns related to alcohol consumption, along with increasing awareness of its potential health consequences, might partially constrain demand growth. Economic downturns and shifts in consumer spending habits can also impact demand for premium alcoholic beverages like gin. Finally, the sustainability of gin production, particularly concerning water usage and the sourcing of botanicals, presents both a challenge and an opportunity for the industry to address environmentally conscious consumers.

The global gin market exhibits diverse growth patterns across regions and segments. However, several key areas stand out:

Household Consumption: The household segment is a major driver of growth, surpassing both pub and other consumption channels. This reflects the increasing popularity of gin as a home-drinking option, enabled by cocktail culture and the availability of premium ingredients for home mixing. The growth in home consumption is further fueled by the increasing number of individuals seeking unique, quality experiences within the comfort of their own homes.

Europe: Europe, particularly the UK, remains a key market for gin, representing a substantial portion of global consumption. The historical association of gin with British culture and the high concentration of both established and craft distilleries in the region contribute to its dominance.

Premium Gin: The premium and super-premium segments demonstrate the highest growth rates. Consumers are willing to pay a higher price for quality, unique flavor profiles, and the artisanal nature of many premium gins.

Pot Distilled Gin: The demand for pot-distilled gin is experiencing significant growth, exceeding the growth rates of column-distilled and compound gins. The complex flavor profiles and unique characteristics associated with pot distillation appeal to discerning consumers.

In summary, the confluence of household consumption's expansion, Europe's established market position, premiumization of gin, and a preference for pot-distilled gin combine to dominate market growth. The projected growth in these areas will significantly contribute to the overall expansion of the global gin market throughout the forecast period (2025-2033).

The continued premiumization of gin, alongside the burgeoning craft distilling scene and innovative flavor explorations, is acting as a potent catalyst for industry growth. Furthermore, targeted marketing and branding initiatives highlight the heritage and sophistication of the product, further fueling demand.

The gin market is experiencing robust growth driven by several key factors, including the increasing demand for premium spirits, the craft distilling movement, and the popularity of sophisticated gin-based cocktails. This comprehensive report offers a deep dive into these trends and provides a detailed outlook on the future of the gin market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include William Grant & Sons, Bacardi, Chase Distillery, Diageo, Joseph E Seagram & Sons, Vok Beverages (Bickford's Group), Chivas Brothers, Pernod Ricard, Archie Rose Distilling, Aviation American Gin, Lucas Bols Amsterdam, Proximo Spirits, Citadelle, Whitbread, Bruichladdich Distillery, Catoctin Creek Distilling, Westmorland Spirits, Greenalls Gin, Sipsmith, Uganda Breweries, Ogham Craft Spirit, That Spirited Lot Distillers, Saint Ives Liquor, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Gin," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.