1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas-Tight and Liquid-Tight Chemical Protective Clothing?

The projected CAGR is approximately 14.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gas-Tight and Liquid-Tight Chemical Protective Clothing

Gas-Tight and Liquid-Tight Chemical Protective ClothingGas-Tight and Liquid-Tight Chemical Protective Clothing by Type (Airtight Protective Clothing, Liquidtight Protective Clothing, World Gas-Tight and Liquid-Tight Chemical Protective Clothing Production ), by Application (Chemical Industry, Nuclear Industry, Petroleum Industry, Others, World Gas-Tight and Liquid-Tight Chemical Protective Clothing Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

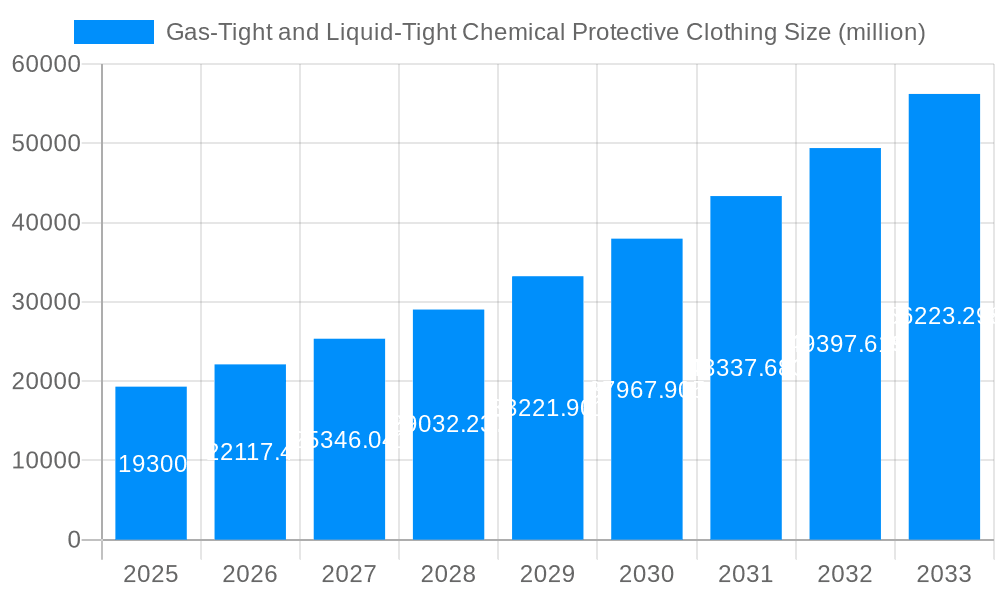

The global market for Gas-Tight and Liquid-Tight Chemical Protective Clothing is experiencing robust expansion, projected to reach an estimated \$19.3 billion by 2025. This significant valuation underscores the critical importance of advanced safety solutions in hazardous environments. The market is driven by a confluence of factors, including increasingly stringent safety regulations across industries and a heightened awareness of worker protection. The chemical, nuclear, and petroleum sectors are primary beneficiaries and consumers of these specialized garments, necessitating their use to mitigate risks associated with exposure to toxic substances, corrosive materials, and hazardous gases. Emerging economies and the continuous industrialization in regions like Asia Pacific are also fueling demand, as new facilities adopt best-in-class safety protocols from inception.

The projected Compound Annual Growth Rate (CAGR) of 14.8% from 2025 to 2033 signifies a dynamic and rapidly evolving market. This impressive growth trajectory is fueled by technological advancements leading to lighter, more breathable, and more resistant protective materials. Innovations in fabric technology, such as advanced polymer coatings and hermetic sealing techniques, are enhancing both the efficacy and wearer comfort of gas-tight and liquid-tight suits. Furthermore, the increasing complexity of industrial operations and the discovery of new chemical compounds necessitate the development of even more sophisticated protective gear. While the market benefits from strong demand drivers, potential restraints could include the high initial cost of specialized clothing and the need for rigorous training and maintenance protocols to ensure optimal performance. However, the uncompromised priority placed on human safety and the avoidance of catastrophic industrial accidents are expected to overshadow these challenges, ensuring sustained market growth.

Here's a comprehensive report description for Gas-Tight and Liquid-Tight Chemical Protective Clothing, incorporating your specified requirements:

The global market for Gas-Tight and Liquid-Tight Chemical Protective Clothing is poised for significant expansion, driven by an increasingly safety-conscious industrial landscape. The Study Period, spanning from 2019 to 2033, encompasses a comprehensive analysis of market dynamics, with the Base Year and Estimated Year both set at 2025, providing a crucial snapshot for the Forecast Period of 2025-2033. Historical data from 2019-2024 highlights the foundational growth and emerging patterns. In the Historical Period, the market demonstrated steady growth, a trend expected to accelerate. By the Estimated Year of 2025, the global market value for this critical safety equipment is projected to reach an impressive $3.5 billion, indicating a robust demand for advanced protective solutions. This surge is underpinned by stringent regulatory frameworks and an escalating awareness of the inherent risks associated with chemical handling across various sectors. The market is characterized by continuous innovation in material science and garment design, leading to enhanced comfort, mobility, and, most importantly, superior protection against a wide array of hazardous substances. The increasing adoption of smart technologies within protective gear, such as integrated sensors for environmental monitoring, further augments its appeal. The competitive landscape is dynamic, with established players and emerging innovators striving to capture market share by offering specialized solutions tailored to specific industrial needs. The forecast period anticipates a compound annual growth rate (CAGR) that will push the market value towards $6.2 billion by 2033, reflecting sustained investment in safety infrastructure and the evolving nature of industrial operations. This growth trajectory underscores the indispensable role of high-performance chemical protective clothing in safeguarding human health and operational integrity. The market's segmentation by type and application reveals distinct areas of demand, with Airtight Protective Clothing and Liquidtight Protective Clothing each contributing significantly to the overall market value, while the Chemical Industry remains a dominant application segment.

Several potent forces are actively propelling the growth and adoption of gas-tight and liquid-tight chemical protective clothing. Foremost among these is the unwavering commitment to worker safety, a paramount concern across all industrial sectors. The increasing stringency of government regulations and occupational health standards worldwide mandates the use of appropriate personal protective equipment (PPE), directly influencing the demand for advanced chemical suits. Industries such as the Chemical, Nuclear, and Petroleum sectors, inherently exposed to high-risk environments, are continuously investing in state-of-the-art protective gear to mitigate the devastating consequences of chemical exposure. Furthermore, technological advancements in material science have enabled the development of lighter, more durable, and more breathable protective fabrics, enhancing user comfort and compliance without compromising on protection levels. This innovation directly addresses historical limitations of bulky and restrictive traditional gear. The growing awareness among both employers and employees about the potential long-term health effects of chemical exposure, coupled with a rising sense of corporate social responsibility, further fuels the demand for high-quality protective solutions. Moreover, the increasing frequency of industrial accidents and incidents, though unfortunate, often serves as a stark reminder and catalyst for enhanced safety protocols, including the procurement of superior chemical protective clothing. The global market's projected trajectory, reaching an estimated $3.5 billion in 2025 and heading towards $6.2 billion by 2033, is a testament to these driving forces and the critical need for robust safety measures.

Despite the robust growth prospects, the gas-tight and liquid-tight chemical protective clothing market faces several significant challenges and restraints that warrant careful consideration. A primary hurdle is the high cost of production and procurement. Advanced materials and complex manufacturing processes required for gas-tight and liquid-tight garments contribute to a substantial price point, which can be prohibitive for smaller organizations or those operating with tighter budgets. This cost factor can inadvertently lead to compromises on quality or a delay in necessary upgrades. Secondly, user comfort and wearability remain persistent issues. While material science is advancing, many of these highly protective suits can still be hot, heavy, and restrictive, leading to wearer fatigue, reduced dexterity, and potential heat stress. This can impact worker productivity and compliance with mandatory usage protocols. Proper training and maintenance are also critical. Ensuring that end-users are adequately trained on the correct donning, doffing, inspection, and disposal of chemical protective clothing is paramount to its effectiveness. Inadequate training can lead to breaches in protection, even with the best equipment. Furthermore, the disposal of contaminated protective clothing presents an environmental and logistical challenge, requiring specialized procedures and facilities, which add to the overall operational cost and complexity. Finally, counterfeit products pose a threat to the market, undermining legitimate manufacturers and potentially exposing users to substandard protection, which can have catastrophic consequences. Navigating these challenges is crucial for sustained and safe market development.

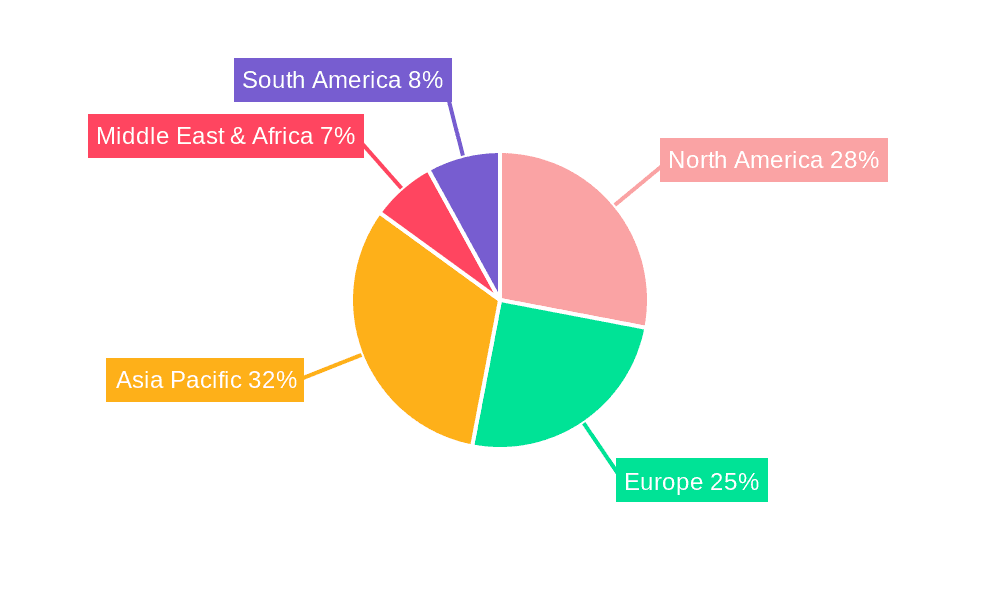

Several regions and segments are poised to dominate the global Gas-Tight and Liquid-Tight Chemical Protective Clothing market, driven by a confluence of industrial activity, regulatory emphasis, and technological adoption.

Dominant Regions:

Dominant Segments:

By 2025, these regions and segments are collectively expected to account for the majority of the global market's estimated $3.5 billion valuation, with continued expansion anticipated throughout the forecast period, pushing the market towards $6.2 billion by 2033.

The Gas-Tight and Liquid-Tight Chemical Protective Clothing industry is fueled by several powerful growth catalysts. The paramount driver is the ever-increasing emphasis on worker safety and health, leading to more stringent regulatory mandates and a higher adoption rate of advanced protective solutions globally. Technological innovations in material science, resulting in lighter, more flexible, and more breathable fabrics, are enhancing user comfort and compliance. Furthermore, the expansion of key end-user industries, such as the chemical, petroleum, and nuclear sectors, particularly in emerging economies, is creating sustained demand. The growing awareness of potential long-term health impacts from chemical exposure also encourages proactive investment in high-level protective gear.

This report offers a truly comprehensive analysis of the Gas-Tight and Liquid-Tight Chemical Protective Clothing market, providing invaluable insights for stakeholders. It delves deep into market segmentation, examining the distinct demand drivers for Airtight Protective Clothing versus Liquidtight Protective Clothing, and the application-specific needs within the Chemical, Nuclear, and Petroleum Industries. The report meticulously forecasts market trends, with a detailed breakdown from the Base Year of 2025 to the end of the Study Period in 2033, building upon a solid foundation of historical data from 2019-2024. Furthermore, it scrutinizes the competitive landscape, identifying key players and their strategic moves, and illuminates the technological advancements and regulatory shifts shaping the industry's future. This detailed coverage ensures a holistic understanding of the market's present state and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.8%.

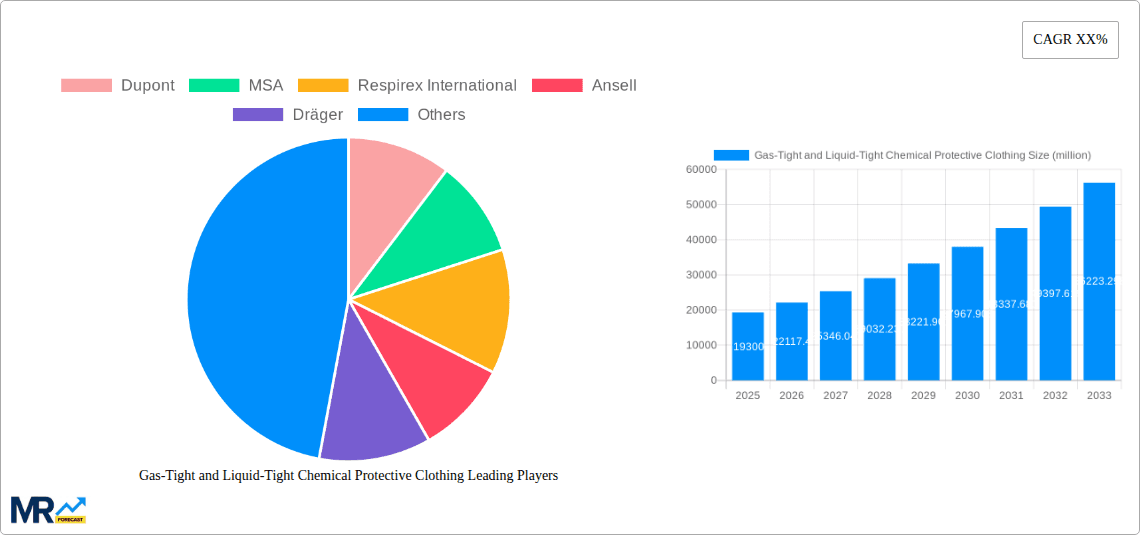

Key companies in the market include Dupont, MSA, Respirex International, Ansell, Dräger, Kappler, Lakeland Industries, Saint-Gobain, Tesimax, Matisec, Zhejiang Safe-pro Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Gas-Tight and Liquid-Tight Chemical Protective Clothing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gas-Tight and Liquid-Tight Chemical Protective Clothing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.