1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Outsourcing Service?

The projected CAGR is approximately 16.21%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Game Outsourcing Service

Game Outsourcing ServiceGame Outsourcing Service by Type (Game Design and Development Outsourcing Services, Game Testing and Quality Assurance Outsourcing Services, Game Technical Support Outsourcing Service, Other), by Application (SMEs, Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

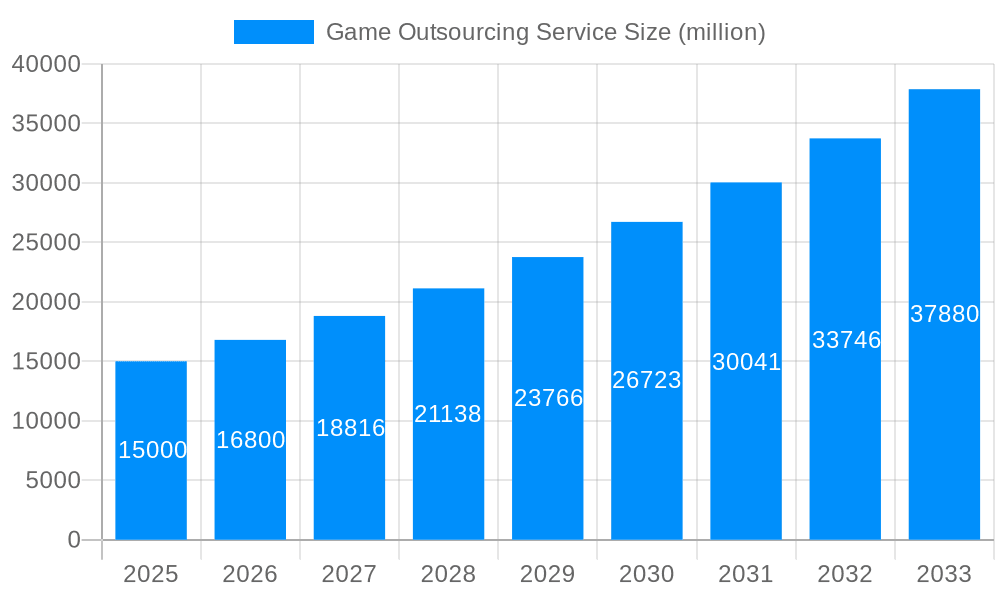

The global game outsourcing services market is exhibiting significant expansion, propelled by escalating demand for high-quality games across multiple platforms, and the surging popularity of esports and mobile gaming. This market, projected to reach $6.4 billion by 2025, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 16.21% from 2025 to 2033, anticipating a valuation of approximately $40 billion by 2033. Growth drivers include the increasing complexity of game development, necessitating specialized expertise; the substantial rise in mobile gaming and esports demand; the evolution towards cloud-based and cross-platform gaming solutions; and the adoption of agile development methodologies requiring flexible outsourcing partnerships.

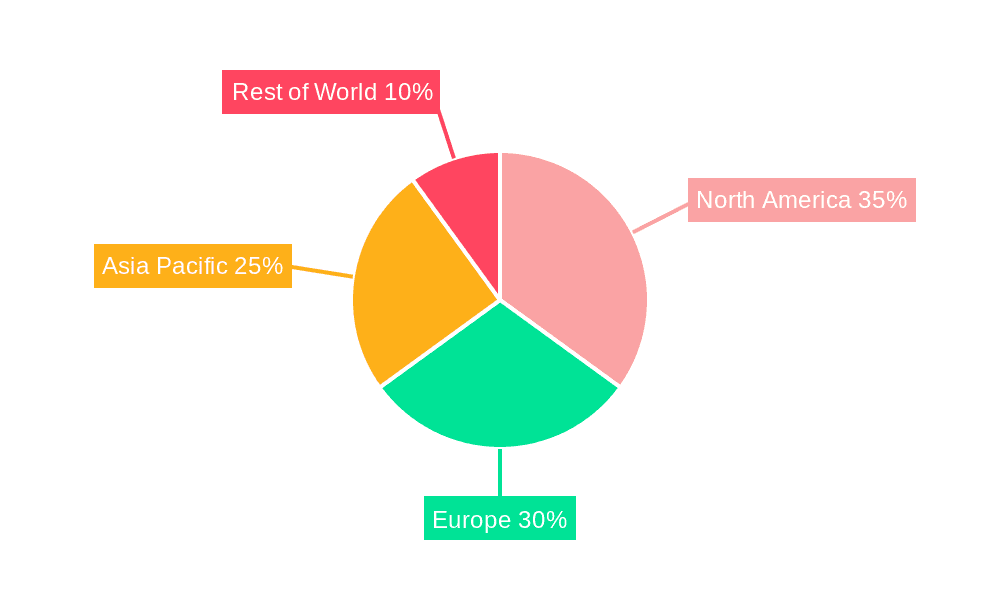

The Game Design and Development Outsourcing Services segment holds the leading market share, followed by Game Testing and Quality Assurance Outsourcing Services. Large enterprises represent the dominant customer segment due to their substantial budgets and pronounced need for outsourced development proficiency. Geographically, North America and Europe currently lead market penetration. However, the Asia-Pacific region is poised for accelerated growth, driven by the expanding gaming ecosystems in China and India. Despite potential challenges such as currency fluctuations and communication intricacies, the market outlook remains robust, supported by ongoing technological innovation, broader demographic adoption of gaming, and the enduring pursuit of premium, engaging interactive entertainment experiences. Leading entities like Keywords Studios and Virtuos are strategically positioned to capitalize on this growth trajectory.

The global game outsourcing service market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the increasing complexity and cost of game development, coupled with the rising demand for high-quality games across diverse platforms, companies are increasingly turning to specialized outsourcing partners. This trend is particularly pronounced in the mobile gaming sector, which is experiencing a surge in popularity and competition. The historical period (2019-2024) witnessed a steady rise, with the base year (2025) marking a significant inflection point. The forecast period (2025-2033) anticipates robust expansion, fueled by technological advancements like cloud gaming and the metaverse, which further increase the need for specialized expertise and scalable development teams. Smaller game studios are leveraging outsourcing to access skills and resources beyond their internal capabilities, while larger enterprises are utilizing it for cost optimization and accelerated time-to-market. The market is witnessing a shift towards specialized services, with companies focusing on niche areas like AI integration, VR/AR development, and esports integration. This specialization allows for greater efficiency and higher quality output. The increasing adoption of agile methodologies and DevOps practices within the game development lifecycle further fuels the demand for outsourcing partners with expertise in these areas. Moreover, geographic diversification of outsourcing locations is emerging, with regions beyond traditional hubs emerging as cost-effective and talent-rich alternatives. The market's evolution reflects a broader trend in the software development industry, where outsourcing is no longer a niche strategy but a core component of successful product development. The increasing adoption of cloud-based development tools and platforms also facilitates seamless collaboration between in-house teams and outsourcing partners. The shift towards a "game-as-a-service" model is also impacting the market, pushing for continuous updates, content additions, and ongoing technical support, enhancing the long-term engagement of outsourcing partners. The overall landscape is characterized by intense competition and a continuous drive for innovation, with companies constantly seeking ways to enhance their service offerings and cater to the ever-evolving needs of the game development industry.

Several key factors are propelling the growth of the game outsourcing service market. Firstly, the rising complexity of modern game development necessitates specialized skills across various domains, such as 3D modeling, animation, programming, sound design, and quality assurance. In-house teams often lack the breadth and depth of expertise required to handle all aspects of game development efficiently. Outsourcing allows companies to access a pool of specialized talent on demand, significantly reducing development time and cost. Secondly, the escalating cost of hiring and retaining skilled game developers is a significant driver. Outsourcing offers a cost-effective alternative, especially for smaller studios and independent developers. Thirdly, the increasing demand for high-quality games across multiple platforms (PC, consoles, mobile) necessitates scalable development capabilities. Outsourcing provides the flexibility to scale teams up or down based on project needs, ensuring that resources are efficiently utilized. Fourthly, the need for faster time-to-market is driving the adoption of outsourcing services. By leveraging external teams, companies can accelerate their development cycles and launch games more quickly, gaining a competitive edge in the market. Finally, the geographic distribution of talent is a key factor. Outsourcing allows companies to tap into talent pools in different regions, leading to access to a diverse range of skills and cost advantages. This geographical diversification enhances efficiency and ensures a continuous flow of talented professionals. The combination of these factors contributes to the robust growth trajectory projected for the game outsourcing service market in the coming years.

Despite the significant growth potential, the game outsourcing service market faces several challenges. Communication barriers and cultural differences can complicate collaboration between in-house teams and outsourced partners, potentially leading to misunderstandings and delays. Ensuring consistent quality of work across different outsourcing teams requires robust quality control processes and effective communication strategies. Intellectual property protection is a major concern; rigorous contractual agreements and robust security measures are vital to mitigate risks associated with sharing sensitive game assets. Finding and vetting reliable outsourcing partners can be a time-consuming and complex process, demanding careful due diligence to identify teams with the required expertise and a proven track record. Managing multiple outsourcing partners simultaneously can create logistical and coordination challenges, requiring efficient project management tools and strategies. Time zone differences and varying work schedules can create communication hurdles and impact project timelines, demanding careful planning and coordination. Additionally, the potential for unforeseen costs and hidden expenses necessitates clear contractual agreements and meticulous budgeting. Finally, maintaining consistent brand identity and artistic style across different outsourced teams requires strong design guidelines and meticulous quality assurance. Overcoming these challenges requires a strategic approach to outsourcing, careful partner selection, and robust project management techniques.

The game outsourcing service market is geographically diverse, with several regions experiencing significant growth. However, Asia, specifically India and China, are projected to dominate the market due to a large pool of skilled developers, cost advantages, and government support for the gaming industry. These regions offer a considerable cost advantage compared to Western markets, making them attractive destinations for outsourcing game development, testing, and support services. Within the segment types, Game Design and Development Outsourcing Services are anticipated to hold the largest market share. This reflects the core nature of game development, where outsourcing is frequently utilized for a wide range of tasks, from initial concept design to asset creation and programming.

India: Boasts a large and growing pool of talented game developers, often at a significantly lower cost than Western counterparts. Many Indian outsourcing firms possess extensive experience in various game development aspects.

China: A major player in the global gaming market, China has a vast number of developers and studios proficient in game development, testing, and art creation.

Game Design and Development Outsourcing Services: This segment encompasses a broad range of activities crucial to game creation, driving the highest demand for outsourcing services. The increasing complexity of game development processes further enhances the significance of this segment.

Large Enterprises: Larger game development companies often leverage outsourcing to augment their internal capabilities, manage increased workloads, and access specialized skills efficiently. Their higher budgets allow them to invest in higher quality outsourcing services.

In summary: The confluence of cost-effectiveness, abundant skilled labor, and significant growth within the gaming sector positions Asia, specifically India and China, as dominant regions. Within the segments, Game Design and Development Outsourcing Services dominate due to their fundamental role in the game development lifecycle. Large Enterprises, due to their scale and budget, significantly contribute to this segment's growth.

Several factors are catalyzing the growth of the game outsourcing service industry. The increasing demand for high-quality games across numerous platforms fuels the need for specialized skills and efficient development processes, which outsourcing effectively addresses. Technological advancements, particularly in AI, VR/AR, and cloud gaming, create new opportunities for specialized outsourcing services, fostering innovation and expansion within the sector. The rising popularity of eSports and mobile gaming further intensifies competition, driving the demand for rapid game development and continuous updates, fueling the need for outsourcing support.

This report offers a comprehensive overview of the Game Outsourcing Service market, covering its trends, driving forces, challenges, key players, and future outlook. The analysis includes a detailed market segmentation by type of service, application, and geography, providing valuable insights for stakeholders. The forecast period extends to 2033, offering a long-term perspective on market dynamics. The report also highlights key industry developments, shedding light on the evolving landscape of the game outsourcing service sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.21% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.21%.

Key companies in the market include Keywords Studios, Juego Studios, Chromatic Games, Quytech, N-IX Game & VR Studio, Room 8 Studio, Virtuos, Innovecs Games, 3D Ace, Zhongyi Games, Wuhan Chuangyuji Network Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 6.4 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Game Outsourcing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Game Outsourcing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.