1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture E-commerce?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture E-commerce

Furniture E-commerceFurniture E-commerce by Type (/> Solid Wood Type, Metal Type, Glass Type, Other), by Application (/> Residential Furniture, Commercial Furniture), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

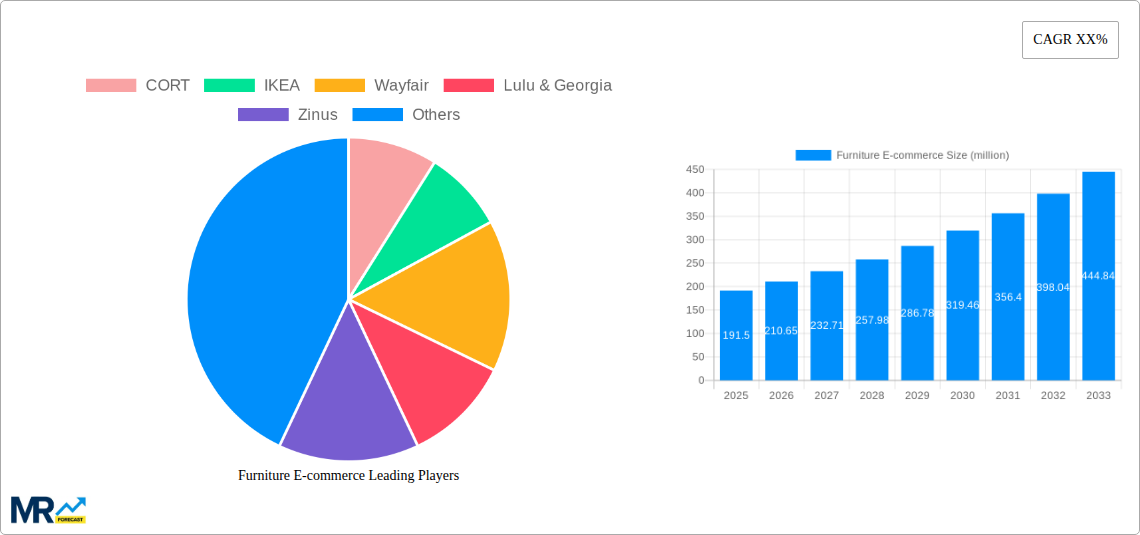

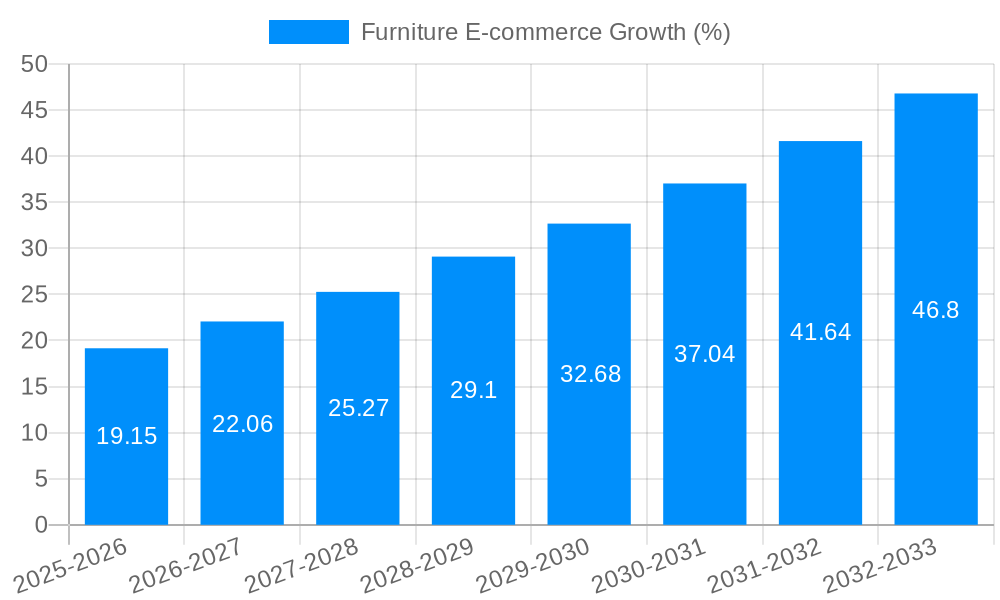

The global furniture e-commerce market, valued at $191.5 million in 2025, is experiencing robust growth. While a precise CAGR isn't provided, considering the industry's ongoing digital transformation and the increasing preference for online shopping, a conservative estimate of 10-15% annual growth seems reasonable. This expansion is fueled by several key drivers: the rising adoption of smartphones and internet access, particularly in emerging markets; the convenience and wide selection offered by online platforms; and the increasing popularity of home improvement and renovation projects. Furthermore, innovative marketing strategies employed by e-commerce giants like Amazon and specialized furniture retailers are boosting sales. The market faces some challenges, including concerns about product quality assurance and logistical complexities associated with delivering bulky furniture items. However, technological advancements such as augmented reality (AR) applications that allow virtual furniture placement and improved delivery infrastructure are mitigating these restraints. The market is segmented based on product type (e.g., bedroom, living room, outdoor), price range, and customer demographics. Major players like IKEA, Wayfair, and Amazon are driving market consolidation, leveraging their established brand recognition and extensive logistics networks. The competition is intense, emphasizing the importance of customer experience, competitive pricing, and effective marketing strategies for sustained success.

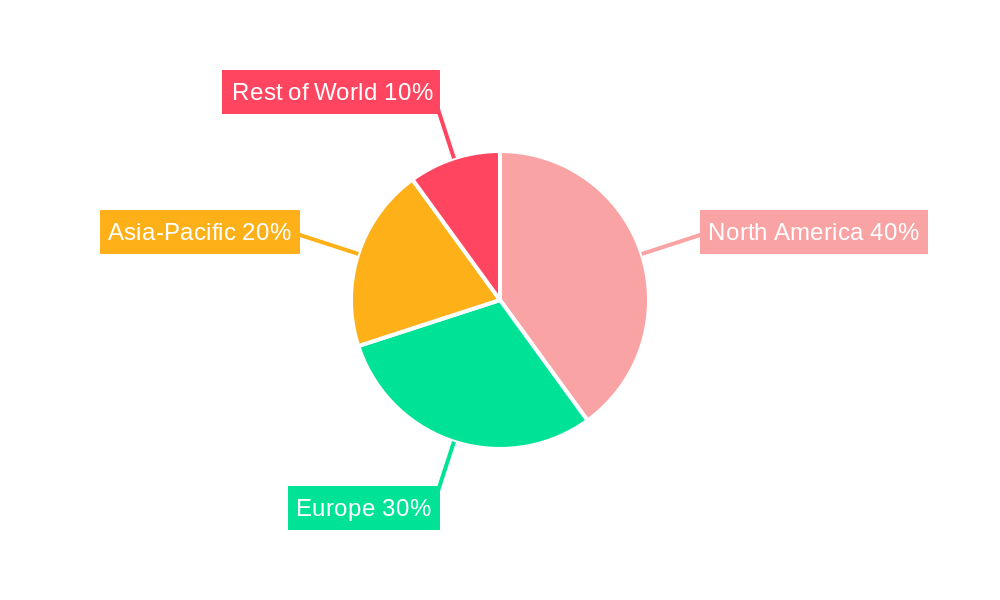

The forecast period (2025-2033) suggests continued growth, driven by increasing disposable incomes, particularly in developing economies. The market will likely witness further consolidation among existing players and the emergence of niche players catering to specific customer segments. Strategic partnerships between online retailers and physical furniture stores will likely become more prevalent, creating hybrid models that combine the convenience of online shopping with the tactile experience of physical showrooms. Further technological advancements, including personalized recommendations and improved online visualization tools, will further enhance the customer experience, fueling market growth. Regional variations in market growth will depend on factors such as internet penetration, consumer spending habits, and the level of e-commerce infrastructure development. North America and Europe are expected to remain significant markets, but Asia-Pacific is poised for significant growth due to its expanding middle class and rising adoption of e-commerce.

The global furniture e-commerce market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. This surge is driven by a confluence of factors, including the increasing adoption of online shopping, particularly among millennials and Gen Z who are digitally native and prefer the convenience of online purchasing. The historical period (2019-2024) witnessed a significant shift in consumer behavior, with a substantial increase in online furniture purchases. This trend is expected to continue throughout the forecast period (2025-2033), with the estimated year 2025 marking a pivotal point in market maturity. The market's expansion isn't solely reliant on established players; innovative business models, like subscription-based furniture rentals (popularized by companies like CORT) and the rise of direct-to-consumer brands, are disrupting traditional retail channels. The integration of augmented reality (AR) and virtual reality (VR) technologies is revolutionizing the online furniture shopping experience, allowing consumers to visualize furniture in their homes before purchasing. This reduces the risk associated with online furniture buying, a significant barrier to entry in the past. The market also reflects a growing awareness of sustainability and ethical sourcing, driving demand for eco-friendly and responsibly manufactured furniture. The year 2025 serves as a crucial benchmark, signifying not only market stabilization but also the widespread adoption of new technologies and consumer preferences. This shift towards a more sophisticated and personalized online shopping experience promises continued, robust growth well into the next decade. This report delves into these trends, providing a detailed analysis of market size (in millions of units) and segment-specific growth trajectories. The study period of 2019-2033 provides a comprehensive historical and future perspective on this dynamic market.

Several key factors are propelling the growth of the furniture e-commerce market. The convenience and accessibility offered by online platforms are paramount. Consumers can browse a vast selection of furniture from the comfort of their homes, comparing prices and styles at their leisure, a stark contrast to the often time-consuming experience of visiting physical stores. Furthermore, the expansion of high-speed internet access globally has significantly broadened the reach of online retailers, allowing even consumers in remote areas to participate in the e-commerce revolution. The rise of mobile commerce plays a crucial role, enabling consumers to shop for furniture anytime, anywhere. Targeted advertising and personalized recommendations, leveraging data-driven insights, effectively guide consumers towards products that align with their preferences and budgets. The integration of innovative technologies, such as AR and VR, further enhances the online shopping experience by bridging the gap between the online and offline worlds. These technologies allow consumers to virtually place furniture in their homes, minimizing the uncertainty associated with online purchases. Finally, competitive pricing strategies, coupled with frequent sales and promotional offers, further incentivize online purchases, making furniture e-commerce a compelling alternative to traditional retail.

Despite the significant growth, the furniture e-commerce market faces considerable challenges. One major hurdle is the difficulty in accurately representing the size, color, and texture of furniture through online images and videos. This can lead to discrepancies between consumer expectations and the actual product, resulting in returns and dissatisfaction. Furthermore, the high cost of shipping and handling large, bulky furniture items represents a significant expense for both consumers and retailers. Concerns regarding product assembly, damage during shipping, and the overall return process can also deter potential customers. The trust factor remains vital; consumers need assurance regarding the quality, authenticity, and durability of the furniture purchased online. Establishing trust requires effective communication, transparent return policies, and positive customer reviews. Finally, the market's competitive nature necessitates constant innovation and adaptation to remain relevant and attract customers in an increasingly saturated landscape. Overcoming these challenges requires a combination of technological advancements, improved customer service, and robust logistics solutions.

North America (United States and Canada): This region is currently a dominant player, driven by high internet penetration, disposable income, and a preference for online shopping. The established e-commerce infrastructure and presence of major players like Wayfair and Amazon contribute significantly to this market dominance. The market size in millions of units is substantial, and continued growth is expected due to sustained consumer demand for convenience and the expansion of online retail options.

Europe (Western Europe): Strong e-commerce adoption rates, a growing middle class, and a preference for modern and stylish furniture are fueling the European market. Countries like Germany and the UK are major contributors, with significant market share in terms of both value and unit sales.

Asia-Pacific (China and India): This region presents immense growth potential, driven by a rapidly expanding middle class, increasing urbanization, and rising disposable incomes. However, challenges such as logistics infrastructure and payment methods need to be addressed to unlock the full potential of this market. Despite these challenges, the sheer size of the population and burgeoning e-commerce sector make it a key region to watch.

Segments: The mid-range furniture segment is currently experiencing strong growth, as consumers seek affordable yet stylish options. The home décor segment is also witnessing significant expansion, with customers investing in accessories and smaller items to enhance their living spaces. The specialized furniture segment (e.g., ergonomic office chairs, custom-made furniture) is gaining traction as consumers prioritize functionality and personalization.

Several factors will continue to propel the growth of the furniture e-commerce market. Technological innovations like AR/VR will enhance the online shopping experience, improving customer satisfaction. The increasing adoption of mobile commerce and the expansion of high-speed internet access will further expand market reach. Growth will also be fueled by the increasing popularity of direct-to-consumer brands, offering competitive pricing and unique styles.

This report offers a comprehensive analysis of the furniture e-commerce market, providing valuable insights into market trends, driving forces, challenges, and key players. The detailed segmentation and regional breakdown allow for a thorough understanding of market dynamics, facilitating informed decision-making for businesses operating in or planning to enter this dynamic sector. The long-term forecast (2025-2033) provides a strategic perspective on future market growth and evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CORT, IKEA, Wayfair, Lulu & Georgia, Zinus, Amazon, Anthropologie, West Elm, One Kings Lane, Novogratz, World Market, Masco, La-Z-Boy, Ashley, Danube Group, 2XL Furniture and Home Décor, Royal Furniture, Linshimuye, Kuka Home, Suofeinuo, .

The market segments include Type, Application.

The market size is estimated to be USD 191500 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Furniture E-commerce," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture E-commerce, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.