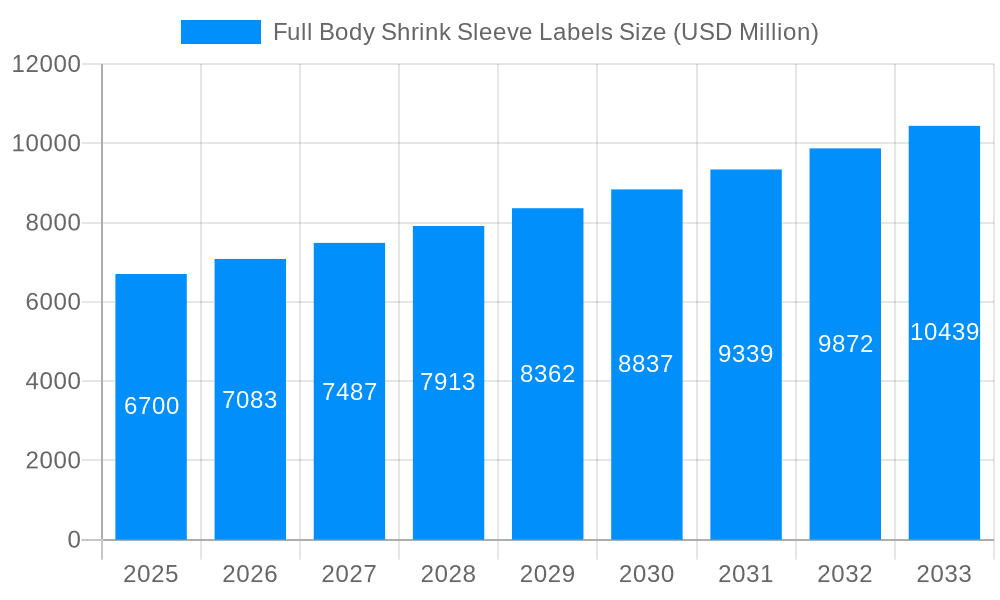

1. What is the projected Compound Annual Growth Rate (CAGR) of the Full Body Shrink Sleeve Labels?

The projected CAGR is approximately 5.7%.

Full Body Shrink Sleeve Labels

Full Body Shrink Sleeve LabelsFull Body Shrink Sleeve Labels by Type (Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polylactic Acid (PLA), Others, World Full Body Shrink Sleeve Labels Production ), by Application (Food & Beverage, Pharmaceuticals, Household, Personal Care & Cosmetics, Others, World Full Body Shrink Sleeve Labels Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Full Body Shrink Sleeve Labels market is poised for robust expansion, projecting a significant market size of USD 6.7 billion in 2025. This growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.7% anticipated from 2025 through 2033. This upward momentum is largely propelled by the increasing demand for visually appealing and informative packaging solutions across diverse consumer sectors. The food and beverage industry, in particular, is a primary driver, leveraging shrink sleeve labels for enhanced branding, tamper-evidence, and on-pack promotions. Similarly, the pharmaceuticals and personal care & cosmetics sectors are increasingly adopting these labels for their ability to convey complex product information, comply with stringent regulatory requirements, and attract consumer attention in crowded marketplaces. The versatility of shrink sleeve labels, offering 360-degree branding and a premium aesthetic, is a key factor in their widespread adoption.

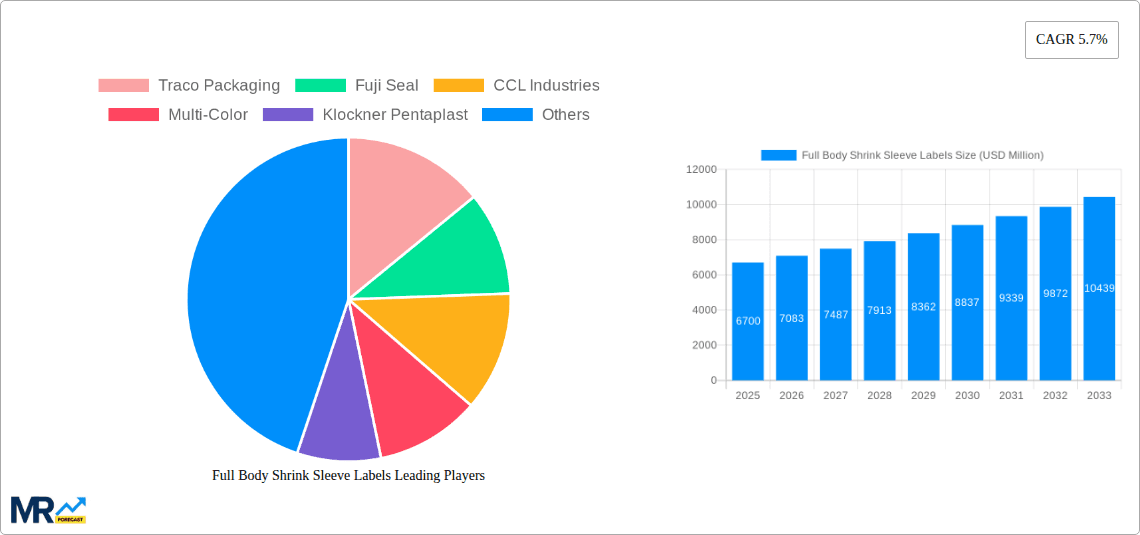

The market's growth is further bolstered by advancements in material science and printing technologies, enabling more sustainable and cost-effective production of shrink sleeve labels. Polyethylene (PE) and Polyvinyl Chloride (PVC) continue to dominate the material segment due to their cost-effectiveness and performance characteristics, while Polyethylene Terephthalate (PET) and Polylactic Acid (PLA) are gaining traction owing to growing environmental consciousness and demand for recyclable or compostable options. Key players such as Traco Packaging, Fuji Seal, and CCL Industries are actively investing in innovation and expanding their production capacities to cater to the escalating global demand. While the market exhibits strong growth, potential restraints could emerge from raw material price volatility and increasing competition, necessitating a focus on operational efficiency and product differentiation to maintain market leadership throughout the forecast period.

Here's a report description for Full Body Shrink Sleeve Labels, incorporating your specified elements and aiming for a unique perspective.

This report offers an in-depth analysis of the global Full Body Shrink Sleeve Labels market, projecting its trajectory from 2019 to 2033. Within the Base Year of 2025, we estimate the market to be valued at several tens of billions of USD, with a robust Forecast Period from 2025 to 2033 indicating sustained and significant expansion. The Historical Period of 2019-2024 laid the groundwork for current trends, revealing an evolving landscape driven by packaging innovation and consumer demand. Our comprehensive study, covering the Study Period of 2019-2033, delves into production volumes, applications, industry developments, and the strategic positioning of key players within this dynamic sector. We will explore the intricate interplay of material types and end-user segments, providing a holistic view of market opportunities and challenges.

The global Full Body Shrink Sleeve Labels market is experiencing a significant upswing, projected to reach a valuation of over $X0 billion by 2033, a testament to its growing indispensability in modern packaging. This growth is fueled by an escalating demand for visually appealing, information-rich, and tamper-evident labeling solutions across a multitude of industries. The Estimated Year of 2025 sees the market solidifying its position, with production volumes expected to hit unprecedented highs. A key trend is the increasing adoption of shrink sleeve labels for their ability to conform to complex container shapes, offering a 360-degree branding canvas that significantly enhances on-shelf presence. This is particularly evident in the Food & Beverage and Personal Care & Cosmetics segments, where aesthetic appeal and detailed product information are paramount. Furthermore, advancements in printing technologies, including high-resolution graphics, matte finishes, and special effects like thermochromic inks, are allowing brands to create more engaging and interactive packaging. The Historical Period of 2019-2024 witnessed a gradual shift from traditional labels to shrink sleeves, driven by their superior performance in terms of durability, moisture resistance, and resistance to scuffing, making them ideal for products that undergo rigorous handling and storage conditions. The growing emphasis on sustainability is also shaping trends, with a rising preference for recyclable materials like PET and PLA-based shrink sleeves, signaling a move towards eco-conscious packaging solutions. The ability of shrink sleeves to provide a complete seal also enhances product security, a critical factor in the Pharmaceuticals sector, contributing to their increasing market penetration. The overall outlook is one of continuous innovation and expanding applications, with shrink sleeves poised to become the dominant labeling format for many product categories.

The meteoric rise of the Full Body Shrink Sleeve Labels market is propelled by a confluence of powerful drivers, most notably the escalating consumer demand for visually engaging and informative packaging. In the Base Year of 2025, brands are increasingly leveraging the 360-degree branding potential of shrink sleeves to create a compelling on-shelf presence that cuts through market clutter. This is particularly crucial in competitive sectors like Food & Beverage and Personal Care & Cosmetics, where the label is often the primary point of contact with the consumer. The inherent functionality of shrink sleeves, including their ability to conform to virtually any container shape, their tamper-evident properties, and their resistance to environmental factors like moisture and abrasion, further solidifies their appeal. This robustness is a significant advantage, especially in the Household and Pharmaceuticals sectors, where product integrity and shelf-life are critical concerns. The historical period of 2019-2024 also saw a growing awareness of the limitations of conventional labeling methods, prompting manufacturers to seek more versatile and effective alternatives. The development of advanced printing technologies has also played a pivotal role, enabling the creation of vibrant graphics, intricate designs, and special effects that capture consumer attention. Moreover, the increasing emphasis on brand storytelling and the need to convey complex product information, including ingredients, usage instructions, and promotional messaging, find an ideal platform in the expansive surface area of shrink sleeves. This multifaceted functionality, combined with an evolving consumer preference for premium and informative packaging, continues to drive the market's upward trajectory.

Despite its robust growth trajectory, the Full Body Shrink Sleeve Labels market is not without its hurdles. A significant challenge lies in the cost of production, particularly for specialized materials and high-quality graphics, which can be higher compared to traditional label formats. This cost factor can sometimes be a deterrent for smaller businesses or for products with very tight margins, impacting adoption rates in certain Other segments. Furthermore, the recycling infrastructure for certain types of shrink sleeve materials, particularly those made from PVC, remains a concern. While advancements in PET and PLA-based sleeves are addressing this, the overall global recycling ecosystem needs to mature to fully support a circular economy for these materials, posing a restraint in environmentally conscious markets. The application process itself can also present challenges, requiring specialized equipment and precise temperature control to ensure proper shrinkage and adhesion. Inconsistent application can lead to aesthetic defects or functional issues, necessitating careful calibration and quality control. The material compatibility with diverse product contents also requires careful consideration, as certain chemicals or contents can degrade or react with the sleeve material, leading to product spoilage or label failure. Finally, the fluctuations in raw material prices, particularly for polymers like PET and PE, can impact profit margins and introduce price volatility, adding an element of unpredictability to the market's growth. These factors, while not insurmountable, require ongoing innovation and strategic planning from market players to mitigate their impact.

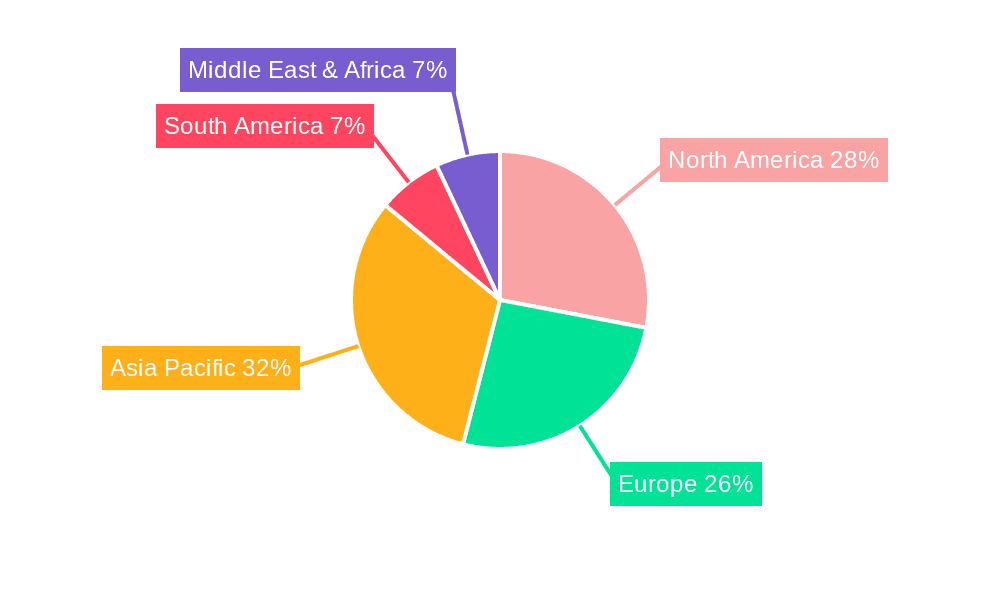

The global Full Body Shrink Sleeve Labels market is characterized by a dynamic interplay of dominant regions and segments, with the North America region poised to command a significant share in the Estimated Year of 2025 and throughout the Forecast Period of 2025-2033. This dominance is largely attributable to a robust and mature Food & Beverage sector, a burgeoning Personal Care & Cosmetics industry, and a highly advanced Pharmaceuticals sector, all of which are significant adopters of shrink sleeve technology. In North America, the sheer volume of consumer packaged goods, coupled with a strong emphasis on premium branding and innovative packaging, creates a fertile ground for shrink sleeves. The presence of leading multinational corporations with extensive R&D budgets and a keen eye for emerging packaging trends further bolsters the region's market leadership.

Within the Application segment, Food & Beverage is projected to be the most dominant. The continuous introduction of new products, seasonal packaging, and promotional campaigns in this sector necessitates flexible and visually appealing labeling solutions. Shrink sleeves offer an ideal platform for conveying detailed nutritional information, appealing product imagery, and promotional messages, all while providing tamper-evident security. For instance, beverages in uniquely shaped bottles or cans, convenience foods, and frozen food packaging frequently utilize full-body shrink sleeves to enhance brand visibility and provide essential consumer information. The sector's high-volume production further drives demand for efficient and cost-effective labeling, where shrink sleeves, despite their initial investment, often prove beneficial in the long run due to their durability and broad application scope.

Furthermore, the Personal Care & Cosmetics segment is also a significant growth driver. The highly competitive nature of this market demands packaging that not only protects the product but also resonates with consumers on an aesthetic and emotional level. Shrink sleeves allow for seamless, premium finishes, metallic effects, and intricate designs that elevate product appeal on retail shelves. The ability to wrap around complex shapes of cosmetic containers, such as makeup palettes, perfume bottles, and skincare jars, makes them indispensable.

When considering the Type of materials, Polyethylene Terephthalate (PET) is expected to emerge as a leading segment, particularly due to its excellent clarity, strength, and recyclability, aligning with the growing global focus on sustainability. PET shrink sleeves offer a good balance of performance and environmental responsibility, making them a preferred choice across various applications. The Household sector also contributes significantly, with cleaning products and detergents often employing shrink sleeves for their durability and resistance to chemicals.

In terms of other key regions, Europe follows closely behind North America, driven by similar factors such as a strong CPG market, stringent labeling regulations, and a growing consumer preference for sustainable packaging. The increasing adoption of advanced printing technologies and a focus on brand differentiation further fuel the demand for shrink sleeves in European markets. Emerging economies in Asia-Pacific are also witnessing rapid growth, propelled by increasing disposable incomes, a growing middle class, and the expansion of modern retail formats, all of which contribute to a higher demand for attractively packaged goods.

The Full Body Shrink Sleeve Labels industry is experiencing robust growth propelled by several key catalysts. The escalating consumer demand for visually appealing and informative packaging across Food & Beverage, Personal Care & Cosmetics, and Pharmaceuticals sectors is a primary driver. Furthermore, the increasing adoption of sustainable materials like PET and PLA is broadening their appeal. Advancements in printing technology, enabling high-quality graphics and special effects, are also enhancing their desirability. The inherent benefits of shrink sleeves, including tamper-evidence, durability, and conformity to complex shapes, continue to solidify their market position.

This report provides a comprehensive deep-dive into the global Full Body Shrink Sleeve Labels market, offering unparalleled insights for stakeholders. Covering the Study Period from 2019 to 2033, it meticulously analyzes production volumes, market segmentation by material type (including Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polylactic Acid (PLA), and Others) and application (Food & Beverage, Pharmaceuticals, Household, Personal Care & Cosmetics, and Others). The report presents a detailed market valuation for the Base Year of 2025, alongside a robust Forecast Period analysis from 2025 to 2033, projecting future growth trends and opportunities. With a keen focus on industry developments, growth catalysts, and the competitive landscape featuring leading players, this report equips businesses with the strategic intelligence needed to navigate and capitalize on the evolving shrink sleeve market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include Traco Packaging, Fuji Seal, CCL Industries, Multi-Color, Klockner Pentaplast, Huhtamaki, Clondalkin Group, Brook & Whittle, WestRock, Hammer Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Full Body Shrink Sleeve Labels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Full Body Shrink Sleeve Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.