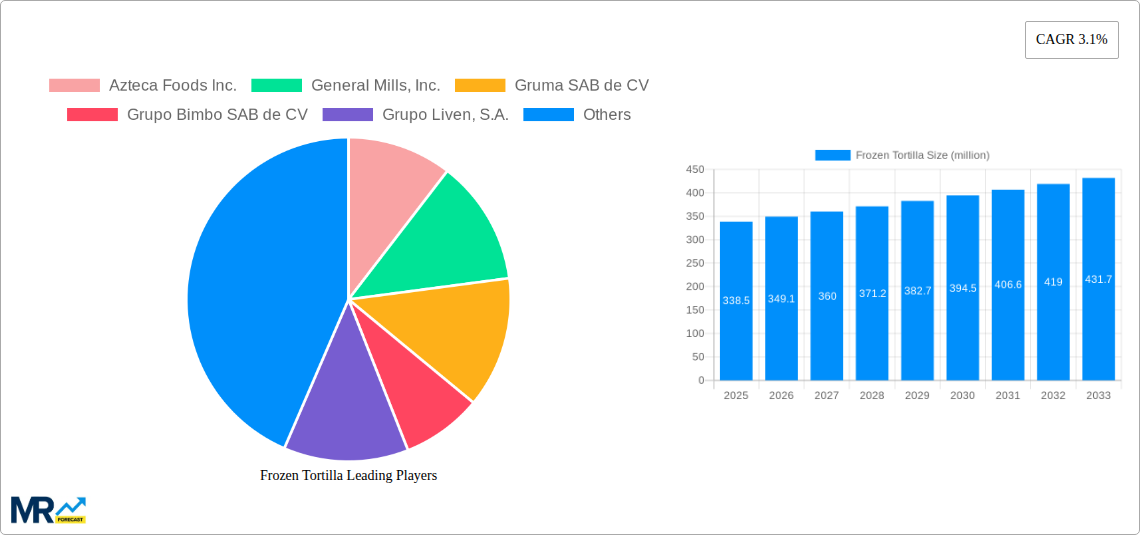

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Tortilla?

The projected CAGR is approximately 3.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Frozen Tortilla

Frozen TortillaFrozen Tortilla by Application (Online Sales, Offline Sales), by Type (Wheat, Corn, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

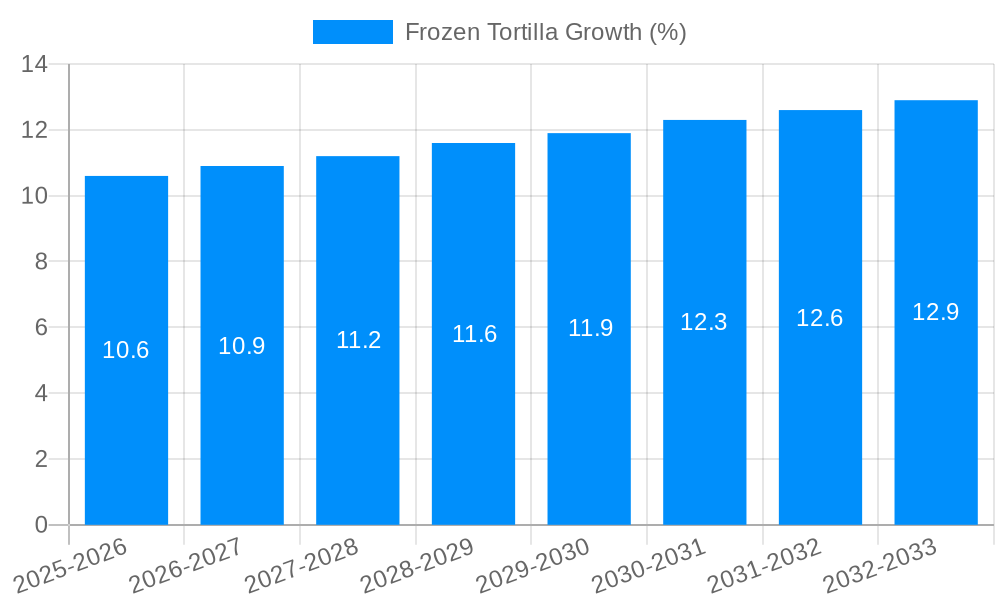

The global frozen tortilla market, valued at $338.5 million in 2025, is projected to experience steady growth, driven by increasing demand for convenient and ready-to-use food products. The convenience factor is a significant driver, particularly among busy consumers and the food service industry. The market is segmented by application (online and offline sales) and type (wheat, corn, and others), with wheat tortillas currently holding the largest market share due to widespread consumer preference. Growth is further fueled by the expanding popularity of Mexican cuisine globally and the rising adoption of frozen foods as a time-saving solution. While precise figures for individual segment sizes are unavailable, it is reasonable to assume that online sales are growing faster than offline sales, reflecting broader e-commerce trends in the food sector. Similarly, while wheat tortillas currently dominate, the "others" segment—potentially encompassing blends and specialty varieties—shows potential for growth as consumer preferences diversify. Geographic expansion, particularly in developing economies with rising disposable incomes, presents a significant opportunity for market expansion. However, challenges such as fluctuating raw material prices and potential health concerns related to high sodium content could restrain growth. Considering a CAGR of 3.1%, the market is anticipated to reach approximately $400 million by 2027 and continue its steady expansion throughout the forecast period. Key players in the market, including Azteca Foods Inc., General Mills, Inc., and Gruma SAB de CV, are leveraging innovation and strategic partnerships to enhance their market position and capitalize on growth opportunities. Competition is relatively intense, necessitating continuous product development and strategic pricing strategies for market success.

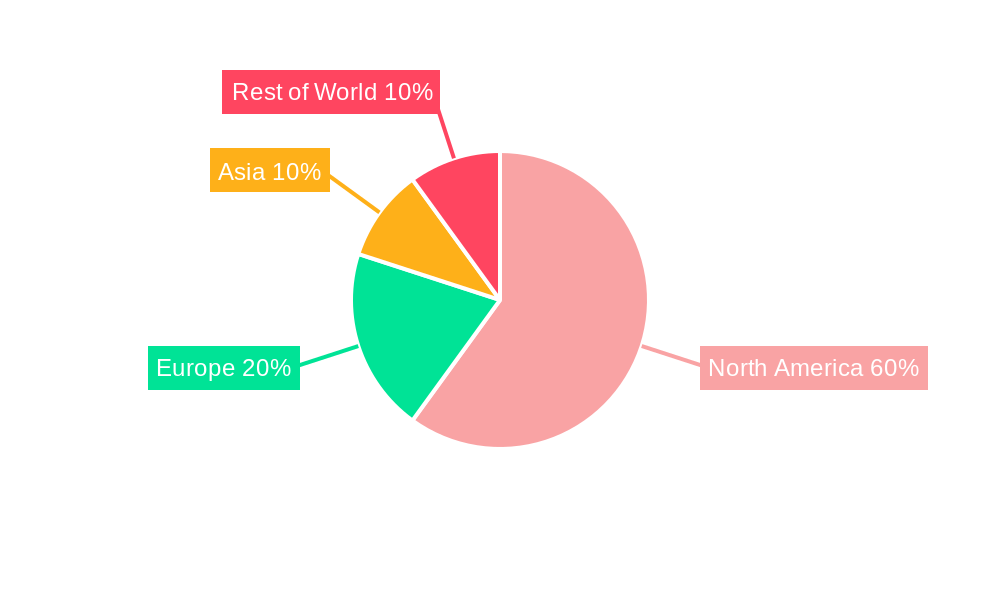

The North American market, particularly the United States and Mexico, currently dominates the frozen tortilla market due to high consumption of Mexican-inspired cuisine. However, Asia-Pacific and European markets are exhibiting significant growth potential, driven by increasing consumer awareness of frozen food convenience and the expansion of international food options. The competitive landscape is characterized by a mix of large multinational corporations and smaller regional players. Large companies possess established distribution networks and brand recognition, providing them with a competitive edge. However, smaller companies often specialize in niche products or regional preferences, enabling them to cater to specific consumer segments. Successful market strategies will necessitate a focus on product diversification, adapting to regional preferences, and efficiently managing supply chain complexities to meet growing demand while maintaining cost competitiveness.

The frozen tortilla market, valued at approximately 15 billion units in 2024, is experiencing robust growth, projected to reach over 30 billion units by 2033. This surge is driven by several converging factors, including the increasing popularity of Mexican-inspired cuisine globally, the convenience offered by frozen tortillas, and the expanding retail landscape encompassing both online and offline channels. The market displays a clear preference for corn tortillas, which currently hold a significant market share, although wheat tortillas are also experiencing consistent growth, fueled by their versatility in various applications. Consumers are increasingly seeking out convenient meal solutions, and frozen tortillas perfectly align with this demand, providing a quick and easy base for a variety of dishes. Furthermore, the continuous innovation in production methods, leading to improved quality and extended shelf life, has further enhanced the market appeal. The shift towards healthier eating habits also plays a role; many manufacturers are catering to this trend by offering whole-wheat and other healthier options. The market demonstrates geographic diversity, with significant growth seen in North America and Europe, while emerging markets in Asia and Latin America are also exhibiting promising growth potential. The competitive landscape is dynamic, characterized by both large multinational corporations and smaller regional players, each vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. The overall market trajectory indicates a bright future for the frozen tortilla industry, driven by a multitude of factors converging to create a sustained period of growth and expansion.

Several key factors are fueling the growth of the frozen tortilla market. The rising popularity of Mexican and Tex-Mex cuisines globally is a primary driver. Frozen tortillas offer a convenient and readily available base for a vast array of dishes, from tacos and burritos to quesadillas and wraps, making them an integral component of these increasingly popular culinary trends. The busy lifestyles of modern consumers further contribute to the market's expansion, as frozen tortillas provide a time-saving solution for quick and easy meal preparation. The robust growth of the food service industry, including restaurants, quick-service establishments, and food trucks, also significantly boosts demand. Furthermore, the increasing availability of frozen tortillas through various distribution channels, encompassing supermarkets, hypermarkets, online retailers, and convenience stores, contributes to market accessibility and expansion. Finally, continuous product innovation, encompassing the introduction of new flavors, sizes, and healthier options like whole-wheat or organic tortillas, actively expands the market's appeal and cater to evolving consumer preferences, driving further market growth.

Despite the significant growth potential, several challenges restrain the frozen tortilla market. Fluctuations in the price of raw materials, particularly corn and wheat, pose a considerable threat. These price changes directly impact production costs and potentially influence consumer purchasing decisions, especially within a price-sensitive market segment. Maintaining product quality and ensuring consistent freshness throughout the supply chain is another hurdle. Factors like improper storage and transportation can negatively affect the quality of frozen tortillas, impacting consumer satisfaction and brand reputation. Intense competition among various manufacturers requires continuous innovation and investment in product development and marketing to maintain a competitive edge. The ever-evolving consumer preferences also pose a challenge, with many seeking healthier options and increasingly demanding sustainable and ethically sourced products. Finally, regulatory changes concerning food safety and labeling can impose additional costs and complicate the manufacturing process. Effectively addressing these challenges is crucial for sustained growth within the frozen tortilla market.

The North American market, particularly the United States, is expected to dominate the frozen tortilla market throughout the forecast period (2025-2033). This dominance stems from high consumption of Mexican-inspired food, well-established distribution networks, and a high degree of consumer awareness of this convenient food product. However, significant growth is also anticipated in other regions, including Europe and parts of Asia, driven by the increasing popularity of Mexican cuisine and the rising demand for convenient food options.

Within the segments, corn tortillas will maintain their leading position due to their authentic taste and traditional association with Mexican food. However, the wheat tortilla segment is also poised for substantial growth, driven by its versatility and adaptation to various culinary applications, including wraps, burritos, and quesadillas.

The dominance of offline sales reflects the traditional shopping habits of a large portion of the population, particularly in mature markets. While online sales are experiencing growth, particularly within younger demographics, offline channels remain the primary distribution channel for frozen tortillas. This makes strong retailer partnerships crucial for market success. The high penetration of supermarkets and hypermarkets, combined with the readily available shelf space dedicated to frozen food, ensures high visibility and accessibility for the product.

The frozen tortilla market is fueled by several converging growth catalysts. The rising popularity of Mexican food worldwide creates a huge demand for convenient tortilla options. The increasing preference for quick and easy meal solutions among busy consumers further boosts the market. Continuous innovation in production and processing ensures improved quality, extended shelf life, and a wider variety of offerings, while new product lines cater to health-conscious consumers. The expansion of retail channels including online sales contributes significantly to wider market reach and sales volume.

This report provides a comprehensive analysis of the frozen tortilla market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It offers in-depth insights into market trends, driving forces, challenges, key players, and significant developments. The report details segment breakdowns by application (online vs. offline sales), type (wheat, corn, others), and geographic region, providing a thorough understanding of the market dynamics and growth opportunities. It is an indispensable resource for industry stakeholders seeking to understand and navigate the complexities of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.1%.

Key companies in the market include Azteca Foods Inc., General Mills, Inc., Gruma SAB de CV, Grupo Bimbo SAB de CV, Grupo Liven, S.A., Ole Mexican Foods Inc., Tyson Foods, Inc., Easy Food Inc., Rudy’s Tortilla, Tortilla king Inc., Bimbo Bakeries USA, Liven S.A., Mexican Food Specialties, Inc., Mission Foods, Signature Flatbreads Ltd., Tyson Mexican Original, Inc., .

The market segments include Application, Type.

The market size is estimated to be USD 338.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Frozen Tortilla," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Frozen Tortilla, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.