1. What is the projected Compound Annual Growth Rate (CAGR) of the Frosted Plastic Bottles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Frosted Plastic Bottles

Frosted Plastic BottlesFrosted Plastic Bottles by Type (Less than 1 Liter, 1 Liter to 10 Liters, 11 Liters to 20 Liters, 20 Liters above), by Application (Food and Beverages, Pharmaceuticals, Cosmetics, Others (Chemicals and Textiles)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

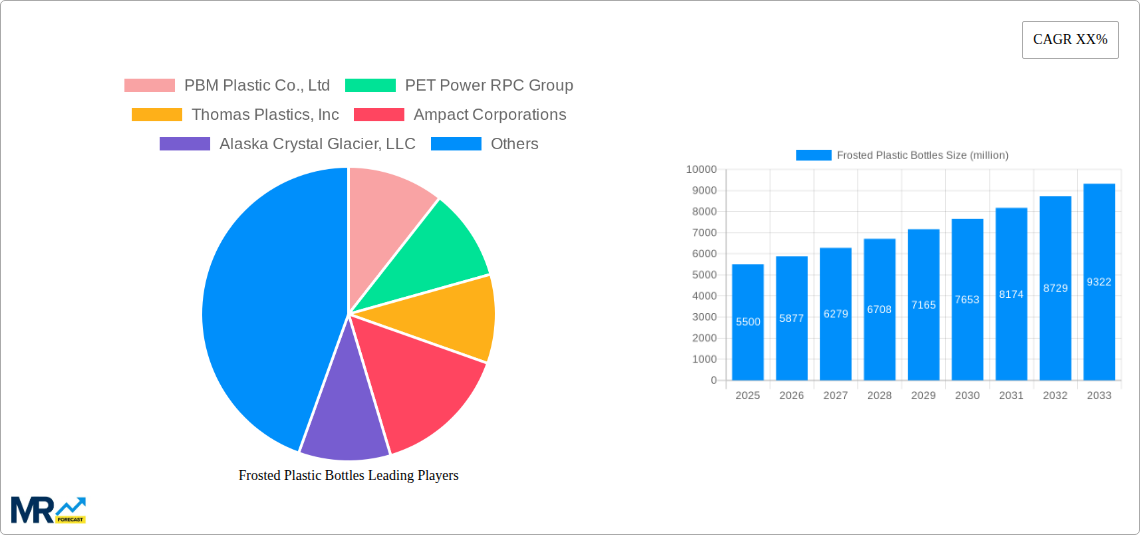

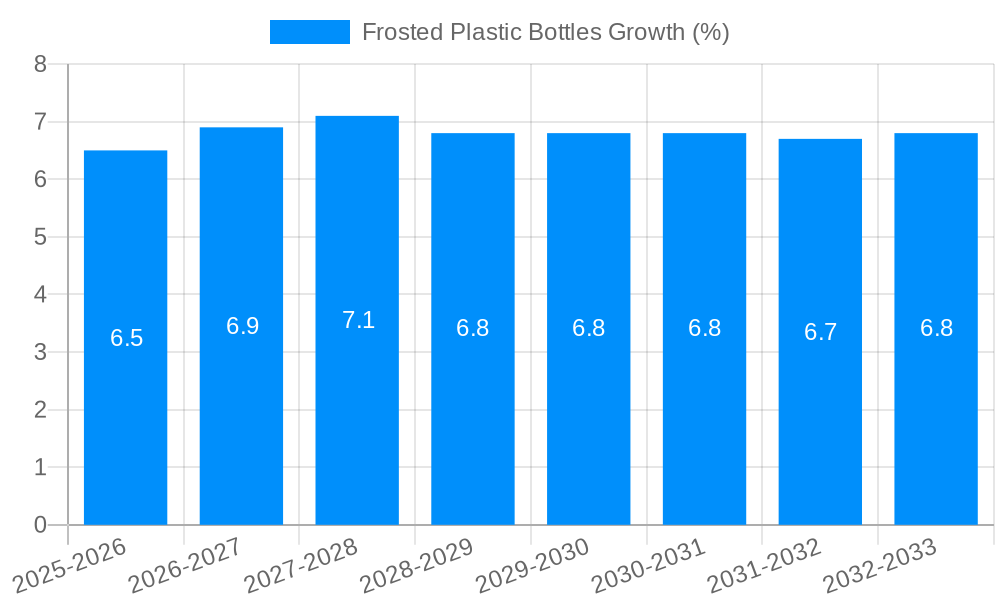

The global Frosted Plastic Bottles market is projected to reach approximately $5,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 6.5% throughout the forecast period of 2025-2033. This significant market expansion is primarily driven by the increasing demand for aesthetically appealing and premium packaging solutions across various industries, particularly in the food and beverages, pharmaceuticals, and cosmetics sectors. The frosted finish offers a sophisticated look that enhances brand perception and product differentiation, making it a preferred choice for manufacturers aiming to capture consumer attention. Furthermore, the growing consumer preference for sustainable and lightweight packaging alternatives over traditional glass is also fueling the adoption of frosted plastic bottles, aligning with environmental consciousness and logistical efficiencies.

The market is segmented by type, with the "1 Liter to 10 Liters" and "20 Liters above" categories expected to witness substantial growth, catering to both individual consumer needs and larger industrial requirements. In terms of application, the Food and Beverages segment is anticipated to dominate, driven by the demand for visually appealing packaging for juices, premium water, and other beverages. The Pharmaceuticals sector is also a key growth driver, utilizing frosted bottles for their protective properties against light degradation for sensitive medications and the perceived sterility. Emerging economies in the Asia Pacific region, particularly China and India, are expected to be significant contributors to market growth due to rapid industrialization, rising disposable incomes, and an expanding middle-class consumer base actively seeking high-quality packaged goods. Key players like Amcor Limited, Berry Global, Inc., and Graham Packaging Company Inc. are expected to play a pivotal role in shaping the market through product innovation and strategic expansions.

This report offers an in-depth examination of the global frosted plastic bottles market, providing critical insights into trends, drivers, challenges, and the competitive landscape from 2019 to 2033. Analyzing historical data (2019-2024) and leveraging the base year 2025 for estimations, the study projects future market trajectories throughout the forecast period (2025-2033). Our analysis is grounded in a robust methodology, incorporating quantitative and qualitative data to deliver a nuanced understanding of this dynamic sector. The report aims to equip stakeholders with actionable intelligence to navigate market complexities and capitalize on emerging opportunities.

The global frosted plastic bottles market is undergoing a significant transformation, driven by evolving consumer preferences and industry advancements. A key trend observed is the increasing demand for aesthetic appeal in packaging, particularly within the cosmetics and premium food and beverage segments. Frosted finishes offer a sophisticated and premium look, distinguishing products on crowded retail shelves. This has led to a rise in the adoption of frosted PET and HDPE bottles, with a substantial market value anticipated to reach several million units by the forecast period. The report identifies a growing preference for reusable and refillable frosted plastic bottles, aligning with the broader sustainability movement. Consumers are increasingly willing to invest in durable, aesthetically pleasing containers that can be repurposed, thereby reducing single-use plastic waste. This trend is particularly pronounced in regions with strong environmental awareness and government initiatives promoting circular economy models. Furthermore, advancements in frosting techniques are enabling manufacturers to achieve a wider range of textures and opacities, catering to diverse brand requirements. The integration of advanced printing and labeling technologies onto frosted surfaces further enhances product differentiation and brand storytelling. The market is also witnessing a gradual shift towards lighter-weight frosted plastic bottles without compromising on structural integrity, driven by cost optimization and reduced shipping expenses. Innovations in material science are also playing a crucial role, with the development of bio-based and recycled frosted plastics gaining traction, appealing to environmentally conscious brands and consumers alike. The study will delve into the market penetration of these sustainable alternatives, projecting their contribution to the overall market value in millions of units. The versatility of frosted plastic bottles in applications beyond traditional uses, such as in specialized chemical packaging and textile presentation, is also a noteworthy trend contributing to market expansion. The report will quantify the market share of these niche applications, providing a comprehensive overview of the sector's diversification. The increasing adoption of custom-designed frosted bottles by emerging brands to establish a unique brand identity is another critical trend, signaling a move towards personalized packaging solutions. This personalization trend is expected to contribute significantly to the market's growth in millions of units.

Several key factors are propelling the growth of the global frosted plastic bottles market. Foremost among these is the escalating consumer demand for visually appealing and premium packaging. In sectors like cosmetics and luxury food and beverages, frosted finishes provide a sophisticated and distinctive aesthetic that enhances product appeal and brand perception. This demand translates directly into increased production of frosted plastic bottles, contributing significantly to the market's overall value, projected in millions of units. The growing emphasis on sustainability and the circular economy is another powerful driver. Consumers are increasingly seeking eco-friendly packaging solutions, and frosted plastic bottles, particularly those made from recycled or bio-based materials, align with these preferences. Brands are recognizing this shift and are opting for frosted plastic packaging to meet consumer expectations and bolster their corporate social responsibility image. This trend is expected to witness substantial growth in market share over the forecast period, measured in millions of units. Furthermore, the versatility of frosted plastic bottles in terms of design, size, and application is a significant contributing factor. From smaller bottles for single-use cosmetics to larger containers for industrial chemicals, the adaptability of frosted plastic makes it a preferred choice across diverse industries. Technological advancements in manufacturing processes, including improved frosting techniques and printing capabilities, are also enabling the production of higher-quality and more visually engaging frosted bottles, further stimulating market demand. The rising disposable incomes in emerging economies are also contributing to increased consumption of packaged goods, thereby driving the demand for packaging solutions like frosted plastic bottles. The report will quantify this impact in millions of units, showcasing regional market dynamics. The inherent properties of plastics, such as their durability, lightweight nature, and cost-effectiveness, continue to make them a favored material for packaging, and the frosted aesthetic adds an element of perceived value without significantly inflating costs.

Despite its robust growth trajectory, the frosted plastic bottles market faces several challenges and restraints that could temper its expansion. A primary concern is the increasing regulatory scrutiny and public pressure surrounding plastic waste and its environmental impact. While advancements in recycling and the use of recycled content are being made, the perception of plastic as an unsustainable material remains a significant hurdle. This could lead to stricter regulations on single-use plastics, potentially impacting the demand for certain types of frosted plastic bottles, especially in specific applications. The report will analyze the potential impact of these regulations on market volume in millions of units. Furthermore, the cost of producing frosted plastic bottles can sometimes be higher than that of clear plastic alternatives due to additional processing steps involved in achieving the frosted effect. This price sensitivity can be a deterrent for brands operating on tighter budgets, particularly in price-competitive market segments. The report will provide an estimated cost differential impacting market share in millions of units. Competition from alternative packaging materials, such as glass, aluminum, and paper-based solutions, also poses a restraint. While frosted plastic offers unique advantages, these alternative materials are often perceived as more sustainable or premium by certain consumer segments. The market share battle with these alternatives will be analyzed in millions of units. Additionally, the technical limitations in achieving certain levels of clarity or specific frosted effects on some types of plastics can restrict their application in highly specialized use cases. The susceptibility of some frosted plastic finishes to scratching or scuffing during handling and transit can also be a concern for product integrity and brand image, necessitating robust protective measures that may add to the overall cost. The report will explore the market's response to these limitations, projecting its impact on market volume in millions of units. The complex recycling infrastructure and varying recycling rates across different regions can also pose a challenge to the widespread adoption of frosted plastic bottles, particularly those made from mixed or colored plastics.

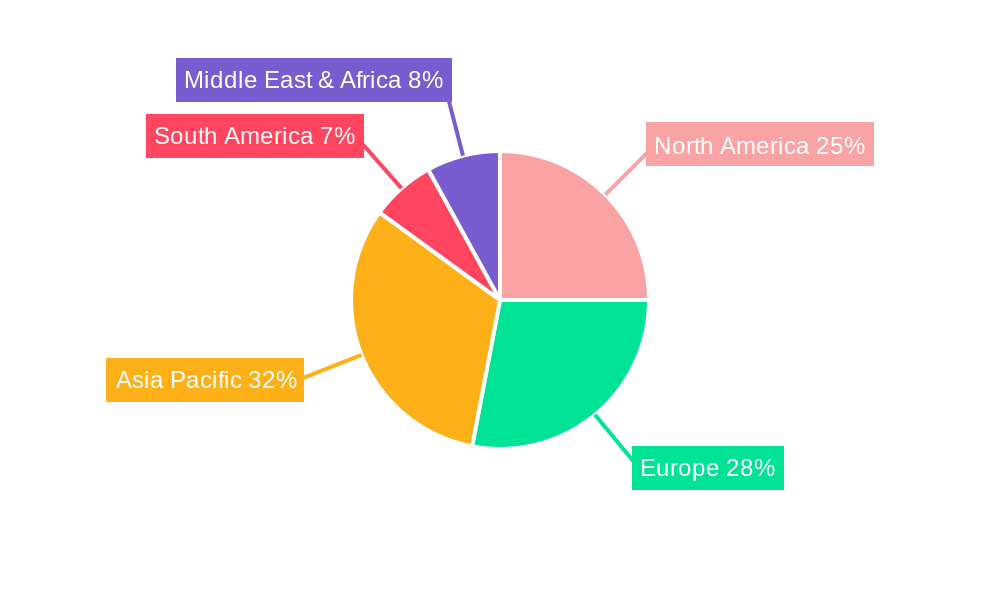

Several regions and segments are poised to dominate the global frosted plastic bottles market, driven by a confluence of economic, demographic, and consumer-driven factors.

Dominating Segments:

Type: Less than 1 Liter: This segment is expected to be a significant growth engine for the frosted plastic bottles market. Its dominance is primarily attributed to its widespread application in the cosmetics, personal care, and small-format food and beverage industries. The demand for travel-sized products, single-use cosmetic samples, and individual servings of beverages inherently favors smaller packaging. Frosted finishes add a touch of luxury and distinction to these smaller containers, making them highly desirable for premium brands aiming to capture consumer attention. The sheer volume of products falling within this category, with an estimated several million units produced annually, solidifies its leading position. The increasing trend of personalized beauty products and niche beverage offerings further fuels the demand for smaller, aesthetically appealing frosted bottles. This segment's adaptability to various product types, from skincare serums to gourmet sauces, ensures its continued relevance and market leadership.

Application: Cosmetics: The cosmetics industry is a powerhouse for frosted plastic bottles. The inherent desire for elegance, sophistication, and a premium feel in cosmetic products directly aligns with the visual appeal of frosted packaging. Brands utilize frosted bottles to house everything from high-end foundations and perfumes to specialized skincare treatments. The ability of frosted finishes to diffuse light and create a softer, more luxurious appearance makes them ideal for products where visual presentation is paramount. The global cosmetics market, valued in the hundreds of billions of dollars, translates into a substantial demand for packaging solutions like frosted plastic bottles, with the forecast indicating a continued upward trajectory in millions of units. The trend towards natural and organic cosmetics also often uses frosted packaging to convey a sense of purity and gentleness.

Application: Food and Beverages: Within the food and beverage sector, frosted plastic bottles are increasingly making inroads, particularly in premium and niche markets. This includes artisanal beverages, specialty oils, gourmet vinegars, and even high-end water brands. The frosted effect elevates the perceived value of these products, differentiating them from mass-market offerings. The demand for convenience and portability, coupled with a desire for aesthetically pleasing packaging, makes frosted plastic bottles an attractive option for ready-to-drink beverages and single-serving food items. The sheer volume of production in the broader food and beverage sector, with millions of units consumed globally, ensures this segment's significant contribution to the frosted plastic bottle market. The increasing popularity of craft beverages and the focus on branding in the food and beverage industry are further propelling the adoption of frosted packaging.

Dominating Regions:

North America: North America, particularly the United States, is a leading market for frosted plastic bottles. This dominance is driven by a mature and sophisticated consumer market with a high disposable income, a strong preference for premium and aesthetically pleasing products, and a well-established cosmetics and food and beverage industry. The region's proactive stance on product innovation and branding, coupled with a significant presence of major packaging manufacturers, contributes to its leading position. The emphasis on sustainability is also driving the demand for recyclable and reusable frosted plastic packaging solutions. The market value in this region is projected to reach several million units in the coming years.

Europe: Europe, with its strong emphasis on luxury goods, sustainable practices, and a highly discerning consumer base, represents another dominant region for frosted plastic bottles. Countries like Germany, France, and the United Kingdom are major consumers, driven by their robust cosmetics, pharmaceuticals, and premium food and beverage sectors. The region's commitment to environmental regulations and the circular economy is fostering innovation in recyclable and bio-based frosted plastic packaging. The demand for aesthetically superior packaging in these established markets contributes significantly to the overall market volume, measured in millions of units.

The frosted plastic bottles industry is experiencing significant growth fueled by several key catalysts. The escalating consumer demand for visually appealing and premium packaging across diverse sectors, particularly in cosmetics and high-end food and beverages, is a primary driver. Frosted finishes imbue products with a sophisticated and distinguished look, enhancing brand perception and shelf appeal, thereby stimulating demand for these bottles in millions of units. Furthermore, the growing global consciousness towards sustainability is spurring innovation in eco-friendly packaging. The development and adoption of frosted plastic bottles made from recycled content and bio-based materials are aligning with this trend, attracting environmentally aware brands and consumers alike, thus boosting market volume in millions of units. Advancements in manufacturing technologies, enabling more efficient and versatile frosting techniques and improved printing capabilities, are also crucial growth catalysts. These innovations allow for greater design flexibility and enhanced product aesthetics, further driving market expansion.

This comprehensive report delves deep into the multifaceted global frosted plastic bottles market, providing an all-encompassing analysis for the study period of 2019-2033, with 2025 serving as the base and estimated year. It meticulously examines key market trends, including the growing preference for aesthetically appealing packaging and the rising demand for sustainable options, projecting market values in millions of units. The report identifies the pivotal driving forces behind market growth, such as evolving consumer preferences for premium products and technological advancements in frosting and printing techniques. It also critically assesses the challenges and restraints, including regulatory pressures, cost sensitivities, and competition from alternative materials, analyzing their potential impact on market volume in millions of units. Furthermore, the report highlights the dominating regions and segments, such as North America, Europe, the "Less than 1 Liter" category, and the Cosmetics and Food & Beverage applications, showcasing their significant market share in millions of units. It further explores crucial growth catalysts and profiles leading players in the industry. The report concludes with an overview of significant developments and provides a holistic perspective for stakeholders to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PBM Plastic Co., Ltd, PET Power RPC Group, Thomas Plastics, Inc, Ampact Corporations, Alaska Crystal Glacier, LLC, Amcor Limited, Ampulla, Berry Global, Inc, Graham Packaging Company Inc, Plastipak Holdings Inc, Cospack America Corporation, Berlin Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Frosted Plastic Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Frosted Plastic Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.