1. What is the projected Compound Annual Growth Rate (CAGR) of the Formula 1 Racing Car?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Formula 1 Racing Car

Formula 1 Racing CarFormula 1 Racing Car by Type (Acceleration of Less Than 2.5 Seconds for 100 Kilometres, Acceleration over 2.5 Seconds for 100 Kilometres, World Formula 1 Racing Car Production ), by Application (Sports Industry, Television Boardcasting, Public Welfare, Others, World Formula 1 Racing Car Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Formula 1 (F1) racing car market, encompassing design, manufacturing, and technological innovation, is a high-value, high-growth sector. The market size is estimated at $9.5 billion in the base year 2024, with a projected compound annual growth rate (CAGR) of 8.1%. This growth is propelled by increasing sponsorship revenue, lucrative broadcasting rights, and significant investments in performance-enhancing technologies. Key growth drivers include a expanding global fan base, advancements in sustainable fuels and aerodynamics, and the increasing commercialization of the sport via strategic partnerships.

Emerging trends encompass a heightened focus on sustainability, the integration of advanced data analytics and AI for optimizing car performance, and the expanded use of carbon fiber composites for weight reduction. Key restraints include the substantial cost of entry for new teams, stringent regulatory frameworks, and potential economic downturns impacting sponsorship acquisition.

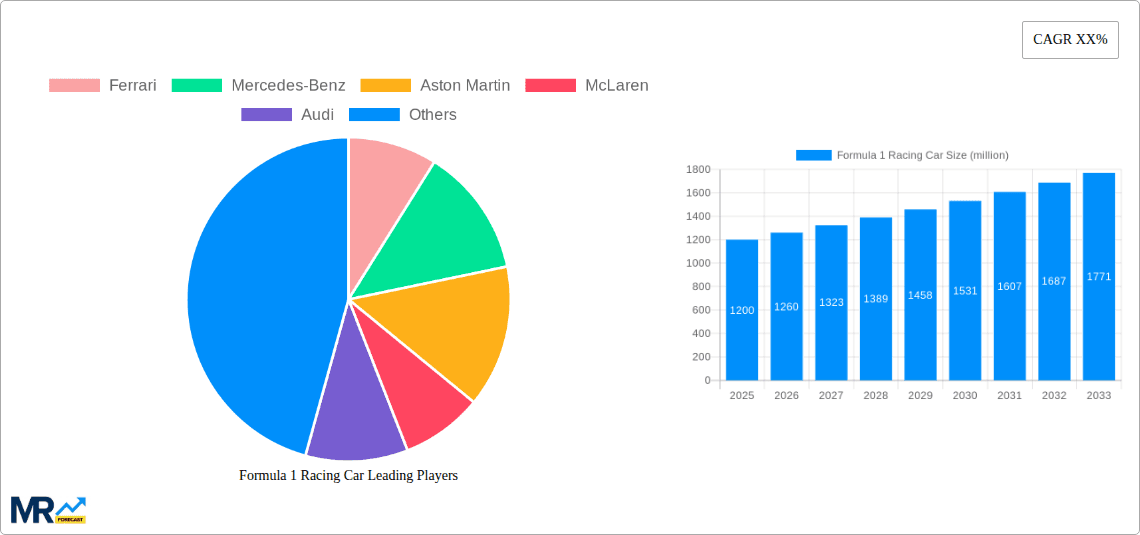

The competitive landscape is intensely contested, featuring established manufacturers such as Ferrari, Mercedes-Benz, Red Bull Racing, Aston Martin, and McLaren, alongside emerging competitors, all vying for performance supremacy. Regional market distribution is primarily concentrated in Europe and North America, with Asia presenting significant growth potential. The forecast period (2024-2033) anticipates sustained market expansion driven by technological breakthroughs, growing global viewership, and further commercial collaborations. The continuous evolution of F1 regulations will necessitate ongoing innovation and adaptation from manufacturers to maintain competitiveness. Market consolidation is anticipated as smaller teams face challenges competing with the financial resources of larger organizations.

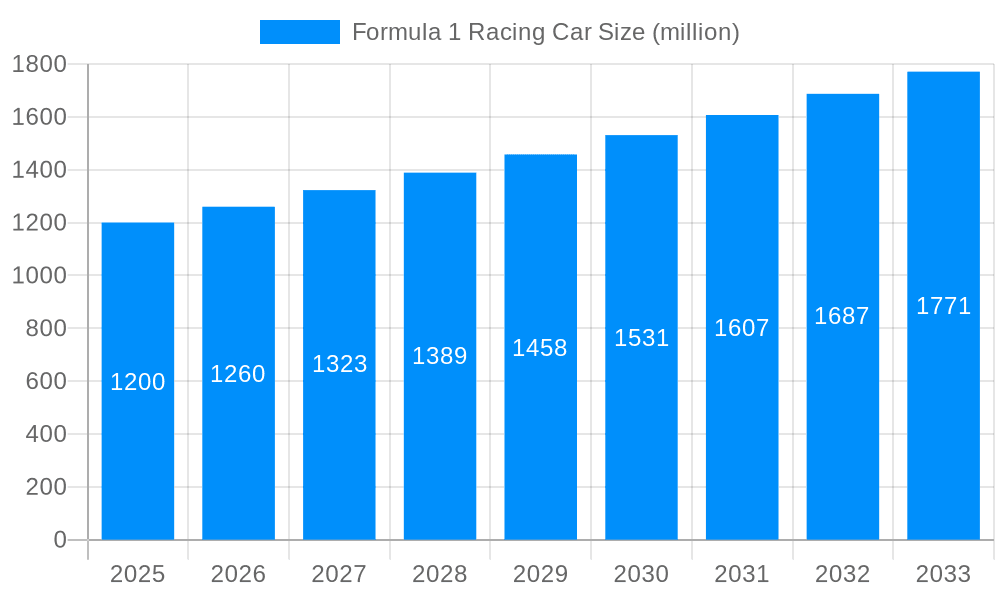

The Formula 1 racing car market, valued at approximately $200 million in 2024, is poised for significant growth, projected to reach $500 million by 2033. This expansion is driven by a confluence of factors, including technological advancements, increasing global viewership, and the burgeoning popularity of esports. The historical period (2019-2024) saw fluctuating growth, influenced by global economic trends and regulatory changes within the sport. The base year (2025) marks a pivotal point, with the introduction of new regulations and technological innovations expected to stimulate market expansion. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) exceeding 10%, fueled by a combination of factors detailed in the following sections. Key market insights reveal a strong correlation between technological improvements in car design and performance, leading to increased sponsorship deals and broadcasting revenue. This, in turn, drives investment in research and development, creating a positive feedback loop of growth. Furthermore, the rising popularity of F1 in new markets, particularly in Asia and the Middle East, presents considerable untapped potential. The increasing engagement of younger demographics through digital platforms and esports further contributes to the market's sustained expansion. Finally, the sustainability initiatives undertaken by teams and the FIA (Fédération Internationale de l'Automobile) are attracting environmentally conscious sponsors and fans, adding another dimension to the growth trajectory. The strategic alliances and partnerships between teams and technology providers are also key drivers, ensuring a consistent pipeline of innovation.

Several key forces are propelling the growth of the Formula 1 racing car market. Firstly, technological advancements are paramount. The relentless pursuit of aerodynamic efficiency, engine performance, and materials science leads to continuous innovation, attracting significant investment from both manufacturers and sponsors. This constant drive for improvement not only enhances on-track performance but also creates opportunities for technology transfer to other industries, fostering further growth. Secondly, the global appeal of Formula 1 continues to expand. The sport’s high-octane action, combined with sophisticated marketing and broadcasting strategies, attracts a vast and diverse global audience. This wide reach translates into lucrative sponsorship deals and broadcasting rights, creating a financially stable ecosystem that fuels further investment and development. Thirdly, the rise of esports and sim racing significantly contributes to the market’s dynamism. These digital platforms engage a younger generation, expanding the sport's fan base and creating new revenue streams through virtual races and gaming-related merchandise. Finally, the increasing focus on sustainability within the sport is attracting environmentally conscious sponsors and fans, thereby adding a significant ethical dimension to the market's overall appeal and fostering responsible growth.

Despite the positive growth trajectory, the Formula 1 racing car market faces several challenges. The high cost of entry and operation is a major barrier, particularly for new teams seeking to compete at the highest level. The complex regulations and technological advancements require substantial investment in research and development, limiting accessibility to smaller or less well-funded teams. Furthermore, economic downturns or global crises can significantly impact sponsorship deals and broadcasting revenues, potentially hindering the market's expansion. The inherent risks associated with motorsports, including potential injuries to drivers and mechanical failures, pose another challenge. Finally, environmental concerns, although increasingly addressed by the sport, remain a potential point of contention, particularly with regard to the carbon footprint of the racing cars and their transportation. These factors necessitate a careful balance between technological progress, financial stability, and sustainability to ensure the long-term health of the Formula 1 racing car market.

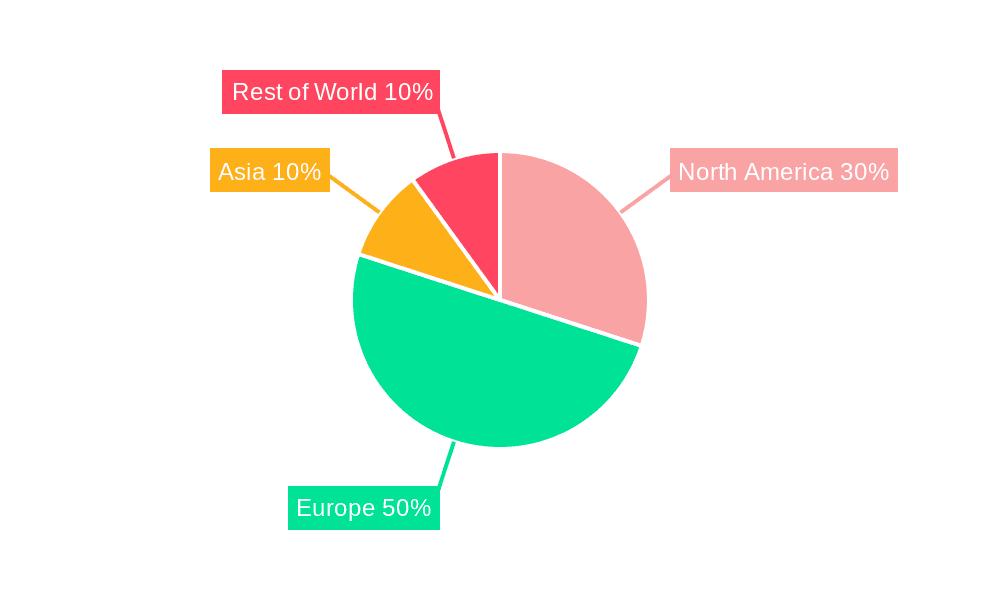

The Formula 1 racing car market exhibits regional variations in dominance, with Europe historically being a key player due to the concentration of major manufacturers and teams. However, the Asia-Pacific region is experiencing rapid growth, driven by rising disposable incomes and a growing interest in motorsports. Specific countries like the UK, Italy, and Germany remain significant hubs for manufacturing, technology development, and team headquarters.

Europe: Remains a dominant force, hosting several Grand Prix races and boasting a legacy of automotive excellence. European countries provide a strong technological and engineering base, attracting significant investment and talent.

Asia-Pacific: Shows significant growth potential, fueled by a burgeoning middle class, increased broadcasting reach, and the growing popularity of motorsports. China, Japan, and Singapore are particularly important markets.

North America: The US market is expanding, largely due to the increased popularity of the sport and the addition of the Miami Grand Prix. The large North American market with its substantial motorsport fan base is expected to contribute significantly to market expansion.

Segments: The high-performance segment, focusing on cutting-edge technology and premium materials, commands the highest prices and profits. However, the growing market segment around supporting technology and services, such as data analytics, simulations and telemetry systems, also shows strong growth potential in the forecast period.

The paragraph above explains that Europe continues to hold a significant market share due to its established manufacturing base and rich history in motorsport. However, the Asia-Pacific region is rapidly emerging as a major growth area, driven by increasing disposable incomes and escalating popularity. The North American market also shows considerable potential due to increased exposure and the addition of new races. Within the market, the high-performance segment dominates due to its premium pricing and advanced technologies. But the supporting technology and services segment is also a strong growth driver for the future, showing opportunities in data analytics, simulation, and telemetric systems. This diversification within the market creates numerous opportunities for growth and innovation in the coming years.

The Formula 1 racing car industry's growth is being propelled by several key factors. Technological advancements in aerodynamics, engine technology, and materials science are constantly pushing the boundaries of performance, leading to increased viewer interest and sponsorship opportunities. The global reach of Formula 1, coupled with sophisticated marketing strategies, attracts a large and diverse audience. Furthermore, the rise of esports and sim racing expands the fan base and provides new revenue streams. Finally, increased investments in sustainability initiatives make the sport more appealing to environmentally conscious sponsors and fans.

This report provides a comprehensive analysis of the Formula 1 racing car market, covering historical trends, current market dynamics, and future projections. It offers a detailed look at leading players, key technological advancements, regional market variations, and growth catalysts. The report's insights are invaluable for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

Key companies in the market include Ferrari, Mercedes-Benz, Aston Martin, McLaren, Audi, Williams, Renault, Sauber, Honda, Toyota, .

The market segments include Type, Application.

The market size is estimated to be USD 9.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Formula 1 Racing Car," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Formula 1 Racing Car, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.