1. What is the projected Compound Annual Growth Rate (CAGR) of the Formal Shoes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Formal Shoes

Formal ShoesFormal Shoes by Type (Natural Leather, Artificial Leather), by Application (Offline Sales, Online Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

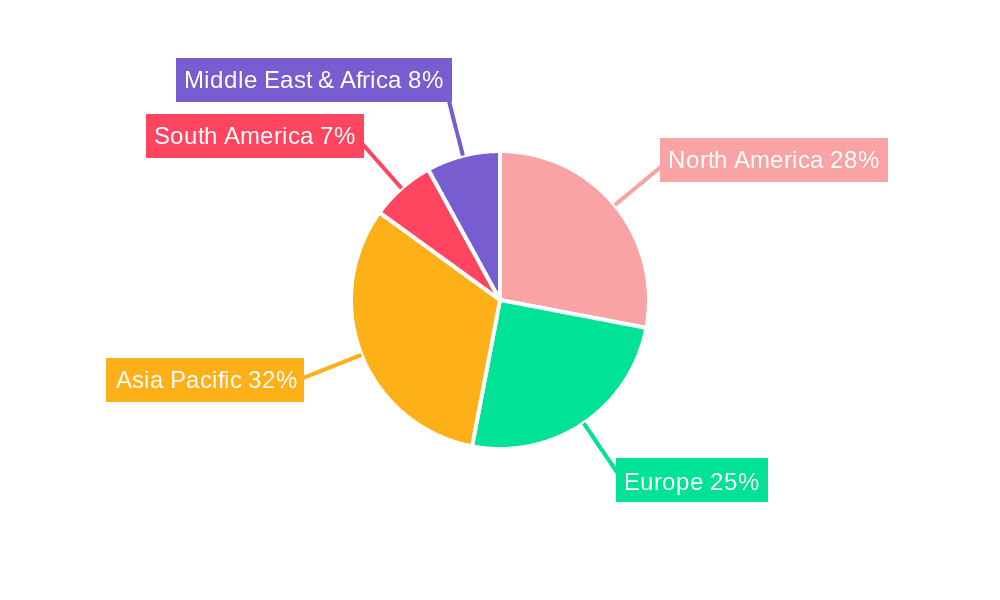

The global formal shoe market, characterized by a diverse range of materials (natural and artificial leather) and sales channels (offline and online), is experiencing robust growth. While precise figures for market size and CAGR aren't provided, a logical estimation based on industry trends suggests a substantial market value, likely exceeding $100 billion in 2025. This growth is fueled by several factors: the increasing professionalization of the global workforce, a rising demand for high-quality, durable footwear, and the expanding reach of e-commerce platforms that streamline purchasing. Fashion trends also significantly influence market dynamics; the cyclical nature of fashion means that certain styles of formal shoes experience periods of high demand, while others wane. The market is segmented by material type – natural leather commanding a premium price point due to its superior quality and perceived prestige, while artificial leather caters to a price-sensitive segment seeking affordability. Distribution channels also impact sales; online sales show consistent growth, though traditional brick-and-mortar stores remain dominant in many regions, especially for premium brands that benefit from in-person fitting and brand experience. Competitive pressures are intense, with established players like C&J Clark, Gucci, and Prada facing challenges from both emerging brands and private label offerings. Regional variations exist, with North America and Europe currently holding significant market share; however, Asia Pacific, driven by rapid economic growth and expanding middle class in countries like China and India, presents a substantial growth opportunity.

Market restraints include fluctuating raw material costs (particularly leather), economic downturns affecting consumer spending on discretionary items like formal shoes, and increasing competition from both established and emerging players. The industry's sustainability concerns are also gaining traction, with consumers demanding more eco-friendly materials and production processes. To maintain a competitive edge, manufacturers need to focus on innovation, incorporating sustainable materials and offering personalized experiences, both online and offline. This includes advanced customization options and omnichannel strategies to effectively reach consumers across various platforms and cater to diverse needs and preferences. Furthermore, the ongoing integration of technology in design, production, and marketing will play a significant role in shaping the future of this dynamic market.

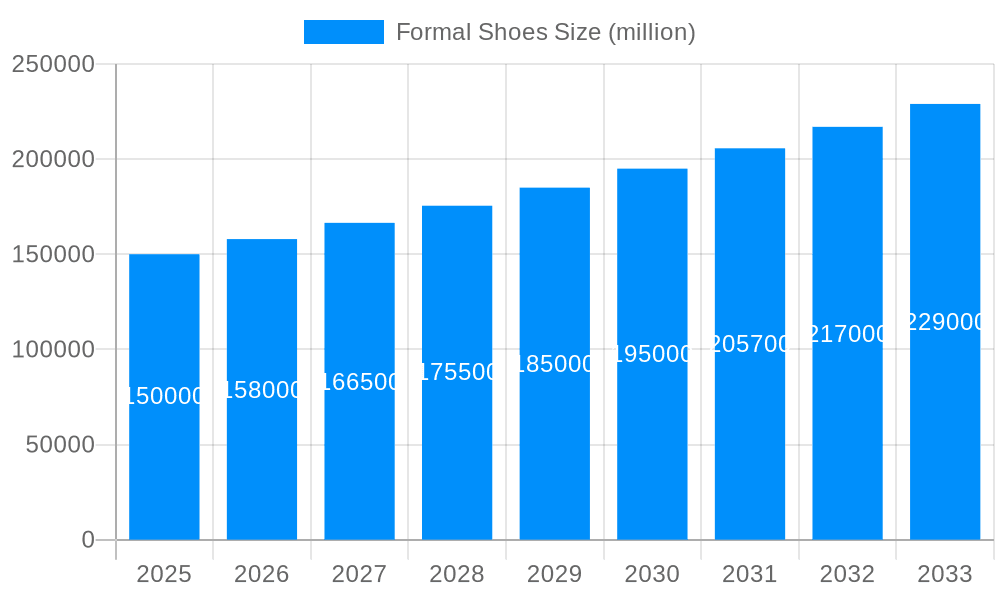

The global formal shoe market, valued at several billion units in 2024, is projected to experience significant growth throughout the forecast period (2025-2033). This growth is driven by a confluence of factors, including evolving fashion trends, the increasing participation of women in the formal workforce, and a rising preference for premium and handcrafted footwear. The market exhibits diverse trends, with a noticeable shift towards versatile designs that seamlessly transition from professional settings to semi-formal occasions. This demand for hybrid styles is reflected in the popularity of loafers, oxfords with less structured designs, and brogues with modern twists. Further, the rise of sustainable and ethically sourced materials, such as vegetable-tanned leather and recycled fabrics, is gaining momentum, shaping consumer preferences and influencing manufacturer practices. Simultaneously, technological advancements in shoe manufacturing, leading to improved comfort features like enhanced cushioning and ergonomic designs, are significantly influencing market dynamics. The increasing adoption of e-commerce platforms and the omni-channel approach by brands are also reshaping how formal shoes are marketed and sold. While classic styles remain popular, innovative materials and designs cater to a younger generation seeking both style and comfort, driving continuous innovation within the industry. The influence of luxury brands is also notable, as their designs and marketing campaigns significantly impact overall market trends and create aspirational styles driving consumption. Finally, regional variations in preferences influence style choices and materials, creating a vibrant and dynamic global landscape. The interplay of these factors creates a complex, yet potentially lucrative, market that is undergoing a continuous evolution.

Several key factors are propelling the growth of the formal shoes market. Firstly, the increasing formalization of various professional sectors, particularly in developing economies, contributes significantly to the rising demand for formal footwear. The growing number of white-collar jobs necessitates appropriate professional attire, making formal shoes a necessary component. Secondly, the rising disposable incomes in emerging markets are fuelling increased spending on apparel and accessories, including formal shoes. Consumers in these regions are becoming increasingly fashion-conscious and willing to invest in higher-quality footwear to enhance their professional image. Furthermore, the growing influence of fashion trends and celebrity endorsements plays a vital role in shaping consumer preferences and driving demand for specific styles and brands. The constant introduction of new designs, materials, and technologies keeps the market dynamic and attractive to consumers. The rise of e-commerce has further amplified this growth, providing convenient access to a wide variety of formal shoe options from different brands across geographical boundaries. Finally, technological advancements in manufacturing, such as 3D printing and automated production processes, are enabling greater efficiency, reduced production costs, and increased customization options, all of which contribute positively to the market's expansion.

Despite the positive growth outlook, the formal shoes market faces certain challenges. Firstly, fluctuations in raw material prices, especially for leather, can significantly impact production costs and profitability. Economic downturns can also dampen consumer spending, leading to reduced demand for non-essential items such as high-end formal shoes. The rise of casual work attire in some industries presents a significant challenge, as it directly reduces the need for formal footwear. Furthermore, intense competition among numerous established and emerging brands necessitates continuous innovation and aggressive marketing strategies to maintain market share. Maintaining quality and ensuring ethical sourcing of materials are crucial concerns for environmentally conscious consumers, creating pressure on manufacturers to adopt sustainable practices. Finally, the increasing popularity of athleisure and comfortable casual footwear poses a significant competitive threat to the formal shoe segment, diverting consumer spending towards more relaxed styles. Addressing these challenges effectively will be crucial for continued growth and success in the formal shoe market.

The global formal shoes market is geographically diverse, with several regions and segments exhibiting significant growth potential. Considering the segment of "Offline Sales," we observe substantial dominance in developed economies like North America and Europe. This is primarily due to the established retail infrastructure, higher consumer spending power, and a long-standing tradition of formal wear in professional settings. However, rapid economic growth in Asian markets, particularly in China and India, is leading to a surge in offline formal shoe sales. This growth is fueled by increasing urbanization, a rise in the middle class, and a growing preference for branded footwear.

The dominance of offline sales is primarily driven by the desire for physical interaction with products, the ability to try on shoes for fit, and the immediate gratification of purchase. However, the online segment is rapidly expanding, particularly among younger demographics who prefer the convenience and wider selection offered by online platforms. This shift towards online channels will likely accelerate in the coming years, impacting the distribution landscape of formal footwear.

The formal shoes industry is poised for sustained growth, primarily fueled by the increasing demand for professional attire in various sectors globally. The rising disposable incomes in emerging economies, coupled with the growing awareness of personal branding and professional image, are major catalysts for market expansion. Innovative designs, sustainable materials, and advanced manufacturing techniques continuously improve the quality and desirability of formal shoes, further accelerating market growth.

This report provides a comprehensive overview of the global formal shoes market, offering detailed insights into market trends, driving forces, challenges, key players, and significant developments. It provides in-depth analysis for effective strategic planning and informed decision-making within the industry. The report utilizes extensive market data, combined with expert analysis, to forecast future market growth with accuracy and confidence. It serves as an invaluable resource for businesses, investors, and researchers involved in the formal footwear market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

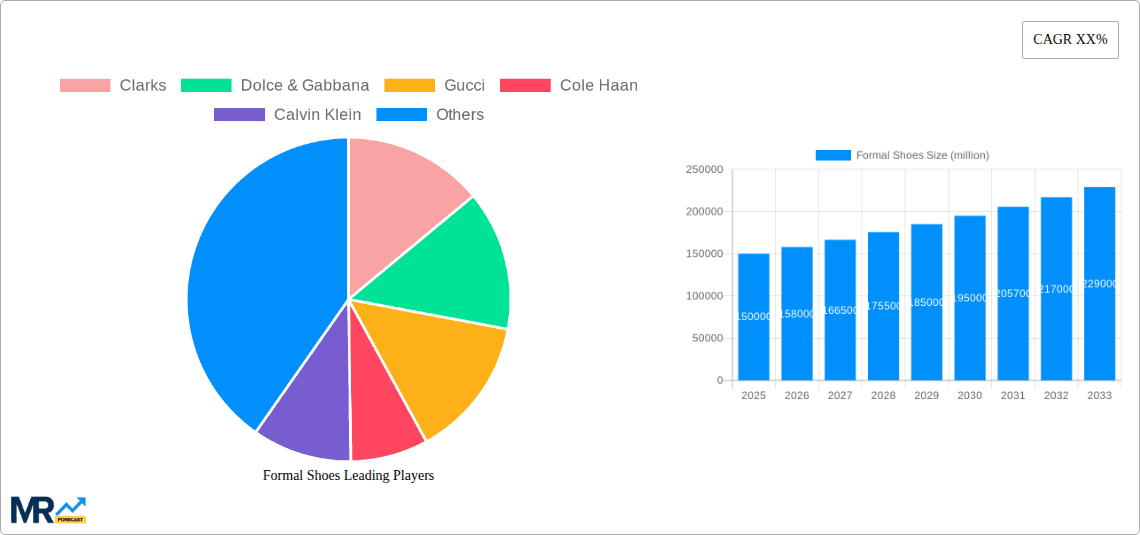

Key companies in the market include C. & J. Clark International Ltd, Dolce & Gabbana, Guccio Gucci S.p.A, Cole Haan LLC, Calvin Klein, Burberry Group Inc., Louis Vuitton (LVMH), Prada S.p.A., Hugo Boss AG, Alden Shoe, Belle, Aldo Group, ECCO Sko A/S, Salvatore Ferragamo S.p.A., Ruosh, Pavers England, Hidesign, Red Tape, ZheJiang AoKangShoes Co., Ltd., Yearcon, RedDragonfly, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Formal Shoes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Formal Shoes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.