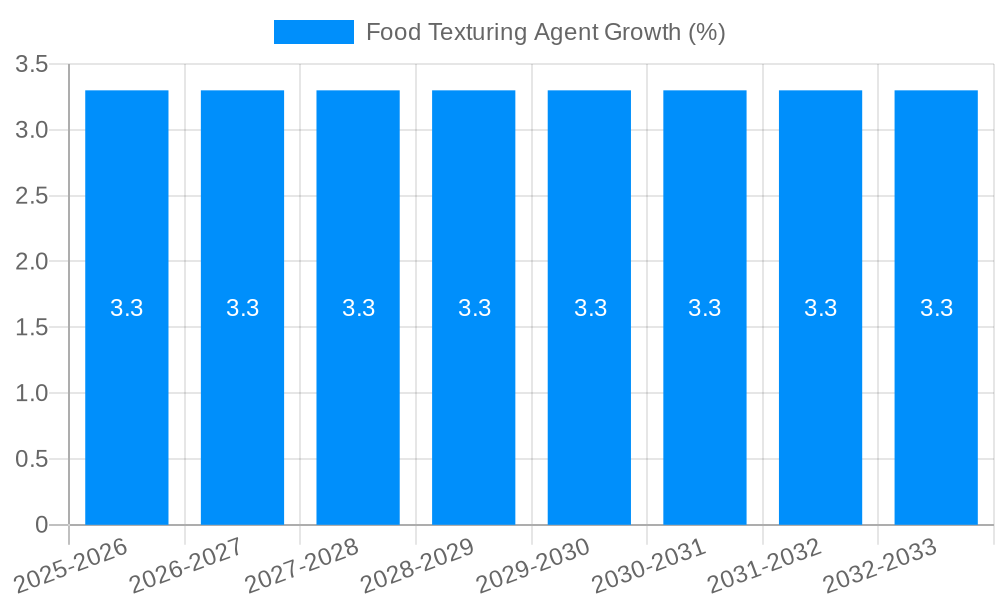

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Texturing Agent?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Texturing Agent

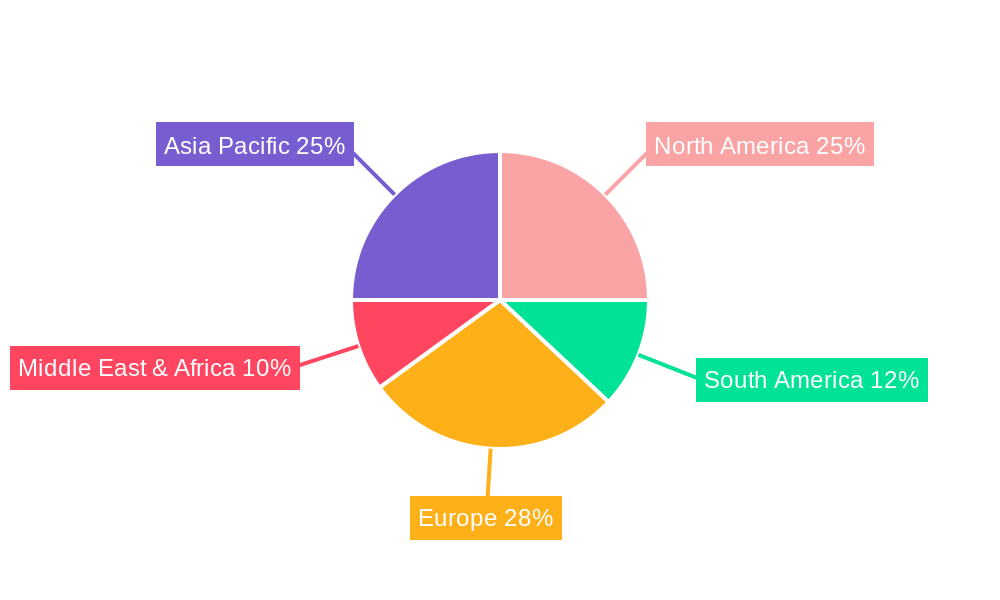

Food Texturing AgentFood Texturing Agent by Type (Emulsifiers, Phosphates, Stabilisers, Dough Conditioners), by Application (Dairy, Frozen food, Bakery Items, Snacks, Beverages, Meat and Poultry Products), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

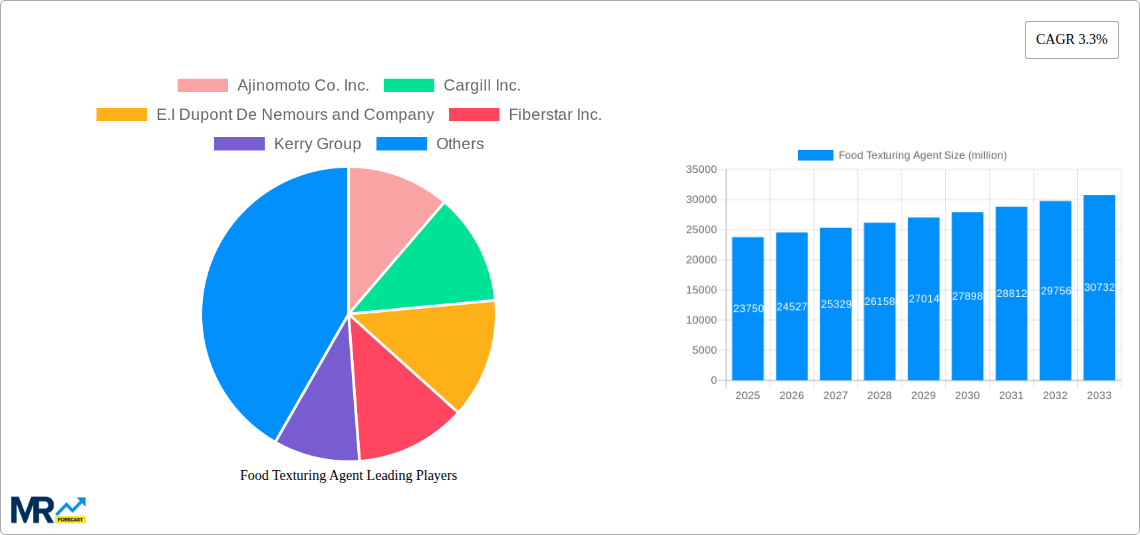

The global Food Texturing Agent market is projected to reach a significant valuation, estimated at approximately USD 23,750 million in 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 3.3% anticipated from 2019 to 2033. The increasing consumer demand for processed and convenience foods, coupled with a growing emphasis on sensory attributes like texture and mouthfeel, are primary market drivers. Food manufacturers are continually innovating to enhance the appeal and shelf-life of their products, making texturizing agents indispensable components in formulations across various food categories. This trend is particularly evident in the dairy, frozen food, bakery, and snack segments, where consumers actively seek desirable textures, from creamy and smooth to crispy and chewy.

The market's expansion is further propelled by advancements in food science and technology, leading to the development of novel texturizing agents with improved functionality and cleaner labels. Key segments like Emulsifiers, Phosphates, Stabilizers, and Dough Conditioners are expected to witness robust demand. While the market presents substantial opportunities, potential restraints such as fluctuating raw material prices and increasing regulatory scrutiny regarding food additives could pose challenges. However, the widespread application in diverse food products, from beverages and meat products to confectionery, alongside the geographical presence of major players like Ajinomoto, Cargill, and DuPont, points towards a dynamic and resilient market trajectory. The Asia Pacific region, with its burgeoning population and rapid urbanization, is poised to be a significant growth engine.

Here's a unique report description on Food Texturing Agents, incorporating your specific requirements:

The global food texturing agent market is poised for remarkable growth, projected to reach an estimated value of $30,500 million in the base year of 2025. This robust expansion is driven by an intricate interplay of evolving consumer preferences, technological advancements, and the ever-present demand for enhanced sensory experiences in food products. Over the historical period of 2019-2024, the market witnessed a steady upward trajectory, laying a strong foundation for accelerated growth during the forecast period of 2025-2033. Consumers are increasingly seeking products that not only taste good but also offer a satisfying mouthfeel and visual appeal, making texturizing agents indispensable tools for food manufacturers. The rising disposable incomes in emerging economies, coupled with a growing awareness of the functional benefits of specific texturizing agents, such as improved texture, stability, and shelf life, are significant contributors to this trend. Furthermore, the demand for clean-label and natural ingredients is influencing the development and adoption of texturizing agents derived from plant-based sources, like hydrocolloids, which are gaining considerable traction. The report will delve into the nuanced shifts within various texturizing agent types, including emulsifiers, phosphates, stabilizers, and dough conditioners, analyzing their individual growth trajectories and their collective impact on the broader market. Innovations in processing technologies and encapsulation methods are also enabling the creation of novel texturizing solutions, offering manufacturers greater versatility and precision in achieving desired product characteristics. The increasing complexity of food formulations, driven by the need for convenience, reduced fat, and sugar content, further amplifies the importance of sophisticated texturizing agents to compensate for the loss of desirable textures. This dynamic landscape suggests a market ripe with opportunity, necessitating a deep understanding of consumer behavior and technological capabilities to navigate its future. The study period of 2019-2033 provides a comprehensive temporal lens through which to analyze these evolving trends.

The surge in demand for food texturizing agents is fundamentally propelled by a confluence of powerful market dynamics. Foremost among these is the pervasive trend towards premiumization in the food industry. Consumers are willing to pay more for products that offer a superior sensory experience, and texturizing agents are critical in delivering that desirable mouthfeel, creaminess, viscosity, and visual appeal. This aspiration for elevated culinary experiences, from indulgent dairy products to artisanal bakery items, directly fuels the adoption of advanced texturizing solutions. Alongside premiumization, the burgeoning global population and the accompanying need for efficiently produced, shelf-stable food products present another significant driver. Texturizing agents play a vital role in extending the shelf life of processed foods, preventing undesirable changes in texture over time, and ensuring consistent product quality, thereby reducing food waste and enhancing food security. The increasing adoption of convenience foods, driven by busy lifestyles and a demand for on-the-go consumption, also necessitates the use of texturizing agents. These ingredients help maintain the desired texture and consistency in ready-to-eat meals, snacks, and beverages, making them more appealing and palatable. Moreover, the continuous innovation in food science and technology has led to the development of new and improved texturizing agents with enhanced functionalities, catering to specific product requirements and enabling manufacturers to create novel food concepts. The forecast period of 2025-2033 is expected to see these drivers intensify, solidifying the essential role of texturizing agents in the modern food landscape.

Despite the optimistic growth outlook for the food texturing agent market, several challenges and restraints warrant careful consideration. A primary concern revolves around the increasing consumer demand for "clean label" products, which often translates into a preference for ingredients perceived as natural and minimally processed. This trend can create headwinds for certain synthetic texturizing agents, prompting a need for manufacturers to invest in developing and promoting naturally derived alternatives. The regulatory landscape surrounding food additives, including texturizing agents, can also pose a challenge. Varying regulations across different countries and regions can complicate product development and market entry strategies, requiring extensive compliance efforts. Fluctuations in the prices of raw materials, particularly for plant-based texturizing agents like starches and gums, can impact the cost-effectiveness of these ingredients and subsequently affect profit margins for manufacturers. Supply chain disruptions, as experienced in recent years, can also lead to availability issues and price volatility, posing a risk to consistent production. Furthermore, consumer perception and awareness regarding the role and safety of texturizing agents can sometimes lead to apprehension or misinformation, necessitating clear communication and education from the industry. The ongoing R&D required to develop novel, high-performing, and cost-effective texturizing agents also represents a significant investment for companies. Overcoming these hurdles will be crucial for sustained market expansion.

The Asia Pacific region is anticipated to emerge as a dominant force in the global food texturing agent market during the study period of 2019-2033, with its influence expected to be particularly pronounced in the base year of 2025. This dominance is attributed to a potent combination of factors, including a rapidly growing population, increasing urbanization, and a burgeoning middle class with rising disposable incomes. These demographic shifts translate into a significant increase in the consumption of processed foods, ready-to-eat meals, and convenient food products, all of which heavily rely on texturizing agents to enhance palatability and shelf life.

Within the Asia Pacific, countries like China, India, and Southeast Asian nations are experiencing substantial growth in their food processing sectors. This expansion is fueled by both domestic demand and the increasing export of food products. The demand for diverse food textures, catering to both traditional and Westernized palates, is a key driver for the adoption of a wide array of texturizing agents. For instance, the dairy segment in this region, encompassing yogurt, ice cream, and flavored milk, is a significant consumer of stabilizers and emulsifiers to achieve desired creaminess and prevent ice crystal formation. Similarly, the rapidly expanding bakery sector, driven by the popularity of bread, cakes, and pastries, relies on dough conditioners and stabilizers to improve dough handling properties, crumb structure, and overall product quality. The snack market, a fast-growing segment, utilizes texturizing agents to impart crispy textures and prevent oil absorption.

In terms of specific segments, Stabilisers are expected to play a pivotal role in driving market growth across various applications. Stabilisers are crucial for maintaining the consistency, texture, and appearance of a wide range of food products, from beverages and dairy items to frozen foods and sauces. Their ability to prevent separation, improve viscosity, and enhance mouthfeel makes them indispensable ingredients for manufacturers aiming to deliver high-quality, stable products.

The extensive application of stabilizers across diverse food categories, coupled with their critical role in ensuring product integrity and sensory appeal, solidifies their position as a leading segment. The forecast period of 2025-2033 will witness continued innovation and demand for advanced stabilizing solutions, further cementing this segment's dominance within the broader food texturizing agent market. The estimated market size of $30,500 million in 2025 underscores the significant economic impact of these ingredients.

Several key growth catalysts are poised to accelerate the expansion of the food texturing agent industry. The persistent demand for indulgent and convenient food products, coupled with rising consumer expectations for superior sensory attributes, forms a foundational growth driver. Furthermore, advancements in biotechnology and ingredient processing are leading to the development of novel texturizing agents with improved functionalities and cleaner ingredient profiles, catering to evolving consumer preferences. The increasing focus on reducing sugar, fat, and salt content in food formulations presents another significant catalyst, as texturizing agents become crucial for compensating for the textural losses associated with these reformulations, thereby maintaining product palatability.

The food texturing agent market is characterized by the presence of several established and innovative players. The report will provide in-depth analysis of the strategies and market presence of companies including:

The food texturing agent sector has witnessed numerous strategic developments aimed at innovation, expansion, and meeting evolving market demands. These include:

This comprehensive report provides an exhaustive analysis of the global food texturing agent market. It meticulously examines the market dynamics, trends, and growth prospects across the study period of 2019-2033, with a keen focus on the base year of 2025, where the market is estimated to reach $30,500 million. The report delves into the key drivers, challenges, and opportunities shaping the industry, offering invaluable insights for stakeholders. It also presents a detailed regional analysis, highlighting dominant markets and their underlying growth factors, alongside a granular segmentation of the market by type and application. Furthermore, the report profiles leading industry players and outlines significant recent developments, providing a holistic view of this dynamic and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

Key companies in the market include Ajinomoto Co. Inc., Cargill Inc., E.I Dupont De Nemours and Company, Fiberstar Inc., Kerry Group, Archer Daniels Midland Co., Tate & Lyle Inc., Penford Corp., Ashland Inc., FMC Corporation, CP Kelco, Estelle Chemicals, Royal DSM N.V., Premium Ingredients, .

The market segments include Type, Application.

The market size is estimated to be USD 23750 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Texturing Agent," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Texturing Agent, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.