1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Safety Detector?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Safety Detector

Food Safety DetectorFood Safety Detector by Type (Fixed, Portable, World Food Safety Detector Production ), by Application (Food and Beverage, Laboratory, Others, World Food Safety Detector Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

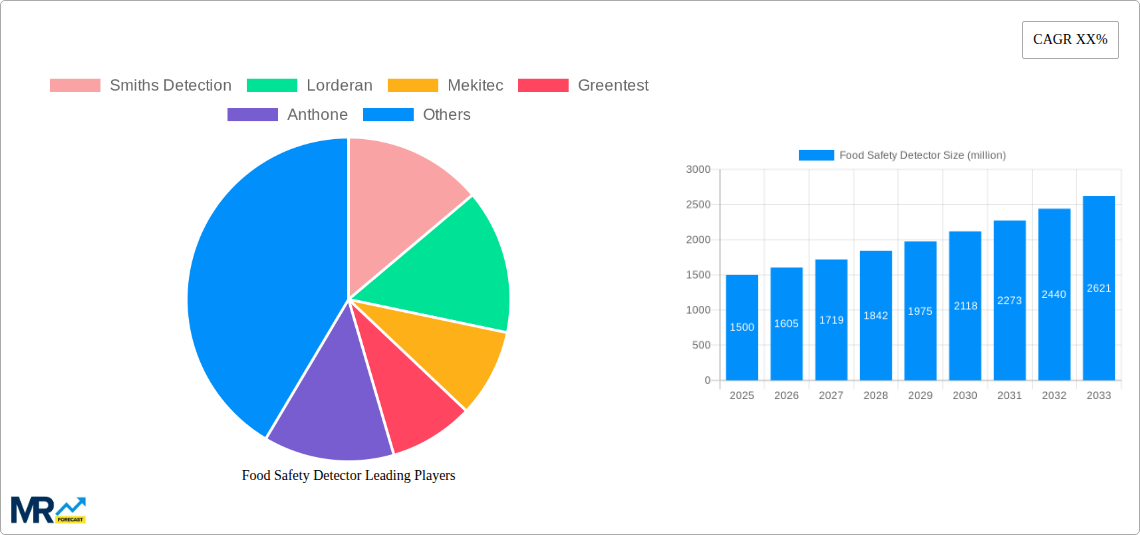

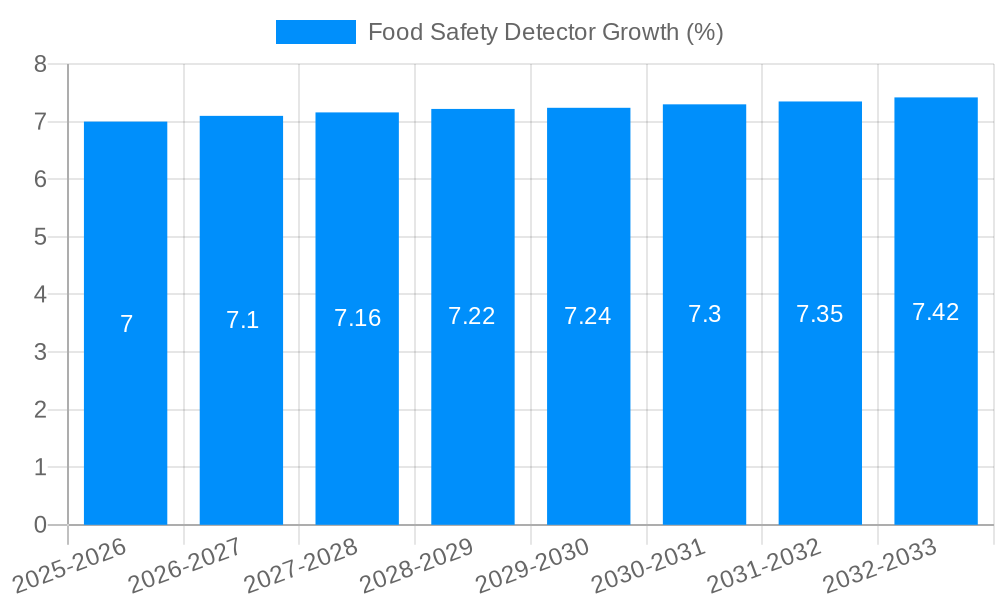

The global Food Safety Detector market is poised for substantial growth, projected to reach approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This expansion is primarily fueled by increasing consumer awareness regarding foodborne illnesses and stringent government regulations demanding higher standards of food quality and safety. The growing complexity of global food supply chains, coupled with advancements in detection technologies, further propels market demand. Key market drivers include the rising incidence of food contamination incidents and the increasing adoption of innovative, rapid, and portable detection solutions across various segments of the food industry. The "Fixed" detector segment is expected to dominate, offering comprehensive laboratory-grade analysis, while the "Portable" segment will witness significant growth driven by its application in on-site testing and remote locations.

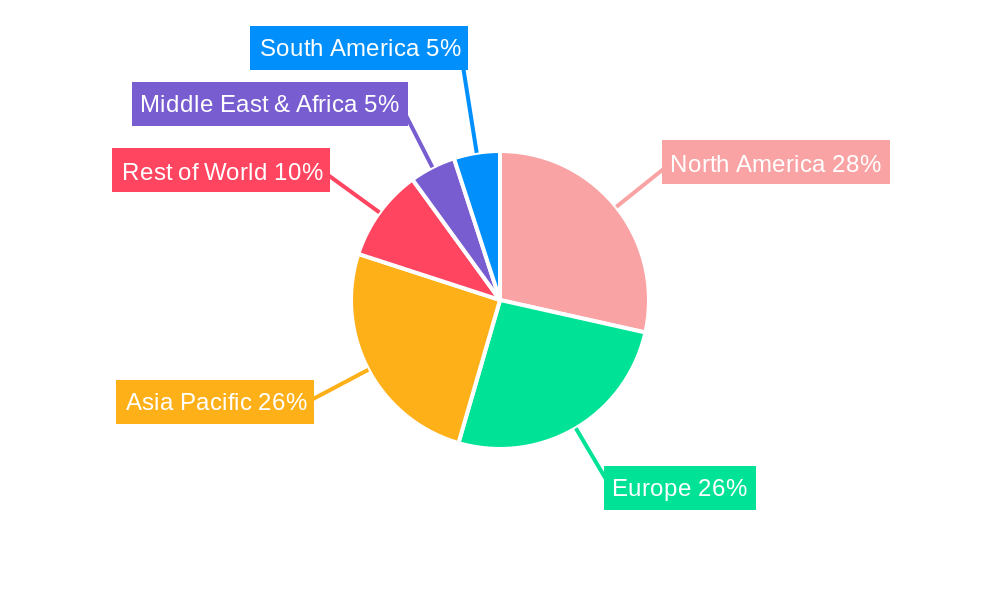

The food and beverage industry remains the largest application segment, leveraging these detectors to ensure product integrity from farm to fork. The laboratory segment also presents a consistent demand, with research institutions and quality control facilities relying on these instruments. Emerging economies, particularly in the Asia Pacific region, are expected to emerge as significant growth hubs due to rapid industrialization, increasing disposable incomes, and a growing focus on international food safety standards. However, the market faces certain restraints, including the high initial cost of advanced detection equipment and the need for specialized training for operators. Despite these challenges, the commitment to safeguarding public health and ensuring consumer confidence in the food supply chain will continue to drive innovation and market penetration of food safety detectors worldwide. Key players such as Smiths Detection, Waters Corporation, and Shimadzu Instruments are instrumental in shaping the market through continuous product development and strategic collaborations.

This comprehensive report delves into the dynamic global Food Safety Detector market, meticulously analyzing its trajectory from 2019 to 2033. The study period encompasses a historical analysis from 2019-2024, a base and estimated year of 2025, and a robust forecast period from 2025-2033. We project the global market to be valued in the hundreds of millions of dollars by 2025, with significant growth anticipated throughout the forecast period. This report is an indispensable resource for stakeholders seeking in-depth insights into market trends, driving forces, challenges, regional dominance, growth catalysts, key players, and significant developments shaping the future of food safety detection technologies.

The global Food Safety Detector market is experiencing a significant upward trend, driven by an increasingly vigilant consumer base and a growing awareness of the critical role food safety plays in public health and economic stability. During the historical period (2019-2024), we observed a steady rise in demand for advanced detection systems, spurred by an escalation in foodborne illness outbreaks and recalls. These incidents, often publicized globally, have underscored the inadequacies of traditional testing methods and fueled the adoption of more sophisticated and rapid detection technologies.

Looking ahead, the market is poised for accelerated growth, with innovations in Artificial Intelligence (AI) and Machine Learning (ML) set to revolutionize food safety. These technologies are enabling real-time monitoring, predictive analysis of potential contamination risks, and the development of smart detectors that can identify a wider spectrum of hazards, including chemical, biological, and physical contaminants, with unprecedented accuracy and speed. The increasing complexity of global food supply chains, coupled with the rise of artisanal and specialty food products, also necessitates advanced detection solutions capable of handling diverse matrices and potential adulterants.

Furthermore, the development of miniaturized and portable detection devices is a key trend, empowering on-site testing at various points in the supply chain, from farms to processing plants and even at the consumer level. This accessibility reduces reliance on centralized laboratories, significantly shortening testing turnaround times and enabling quicker responses to potential safety concerns. The integration of IoT (Internet of Things) connectivity in these devices will further enhance their utility, facilitating data sharing and remote monitoring, creating a more interconnected and responsive food safety ecosystem. The market is also witnessing a growing emphasis on non-destructive testing methods, preserving product integrity while ensuring safety. These trends collectively paint a picture of a rapidly evolving market, driven by technological advancements and a persistent commitment to safeguarding global food supplies.

The global Food Safety Detector market is experiencing robust expansion fueled by a confluence of powerful driving forces. Foremost among these is the escalating global concern over foodborne illnesses and contamination incidents. High-profile recalls and outbreaks in recent years have amplified public and regulatory scrutiny, creating an imperative for food producers and regulatory bodies to invest in advanced detection technologies. Consumers are increasingly demanding transparency and assurance regarding the safety of their food, putting pressure on manufacturers to implement stringent quality control measures.

Another significant driver is the increasing stringency of governmental regulations and international food safety standards. Agencies worldwide are continuously updating and enforcing stricter guidelines for food contamination, residue detection, and allergen identification. Compliance with these regulations necessitates the adoption of sophisticated and reliable detection instruments. Moreover, the rapid growth of the global food and beverage industry, coupled with the expansion of complex and often international supply chains, introduces new challenges in maintaining food safety. This necessitates efficient and accurate testing solutions at multiple points along the chain to prevent the spread of contaminants.

The technological advancements in analytical instrumentation also play a pivotal role. Innovations in spectroscopy, chromatography, biosensors, and imaging techniques are leading to the development of more sensitive, specific, rapid, and cost-effective food safety detectors. These technological leaps are making advanced detection capabilities more accessible to a wider range of businesses. Finally, the growing consumer awareness and demand for healthier and safer food products are pushing manufacturers to proactively implement robust safety protocols, thus boosting the demand for effective detection tools.

Despite the promising growth trajectory, the Food Safety Detector market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the high cost of advanced detection technologies. Sophisticated instruments, particularly those employing cutting-edge analytical techniques, can represent a substantial capital investment, making them less accessible for small and medium-sized enterprises (SMEs) operating in developing economies or in niche food sectors. This cost barrier can limit the widespread adoption of the most effective solutions, especially in regions with tighter budgetary constraints.

Another considerable restraint is the need for skilled personnel and extensive training. Operating and maintaining advanced food safety detectors often requires specialized knowledge and technical expertise. A shortage of adequately trained professionals can hinder the effective deployment and utilization of these instruments, thereby limiting their full potential. Furthermore, the complexity of food matrices and the constant emergence of new contaminants pose ongoing challenges. Food products can have intricate compositions, making it difficult to develop universal detection methods that are both sensitive and specific. The continuous evolution of adulteration techniques and the emergence of novel pathogens or chemical residues necessitate ongoing research and development to keep pace, which can be time-consuming and resource-intensive.

The lack of standardized testing protocols across different regions and industries can also create fragmentation and hinder interoperability. While regulations are becoming stricter, variations in methodologies and acceptance criteria can lead to discrepancies and challenges in ensuring consistent food safety across global supply chains. Finally, resistance to adopting new technologies and established practices within some segments of the industry can slow down the transition towards more advanced detection methods. Overcoming this inertia requires strong advocacy, clear demonstrations of ROI, and robust support for technology integration.

The global Food Safety Detector market is characterized by a significant concentration of demand and innovation in specific regions and segments. Among the key regions, North America and Europe are poised to dominate the market in the coming years. This dominance is underpinned by several critical factors.

Within the market segments, the Food and Beverage application segment will unequivocally dominate the global Food Safety Detector market. This dominance stems from the sheer scale and complexity of the food and beverage industry, which is the primary end-user for these detection systems.

While Portable detectors are gaining significant traction due to their flexibility and on-site capabilities, the sheer scale and integrated nature of safety testing within large-scale food and beverage processing operations ensure that Fixed detectors, often integrated into production lines, will continue to constitute a substantial portion of the market demand, especially in high-volume production environments.

The Food Safety Detector industry is propelled by several potent growth catalysts. The increasing frequency of global foodborne illness outbreaks and recalls acts as a major impetus, raising public and regulatory awareness and demanding more advanced detection solutions. Furthermore, the progressive tightening of food safety regulations worldwide by governmental bodies necessitates continuous investment in sophisticated testing equipment for compliance. Technological advancements in areas like spectroscopy, biosensors, and AI are enabling the development of more accurate, rapid, and cost-effective detectors, thereby expanding their accessibility and application.

This report provides an all-encompassing analysis of the Food Safety Detector market, offering deep dives into key market insights and detailed segmentation. We meticulously examine the driving forces, including escalating global concerns over foodborne illnesses and increasingly stringent regulations, which are fueling demand for advanced detection technologies. Simultaneously, we address the challenges and restraints such as the high cost of sophisticated instruments and the need for skilled personnel. The report identifies North America and Europe as dominant regions, supported by robust regulatory frameworks and high consumer awareness, and highlights the Food and Beverage application segment as the primary market driver due to its vast scope and continuous need for safety assurance. Growth catalysts, leading players, and significant developments are comprehensively detailed, ensuring stakeholders have a complete understanding of the market landscape and its future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Smiths Detection, Lorderan, Mekitec, Greentest, Anthone, Stantec, Focused Photonics(Hangzhou),Inc., Beijing Puxi General Instrument Co., Ltd., Beijing Beifen Ruili Analytical Instrument (Group) Co., Ltd., Waters Corporation, Shimadzu Instruments (Suzhou) Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Safety Detector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Safety Detector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.