1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Preservation Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Preservation Packaging

Food Preservation PackagingFood Preservation Packaging by Type (Food Preservation Box, Food Preservation Film, Others), by Application (Household, Commercial, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global food preservation packaging market is poised for significant expansion, projected to reach an estimated USD 450 billion by 2025, driven by a compound annual growth rate (CAGR) of 6.5% through 2033. This robust growth is fueled by a confluence of factors, most notably the escalating consumer demand for convenience and extended shelf life, a direct response to busy lifestyles and a growing global population. Advancements in material science, particularly the development of intelligent and active packaging solutions, are further accelerating adoption. These innovative materials not only enhance food safety by inhibiting microbial growth and oxidation but also provide consumers with real-time information about food freshness, thereby reducing food waste. The increasing preference for single-serving and ready-to-eat meals, especially in urbanized areas, also contributes substantially to market demand. Furthermore, stringent food safety regulations and an increasing awareness of the economic and environmental impact of food spoilage are compelling food manufacturers and retailers to invest in superior preservation packaging.

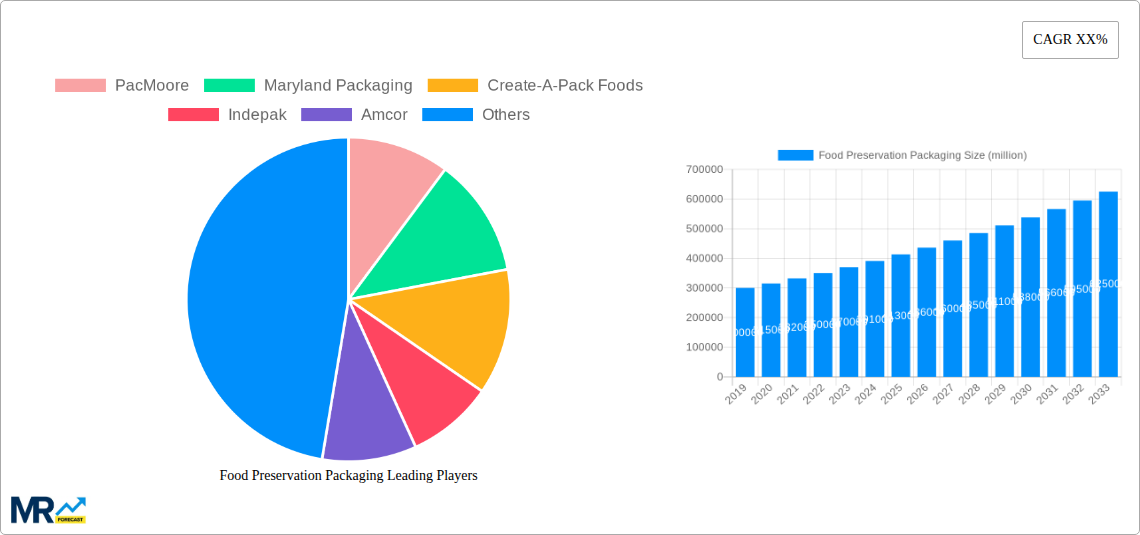

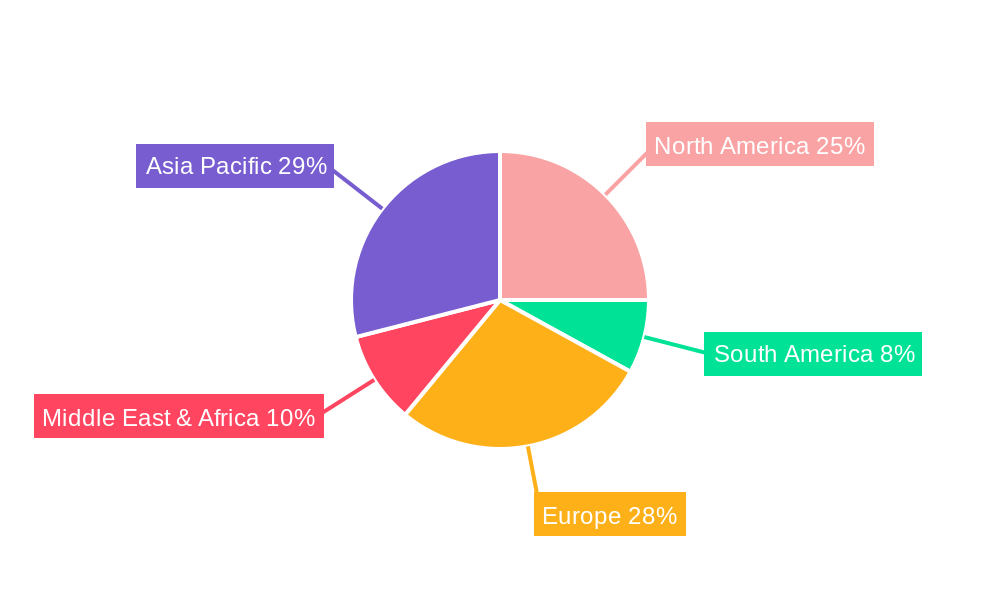

The market is segmented across various product types and applications, with Food Preservation Boxes and Food Preservation Films expected to dominate, catering to both Household and Commercial applications. The household segment is experiencing a surge in demand for reusable and eco-friendly preservation solutions, while the commercial sector, encompassing food service and retail, requires high-performance packaging to maintain product integrity during transit and display. Geographically, the Asia Pacific region, particularly China and India, is emerging as a key growth engine due to its burgeoning middle class, rapid urbanization, and a growing emphasis on food quality and safety standards. North America and Europe, with their established food processing industries and high consumer spending power, continue to represent substantial markets. However, challenges such as the increasing cost of raw materials and the growing concern over plastic waste are acting as restraints, prompting a greater focus on sustainable and recyclable packaging alternatives. Companies like Amcor, Berry Global, and Sealed Air are at the forefront of innovation, developing solutions that balance preservation efficacy with environmental responsibility.

This report provides an in-depth analysis of the global food preservation packaging market, a sector projected to experience significant growth and evolution. Spanning a study period from 2019 to 2033, with a base year of 2025, this research delves into the intricate dynamics shaping the industry, from emerging trends and driving forces to the challenges and key players influencing its trajectory. The report utilizes a wealth of data, including market insights from leading companies and detailed segment analysis, to offer a robust understanding of the present landscape and future potential.

The food preservation packaging market is undergoing a transformative phase, driven by a confluence of consumer demand for convenience, a heightened awareness of food safety and shelf-life extension, and a growing imperative for sustainable solutions. Consumers are increasingly seeking packaging that not only protects food from spoilage but also maintains its nutritional value and sensory appeal for longer durations. This trend is particularly evident in the burgeoning demand for intelligent and active packaging solutions. Intelligent packaging, which monitors and communicates the condition of food, and active packaging, which actively modifies the atmosphere inside the package or releases/absorbs substances, are gaining traction. For instance, the incorporation of oxygen absorbers, ethylene scavengers, and moisture regulators within packaging materials is becoming commonplace, significantly extending the shelf life of perishable goods such as fresh produce, dairy products, and processed meats. This not only reduces food waste but also allows for greater flexibility in distribution and retail, enabling products to reach a wider consumer base without compromising quality.

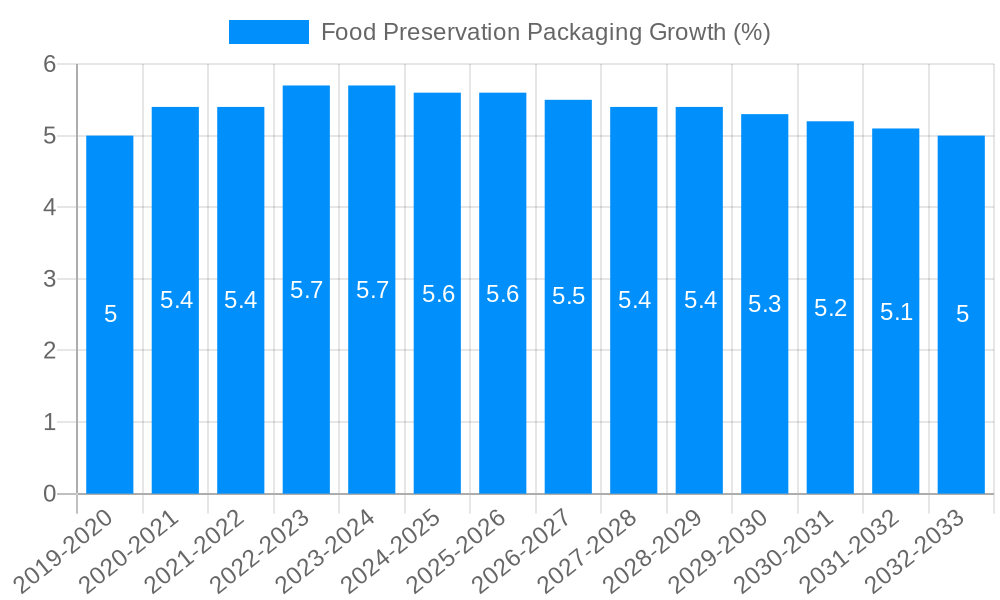

Furthermore, the market is witnessing a pronounced shift towards convenience-oriented packaging formats. Ready-to-eat meals, single-serving portions, and retort pouches are experiencing a surge in popularity, reflecting the fast-paced lifestyles of modern consumers. These formats require robust and reliable packaging that can withstand various processing techniques like high-temperature sterilization and freezing, while also being easy to open and dispose of. The increasing urbanization and the growing disposable income in emerging economies are further fueling this demand. Simultaneously, there is a relentless pursuit of environmentally friendly packaging alternatives. The stringent regulations and growing consumer advocacy against single-use plastics are compelling manufacturers to explore biodegradable, compostable, and recyclable materials. This has led to significant investment in research and development of innovative materials derived from renewable resources, such as bioplastics, paper-based packaging with barrier coatings, and redesigned multi-material solutions that are easier to recycle. The industry is actively working towards reducing the environmental footprint of food preservation packaging without sacrificing performance. The overall market is projected to witness a compound annual growth rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033, with the global market value expected to reach an estimated USD 250 million by 2033. The base year of 2025 is anticipated to see a market valuation in the range of USD 180 million.

Several powerful forces are collectively propelling the growth of the global food preservation packaging market. Foremost among these is the escalating global population and the subsequent increase in food demand. As the world's population continues to grow, so does the necessity to efficiently produce, distribute, and preserve food to meet the nutritional needs of billions. Food preservation packaging plays a pivotal role in minimizing post-harvest losses and ensuring that food reaches consumers in a safe and edible state, thereby supporting food security initiatives worldwide. Coupled with this is the rising awareness among consumers regarding food safety and health. In an era where foodborne illnesses are a significant public health concern, consumers are increasingly demanding packaging that offers superior protection against contaminants, microbial growth, and spoilage. This has pushed manufacturers to invest in advanced packaging technologies that provide enhanced barrier properties and tamper-evident features, instilling greater confidence in product integrity.

Moreover, the trend towards smaller households and single-person living is a significant driver for the demand for smaller, portion-controlled, and easy-to-use food preservation packaging. This caters to the need for convenience and reduces food waste within individual households. The growth of the e-commerce sector for food products also presents a substantial opportunity. As more consumers opt for online grocery shopping, the demand for robust and protective packaging that can withstand the rigors of shipping and handling, while also maintaining product freshness, is on the rise. This necessitates innovative packaging designs that ensure food arrives at the consumer's doorstep in optimal condition, further cementing the importance of advanced preservation techniques. The ever-increasing shelf life expectations from both consumers and retailers also pushes for more sophisticated preservation packaging.

Despite the robust growth trajectory, the food preservation packaging market faces a set of formidable challenges and restraints that can impede its progress. A primary concern revolves around the rising cost of raw materials. The production of advanced food preservation packaging often relies on specialized polymers, barrier films, and innovative materials. Fluctuations in the prices of crude oil, natural gas, and other petrochemical feedstocks, as well as the increasing demand for sustainable and novel materials, can lead to volatile and escalating raw material costs. This, in turn, puts pressure on manufacturers to absorb these costs or pass them on to consumers, potentially impacting market competitiveness.

Another significant hurdle is the stringent and evolving regulatory landscape surrounding food contact materials. Governments worldwide are implementing stricter regulations concerning the safety, recyclability, and environmental impact of packaging materials. Companies must continuously invest in research and development to ensure their packaging solutions comply with these ever-changing standards, which can be a costly and time-consuming process. Furthermore, the consumer perception and adoption of sustainable packaging can be a double-edged sword. While there is a growing demand for eco-friendly options, consumers are often reluctant to compromise on performance, convenience, or cost. Educating consumers about the benefits and functionality of new sustainable packaging materials, and ensuring they are readily accessible and affordable, remains a key challenge. The complexity of recycling multi-material packaging also poses a significant environmental and economic challenge, often leading to materials ending up in landfills rather than being effectively recycled. The limited infrastructure for collection and processing of certain novel biodegradable or compostable packaging materials in some regions further hinders their widespread adoption.

The global food preservation packaging market exhibits a dynamic regional landscape, with specific segments playing a pivotal role in its overall dominance. Amongst the various segments, Food Preservation Film is poised to emerge as a dominant force, driven by its inherent versatility and wide-ranging applications across both household and commercial sectors.

Key Region: North America

North America is expected to lead the market, driven by several factors:

Key Segment: Food Preservation Film

The dominance of Food Preservation Film within the market is attributed to its extensive applicability and continuous innovation:

In terms of specific applications within the film segment, the Commercial application segment for food preservation films is expected to hold the largest market share, accounting for approximately 65% of the total film market value in 2025. This is due to the large-scale needs of food manufacturers, processors, and retailers. The Household segment, while smaller, is also showing robust growth due to increasing consumer awareness and adoption of advanced food storage solutions. The global food preservation film market alone is projected to reach an estimated USD 150 million by 2033.

Several key growth catalysts are poised to significantly boost the food preservation packaging industry. The escalating demand for extended shelf-life products across all food categories, driven by consumer desire for convenience and reduced food waste, is a primary catalyst. Furthermore, the continuous innovation in material science, leading to the development of advanced barrier films, active packaging components, and biodegradable alternatives, is opening new avenues for growth. The growing awareness of food safety standards and the increasing stringency of regulations are also compelling manufacturers to adopt more sophisticated preservation packaging solutions. The expanding e-commerce food delivery sector necessitates robust and protective packaging that maintains product integrity during transit.

This report offers a comprehensive examination of the food preservation packaging market, providing an exhaustive analysis of its current state and future outlook. It delves into intricate details of market trends, examining the growing consumer demand for convenience and sustainability alongside the technological advancements in active and intelligent packaging. The report meticulously analyzes the key drivers fueling market expansion, including population growth, increasing food safety concerns, and the rise of e-commerce for food products. It also addresses the significant challenges and restraints, such as raw material cost volatility, stringent regulations, and the complexities of recycling. Furthermore, the report highlights dominant regions and segments, with a particular focus on the significant role of Food Preservation Films in North America. It identifies crucial growth catalysts, outlines the strategies of leading players, and details significant industry developments with precise year/month timelines, offering an unparalleled resource for stakeholders seeking a complete understanding of this vital market. The report aims to provide actionable insights for businesses seeking to navigate and capitalize on the evolving landscape of food preservation packaging.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PacMoore, Maryland Packaging, Create-A-Pack Foods, Indepak, Amcor, Berry Global, Sonoco Products, ProAmpac, Sealed Air, Linpac Packaging, Chuo Kagaku Co., Ltd., Shandong Jinhaiyuan Packaging Technology Co., Ltd., Dongguan Fengeryi Packaging Materials Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Preservation Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Preservation Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.