1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Grade rPET?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Grade rPET

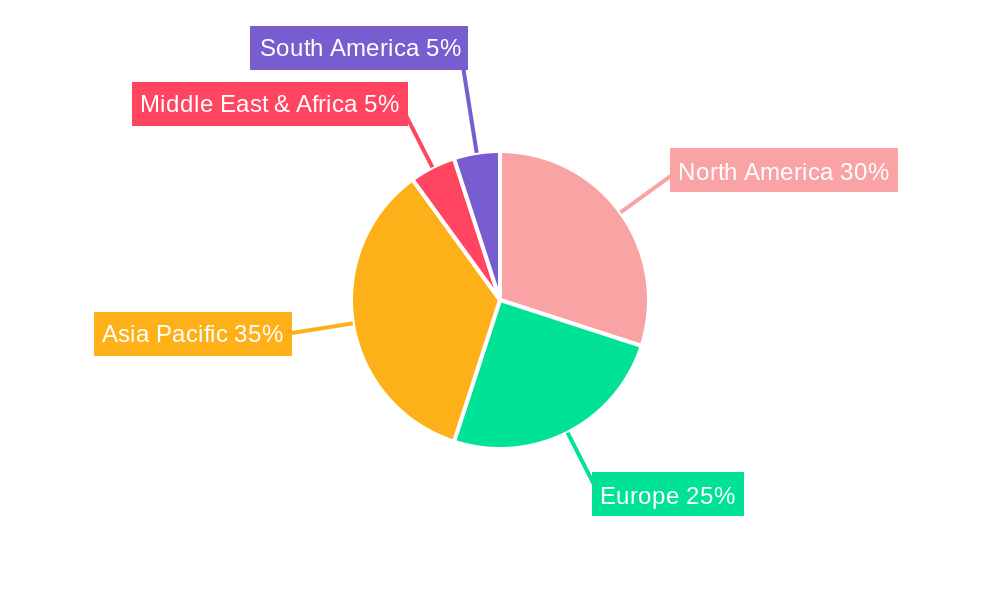

Food Grade rPETFood Grade rPET by Type (Clear Flake, Color Flake, World Food Grade rPET Production ), by Application (PET Bottles, Sheet and Film, Fiber, Others, World Food Grade rPET Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

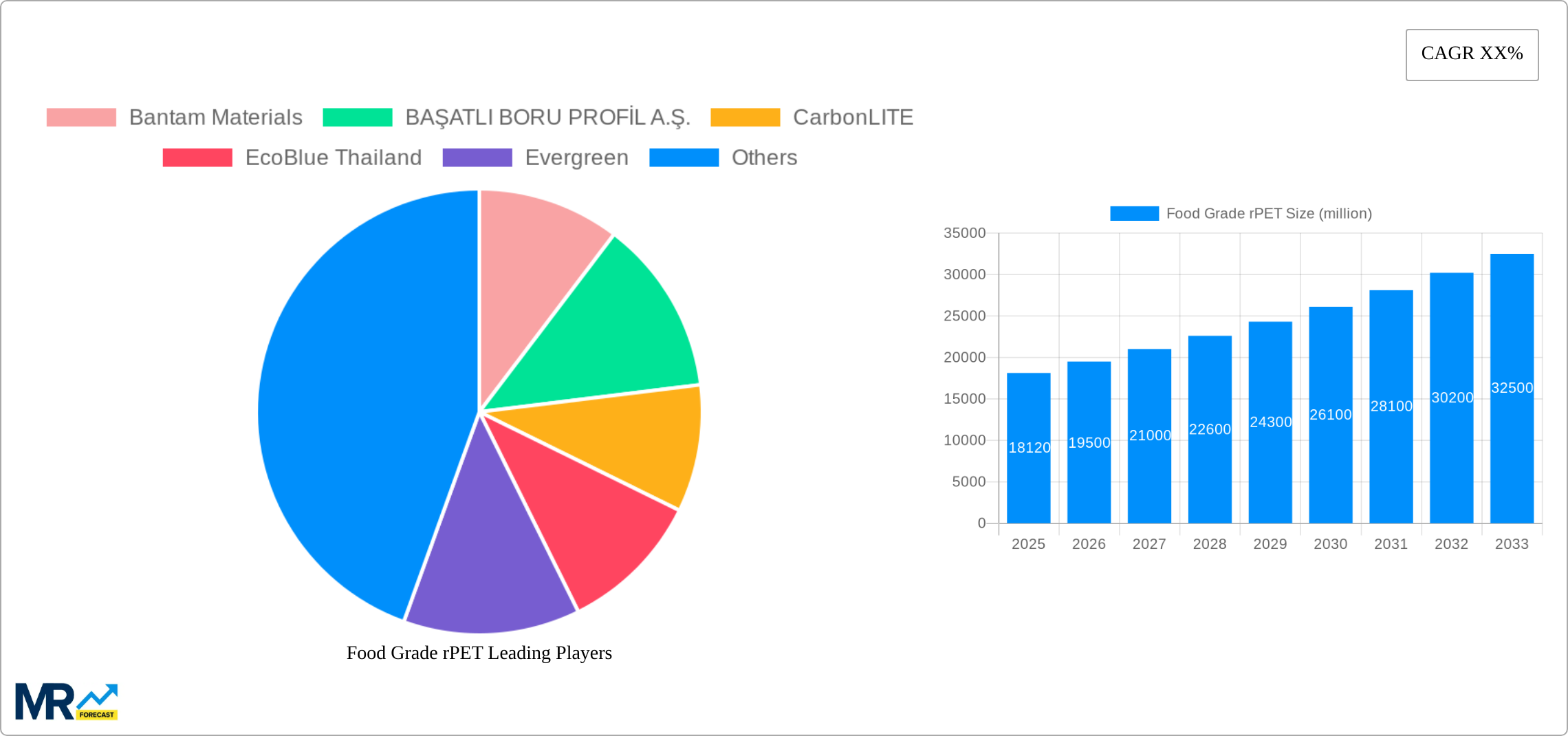

The global food-grade recycled polyethylene terephthalate (rPET) market, valued at approximately $18.12 billion in 2025, is experiencing robust growth driven by increasing consumer demand for sustainable packaging solutions and stringent regulations aimed at reducing plastic waste. The rising awareness of environmental issues and the associated push for circular economy practices are key catalysts propelling market expansion. Significant growth is observed in applications like PET bottles, where food-grade rPET is rapidly replacing virgin PET due to its cost-effectiveness and comparable quality. Furthermore, the increasing adoption of rPET in food packaging across various segments, including sheet and film, fiber, and others, is contributing to the market's expansion. Technological advancements in rPET production, leading to enhanced clarity, strength, and food safety, are also fueling market growth. While challenges remain in terms of consistent supply chain management and the cost competitiveness against virgin PET in some regions, the overall trajectory of the food-grade rPET market remains positive, indicating a high potential for expansion in the coming years.

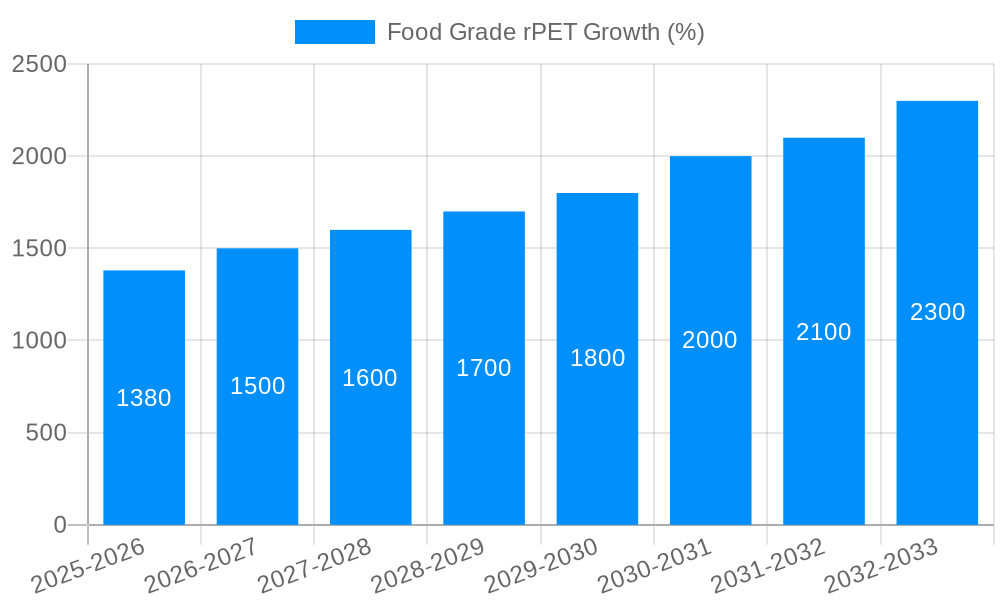

Several factors are shaping the future of this market. Firstly, governmental initiatives promoting recycling and the implementation of extended producer responsibility (EPR) schemes are significantly influencing the adoption of rPET. Secondly, the innovation in rPET production technologies, resulting in higher-quality and more versatile materials, is broadening its application scope. Thirdly, collaborative efforts between brand owners, recyclers, and resin producers are creating more efficient closed-loop recycling systems, ensuring a consistent supply of high-quality food-grade rPET. However, challenges such as the inconsistent quality of collected PET waste, the energy-intensive nature of the recycling process, and the need for continuous technological advancements to overcome certain limitations are crucial factors to monitor. Despite these challenges, the growing consumer preference for eco-friendly products and stricter environmental regulations will further drive the demand for food-grade rPET, leading to substantial market expansion throughout the forecast period (2025-2033). We estimate a considerable CAGR for the coming years, reflecting the overall positive market outlook.

The global food-grade recycled polyethylene terephthalate (rPET) market is experiencing substantial growth, driven by increasing consumer demand for sustainable packaging solutions and stringent regulations aimed at reducing plastic waste. The market, valued at several billion USD in 2024, is projected to witness a compound annual growth rate (CAGR) exceeding X% during the forecast period (2025-2033), reaching a value exceeding Y billion USD by 2033. This surge is fueled by several converging factors: a heightened awareness of environmental issues among consumers, leading to a preference for eco-friendly products; the growing adoption of circular economy principles by businesses; and the increasing availability of high-quality food-grade rPET due to advancements in recycling technologies. Furthermore, governmental initiatives promoting the use of recycled materials and imposing restrictions on virgin PET are significantly impacting market expansion. The shift towards sustainable packaging is particularly pronounced in the food and beverage industry, where brands are actively integrating rPET into their product packaging to appeal to environmentally conscious consumers and enhance their brand image. This trend is expected to continue, driving further growth in the food-grade rPET market in the coming years. The market is witnessing a diversification in applications, beyond the traditional use in bottles, encompassing food-grade rPET sheets and films for various packaging needs, and even expanding into fibers for textiles. This versatility significantly boosts the market's potential, creating opportunities for new players and further innovation within the industry. Competition is increasingly fierce, with both established players and emerging companies vying for market share through investments in advanced recycling technologies and strategic partnerships.

The food-grade rPET market's rapid expansion is propelled by several key drivers. Firstly, the escalating global concern regarding plastic pollution and its environmental impact is pushing consumers and businesses towards more sustainable alternatives. This growing environmental consciousness translates into increased demand for recycled materials like food-grade rPET, offering a viable solution to reduce reliance on virgin PET and minimize landfill waste. Secondly, stringent government regulations and policies aimed at curbing plastic waste are creating a favorable environment for the adoption of rPET. Many countries are implementing mandates for recycled content in plastic packaging, making food-grade rPET a necessary component for companies to comply with regulations and avoid penalties. Thirdly, technological advancements in recycling processes have significantly improved the quality and purity of food-grade rPET, addressing past concerns about its potential impact on food safety. This improvement in quality has broadened the range of applications for food-grade rPET, boosting its market appeal. Finally, the growing interest in circular economy models is further incentivizing the use of recycled materials. Companies are increasingly adopting circular economy strategies to minimize waste, enhance their environmental footprint, and foster brand loyalty among environmentally conscious consumers. This concerted effort across consumers, governments, and businesses is driving the impressive growth trajectory of the food-grade rPET market.

Despite the significant growth potential, the food-grade rPET market faces several challenges. One major hurdle is the inconsistent quality of recycled PET flakes available for food-grade applications. Variations in the quality of collected and processed waste necessitate stringent quality control measures, which can increase production costs and complexity. Another key challenge lies in the higher cost of food-grade rPET compared to virgin PET. Although the price gap is narrowing, the cost difference remains a barrier to widespread adoption, particularly for companies operating on tight margins. Scaling up recycling infrastructure to meet the burgeoning demand for food-grade rPET also presents a significant obstacle. Investing in advanced recycling technologies and expanding collection networks requires substantial capital investment and logistical coordination. Furthermore, the lack of standardized quality control protocols and certification across the industry can create confusion and mistrust among consumers and brands. Ensuring consistent quality and traceability of recycled materials is crucial to build consumer confidence and drive market expansion. Finally, contamination of recycled PET during collection and processing remains a recurring issue. Effective waste management systems and consumer education are essential to minimize contamination and guarantee the production of high-quality food-grade rPET. Addressing these challenges will be key to unlocking the full potential of the food-grade rPET market.

The North American and European regions are currently leading the food-grade rPET market, driven by strong environmental regulations, robust recycling infrastructure, and high consumer awareness. However, Asia-Pacific is expected to experience the fastest growth in the coming years, fueled by increasing demand from developing economies and growing investments in recycling facilities.

Dominant Segments:

Clear Flake: This segment holds the largest market share due to its wider applicability in various food packaging applications. The demand for clear rPET bottles for beverages, water, and other consumables drives the growth of this segment significantly. Millions of tons of clear flake rPET are processed annually, representing a substantial portion of the overall food-grade rPET production. Technological advancements in enhancing clarity and removing contaminants from recycled clear PET flakes are further boosting this segment.

PET Bottles: The application of food-grade rPET in bottles remains the dominant segment. The vast majority of food-grade rPET is currently utilized for producing bottles for beverages, edible oils, and various other food products. The ease of processing and widespread acceptance of rPET bottles in the market contribute significantly to this segment's leading position. Growth in this area is directly linked to the success of broader initiatives promoting the use of recycled content in plastic packaging. The projected production of food grade rPET bottles alone surpasses X million units by 2033.

Paragraph: The dominance of these segments reflects the current state of the market, with clear rPET and PET bottles as the most mature and widely adopted applications. However, other segments like food-grade rPET sheets and films are showing considerable growth potential, indicating a shift towards more diverse applications as recycling technology improves and consumer demand expands. The Asia-Pacific region, in particular, shows immense potential for growth in all segments, given the increasing consumer awareness and government support for sustainable practices. The projected market size by 2033, for both regions and segments, easily exceeds several billion USD, emphasizing the significant market opportunity for food-grade rPET.

The food-grade rPET industry is experiencing a surge in growth fueled by several key catalysts. These include the increasing consumer preference for sustainable products, leading to higher demand for recycled materials. Stringent government regulations promoting recycled content in packaging are further driving market expansion. Advancements in recycling technologies are resulting in higher-quality rPET, opening new applications and broadening the market's scope. Finally, the growing focus on circular economy initiatives by companies is strongly promoting the use of food-grade rPET, leading to overall market growth.

This report provides a comprehensive analysis of the food-grade rPET market, covering market size, trends, drivers, challenges, leading players, and future outlook. It incorporates extensive data and insights gathered through thorough research and analysis, providing a valuable resource for businesses and stakeholders operating in or seeking to enter this dynamic market. The report provides a detailed regional breakdown allowing for targeted strategic planning and investment decisions. The report also explores future developments and provides forecasts for the years to come, enabling proactive adaptation to market shifts and the formulation of successful strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bantam Materials, BAŞATLI BORU PROFİL A.Ş., CarbonLITE, EcoBlue Thailand, Evergreen, Extrupet, Indorama Ventures, Martogg Group, Mohawk Industries Incorporated, Nivaplast, Pashupati Polytex, Perpetual Recycling Solutions, PET Recycling Team GmbH, Phoenix Technologies, Plastipak, PolyQuest, Pro Environmental Ltd, Sorema, Steinbeis PolyVert, Tianjin Incom Resources Recovery, Visy, Wellman International, PTP Group, Unifi, Inc, Marglen Industries, San Miguel Industrial, NEO GROUP, Kyoei Industry, Hiroyuki Industries (M) Sdn Bhd, Sumilon Eco Pet SARL, Ice River Sustainable Solutions, PLASTREC.

The market segments include Type, Application.

The market size is estimated to be USD 18120 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Grade rPET," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Grade rPET, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.