1. What is the projected Compound Annual Growth Rate (CAGR) of the Food & Beverage High Barrier Packaging Films?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food & Beverage High Barrier Packaging Films

Food & Beverage High Barrier Packaging FilmsFood & Beverage High Barrier Packaging Films by Type (PET, CPP, BOPP, PVA, PLA, Others, World Food & Beverage High Barrier Packaging Films Production ), by Application (Food Industry, Beverage Industry, World Food & Beverage High Barrier Packaging Films Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

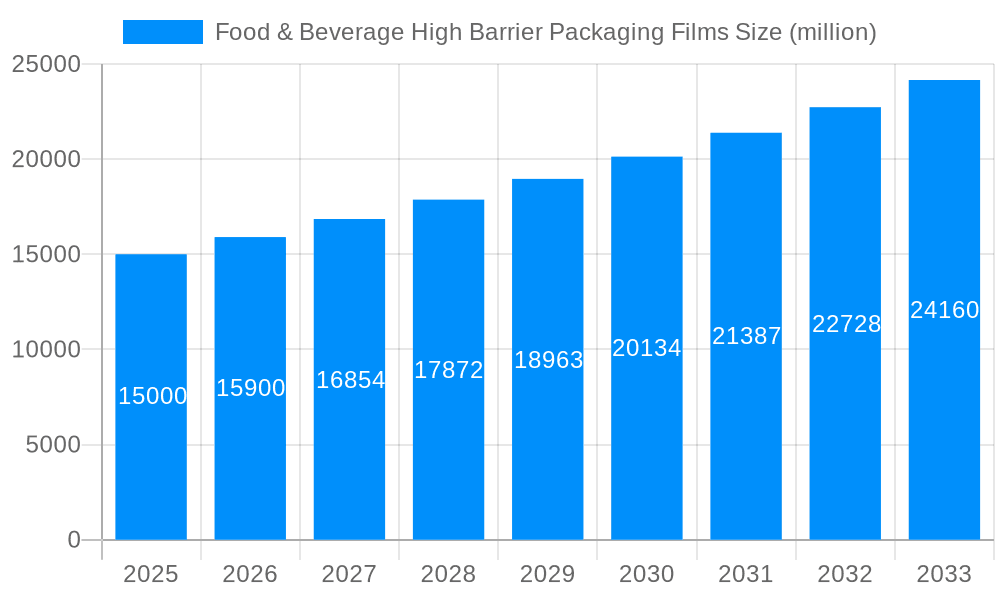

The global food and beverage high-barrier packaging films market is experiencing robust growth, driven by increasing consumer demand for extended shelf life products and a rising focus on food safety and preservation. The market, estimated at $15 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 6% from 2025 to 2033, reaching approximately $25 billion by 2033. This growth is fueled by several key factors. The expanding e-commerce sector necessitates packaging solutions capable of withstanding the rigors of transportation and ensuring product integrity. Furthermore, the growing popularity of ready-to-eat meals and convenient food products is significantly impacting demand. Technological advancements in film materials, including the development of more sustainable and recyclable options, are also contributing to market expansion. Key players like Amcor, DuPont Teijin Films, and Toray Advanced Film are leading innovation in this space, focusing on improved barrier properties, enhanced flexibility, and reduced environmental impact.

However, certain restraints could impede market growth. Fluctuating raw material prices, particularly for polymers, pose a significant challenge. Furthermore, stringent regulatory compliance related to food safety and environmental regulations may increase manufacturing costs. The market is segmented based on material type (e.g., polyethylene terephthalate (PET), polyvinyl chloride (PVC), nylon), packaging type (e.g., pouches, wraps, bags), and application (e.g., dairy products, beverages, snacks). Geographic segmentation reveals strong growth potential in developing economies driven by rising disposable incomes and changing consumer preferences. Competition remains intense, with a mix of established multinational corporations and regional players vying for market share. The future of the market is bright, however, as innovation in material science and a continuing focus on sustainability will propel growth and provide opportunities for industry participants.

The global food and beverage high barrier packaging films market is experiencing robust growth, driven by the increasing demand for extended shelf life and enhanced product protection. The market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a CAGR of X% during the forecast period (2025-2033). This surge is fueled by several key factors. Consumers are increasingly demanding convenient, readily available food and beverages, necessitating packaging solutions that maintain product quality and freshness over extended periods. The growing popularity of ready-to-eat meals and on-the-go consumables further intensifies this demand. Furthermore, stringent regulations regarding food safety and preservation methods are driving the adoption of high-barrier films that effectively prevent spoilage and contamination. The shift towards sustainable packaging is also influencing market trends, with manufacturers exploring biodegradable and recyclable options to meet evolving consumer preferences and environmental concerns. The market is witnessing a diversification of film materials, with innovations in barrier polymers, such as EVOH and PA, improving oxygen and moisture barrier properties. This leads to greater efficiency in preserving sensitive food and beverage products, expanding the applications of high barrier packaging films across a wider array of food and beverage categories. The increasing adoption of advanced packaging technologies, including smart packaging solutions and modified atmosphere packaging (MAP), is also significantly contributing to market expansion. This trend is particularly pronounced in developed regions such as North America and Europe, while developing economies in Asia-Pacific are experiencing rapid growth due to rising disposable incomes and changing consumption patterns. The competitive landscape is dynamic, with major players focusing on product innovation, strategic partnerships, and geographic expansion to consolidate their market shares.

Several factors are synergistically driving the growth of the food and beverage high barrier packaging films market. The foremost driver is the escalating demand for extended shelf life. High-barrier films effectively protect food and beverages from oxygen, moisture, and light, preventing spoilage and extending their shelf life significantly. This is particularly crucial for sensitive products like dairy, meat, and ready-to-eat meals, where maintaining quality and safety is paramount. The rising consumer preference for convenience is also a significant growth catalyst. High-barrier films facilitate the packaging of ready-to-eat and single-serve portions, catering to busy lifestyles and on-the-go consumption. Furthermore, the growing awareness of food safety and hygiene among consumers is boosting the demand for robust packaging solutions that safeguard against contamination. The stringent regulations imposed by governmental bodies across various regions further accelerate the adoption of high-barrier packaging films. Lastly, the increasing focus on sustainability is driving innovation in eco-friendly barrier materials, creating a market for biodegradable and recyclable options that address environmental concerns while meeting the performance requirements of high-barrier packaging. This confluence of factors collectively contributes to the impressive growth trajectory of the food and beverage high barrier packaging films market.

Despite the promising growth prospects, several challenges hinder the expansion of the food and beverage high barrier packaging films market. The high cost of specialized barrier materials like EVOH and PA presents a significant hurdle, particularly for small and medium-sized enterprises (SMEs) operating on tighter budgets. This cost factor often necessitates a trade-off between enhanced product preservation and affordability. The complexity of manufacturing processes associated with high-barrier films requires specialized equipment and expertise, potentially raising production costs and limiting the accessibility for smaller manufacturers. Furthermore, the fluctuating prices of raw materials, especially polymers, can impact the overall cost competitiveness of high-barrier films. Environmental concerns surrounding the disposal and recyclability of certain types of barrier films also pose a challenge. Consumers are increasingly demanding sustainable packaging solutions, which compels manufacturers to invest in research and development to create more eco-friendly alternatives. Meeting these demands while maintaining the necessary barrier properties requires significant technological advancements and can be a time-consuming and costly undertaking. Finally, the intense competition among established players and the emergence of new entrants can lead to price pressures, affecting the profitability of businesses in this segment.

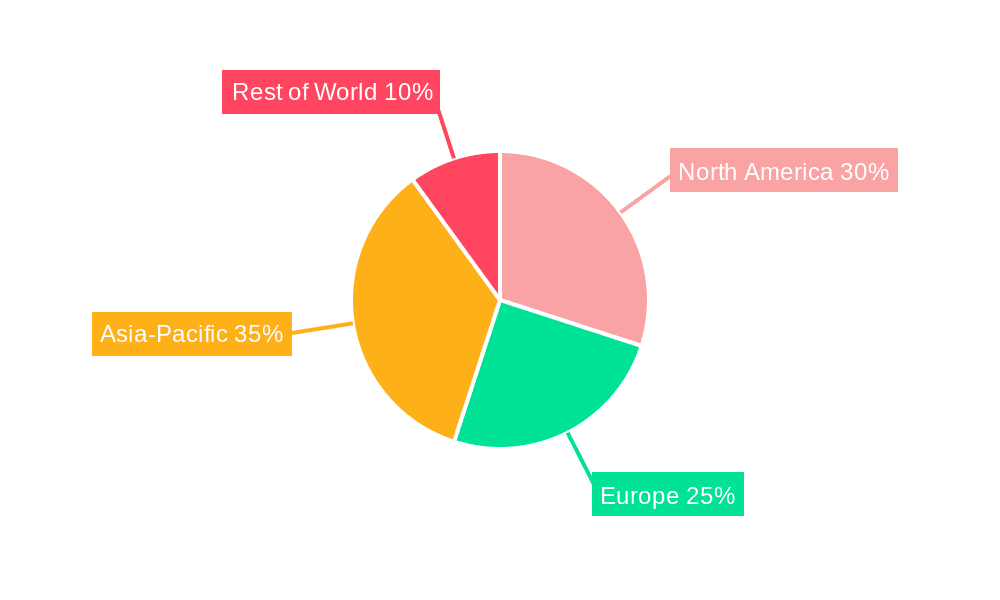

North America: The region holds a significant market share due to high consumer demand for convenience foods and ready-to-eat meals, coupled with stringent food safety regulations. The established food and beverage industry infrastructure and substantial investment in advanced packaging technologies also contribute to its dominance.

Europe: Similar to North America, Europe showcases a mature market with a strong focus on food safety and sustainable packaging, driving demand for high-barrier films with enhanced environmental attributes.

Asia-Pacific: This region is experiencing rapid growth, driven by increasing disposable incomes, a burgeoning middle class, and changing consumption patterns. The growing demand for processed and convenient foods is fueling the need for efficient packaging solutions.

Dominant Segments: The flexible packaging segment is expected to dominate the market due to its versatility, cost-effectiveness, and ease of use. Within this segment, stand-up pouches and retort pouches are witnessing high growth due to their suitability for a wide range of food and beverage products. The EVOH-based films also hold a major share due to their excellent barrier properties and wide range of applications.

The paragraph explains the dominating factors of these regions and segments, highlighting the economic factors, regulatory environments and consumer trends that impact the market. It would also emphasize the increasing prevalence of retort pouches and stand-up pouches, explaining their technical advantages and their alignment with consumer trends such as convenience and single-serving options. The significant market penetration of EVOH-based films would be discussed given their exceptional barrier properties and cost-effectiveness. This section would analyze these trends, providing a qualitative explanation of the market share dominance.

The increasing demand for convenient food and beverages, coupled with the growing awareness of food safety and hygiene, are primary catalysts for market growth. Stringent regulations related to food preservation and the rising adoption of sustainable packaging options further fuel the demand for high-barrier films. Innovations in barrier materials, such as biodegradable and recyclable options, also contribute significantly. The rising adoption of advanced packaging technologies, like modified atmosphere packaging (MAP), creates new opportunities and extends market reach.

(Note: Specific details about announcements and precise dates would require further research within relevant industry publications and company press releases. This list provides a general example.)

This report provides a comprehensive overview of the food and beverage high barrier packaging films market, analyzing market trends, driving forces, challenges, key players, and significant developments. It includes detailed forecasts, segment analysis, and regional breakdowns, providing valuable insights for businesses operating in or considering entering this dynamic market. The report also examines the impact of sustainability initiatives and technological innovations on the industry's future trajectory. It serves as a crucial resource for strategic decision-making, identifying opportunities for growth and market penetration.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

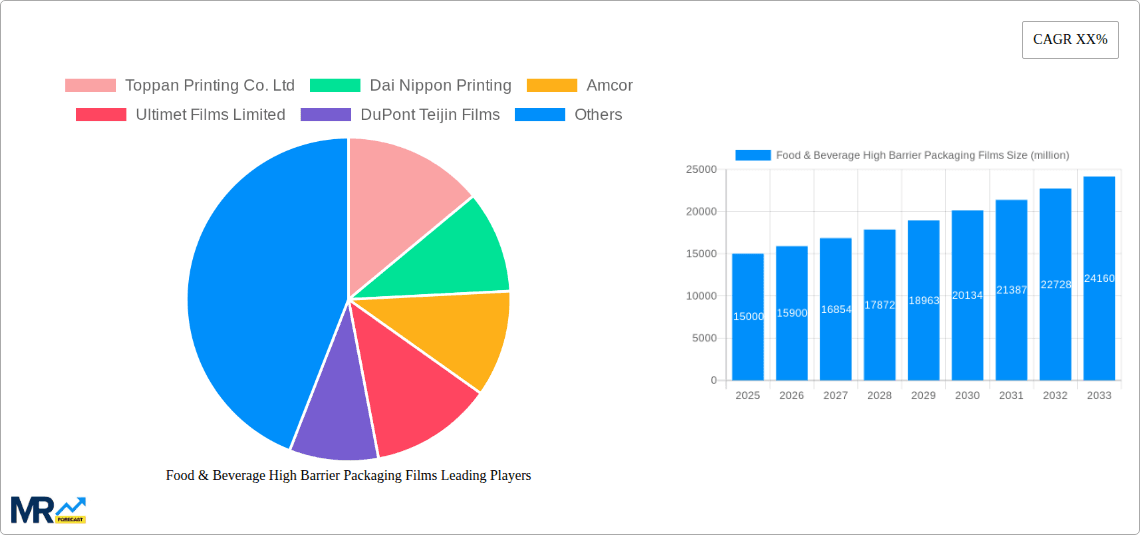

Key companies in the market include Toppan Printing Co. Ltd, Dai Nippon Printing, Amcor, Ultimet Films Limited, DuPont Teijin Films, Toray Advanced Film, Mitsubishi PLASTICS, Toyobo, Schur Flexibles Group, Sealed Air, Mondi, Wipak, 3M, QIKE, Berry Plastics, Taghleef Industries, Fraunhofer POLO, Sunrise, JBF RAK, Bemis, Konica Minolta, FUJIFILM, Biofilm.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food & Beverage High Barrier Packaging Films," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food & Beverage High Barrier Packaging Films, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.