1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Antimicrobial Coating?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Antimicrobial Coating

Food Antimicrobial CoatingFood Antimicrobial Coating by Type (Silver, Copper, Zinc Oxide, Others), by Application (Sweeteners, Processed, Ready to Eat Food, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

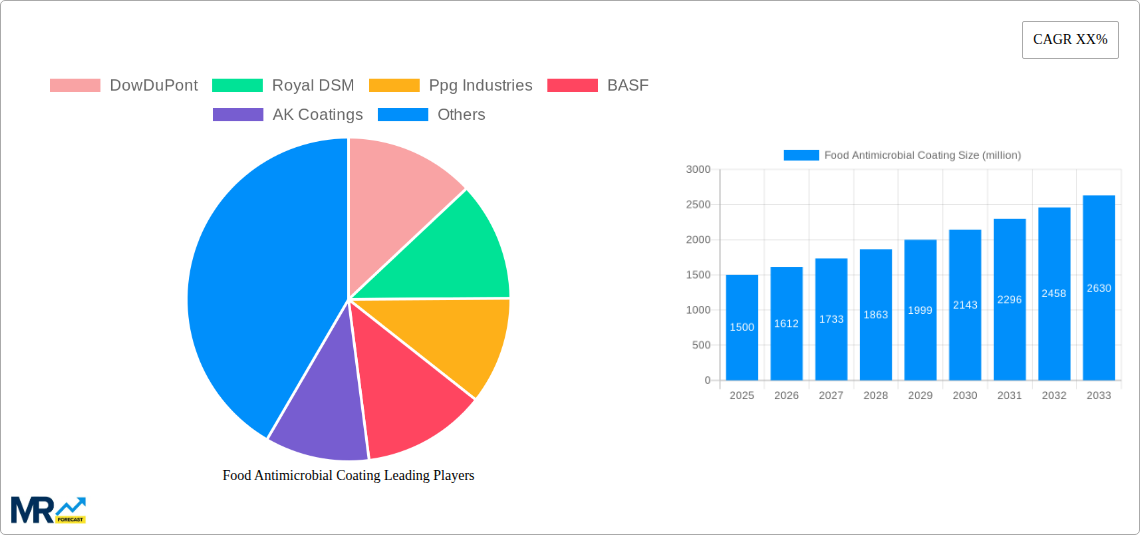

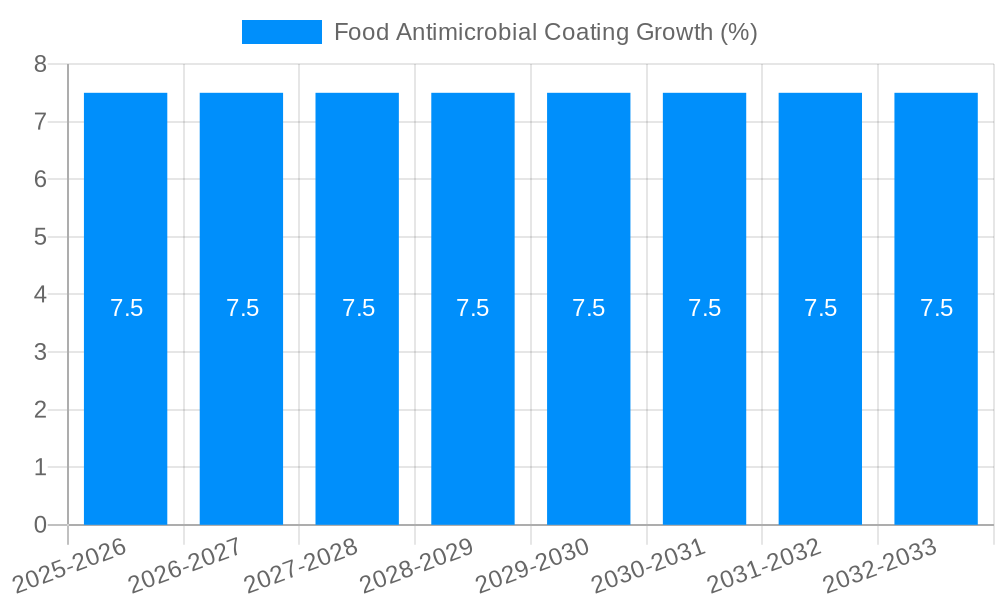

The global Food Antimicrobial Coating market is poised for substantial growth, projected to reach an estimated $1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated to extend through 2033. This expansion is primarily driven by the increasing consumer demand for safer and longer-lasting food products, coupled with stringent food safety regulations worldwide. The growing awareness of foodborne illnesses and the desire to reduce food waste are compelling manufacturers to adopt advanced antimicrobial coating technologies. Key applications within the processed food and ready-to-eat segments are expected to spearhead this growth, benefiting from the enhanced shelf life and reduced spoilage these coatings provide. Zinc oxide coatings, in particular, are gaining traction due to their effectiveness and perceived safety benefits, contributing significantly to market value.

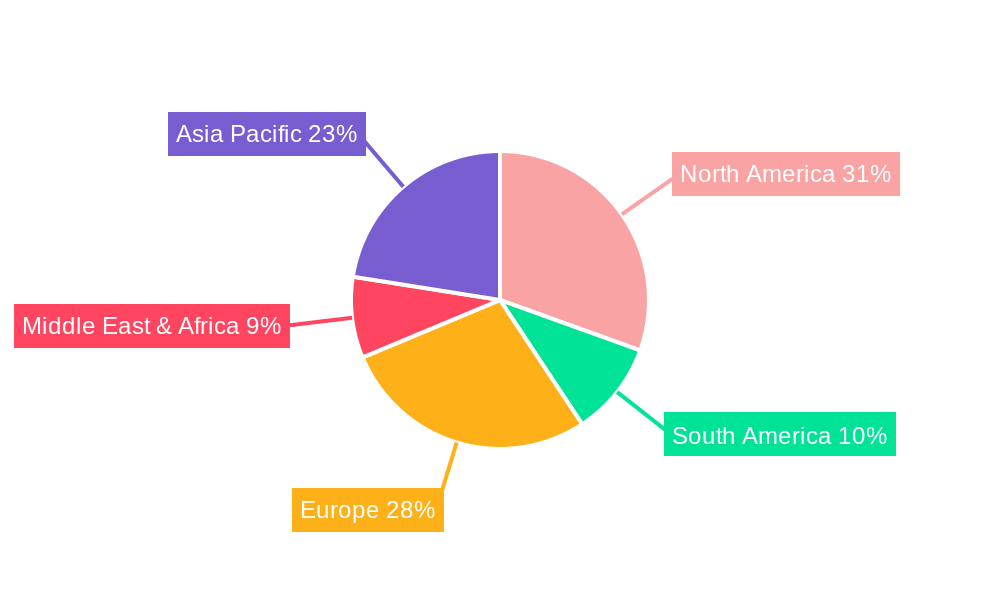

However, the market faces certain restraints, including the higher initial investment costs associated with implementing these advanced coating systems and the ongoing need for research and development to create even more effective and sustainable antimicrobial solutions. Regulatory approvals for novel antimicrobial agents can also present a hurdle. Despite these challenges, emerging trends such as the development of edible antimicrobial coatings and the integration of smart packaging solutions are creating new avenues for market expansion. The Asia Pacific region is emerging as a significant growth engine, driven by a burgeoning processed food industry and increasing disposable incomes. North America and Europe continue to be dominant markets, characterized by a strong emphasis on food safety and quality.

This report offers an in-depth examination of the global Food Antimicrobial Coating market, projecting significant growth from 2019 to 2033. The market, valued at approximately $2.1 million in 2023, is poised for expansion, driven by increasing consumer demand for safer, longer-lasting food products and stringent regulatory landscapes. The base year for our analysis is 2025, with projections extending through 2033. The historical period encompasses 2019-2024, providing context for current trends.

The Food Antimicrobial Coating market is experiencing a dynamic evolution, characterized by a heightened focus on efficacy, sustainability, and broad-spectrum protection against microbial contamination. During the study period of 2019-2033, a key market insight is the increasing adoption of nano-particle based coatings, particularly those incorporating Silver and Zinc Oxide. These materials offer superior antimicrobial activity at lower concentrations, a crucial factor given rising ingredient costs and regulatory scrutiny. Consumers are increasingly aware of foodborne illnesses, driving demand for solutions that enhance food safety and extend shelf-life. This trend is particularly evident in the Processed and Ready to Eat Food segments, where product integrity and consumer trust are paramount. The demand for natural and bio-based antimicrobial agents is also on the rise, reflecting a broader consumer preference for "clean label" products. While traditional synthetic coatings remain prevalent, innovation is leaning towards eco-friendly alternatives. Regulatory bodies worldwide are gradually implementing stricter guidelines for food packaging and ingredients, further stimulating the market for scientifically validated antimicrobial coatings. The integration of antimicrobial properties directly into food packaging materials, rather than as standalone treatments, is another significant trend, offering convenience and enhanced protection. The market is also witnessing a shift towards customized solutions tailored to specific food types and spoilage mechanisms. For instance, coatings designed to combat mold on baked goods will differ from those targeting bacterial growth in dairy products. The Estimated Year of 2025 sees a strong emphasis on research and development for next-generation antimicrobial technologies, including those that release active agents in a controlled manner or respond to specific environmental triggers. The global market size for food antimicrobial coatings is projected to witness a substantial surge, with projections indicating a value in the tens of millions by the end of the forecast period of 2025-2033. This growth is underpinned by the inherent value proposition of these coatings in reducing food waste, improving public health, and enhancing the economic viability of the food industry.

Several powerful forces are propelling the growth of the Food Antimicrobial Coating market. Foremost among these is the escalating global concern over food safety and the increasing incidence of foodborne illnesses. Consumers, armed with greater access to information, are demanding higher standards of hygiene and safety from food producers. This has translated into a greater willingness to invest in technologies that guarantee product integrity throughout the supply chain. Coupled with this is the significant economic impact of food spoilage and waste. Antimicrobial coatings offer a tangible solution by extending the shelf-life of perishable goods, thereby reducing substantial financial losses for manufacturers and retailers, and contributing to a more sustainable food system. The regulatory landscape is also playing a crucial role. Governments worldwide are implementing and tightening regulations concerning food preservation and packaging safety, incentivizing the adoption of effective antimicrobial solutions. This regulatory push, combined with the inherent benefits of these coatings, creates a fertile ground for market expansion. Furthermore, advancements in material science and nanotechnology have enabled the development of more effective, versatile, and cost-efficient antimicrobial coatings. The ability to integrate these coatings seamlessly into existing food processing and packaging lines, without compromising product quality or aesthetic appeal, further fuels their adoption.

Despite the promising outlook, the Food Antimicrobial Coating market faces several challenges and restraints that could impede its growth. A primary hurdle is the cost of implementation. While the long-term benefits of reduced spoilage are significant, the initial investment in new coating technologies and application equipment can be substantial, particularly for small and medium-sized enterprises. Consumer perception and regulatory hurdles surrounding the use of certain antimicrobial agents, especially novel or synthetically derived ones, can also pose a significant challenge. There is an ongoing need for rigorous scientific validation and clear communication to build consumer trust and navigate complex approval processes. Furthermore, the development of microbial resistance to certain antimicrobial agents is a growing concern, necessitating continuous innovation and the exploration of multi-modal approaches to combat microbial growth. The complexity of diverse food matrices and the specific spoilage mechanisms associated with each can also make it challenging to develop universally applicable and highly effective coatings. Ensuring compatibility with existing packaging materials and manufacturing processes without compromising the integrity or sensory attributes of the food product requires extensive research and development. Finally, the global supply chain for raw materials used in antimicrobial coatings can be subject to volatility, impacting production costs and availability.

The Food Antimicrobial Coating market exhibits significant regional variations and segment dominance. Among the key regions, North America and Europe are currently at the forefront, driven by strong consumer awareness regarding food safety, established regulatory frameworks, and a highly developed food processing industry. The demand for Processed and Ready to Eat Food in these regions is exceptionally high, directly influencing the adoption of antimicrobial coatings to maintain product quality and extend shelf-life. The United States and Germany stand out as key countries within these regions, characterized by significant investments in R&D and widespread adoption by major food manufacturers.

Focusing on segments, the Type of antimicrobial coating plays a crucial role in market dominance. Silver-based antimicrobial coatings have historically commanded a significant share due to their proven efficacy against a broad spectrum of bacteria and fungi. Their application is widespread, from active packaging for meat and poultry to coatings for reusable food containers. The Processed Food segment, encompassing ready meals, processed meats, dairy products, and baked goods, is a major consumer of these coatings. The inherent need to preserve these products during extended shelf-life and complex distribution networks makes antimicrobial coatings an essential component.

Furthermore, the Application segment of Ready to Eat Food is experiencing exponential growth. As consumer lifestyles become increasingly fast-paced, the demand for convenient, pre-prepared meals continues to surge. Antimicrobial coatings are vital in ensuring the safety and extending the freshness of these products, directly addressing concerns about microbial contamination and spoilage. The ability of these coatings to inhibit the growth of common foodborne pathogens like Listeria, Salmonella, and E. coli is a critical selling point for manufacturers targeting this lucrative market.

Beyond these, Zinc Oxide is emerging as a strong contender, offering a cost-effective and potentially less controversial alternative to silver in certain applications. Its use is gaining traction in packaging for fruits, vegetables, and dairy products. The Others category within Type, encompassing natural and bio-based antimicrobial agents like chitosan and essential oils, is also witnessing an upward trend. This is largely driven by consumer demand for "clean label" products and a growing awareness of the environmental impact of synthetic additives.

While Sweeteners might represent a smaller niche, the potential for antimicrobial coatings to prevent microbial degradation of natural sweeteners or to extend the shelf-life of finished products containing them cannot be overlooked. The Others application segment, which could include beverages, confectionery, and specialty food items, also offers untapped potential for tailored antimicrobial coating solutions. The continuous innovation in material science, particularly in encapsulation and controlled release technologies, is enabling the development of antimicrobial coatings that are specific to the unique challenges presented by different food types and processing methods. This adaptability will further solidify the market dominance of specific segments and regions in the coming years.

The Food Antimicrobial Coating industry is propelled by several growth catalysts. The escalating global population and the subsequent increase in food demand necessitate enhanced preservation techniques to minimize spoilage and ensure food security. Growing consumer awareness and demand for safer, healthier food products with extended shelf-life are driving manufacturers to invest in advanced preservation technologies like antimicrobial coatings. Favorable regulatory frameworks in various countries, promoting food safety standards and incentivizing the use of effective antimicrobial solutions, further stimulate market growth. Finally, continuous innovation in material science, leading to the development of more efficient, cost-effective, and sustainable antimicrobial coating solutions, is a significant catalyst for the industry's expansion.

This comprehensive report offers a detailed exploration of the Food Antimicrobial Coating market from 2019 to 2033, with a strong focus on the base year of 2025 and the forecast period of 2025-2033. It delves into the intricate dynamics of market trends, driving forces, and challenges, providing crucial insights into regional dominance and segment segmentation. The report meticulously analyzes the impact of key player strategies and technological advancements, offering a holistic view of the industry's trajectory. Our analysis incorporates market valuations in the million unit range, providing a quantitative understanding of the market's economic significance. This report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving landscape of food safety and preservation technologies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DowDuPont, Royal DSM, Ppg Industries, BASF, AK Coatings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Antimicrobial Coating," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Antimicrobial Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.