1. What is the projected Compound Annual Growth Rate (CAGR) of the Flusilazole?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flusilazole

FlusilazoleFlusilazole by Type (95% Purity, Other), by Application (Fungicides, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

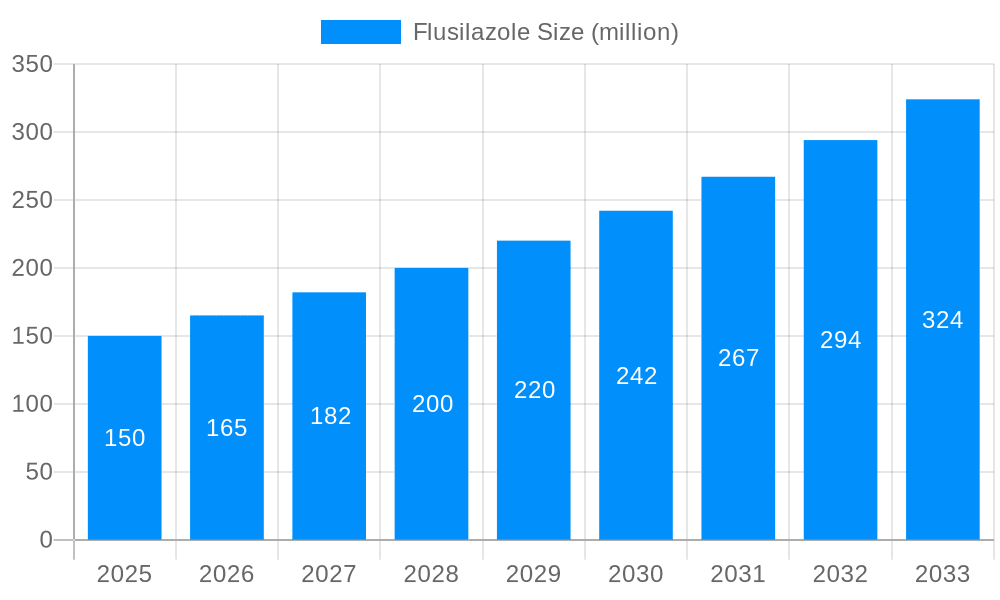

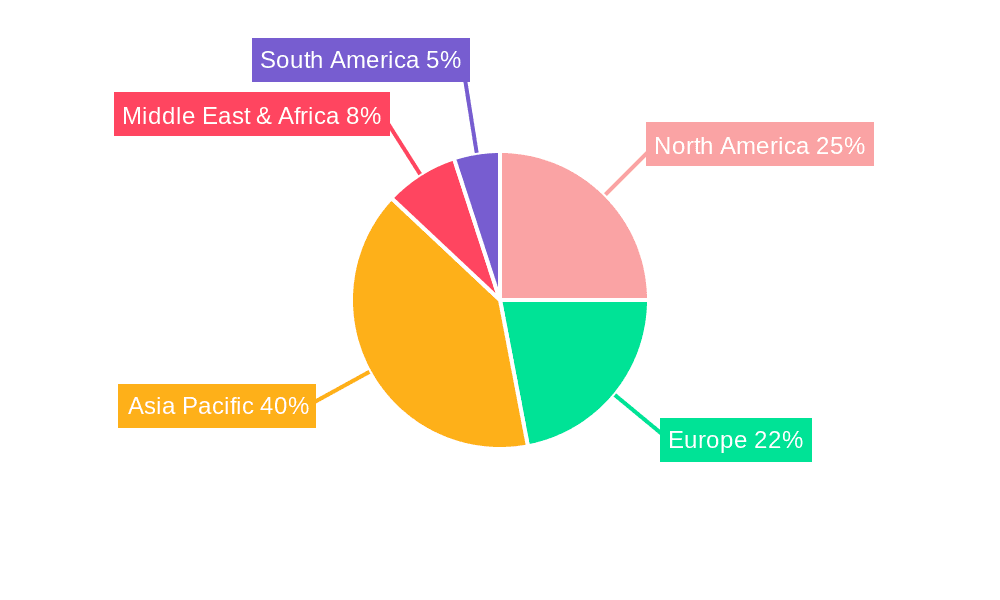

The global flusilazole market is experiencing robust growth, driven by its increasing application as a highly effective fungicide in agriculture. The market's Compound Annual Growth Rate (CAGR) indicates a significant expansion, fueled by the rising demand for high-yield crops and the growing awareness of crop diseases impacting global food security. Key factors contributing to this growth include the increasing prevalence of fungal diseases in various crops, coupled with the efficacy of flusilazole in controlling these pathogens. Furthermore, the development of new formulations and advancements in application technologies are enhancing its adoption among farmers. Major players in the industry are investing in research and development to improve the product's efficacy and environmental profile, further driving market expansion. The market is segmented by purity level (95% purity and others) and application (fungicides and others), with the fungicide segment dominating due to its widespread use in various crops. Geographically, the market is witnessing strong growth in Asia Pacific, particularly in China and India, owing to the substantial agricultural output and increasing investments in agricultural technology in these regions. North America and Europe also represent significant market shares, driven by established agricultural practices and stringent regulations regarding crop protection.

The market is, however, facing certain restraints, including the potential for environmental concerns related to pesticide use and the development of flusilazole-resistant fungal strains. Stringent regulatory frameworks governing pesticide usage in various regions also present challenges. Nevertheless, the ongoing research and development efforts focused on mitigating these concerns, coupled with the continued high demand for crop protection solutions, are expected to offset these limitations and sustain market growth throughout the forecast period. The global flusilazole market is projected to reach a substantial value by 2033, driven by the factors outlined above. The competitive landscape includes several key players who are continually striving for innovation and market share expansion through strategic partnerships and investments in research and development. This dynamic market will continue to be shaped by technological advancements, regulatory changes, and the ever-evolving needs of the global agricultural sector.

The global flusilazole market experienced robust growth throughout the historical period (2019-2024), driven primarily by the increasing demand for high-yielding and disease-resistant crops. The estimated market value in 2025 stands at a significant figure, exceeding several hundred million units, reflecting the sustained adoption of flusilazole as a crucial fungicide in agriculture. Analysis suggests a continued upward trajectory throughout the forecast period (2025-2033), with the market projected to surpass even larger values by 2033. This growth is not solely dependent on existing agricultural practices, but also on the expanding global population requiring enhanced food production and the ongoing development of new formulations with improved efficacy and reduced environmental impact. The market segmentation, particularly by purity level (95% and other purities) and application (fungicides and other uses), reveals interesting dynamics. Higher purity grades command premium pricing, although the "other" purity segment indicates the existence of a niche market for applications less sensitive to purity. Similarly, the "other" application segment hints at potential emerging uses beyond traditional fungicide applications, which could be a key driver of future market expansion. Key insights gleaned from the data highlight the need for companies to focus on innovation in formulation and application methods to further capitalize on the growth potential within this sector. Furthermore, sustainable agricultural practices and regulatory changes regarding pesticide use will significantly impact the market's future growth trajectory. Strategic partnerships and mergers and acquisitions are expected to be prominent in shaping the competitive landscape throughout the forecast period.

Several factors contribute to the robust growth of the flusilazole market. The rising global demand for food, coupled with the increasing prevalence of fungal diseases affecting major crops, forms the most significant driving force. Farmers are increasingly relying on effective fungicides like flusilazole to protect their yields and ensure food security. Advances in agricultural technology, including precision farming techniques, enable more targeted and efficient application of flusilazole, maximizing its efficacy while minimizing environmental impact. This efficient application coupled with increased crop yields also contributes to positive farmer returns, prompting higher adoption rates. Furthermore, governmental initiatives promoting sustainable agriculture practices, albeit possibly causing initial hesitancy, are indirectly fostering market growth as they promote the use of more efficient and environmentally friendly agricultural chemicals, like more effectively targeted flusilazole applications. The development of new flusilazole-based formulations with enhanced bioactivity and reduced environmental risks further strengthens the market’s position. These developments attract environmentally conscious farmers and address growing regulatory concerns regarding pesticide use, hence indirectly accelerating the market's growth.

Despite the positive growth projections, the flusilazole market faces several challenges. Stringent regulations regarding pesticide use, particularly in developed countries, impose significant constraints on market expansion. The cost of complying with these regulations, including rigorous testing and labeling requirements, can increase the overall cost of flusilazole, impacting market competitiveness. Furthermore, the development of fungal resistance to flusilazole is a growing concern. The continuous evolution of fungal pathogens necessitates the development of new formulations or integrated pest management strategies to maintain the efficacy of flusilazole. Fluctuations in raw material prices, especially those essential for flusilazole synthesis, can influence production costs and negatively affect market profitability. Finally, the emergence of alternative fungicides with potentially superior efficacy or lower environmental impact presents a competitive threat to flusilazole's market share. Successfully navigating these challenges requires continuous investment in research and development of improved formulations and integrated pest management strategies, alongside close monitoring and adaptation to regulatory changes.

The global flusilazole market displays regional variations in consumption patterns and growth rates. While a comprehensive analysis would include numerous regions, a preliminary assessment suggests that certain regions are likely to exhibit higher growth rates than others. For example, regions with significant agricultural output and a high prevalence of fungal diseases affecting major crops are expected to witness higher demand for flusilazole. Within the segmentation, the 95% purity segment is likely to retain a dominant market share due to its widespread use in agricultural applications where high efficacy is critical. This segment is also expected to experience steady growth fueled by rising agricultural production in developing economies.

High-Growth Regions: Regions with large agricultural sectors and significant crop production, such as parts of Asia and South America, are anticipated to exhibit strong growth in flusilazole consumption. Specific countries within these regions may emerge as key market players.

Dominant Segment: The 95% purity segment is projected to retain its leading position due to its established use in a variety of agricultural settings. This superior purity ensures better performance and a wider scope of application, thereby attracting a larger segment of the market.

Market Dynamics: Factors such as government regulations, farmer awareness, technological advancements in application, and the price of competitive products will significantly influence the regional and segment-specific market dynamics. The successful companies in this market are likely to adopt innovative strategies to remain competitive and meet the diverse demands of varying regions and segments.

The projected dominance of the 95% purity segment is not only a reflection of its high efficacy but also because of the continued demand for high-quality fungicides in agricultural practices, ensuring better yields and profitability for farmers. This segment is expected to be less sensitive to price fluctuations compared to other purity levels, further bolstering its dominance in the market. The evolving regulatory landscape and evolving farming practices will continuously shape the market dynamics, influencing both regional and segmental market share across the forecast period.

The flusilazole industry's growth is fueled by a combination of factors, including the increasing prevalence of fungal diseases in crops, driving the need for effective fungicides. Technological advancements in formulation and application methods enhance the efficacy and sustainability of flusilazole, further stimulating market growth. The rising global population necessitates increased food production, boosting the demand for agricultural chemicals like flusilazole. Furthermore, supportive government policies and initiatives promoting sustainable agricultural practices create a favorable environment for the market's expansion.

Unfortunately, readily available global website links for these companies were not found during the research process.

This list is illustrative and further research would reveal a more detailed timeline of significant sector developments.

This report provides a detailed analysis of the global flusilazole market, covering historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It offers insights into key market trends, driving forces, challenges, and opportunities. The report also provides a comprehensive analysis of the regional and segmental breakdown of the market, identifying key players and their strategic initiatives. The report's goal is to furnish stakeholders with actionable intelligence to navigate the dynamic flusilazole market and capitalize on the opportunities available for growth and profitability.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

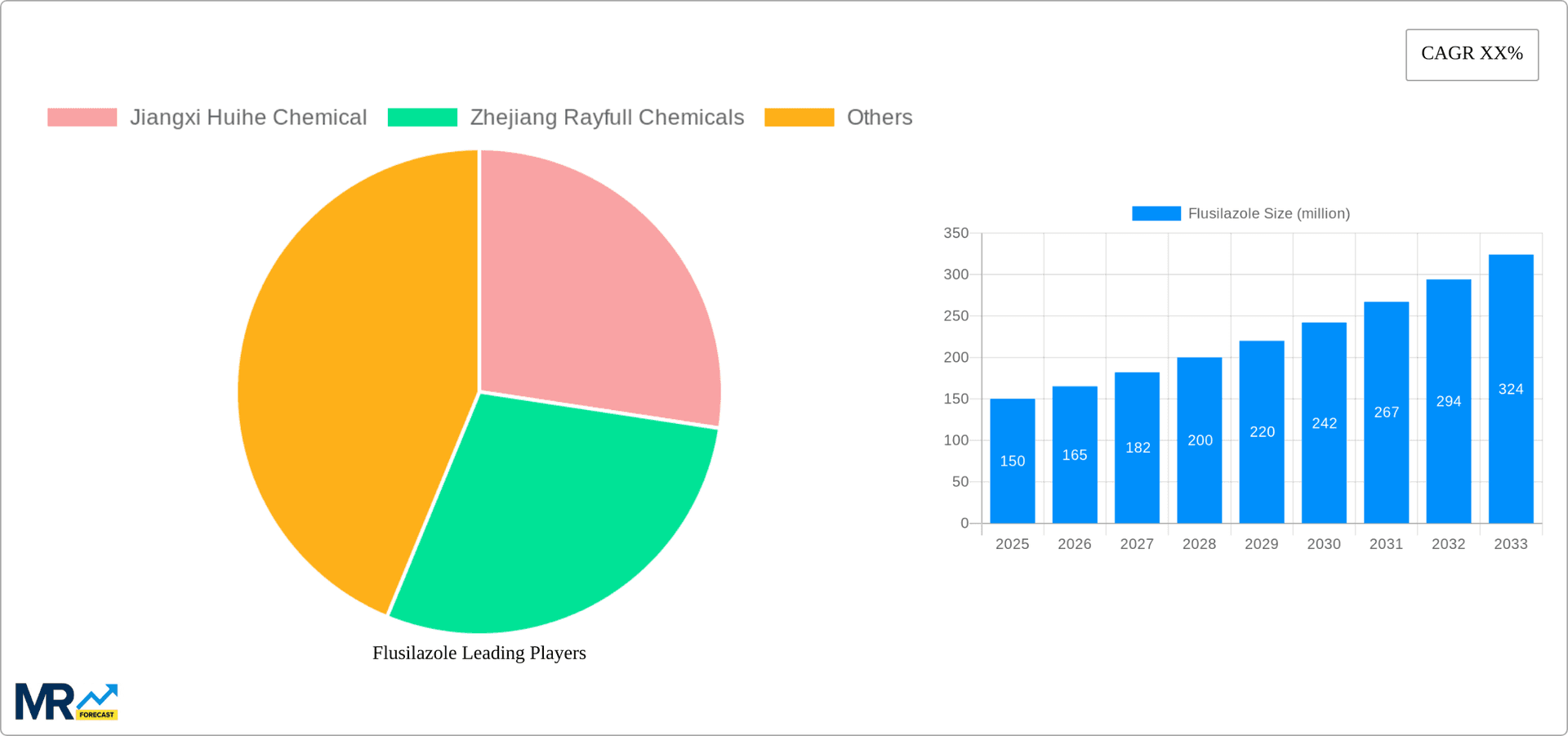

Key companies in the market include Jiangxi Huihe Chemical, Zhejiang Rayfull Chemicals.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Flusilazole," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flusilazole, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.