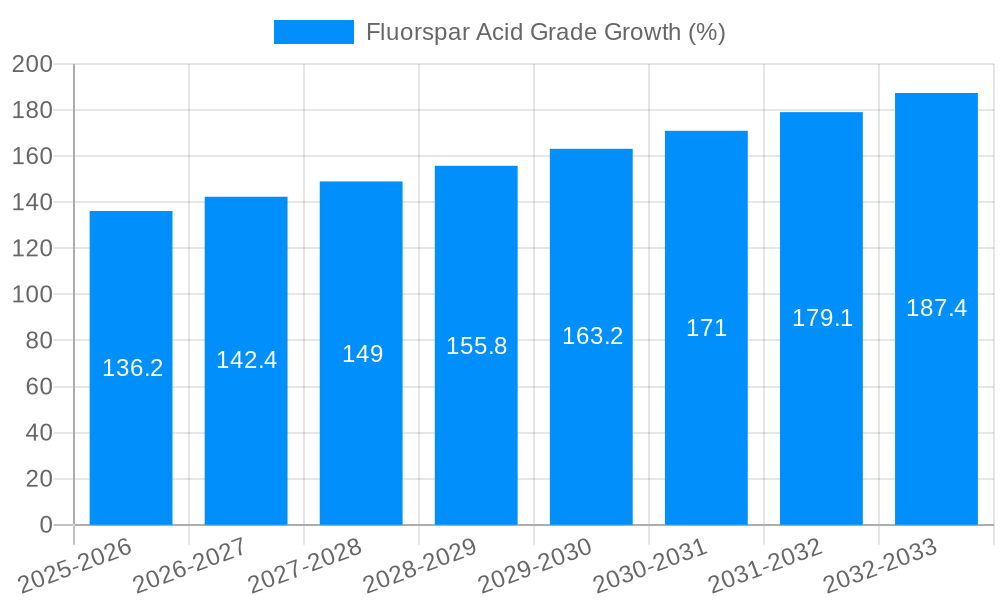

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluorspar Acid Grade?

The projected CAGR is approximately 8.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fluorspar Acid Grade

Fluorspar Acid GradeFluorspar Acid Grade by Application (Chemical Industry, Metallurgy Industry, Building Material, Others), by Type (Special Grade, Grade 1, Grade 2, Grade 3), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Fluorspar Acid Grade market is poised for robust growth, projected to reach approximately USD 1582.9 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is driven by the critical role of acid-grade fluorspar as a primary source of fluorine, essential for the production of hydrofluoric acid (HF). HF, in turn, is a fundamental building block for a vast array of industries. The burgeoning demand from the chemical industry, particularly for refrigerants, fluoropolymers used in high-performance plastics and coatings, and aluminum production, forms a significant growth engine. Furthermore, the metallurgy sector's increasing need for fluorspar as a fluxing agent in steelmaking and as a component in the manufacturing of ferroalloys contributes to market vitality. The building and construction industry's use of fluorspar-derived products in insulation and specialized coatings also underpins consistent demand.

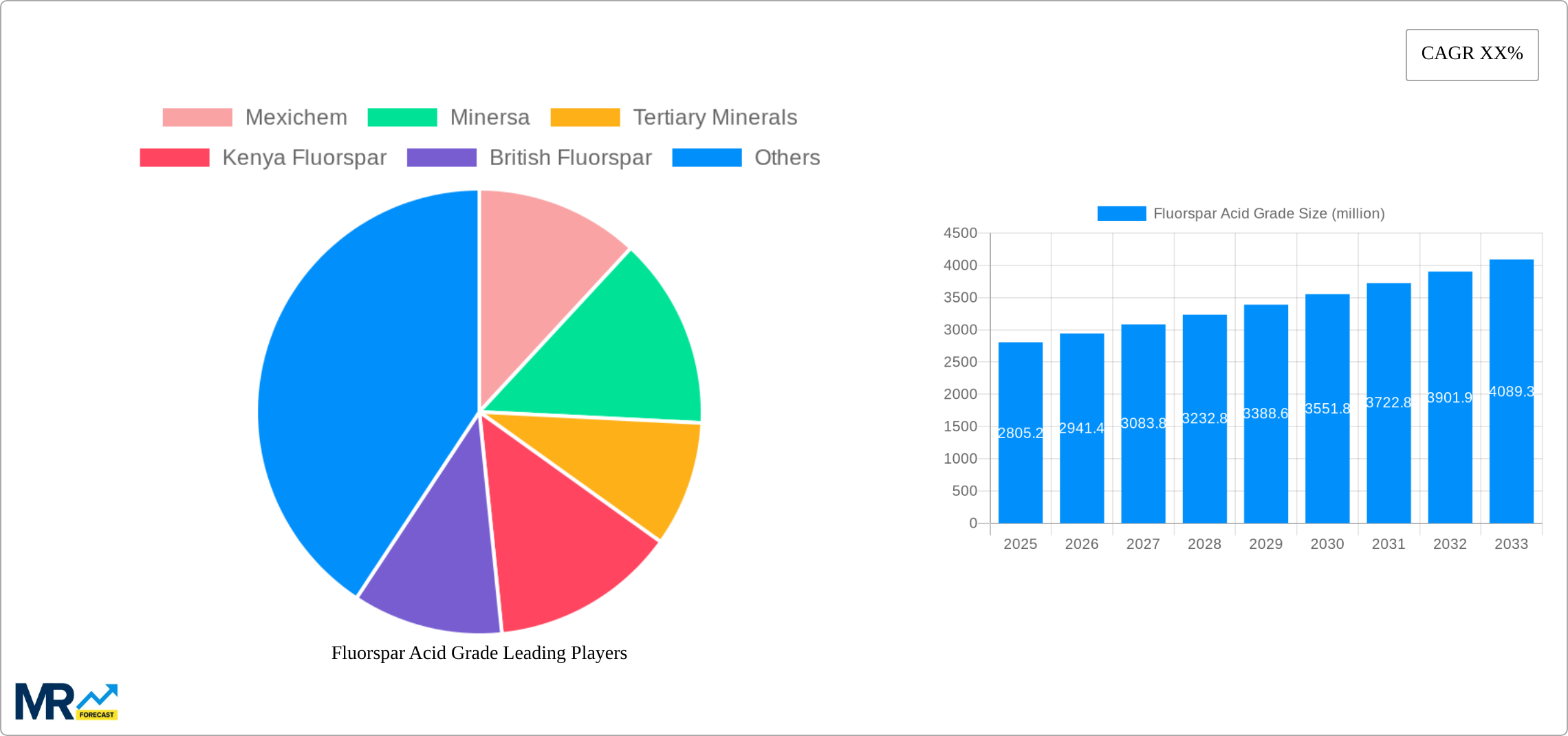

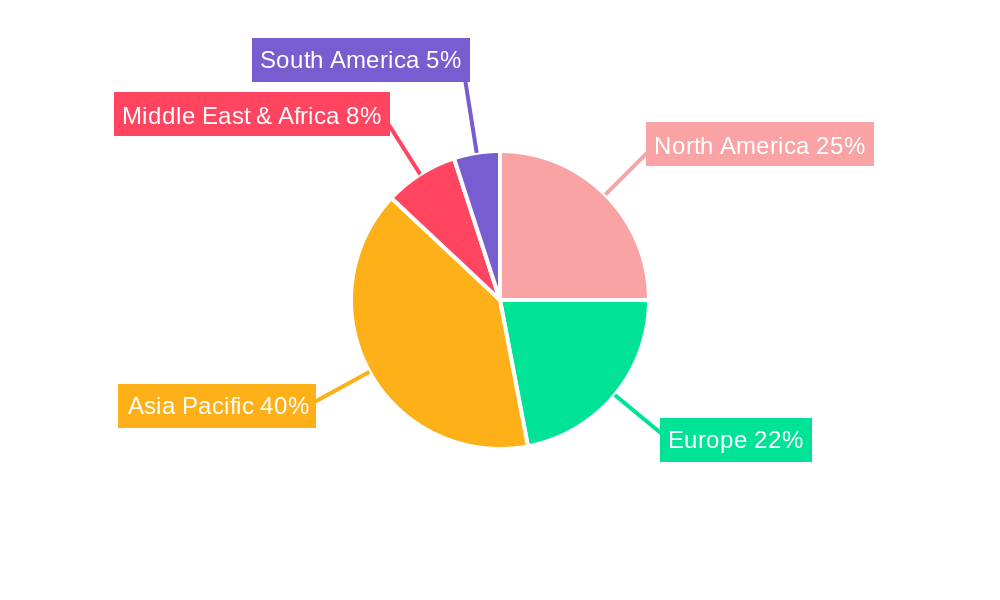

Anticipated market trends indicate a rising preference for Special Grade fluorspar due to its higher purity and specific applications, particularly in advanced chemical processes and electronics manufacturing. While the market is generally stable, certain restraining factors may influence growth trajectories. These include the availability and cost of raw materials, stringent environmental regulations associated with mining and processing, and the development of substitute materials in some niche applications. Geographically, the Asia Pacific region is expected to lead market expansion due to rapid industrialization and a substantial manufacturing base, particularly in China. North America and Europe, with established chemical and metallurgical industries, will continue to be significant contributors to global demand. The competitive landscape is characterized by the presence of several key global players, indicating a moderately consolidated market with ongoing efforts to enhance production efficiency and explore new market applications.

This comprehensive report delves into the intricate world of Fluorspar Acid Grade, a critical raw material underpinning numerous industrial processes. Spanning a detailed study period from 2019 to 2033, with a base year of 2025 and an extensive forecast period extending to 2033, this analysis offers unparalleled insights into market trends, driving forces, challenges, and future growth trajectories. The report meticulously examines the historical performance from 2019-2024, providing a robust foundation for understanding the evolving landscape of the acid-grade fluorspar market. It is estimated that the global market for Fluorspar Acid Grade will reach 15 million units by the estimated year of 2025, with projections indicating a significant upward trend throughout the forecast period.

The global Fluorspar Acid Grade market is characterized by a dynamic interplay of supply and demand, influenced by evolving industrial needs and geopolitical factors. During the historical period of 2019-2024, the market experienced moderate growth, albeit with fluctuations attributed to global economic conditions and the impact of the COVID-19 pandemic on manufacturing output. However, as industries rebounded and new applications emerged, the demand for acid-grade fluorspar began to accelerate. The base year of 2025 marks a pivotal point, with market projections indicating a sustained upward trajectory driven by robust growth in key end-use sectors. A significant trend observed is the increasing preference for higher-purity acid-grade fluorspar, often categorized under the "Special Grade" or "Grade 1" classifications, as stringent quality requirements become paramount in advanced chemical manufacturing and high-performance material production. The estimated market size for 2025 is approximately 15 million units, reflecting a healthy expansion from previous years. Looking ahead, the forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) that will see the market size expand considerably. Key insights reveal a growing concentration of production in regions with significant fluorspar reserves and established processing capabilities. Furthermore, technological advancements in beneficiation and processing are expected to enhance the recovery rates of acid-grade fluorspar, thereby influencing supply dynamics and potentially moderating price volatility. The report highlights a discernible shift towards sustainable mining and processing practices, driven by increasing environmental regulations and corporate social responsibility initiatives, which will undoubtedly shape future market developments and investment decisions. The demand is also being influenced by the development of new applications, particularly within the chemical industry, where acid-grade fluorspar serves as a crucial precursor for a wide array of products. The increasing complexity of manufacturing processes in sectors like pharmaceuticals and advanced materials necessitates a consistent and high-quality supply of acid-grade fluorspar, thus reinforcing its strategic importance.

The robust growth of the Fluorspar Acid Grade market is underpinned by several powerful driving forces, primarily stemming from the indispensable role it plays in critical industrial sectors. The surging demand from the chemical industry is arguably the most significant propellant. Acid-grade fluorspar (CaF2) is the primary source of fluorine, a fundamental element for the production of hydrofluoric acid (HF). HF, in turn, is a cornerstone for manufacturing a vast spectrum of essential chemicals, including refrigerants (both traditional and newer, environmentally friendly alternatives), fluoropolymers (like PTFE and PVDF used in non-stick coatings, electrical insulation, and high-performance films), and a wide array of specialty fluorine compounds vital for pharmaceuticals, agrochemicals, and electronics. The continuous innovation and expansion within these chemical sub-sectors directly translate into increased demand for acid-grade fluorspar. Furthermore, the metallurgy industry, particularly aluminum production, relies heavily on fluorspar. It is a key component in the electrolytic smelting of alumina to produce aluminum, a metal with pervasive applications in transportation, construction, and packaging. As global demand for aluminum continues to grow, so too does the consumption of acid-grade fluorspar for this purpose. The construction sector also contributes to the market's momentum through its use of fluorspar derivatives in the production of certain types of cement, glass, and ceramics, enhancing their properties and performance. The sustained expansion of these end-use industries, coupled with emerging applications and technological advancements in fluorine chemistry, collectively creates a powerful and consistent demand impetus for acid-grade fluorspar.

Despite its significant growth potential, the Fluorspar Acid Grade market is not without its challenges and restraints, which can impede its trajectory and influence market dynamics. One of the most prominent challenges is the geographical concentration of fluorspar reserves. A substantial portion of global fluorspar production is dominated by a few key countries, particularly China. This concentration creates supply chain vulnerabilities, making the market susceptible to geopolitical tensions, trade policies, and domestic production disruptions in these dominant regions. Any significant event affecting production in these areas can lead to price volatility and supply shortages for importing nations. Another considerable restraint is the environmental impact associated with fluorspar mining and processing. The extraction of fluorspar can lead to land degradation, water pollution, and the generation of tailings, which require careful management. Increasingly stringent environmental regulations worldwide necessitate substantial investments in sustainable mining practices and waste management technologies, adding to the operational costs for producers and potentially impacting the overall profitability. Furthermore, the energy-intensive nature of fluorspar processing, particularly the production of hydrofluoric acid, contributes to operational expenses and carbon footprints, which are under increasing scrutiny. Fluctuations in the global economy and the health of downstream industries can also act as restraints. A slowdown in sectors like automotive or construction, which are major consumers of fluorspar-derived products, can directly dampen demand for acid-grade fluorspar. Lastly, the gradual phasing out of certain older-generation refrigerants due to environmental concerns, while driving demand for newer fluorine compounds, can also lead to a period of adjustment and potential short-term demand shifts.

The global Fluorspar Acid Grade market is poised for significant growth, with certain regions and segments demonstrating exceptional dominance and potential. When considering Application: Chemical Industry, it is unequivocally clear that this segment is the primary driver and will continue to dominate the market landscape. The estimated market share for the Chemical Industry in 2025 is projected to be substantial, accounting for over 70% of the total market volume, and is expected to expand at a CAGR of approximately 6.5% during the forecast period.

Dominant Segment: Chemical Industry

Dominant Region: Asia Pacific

While other segments like Metallurgy Industry and Building Materials contribute to the overall demand, their market share is comparatively smaller than the Chemical Industry. Similarly, while regions like North America and Europe are significant consumers of fluorspar and its downstream products, their production capabilities are more limited compared to Asia Pacific, making them net importers and thus less dominant in the overall global supply-demand equation from a production perspective. The synergy between the Chemical Industry's relentless innovation and the Asia Pacific region's industrial might solidifies their dominant positions in the Fluorspar Acid Grade market.

The Fluorspar Acid Grade industry is poised for accelerated growth, driven by several key catalysts. The increasing global demand for high-performance fluoropolymers, essential for advanced electronics, electric vehicles, and renewable energy technologies, directly fuels the need for high-purity acid-grade fluorspar. Furthermore, the ongoing transition to more environmentally friendly refrigerants (HFOs) necessitates a greater reliance on fluorine chemistry, thereby boosting demand for hydrofluoric acid and its precursor. Growing industrialization in emerging economies, particularly in Asia, is expanding their manufacturing capabilities across sectors that utilize fluorspar derivatives, acting as a significant consumption driver. Finally, continuous advancements in fluorine extraction and processing technologies are enhancing efficiency and potentially unlocking new, previously uneconomical, sources of fluorspar.

The global Fluorspar Acid Grade market is shaped by the strategic operations of several prominent companies. These leading players are instrumental in the mining, processing, and supply of this vital industrial mineral.

The Fluorspar Acid Grade sector has witnessed several impactful developments that have reshaped its operational landscape and market dynamics. These advancements reflect a continuous effort towards improved efficiency, sustainability, and market responsiveness.

This report offers a holistic view of the Fluorspar Acid Grade market, providing comprehensive coverage that extends beyond mere statistical data. It delves into the intricate relationships between supply, demand, and pricing, analyzing the impact of geopolitical events, regulatory changes, and technological innovations. The report meticulously examines the market segmentation by application, type, and region, offering granular insights into the growth potential of each. It further identifies key growth catalysts, such as the burgeoning demand for fluoropolymers in high-tech industries and the ongoing global transition towards sustainable energy solutions, which are driving innovation and consumption. The analysis also addresses the inherent challenges and restraints, including supply chain vulnerabilities and environmental concerns, providing a balanced perspective on the market's future. This comprehensive approach ensures that stakeholders are equipped with the knowledge necessary to navigate the complexities of the Fluorspar Acid Grade market and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.5%.

Key companies in the market include Mexichem, Minersa, Tertiary Minerals, Kenya Fluorspar, British Fluorspar, Mongolrostsvetmet, Sinochem Group, Hunan Nonferrous Fluoride Chemical, Centralfluor Industries, Guoxing Corporation, China Kings Resources, Zhejiang Wuyi Shenlong Flotation, Luoyang Fluorine Potassium, Laifeng Furui Mining, Yingpeng Chemical, Luoyang Fengrui Fluorine, Inner Mongolia Xiang Zhen Minig Group, Jinhua Jingxuan Minerals, Chifeng Sky-Horse Fluorspar Mining, .

The market segments include Application, Type.

The market size is estimated to be USD 1582.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fluorspar Acid Grade," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fluorspar Acid Grade, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.