1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluoroelastomer for Aerospace?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fluoroelastomer for Aerospace

Fluoroelastomer for AerospaceFluoroelastomer for Aerospace by Type (Fluorocarbon Elastomers, Fluorosilicone Elastomers, Perfluorocarbon Elastomers, World Fluoroelastomer for Aerospace Production ), by Application (Fuel System Seal, Aircraft Hydraulics, Others, World Fluoroelastomer for Aerospace Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

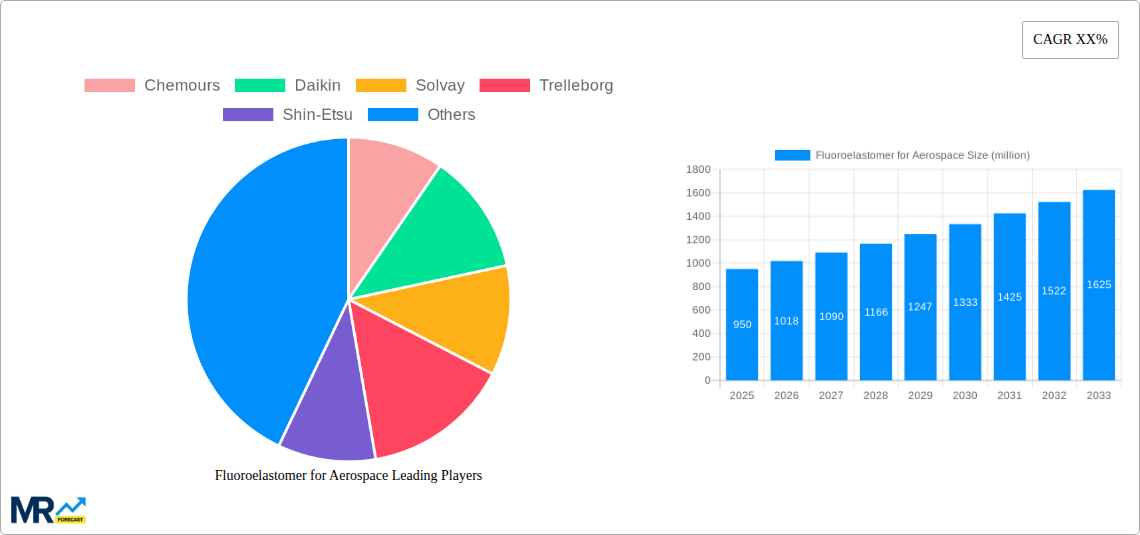

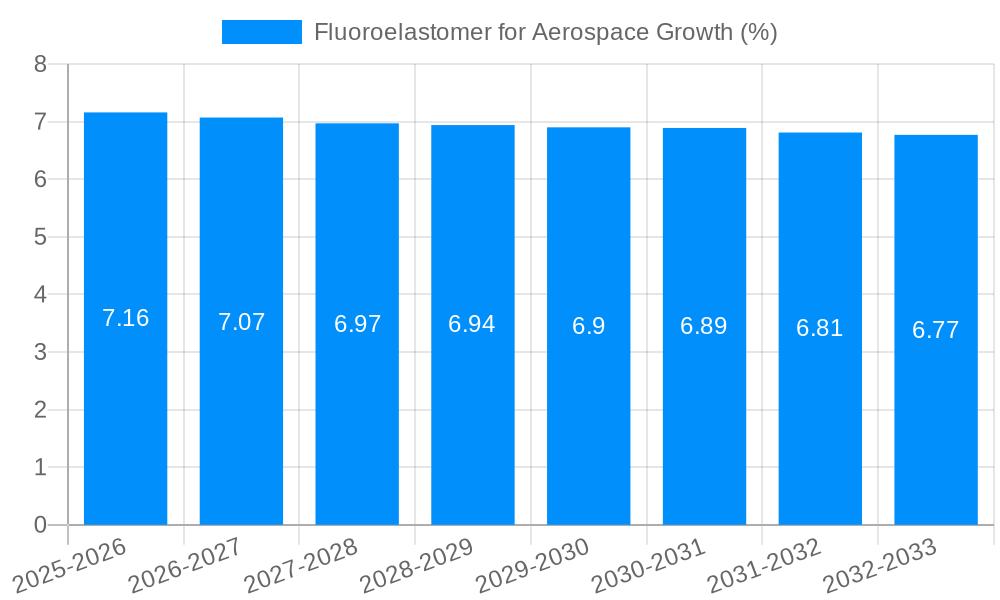

The global fluoroelastomer market for aerospace applications is experiencing robust growth, driven by the intrinsic properties of these advanced materials that are critical for the stringent demands of the aviation industry. With an estimated market size of approximately $950 million in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033, the demand for high-performance seals and components is set to surge. Key drivers include the increasing production of commercial and military aircraft, the continuous evolution of engine technologies requiring enhanced thermal and chemical resistance, and a growing emphasis on fuel efficiency and safety standards. The unique characteristics of fluoroelastomers, such as exceptional resistance to extreme temperatures, aggressive chemicals, fuels, and hydraulic fluids, make them indispensable for critical applications like fuel system seals and aircraft hydraulics. The expansion in aircraft manufacturing, particularly in emerging economies, alongside the retrofitting of older fleets with more durable components, further fuels this market.

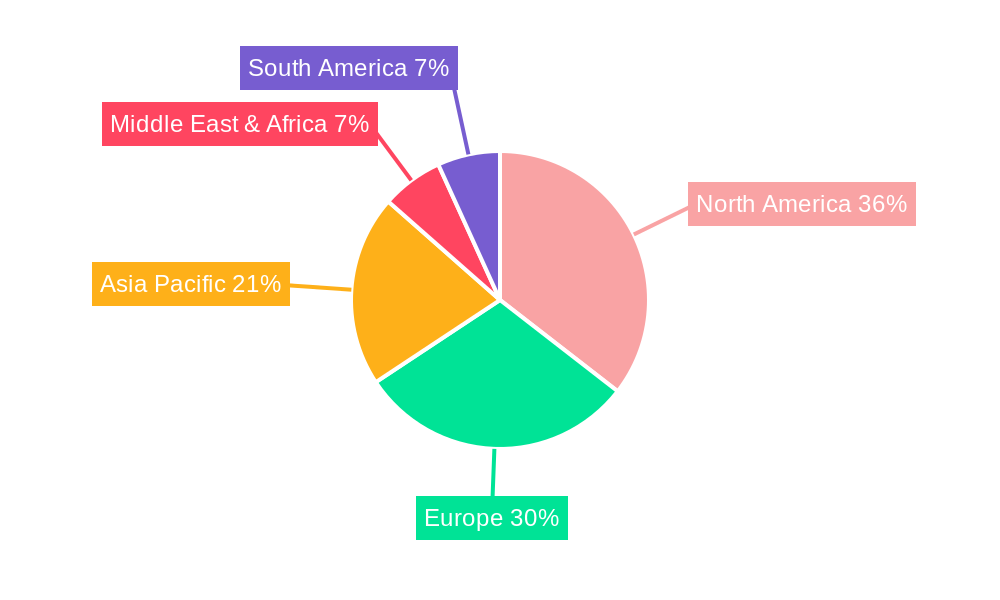

The market is segmented across various fluoroelastomer types, with Fluorocarbon Elastomers (FKM) holding a significant share due to their balanced performance and cost-effectiveness. Fluorosilicone Elastomers (FVMQ) are crucial for low-temperature flexibility, while Perfluorocarbon Elastomers (FFKM) are employed in the most demanding applications requiring unparalleled chemical inertness and high-temperature stability. Geographically, North America and Europe currently lead the market due to the presence of major aerospace manufacturers and stringent regulatory requirements. However, the Asia Pacific region is anticipated to witness the highest growth rate, propelled by its expanding aviation sector and increasing investments in indigenous aerospace manufacturing capabilities. Restraints, such as the high cost of raw materials and complex manufacturing processes, are being addressed through technological advancements and strategic sourcing by key players like Chemours, Daikin, and Solvay, ensuring continued innovation and market expansion.

This report provides an in-depth analysis of the global Fluoroelastomer for Aerospace market, examining historical trends, current dynamics, and future projections from 2019 to 2033. The study leverages the Base Year of 2025 for estimations and details market evolution throughout the Forecast Period (2025-2033) and Historical Period (2019-2024). The report encompasses production volumes in millions of units and analyzes key market segments, driving forces, challenges, regional dominance, growth catalysts, and leading industry players.

The global Fluoroelastomer for Aerospace market is poised for substantial expansion, driven by an escalating demand for high-performance materials that can withstand extreme operational conditions inherent in the aviation industry. XXX signifies that the market is not merely growing, but undergoing a sophisticated evolution characterized by technological advancements and increasing regulatory stringency. Production volumes, which were already significant in the millions, are projected to see a steady upward trajectory. This growth is intricately linked to the continuous innovation in aircraft design and the unwavering commitment to safety and reliability. The inherent properties of fluoroelastomers – their exceptional resistance to high temperatures, aggressive chemicals, fuels, and lubricants, coupled with their low compression set and excellent sealing capabilities – make them indispensable components in critical aerospace applications.

Furthermore, XXX indicates a deeper trend of material specialization within the fluoroelastomer landscape. While traditional fluorocarbon elastomers continue to form the backbone of the market, there is a discernible surge in interest and application for fluorosilicone elastomers due to their broader operating temperature range and enhanced flexibility, and perfluorocarbon elastomers offering unparalleled chemical and thermal resistance for the most demanding environments. This diversification reflects the industry's need for tailored solutions that address specific performance requirements across various aircraft systems, from sophisticated engine seals and fuel lines to critical hydraulic systems and environmental seals. The increasing complexity of modern aircraft, with their intricate systems and more demanding operational envelopes, necessitates materials that offer superior durability, longevity, and safety margins. This ongoing shift towards advanced material solutions is a key indicator of the market's maturity and its ability to adapt to the evolving needs of the aerospace sector, with production volumes consistently in the millions reflecting this sustained demand. The integration of new manufacturing processes and a focus on sustainable material development are also emerging trends that will shape the market landscape in the coming years, further solidifying the importance of fluoroelastomers in aerospace.

Several formidable forces are propelling the Fluoroelastomer for Aerospace market to new heights. Foremost among these is the relentless growth in global air travel and the consequent expansion of commercial aviation fleets. As more aircraft are manufactured and existing fleets undergo maintenance and upgrades, the demand for high-quality, reliable sealing solutions manufactured from fluoroelastomers escalates proportionally. This expansion directly translates into higher production volumes, consistently in the millions of units, to meet the needs of aircraft manufacturers and MRO (Maintenance, Repair, and Overhaul) providers worldwide. Secondly, the increasing stringency of aviation safety regulations and performance standards globally acts as a significant driver. Aerospace manufacturers are compelled to utilize materials that offer the utmost reliability and longevity, ensuring the safe operation of aircraft under extreme conditions. Fluoroelastomers, with their proven track record of performance in harsh environments, are the material of choice for meeting these stringent requirements, thereby fueling market growth. The inherent resilience of these materials against fuels, hydraulic fluids, and extreme temperatures ensures the integrity of critical aircraft systems, directly contributing to flight safety and operational efficiency. This unwavering focus on safety and performance is a cornerstone of the aerospace industry and a primary enabler of the sustained demand for fluoroelastomers.

Despite the robust growth, the Fluoroelastomer for Aerospace market encounters several significant challenges and restraints that temper its expansion. A primary concern is the high cost of raw materials and the complex manufacturing processes involved in producing high-performance fluoroelastomers. The intricate chemical synthesis required to achieve the desired properties can lead to premium pricing, which might influence material selection in cost-sensitive applications or lead to exploration of alternative, albeit less performant, materials. This cost factor can sometimes limit broader adoption, particularly for newer entrants or in segments where extreme performance is not paramount. Another notable restraint is the susceptibility of certain fluoroelastomer types to specific chemicals or extreme conditions, necessitating careful material selection and application engineering. While fluoroelastomers are renowned for their broad resistance, misapplication or exposure to incompatible substances can lead to premature degradation, impacting component lifespan and potentially compromising safety. Furthermore, the market is subject to geopolitical factors and supply chain vulnerabilities that can affect the availability and cost of critical raw materials, leading to fluctuations in production volumes that are measured in the millions. The specialized nature of this industry also means that a limited number of highly skilled personnel are available for research, development, and manufacturing, which can create bottlenecks and limit the pace of innovation and production scale-up.

Dominant Segments and Regions:

Type: Fluorocarbon Elastomers

Application: Fuel System Seal

Region: North America

Region: Europe

The dominance of these segments and regions is underscored by the continuous innovation in material science and manufacturing processes, ensuring that production volumes remain consistently in the millions to meet the evolving needs of the global aerospace industry. The interconnectedness of these factors – advanced material types enabling critical applications, and strong regional demand supported by leading manufacturers – creates a self-reinforcing cycle of growth and market leadership.

Several key factors are acting as potent growth catalysts for the Fluoroelastomer for Aerospace industry. The sustained expansion of global air traffic, coupled with the ongoing retirement of older aircraft and the introduction of new, more fuel-efficient models, directly fuels the demand for replacement parts and new aircraft production. This necessitates a continuous and increasing production of fluoroelastomers, measured in the millions of units, to support these fleet expansions and maintenance activities. Furthermore, the relentless pursuit of enhanced aircraft performance and safety by aerospace manufacturers is a significant catalyst. As aircraft are designed to operate under more extreme conditions and with greater efficiency, the requirement for materials that can withstand these challenges – such as high temperatures, aggressive fluids, and prolonged operational stress – becomes paramount. Fluoroelastomers, with their exceptional resistance properties, are ideally positioned to meet these evolving demands, driving their adoption and consequently, market growth. The increasing emphasis on reducing aircraft weight without compromising structural integrity also favors the use of high-performance, lightweight materials like fluoroelastomers.

This comprehensive report delves into the intricate landscape of the Fluoroelastomer for Aerospace market, offering a detailed examination of trends, drivers, and challenges from 2019 to 2033, with a focused analysis on the Base Year of 2025 and the Forecast Period of 2025-2033. Production volumes, meticulously quantified in the millions of units, are a central metric throughout the analysis, reflecting the scale of market activity. The report scrutinizes key segments, including Fluorocarbon Elastomers, Fluorosilicone Elastomers, and Perfluorocarbon Elastomers, alongside critical applications such as Fuel System Seals and Aircraft Hydraulics. A thorough exploration of market dynamics in North America and Europe, two pivotal regions, provides insights into their dominant roles. Furthermore, the report identifies pivotal growth catalysts, such as the expansion of commercial aviation and the escalating demand for enhanced safety and performance, which are instrumental in shaping the market's trajectory. Leading industry players are profiled, and significant developments, marked by specific years, are highlighted to illustrate the industry's evolution and forward momentum. This comprehensive approach ensures that stakeholders gain a holistic understanding of the Fluoroelastomer for Aerospace market, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Chemours, Daikin, Solvay, Trelleborg, Shin-Etsu, Halopolymer, OJSC, Shanghai Huayi 3F New Materials, Dawnfluo Rubber Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fluoroelastomer for Aerospace," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fluoroelastomer for Aerospace, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.