1. What is the projected Compound Annual Growth Rate (CAGR) of the Flavors for Food and Beverages?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flavors for Food and Beverages

Flavors for Food and BeveragesFlavors for Food and Beverages by Type (Natural Flavour, Developed Flavour), by Application (Food, Beverages), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global flavors for food and beverages market is poised for significant expansion, driven by escalating consumer demand for diverse and premium taste experiences. Key growth catalysts include the rising popularity of processed foods, functional beverages, and convenient meal solutions. A pronounced trend towards natural and clean-label products is compelling manufacturers to prioritize natural flavorings and minimize artificial ingredients. Emerging economies, particularly in the Asia-Pacific region, present substantial growth avenues due to the expanding food and beverage industries. Culinary innovation, featuring ethnic and fusion flavor profiles, effectively caters to evolving consumer palates and fuels market progression. However, stringent regulatory frameworks for food additives and flavor safety, coupled with raw material price volatility and intense industry competition, pose notable challenges.

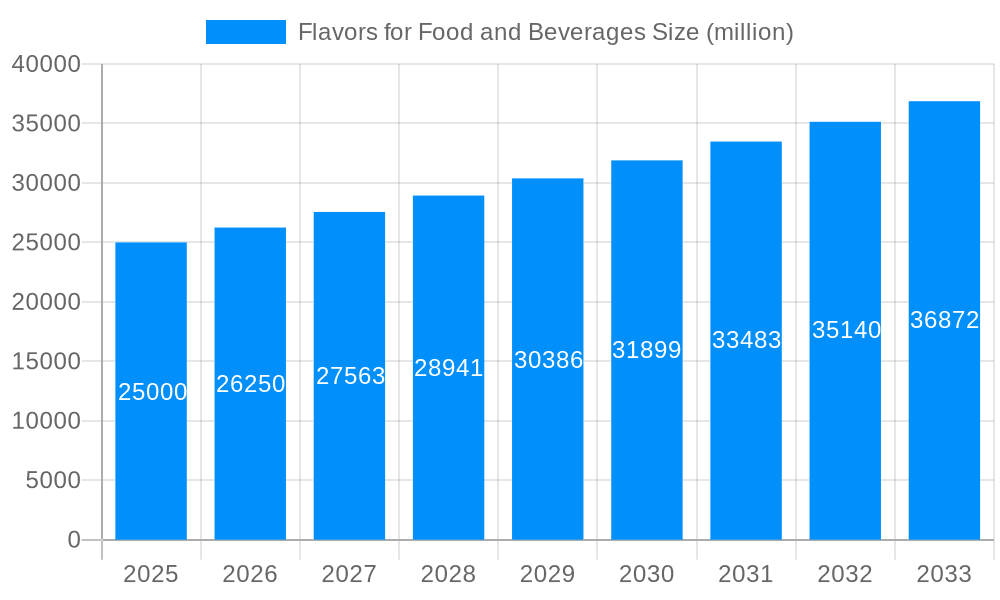

The estimated market size for 2025 stands at $21.42 billion, with a projected Compound Annual Growth Rate (CAGR) of 5.5% for the forecast period (2025-2033). This projection reflects the market's ongoing maturation and the influence of regulatory considerations.

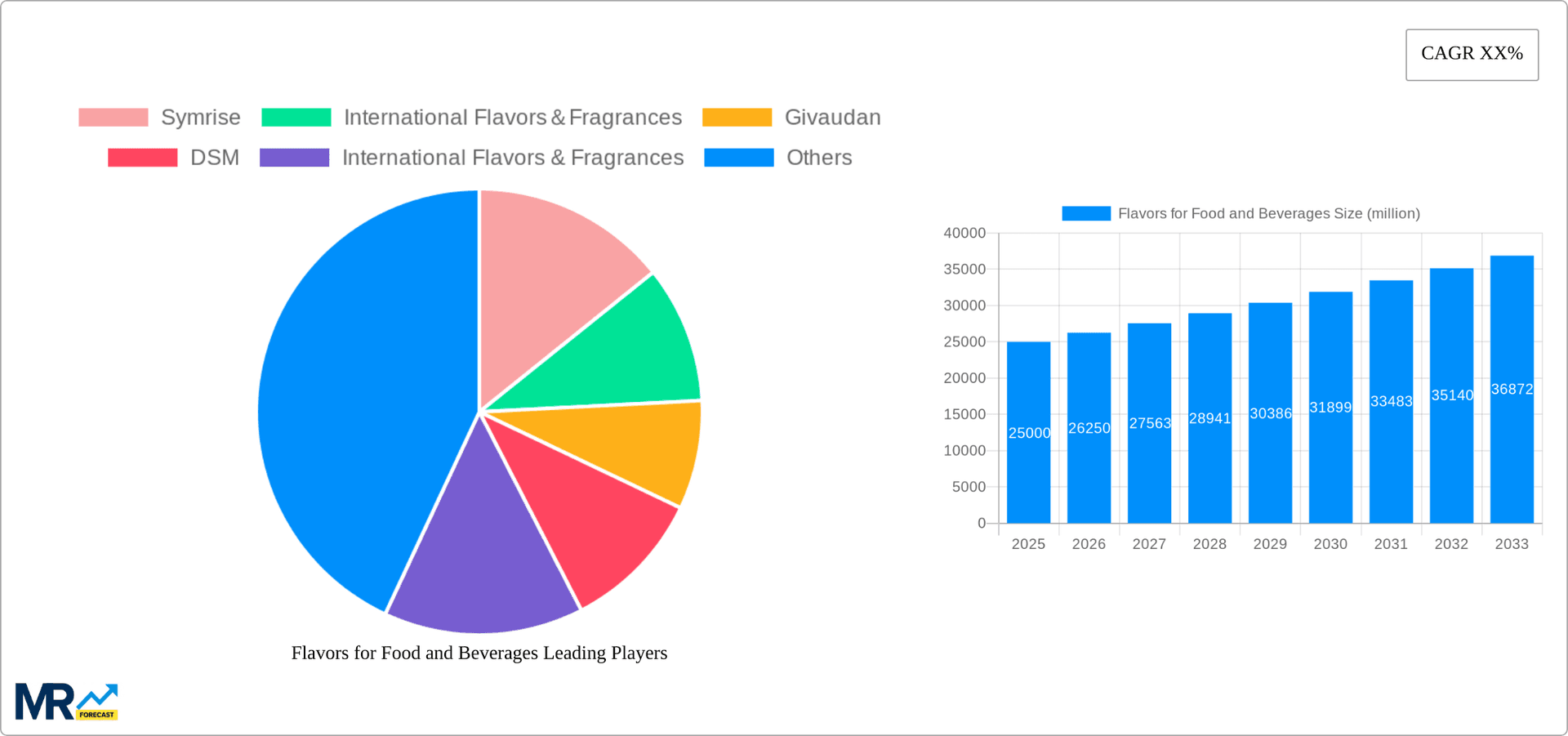

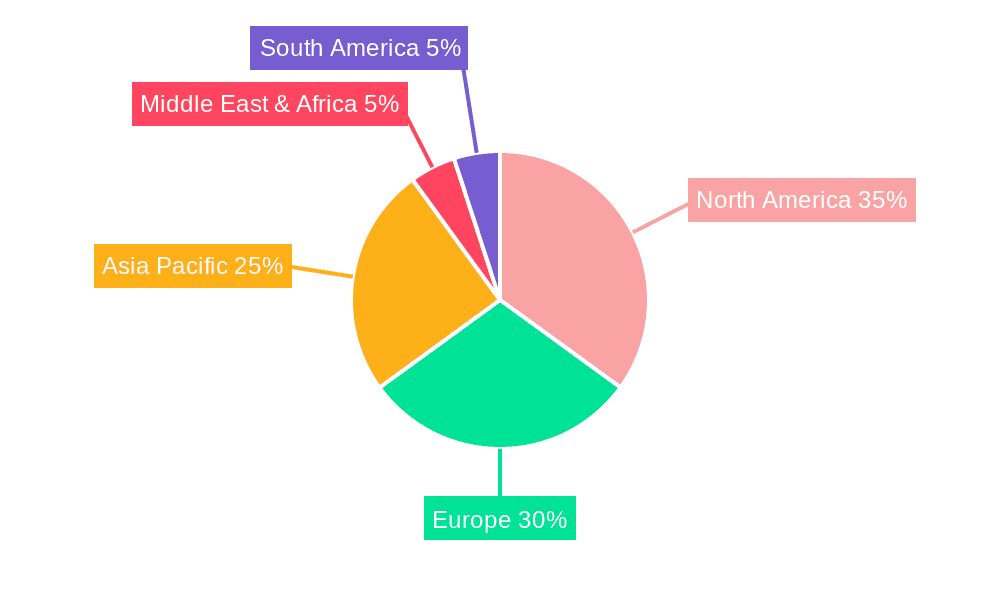

The competitive arena is characterized by leading multinational corporations such as Symrise, International Flavors & Fragrances (IFF), Givaudan, and Firmenich. These entities command substantial market share through comprehensive product offerings, global infrastructure, and robust research and development investments. Niche players are also emerging, focusing on specialized markets and delivering bespoke flavor solutions. The market is segmented by flavor type—natural and developed—and by application—food and beverages. The natural flavor segment is outpacing the developed flavor segment, a direct consequence of consumer preference for clean-label options. While the food application currently dominates, the beverage segment is anticipated to witness accelerated growth, driven by the increasing demand for functional and ready-to-drink beverages. Regional disparities in consumer preferences and regulatory environments contribute to market variations, with North America and Europe currently holding the largest shares, while Asia-Pacific offers considerable growth potential.

The global flavors for food and beverages market is experiencing robust growth, driven by evolving consumer preferences and the increasing demand for diverse and unique taste experiences. The study period of 2019-2033 reveals a significant upward trajectory, with the estimated value in 2025 exceeding several billion USD. This expansion is fueled by several key trends. Firstly, the rising popularity of ethnic cuisines and global fusion foods is pushing manufacturers to incorporate authentic and innovative flavor profiles. This necessitates a constant stream of new flavor development, resulting in an expanding market. Secondly, the health and wellness movement is significantly impacting flavor trends. Consumers are increasingly seeking natural and clean-label ingredients, leading to a surge in demand for natural flavors and reduced reliance on artificial ingredients. This transition, while posing challenges for some manufacturers, simultaneously presents opportunities for companies that can effectively meet this demand. Furthermore, the growing demand for convenience foods and ready-to-eat meals is driving the development of flavors that enhance the palatability and shelf-life of these products. The increasing popularity of customized and personalized food and beverage experiences is also shaping market dynamics. Consumers desire unique and tailored flavors, encouraging manufacturers to embrace innovative flavor combinations and creative application methods. Finally, the rising adoption of digital technologies is improving the efficiency of flavor development and testing processes, ultimately accelerating the launch of new products and accelerating market growth. The forecast period (2025-2033) predicts continued growth, especially within the natural flavor segment and specific applications like beverages and convenience foods. Overall, the market reflects a dynamic and ever-evolving landscape, consistently adapting to consumer preferences and technological advancements.

Several key factors are propelling the growth of the flavors for food and beverages market. Firstly, the burgeoning global population and increasing disposable incomes, particularly in developing economies, are driving higher consumption of processed foods and beverages, thereby increasing the demand for flavors. The diversification of food and beverage options, owing to globalization and changing culinary habits, further accelerates this trend. Secondly, heightened consumer awareness of health and wellness is prompting manufacturers to develop products with cleaner labels and natural ingredients. This is leading to a strong preference for natural flavors over artificial ones, consequently boosting this segment of the market. Thirdly, the innovative use of flavors is crucial for enhancing the appeal of functional foods and beverages, targeted at health-conscious consumers. This has fueled the development of flavors that mask unpleasant tastes or enhance the sensory appeal of foods with added health benefits. Fourthly, the intense competition within the food and beverage industry necessitates continuous product innovation and differentiation. Flavors play a vital role in this process, providing manufacturers with a powerful tool to create unique product offerings and gain a competitive edge. Finally, technological advancements in flavor creation and delivery systems are improving the efficiency and cost-effectiveness of flavor production, stimulating market growth. These advancements allow for the creation of more complex and nuanced flavor profiles and facilitate better incorporation into various food and beverage products.

Despite the significant growth potential, the flavors market faces several challenges. Stringent regulations and safety standards related to food additives and flavorings impose significant compliance costs on manufacturers, which can potentially hinder growth, especially for smaller players. Fluctuations in the prices of raw materials used in flavor production, such as natural extracts and essential oils, pose a significant risk to profit margins. The increasing demand for natural flavors presents a challenge to manufacturers due to the higher cost and complexities involved in sourcing and processing natural ingredients compared to their synthetic counterparts. Maintaining consistency in the quality and taste of natural flavors across large-scale production can also be difficult due to variations in raw material quality. Furthermore, intense competition among established players and the emergence of new entrants create a price-sensitive market environment, putting pressure on profit margins. The need to constantly innovate and develop new flavor profiles to keep up with evolving consumer preferences adds to the pressure on R&D expenditures. Finally, changing consumer perceptions and increasing awareness of the potential health impacts of certain flavoring agents can negatively impact demand for specific types of flavors. Addressing these challenges requires manufacturers to optimize their supply chains, invest in advanced technologies, and continuously innovate to meet evolving consumer demands and regulatory requirements.

The North American and European regions are currently dominating the global flavors market, driven by high per capita consumption of processed foods and beverages, strong consumer demand for diverse flavor profiles, and a robust food and beverage industry. However, Asia-Pacific is exhibiting rapid growth potential due to rising disposable incomes, population growth, and expanding processed food and beverage sectors, particularly in countries like China and India.

Dominant Segments:

The flavors industry is witnessing substantial growth due to several key catalysts. Rising disposable incomes globally are increasing consumer spending on processed food and beverages, driving demand for flavors. The constant evolution of consumer preferences necessitates continuous innovation in flavor development, resulting in new product introductions and market expansion. The rising popularity of ethnic foods and global fusion cuisine further expands the range of flavor profiles required, boosting market growth. Furthermore, advancements in flavor technology and production processes enable the creation of more complex and nuanced flavor combinations, adding value and driving demand. The increasing focus on health and wellness is driving the demand for natural flavors and clean-label products, further accelerating market growth.

This report provides a comprehensive overview of the global flavors for food and beverages market, offering detailed insights into market trends, growth drivers, challenges, and key players. The report covers various segments, including natural and developed flavors, as well as applications across food and beverages. It includes a detailed analysis of the market dynamics during the historical period (2019-2024), provides an estimated snapshot of the market in 2025, and presents a robust forecast for the future (2025-2033). The report is designed to assist businesses in making informed strategic decisions related to flavor development, product innovation, and market expansion.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Symrise, International Flavors&Fragrances, Givaudan, DSM, International Flavors & Fragrances, Kerry Group, Sensient, Takasago, ADM, Firmenich, Mane, IFF, Wild Flavors, T. Hasegawa, Robertet, WILD, McCormick.

The market segments include Type, Application.

The market size is estimated to be USD 21.42 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Flavors for Food and Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flavors for Food and Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.