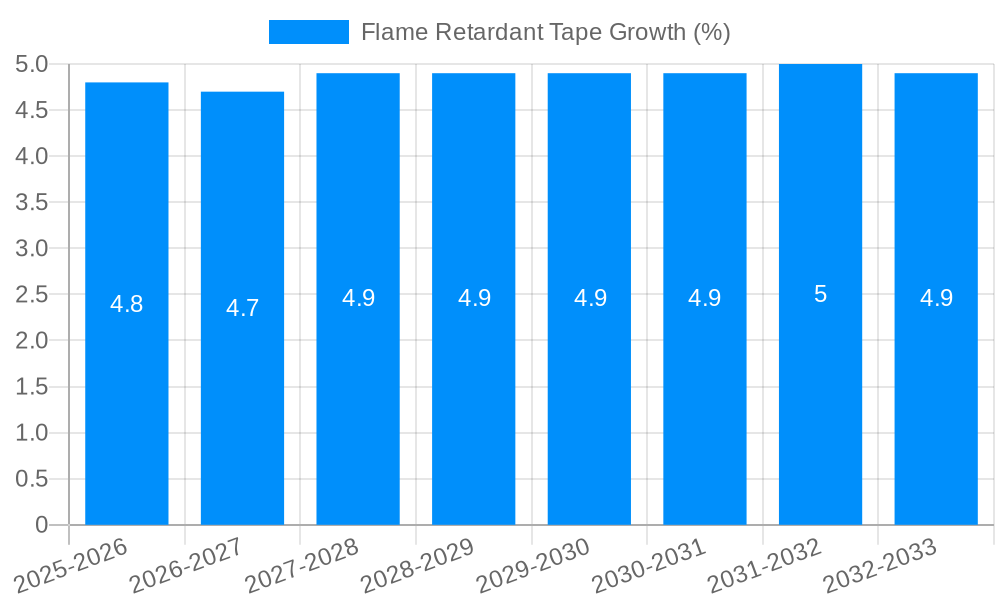

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flame Retardant Tape?

The projected CAGR is approximately 4.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flame Retardant Tape

Flame Retardant TapeFlame Retardant Tape by Application (Electrical & Electronics, Automotive, Building and Construction), by Type (Single-sided Adhesive Tape, Double-sided Adhesive Tape), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

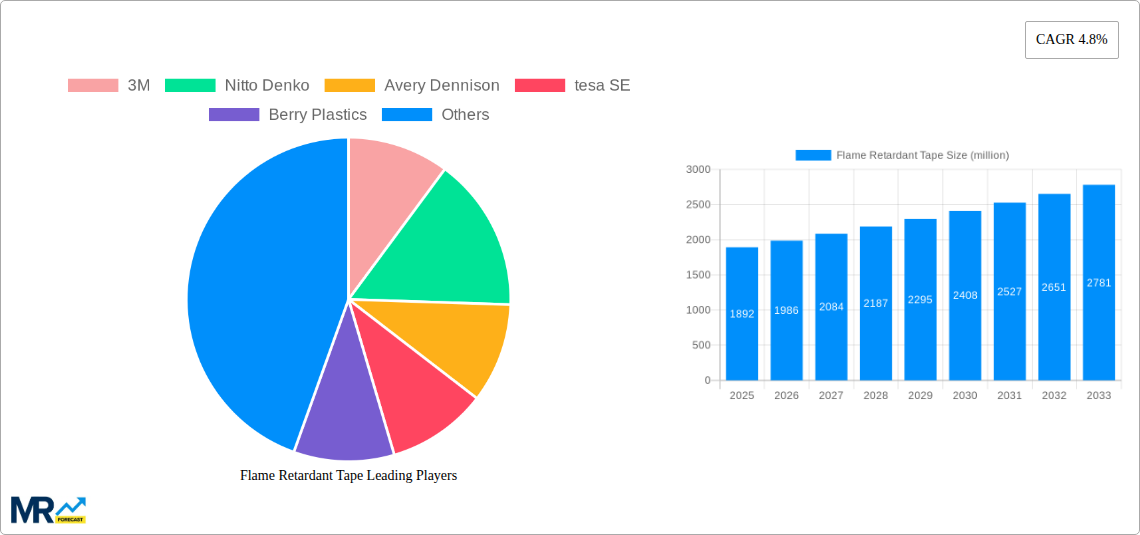

The global Flame Retardant Tape market is poised for significant expansion, projected to reach approximately USD 1892 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.8% anticipated throughout the forecast period of 2025-2033. This sustained growth is primarily driven by the escalating demand for enhanced safety standards across diverse industries, particularly in electrical and electronics, automotive, and building and construction. Regulatory mandates and a growing consumer consciousness regarding fire safety are compelling manufacturers to integrate flame retardant materials into their products, directly fueling the adoption of specialized tapes. The increasing complexity and miniaturization of electronic devices, coupled with the stringent safety requirements in vehicle manufacturing, create a fertile ground for flame retardant tape solutions. Furthermore, the push for sustainable and fire-resistant building materials in construction projects, especially in densely populated urban areas, contributes substantially to market momentum.

Emerging trends indicate a shift towards the development of high-performance flame retardant tapes with improved thermal stability, adhesion properties, and environmental sustainability. Innovations in material science are leading to the creation of halogen-free and low-smoke emitting tapes, aligning with stricter environmental regulations and promoting healthier indoor environments. While the market exhibits strong growth potential, certain restraints, such as the higher cost of specialized flame retardant materials compared to conventional tapes and potential raw material price volatility, could influence the pace of adoption in cost-sensitive segments. Nevertheless, the overarching emphasis on fire safety, coupled with continuous technological advancements and the expansion of end-use applications, positions the Flame Retardant Tape market for continued prosperity and innovation in the coming years. Key players like 3M, Nitto Denko, and Avery Dennison are at the forefront of this evolution, investing in research and development to offer advanced solutions.

This report provides an in-depth analysis of the global Flame Retardant Tape market, projecting a significant expansion from its historical performance. The market, valued at an estimated $2,850.7 million in the base year of 2025, is poised for robust growth, reaching an estimated $5,900.5 million by the end of the forecast period in 2033. This growth trajectory is underpinned by a confluence of increasing safety regulations, technological advancements in material science, and the expanding applications across various critical industries. The historical period of 2019-2024 has laid the groundwork for this expansion, with a steady adoption rate driven by evolving industry standards. The study period from 2019 to 2033 encompasses a comprehensive examination of market dynamics, from its nascent stages to its projected maturity.

The global Flame Retardant Tape market is experiencing a dynamic evolution, characterized by a surging demand for enhanced safety and compliance. With safety regulations becoming increasingly stringent across industries such as Electrical & Electronics, Automotive, and Building and Construction, the adoption of flame retardant solutions is no longer a mere option but a critical necessity. This trend is vividly reflected in the market's projected expansion, with revenues set to more than double from an estimated $2,850.7 million in 2025 to an impressive $5,900.5 million by 2033. The Electrical & Electronics segment, in particular, is a primary driver, fueled by the miniaturization of devices and the increased density of components, necessitating tapes that can effectively prevent fire propagation. For instance, the increasing prevalence of complex wiring harnesses in consumer electronics, data centers, and telecommunications equipment demands tapes with superior flame resistance to mitigate electrical faults and prevent the spread of fires. Furthermore, the automotive sector is witnessing a significant push towards electric vehicles (EVs), where battery packs and associated high-voltage systems present new fire safety challenges. Flame retardant tapes are crucial in insulating these components and preventing thermal runaway, thus ensuring passenger safety. In the Building and Construction sector, the focus is on creating fire-resistant infrastructure and adhering to stricter building codes, leading to a higher demand for flame retardant tapes in applications like cable management, insulation, and sealing. The increasing urbanization and infrastructure development worldwide further amplify this demand. The market is also observing a rise in demand for specialized flame retardant tapes with enhanced properties, such as higher temperature resistance, improved adhesion in challenging environments, and reduced smoke emission, catering to niche applications within these broader segments. The development of halogen-free flame retardant tapes is another significant trend, driven by environmental concerns and regulatory pressure to phase out halogenated compounds due to their potential health and environmental impacts. This shift towards eco-friendly alternatives is opening new avenues for innovation and market penetration, influencing product development strategies of leading players like 3M and Nitto Denko. The market's growth is further propelled by advancements in adhesive technology, ensuring that flame retardant properties do not compromise the tape's functionality, such as its ability to adhere strongly and reliably to diverse surfaces under varying conditions. The market's steady upward trajectory, from historical performance to forecast projections, underscores the indispensable role of flame retardant tapes in ensuring safety and compliance in a rapidly evolving industrial landscape.

The burgeoning growth of the Flame Retardant Tape market is fundamentally propelled by an unwavering commitment to enhanced safety standards and regulatory compliance across a multitude of industries. The Electrical & Electronics sector, a cornerstone of this market, is experiencing an unprecedented surge in demand due to the relentless innovation in electronic devices. The miniaturization of components and the increasing power density within modern electronics necessitate materials that can effectively prevent fire propagation, thereby mitigating risks associated with short circuits and overheating. Similarly, the Automotive industry, particularly with the rapid transition to electric vehicles, presents a significant growth impetus. The integration of high-voltage battery systems introduces new fire safety concerns, making flame retardant tapes indispensable for insulating critical components and preventing thermal runaway incidents. This translates to a substantial market opportunity for tapes that can offer superior protection and reliability in the demanding automotive environment. Moreover, the Building and Construction sector is increasingly emphasizing fire safety in its designs and practices. Stricter building codes and a growing awareness of the catastrophic potential of fires in residential and commercial structures are driving the adoption of flame retardant materials, including tapes, for applications ranging from cable management to insulation and sealing. Beyond these primary segments, industrial developments and technological advancements play a crucial role. The development of new, more effective flame retardant formulations, coupled with improvements in adhesive technologies, is expanding the application scope of these tapes. For instance, the emergence of halogen-free flame retardant tapes addresses growing environmental concerns, further broadening their appeal and market penetration. The global economic landscape, with increasing investment in infrastructure and manufacturing, also contributes to the overall demand for safety-enhancing products like flame retardant tapes.

Despite the robust growth trajectory of the Flame Retardant Tape market, several challenges and restraints can impede its full potential. A primary concern is the cost implication associated with flame retardant materials. The specialized chemicals and manufacturing processes required to impart flame retardant properties often lead to higher production costs compared to conventional tapes. This can make them a less attractive option for cost-sensitive applications or industries where margins are tight, potentially slowing down adoption rates. For instance, while crucial for safety, a significant price premium on flame retardant tapes might deter smaller manufacturers or those in less regulated markets from widespread implementation. Another significant challenge is the performance trade-offs that can sometimes accompany flame retardancy. In some instances, enhancing flame resistance might compromise other crucial properties of the tape, such as its adhesive strength, flexibility, or long-term durability in extreme environmental conditions. Manufacturers continuously strive to balance these properties, but achieving optimal performance across all parameters can be a complex technical hurdle. The availability of suitable raw materials and the complexity of regulatory landscapes across different regions also pose challenges. Fluctuations in the supply chain of specialized flame retardant chemicals can impact production volumes and pricing. Furthermore, varying and evolving flame retardancy standards and certifications in different countries can create complexities for global manufacturers aiming for broad market access. The perceived complexity of application and installation can also be a restraint. While designed for ease of use, some specialized flame retardant tapes might require specific application techniques or surface preparation to ensure their full efficacy, which could lead to a learning curve for end-users. Finally, alternative fire prevention methods and the ongoing development of inherently fire-resistant materials in core product designs might offer competing solutions, potentially limiting the market share of flame retardant tapes in certain niche applications. Addressing these challenges through continuous innovation, cost optimization, and clear communication of benefits will be crucial for sustained market growth.

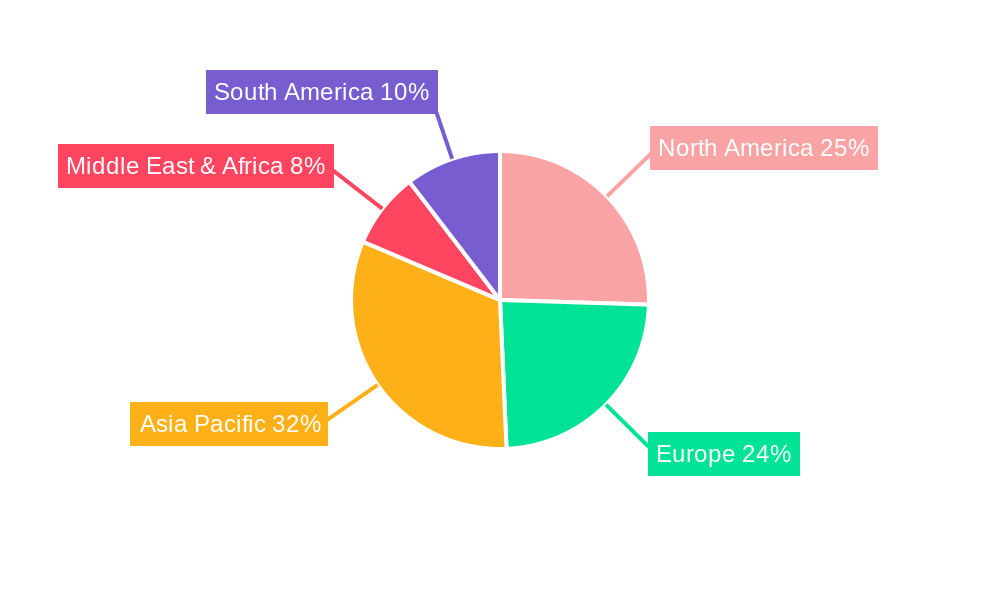

The global Flame Retardant Tape market is characterized by regional dominance driven by a confluence of stringent safety regulations, robust industrial activity, and a high concentration of key end-user industries. Among the various segments, the Electrical & Electronics application segment is projected to be a dominant force, owing to the ever-increasing demand for safety in sophisticated electronic devices and infrastructure. This segment alone is expected to contribute a substantial share of the market revenue, with projected growth fueled by the proliferation of smart devices, data centers, telecommunication networks, and the burgeoning Internet of Things (IoT) ecosystem. The inherent fire risks associated with high-density component packaging and complex wiring in these applications necessitate reliable flame retardant solutions.

Geographically, North America and Europe are anticipated to lead the market, driven by their mature industrial bases, stringent safety standards, and significant investments in advanced manufacturing and technology. In North America, the United States stands out as a key country due to its extensive aerospace, automotive, and electrical industries, all of which have rigorous fire safety requirements. The emphasis on occupant safety in vehicles and consumer electronics, coupled with robust building codes, directly translates to a high demand for flame retardant tapes. Similarly, Europe boasts a strong manufacturing sector with a deep-seated commitment to product safety and environmental regulations. Countries like Germany, France, and the UK are at the forefront of adopting advanced flame retardant technologies to comply with directives such as RoHS (Restriction of Hazardous Substances).

The Electrical & Electronics application segment's dominance can be further elaborated. Within this segment, the demand for flame retardant tapes is particularly acute in:

The dominance of the Electrical & Electronics segment, coupled with the leadership of North America and Europe, forms a powerful synergy that will shape the global Flame Retardant Tape market. This dominance is further solidified by the presence of leading global manufacturers like 3M, Nitto Denko, Avery Dennison, and tesa SE, who have a strong foothold in these regions and a comprehensive product portfolio catering to the demanding requirements of these sectors. The continued innovation in material science and the increasing focus on miniaturization and higher performance in electronics will only serve to strengthen this segment's position in the years to come. The synergy between these leading regions and the dominant application segment creates a compelling market landscape, ripe for continued growth and technological advancement.

The Flame Retardant Tape industry's growth is significantly catalyzed by increasingly stringent global safety regulations and standards, particularly in sectors like Electrical & Electronics and Automotive. The growing demand for electric vehicles, with their inherent battery fire risks, directly fuels the need for advanced flame retardant solutions. Furthermore, technological advancements in material science are leading to the development of more effective, environmentally friendly, and cost-efficient flame retardant tapes, expanding their application range. Consumer awareness regarding fire safety and the drive for product reliability also contribute to this positive growth trajectory.

This comprehensive report delves into the intricacies of the global Flame Retardant Tape market, offering a detailed market size estimation of $2,850.7 million for the base year 2025, with a projected surge to $5,900.5 million by 2033. It meticulously examines key market insights, driving forces, challenges, and growth catalysts, providing a 360-degree view of the industry. The report also identifies dominant regions and segments, alongside a robust list of leading players and significant market developments. This in-depth analysis, covering the study period of 2019-2033, is designed to equip stakeholders with actionable intelligence for strategic decision-making in this vital and expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.8%.

Key companies in the market include 3M, Nitto Denko, Avery Dennison, tesa SE, Berry Plastics, Intertape Polymer, Yongle Tape, Shushi Group, Camat, Teraoka, Scapa, .

The market segments include Application, Type.

The market size is estimated to be USD 1892 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Flame Retardant Tape," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flame Retardant Tape, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.