1. What is the projected Compound Annual Growth Rate (CAGR) of the Fitness Equipment for Home Use?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fitness Equipment for Home Use

Fitness Equipment for Home UseFitness Equipment for Home Use by Type (Treadmill, Exercise Bike, Elliptical, Rower, Strength Equipment, Others, World Fitness Equipment for Home Use Production ), by Application (Private Use, Community Use, World Fitness Equipment for Home Use Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

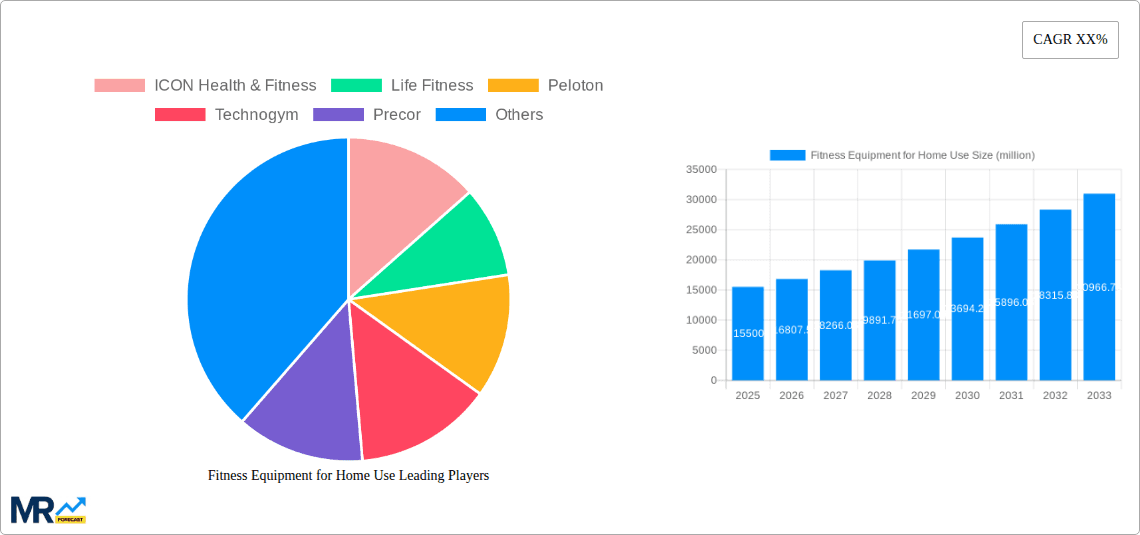

The global market for home fitness equipment experienced robust growth between 2019 and 2024, driven by increasing health consciousness, the convenience of at-home workouts, and the rise of remote work. The market size in 2025 is estimated at $6,726.7 million. This growth is fueled by several key factors: the increasing prevalence of sedentary lifestyles and associated health risks, promoting a surge in demand for convenient and accessible home fitness solutions. Technological advancements, such as connected fitness equipment with interactive features and personalized workout programs, further enhance user experience and drive market expansion. The diverse product portfolio, encompassing treadmills, exercise bikes, ellipticals, rowers, and strength training equipment, caters to varied fitness needs and preferences. The market segmentation also reflects a growing preference for private use, although community use remains a significant segment, particularly for specialized equipment and group fitness classes. Major players like Peloton, ICON Health & Fitness, and Technogym are leading the innovation and market share, leveraging their strong brand recognition and extensive distribution networks.

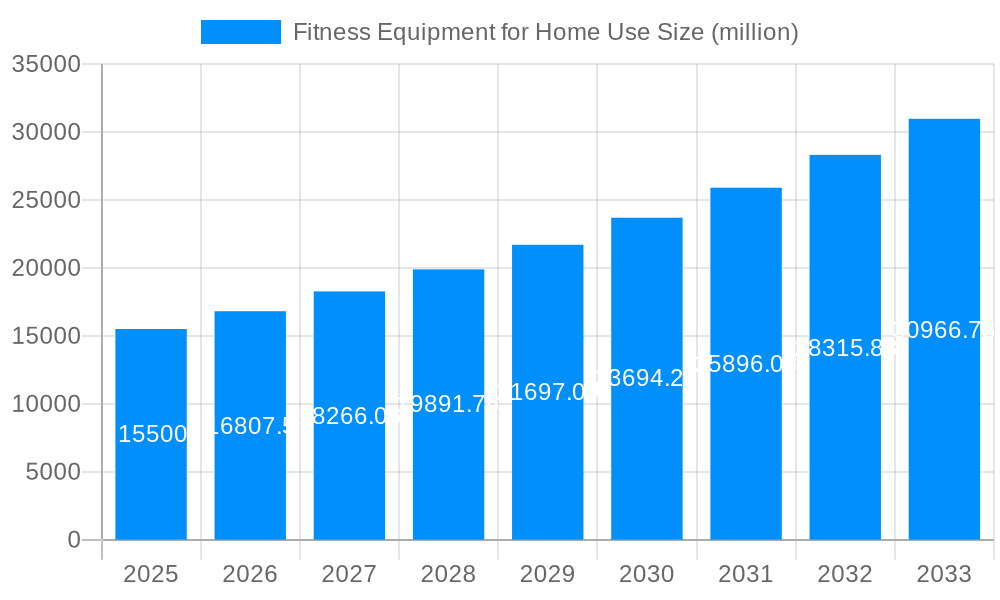

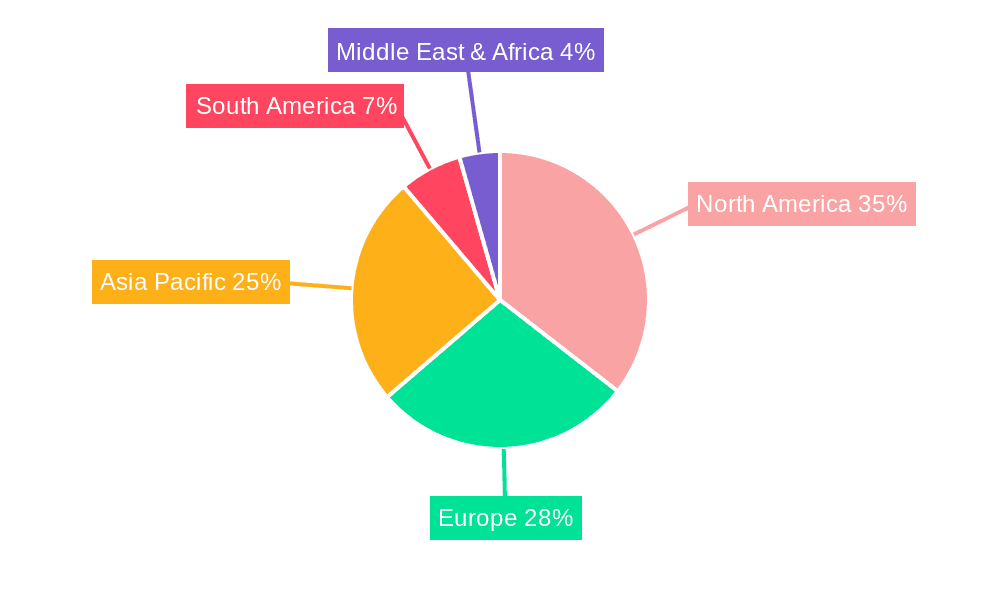

Looking forward, the market is poised for continued growth, though the pace may moderate slightly compared to the pre-2025 surge. Factors such as increasing disposable incomes, particularly in developing economies, and the continued popularity of home-based fitness routines contribute to this positive outlook. However, challenges remain, including potential price sensitivity in certain segments and the ongoing competition from other fitness modalities like outdoor activities and online fitness classes. Innovation in product design, incorporating features such as enhanced user interfaces, data tracking capabilities, and integration with popular fitness apps will be crucial for sustained market growth. The market is expected to benefit from a rising emphasis on preventive healthcare and overall wellness, making home fitness equipment a desirable investment for consumers. Regional variations exist, with North America and Europe currently leading the market, while Asia Pacific presents significant growth potential given the expanding middle class and increasing awareness of fitness.

The global fitness equipment for home use market experienced significant growth during the historical period (2019-2024), driven primarily by the increasing awareness of health and wellness, coupled with the convenience and affordability of home-based fitness solutions. The market witnessed a surge in demand, particularly during the COVID-19 pandemic, as lockdowns and social distancing measures restricted access to gyms and fitness studios. This trend propelled the market to exceed 100 million units in annual production, with key players like ICON Health & Fitness, Peloton, and Technogym capturing significant market share. However, post-pandemic, the market experienced a degree of normalization. While the demand remains robust, the growth rate has moderated compared to the peak pandemic years. The market is now showing a more balanced distribution between various equipment types, with treadmills, exercise bikes, and strength training equipment remaining popular choices. The integration of smart technology and fitness apps continues to be a significant trend, offering personalized workout experiences and data tracking capabilities, further driving consumer preference for technologically advanced equipment. This trend is particularly noticeable in the segment of smart exercise bikes and connected fitness platforms, exemplified by Peloton's success. The market is also witnessing an increasing emphasis on user experience, with manufacturers focusing on designing more compact, aesthetically pleasing, and easily-maintainable equipment. The overall trend indicates a sustained, although perhaps slower-paced, growth trajectory for home fitness equipment, driven by evolving consumer preferences and technological innovations. The estimated market size for 2025 is projected to be around 150 million units, representing a healthy expansion from earlier years. The forecast period (2025-2033) is expected to see continued growth, spurred by an increasingly health-conscious population and the ongoing development of innovative fitness technologies.

Several factors are significantly propelling the growth of the home fitness equipment market. The rising global prevalence of sedentary lifestyles and associated health risks, such as obesity, cardiovascular diseases, and diabetes, is a major driver. Consumers are increasingly recognizing the importance of regular exercise for maintaining physical and mental well-being, leading to a greater willingness to invest in home fitness solutions. The convenience factor plays a significant role. Home workouts eliminate travel time to and from gyms, offering flexibility and convenience, particularly appealing to busy individuals and families. The pandemic further accelerated this trend, showcasing the value of having readily available fitness options at home. Technological advancements, such as the integration of smart features, fitness apps, and virtual coaching programs, have enhanced the user experience and broadened the appeal of home fitness equipment. These advancements provide personalized workout plans, track progress, and offer interactive experiences, motivating users to stick to their fitness routines. Finally, the increasing affordability of home fitness equipment, with a wider range of price points and financing options available, makes it accessible to a larger segment of the population. This combination of health concerns, convenience, technological innovation, and affordability is creating a sustained and robust demand for home fitness equipment.

Despite the significant growth potential, the home fitness equipment market faces several challenges and restraints. One major hurdle is the intense competition within the market, with numerous established and emerging players vying for market share. This competition leads to price wars and necessitates continuous innovation to stand out. The relatively short product life cycles also pose a challenge, as rapid technological advancements require manufacturers to constantly upgrade their offerings to stay competitive. Concerns about product durability and quality control are common among consumers, and negative experiences can negatively impact brand reputation and future sales. Furthermore, the home fitness equipment market is susceptible to economic fluctuations. During economic downturns, consumers may postpone discretionary purchases like fitness equipment, leading to reduced demand. Finally, maintaining consumer engagement and motivation beyond the initial purchase is crucial. Many individuals may lose interest in their home workout routines over time, highlighting the need for effective and engaging workout programs and technological solutions to maintain long-term usage. Addressing these challenges requires manufacturers to focus on product quality, technological innovation, customer engagement strategies, and efficient supply chain management.

The North American market, particularly the United States, currently dominates the home fitness equipment market, driven by high disposable incomes, health consciousness, and a well-established fitness culture. European countries, including Germany and the United Kingdom, also represent significant markets, with a growing adoption of home fitness solutions. However, developing economies in Asia, such as China and India, are emerging as rapidly growing markets, showing substantial potential for expansion due to rising disposable incomes and an increasing awareness of health and wellness.

Dominant Segment: The strength equipment segment is experiencing considerable growth, driven by the increasing popularity of home-based strength training routines. This segment includes dumbbells, weight benches, resistance bands, and other strength training equipment, which cater to a broad range of users and fitness goals. The demand for this type of equipment is driven by the desire for building muscle, increasing overall fitness levels, and improving functional strength. This segment offers a wide variety of price points and levels of sophistication, making it accessible to a wide range of consumers. Its versatility and potential for use without requiring specialized training also contribute to its popularity. The market is witnessing a move towards more compact, space-saving designs while incorporating advanced features to enhance user experience.

Private Use remains the dominant application, accounting for a significant portion of the overall market. This is due to the increasing preference for convenience and personalized fitness routines within the comfort of one's own home. This trend is fuelled by busy lifestyles and the desire for flexible workout scheduling. The segment is further driven by the rising integration of smart technology, making home workouts more engaging and data-driven.

Geographic Dominance: North America is projected to maintain its position as the largest market throughout the forecast period (2025-2033), benefiting from high consumer spending on fitness, technological advancements, and a strong focus on health and wellness.

The home fitness equipment industry is experiencing significant growth, fueled by several key factors: the increasing prevalence of health concerns and sedentary lifestyles, technological advancements integrating smart features and virtual fitness programs, and the growing emphasis on convenience and personalized workouts. The affordability of home equipment, combined with the pandemic's impact on gym accessibility, has further boosted the market's growth trajectory. Future expansion will be supported by evolving consumer preferences for compact, aesthetically pleasing, and user-friendly equipment with advanced technological features.

This report provides a comprehensive analysis of the global fitness equipment for home use market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The report covers various equipment types, application segments, and geographic regions, providing valuable data for businesses involved in the industry or those considering entering the market. The forecast period extending to 2033 allows for long-term strategic planning and investment decisions. The study provides a granular understanding of the market dynamics, enabling businesses to effectively leverage the opportunities and mitigate the challenges within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ICON Health & Fitness, Life Fitness, Peloton, Technogym, Precor, Nautilus, Johnson Health Tech, Dyaco, Impulse, Shuhua Sports, True Fitness, Shanxi Orient, WaterRower, WNQ Fitness, BH Fitness, Concept2, Landice, .

The market segments include Type, Application.

The market size is estimated to be USD 6726.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fitness Equipment for Home Use," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fitness Equipment for Home Use, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.